CAR.UN dividend yield calculator – Canadian Apartment Properties Real Estate Investment Trust Declares 0.12083 Cash Dividend

May 29, 2023

Dividends Yield

Canadian Apartment Properties ($TSX:CAR.UN) Real Estate Investment Trust has announced a cash dividend of 0.12083 per share, payable on June 30 2023. The decision to declare a dividend is great news for investors looking to benefit from dividend income. The trust has issued an average annual dividend per share of 1.45 CAD for the past three years, with dividend yields of 3.16%, 3.04% and 2.46% from 2021 to 2023 respectively. The average dividend yield stands at 2.89%.

The trust will pay an ex-dividend date on May 30 2023 meaning those who purchase shares on or after this date will not receive the dividend declared. Shareholders registered before this date will be entitled to receive the dividend payment after June 30 2023. The trust’s consistent dividend payments and attractive yields make it a great choice for income-seeking investors.

Stock Price

The announcement saw the company’s stock price open at CA$48.5 and close at CA$48.4, representing a slight increase of 0.3% from the prior closing price of CA$48.3. This news is seen as a positive development for both current and prospective investors in CAPREIT, which owns and manages several residential rental properties across Canada. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CAR.UN. More…

| Total Revenues | Net Income | Net Margin |

| 1.02k | -134.9 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CAR.UN. More…

| Operations | Investing | Financing |

| 593.08 | -41.86 | -603.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CAR.UN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.54k | 7.77k | 58.34 |

Key Ratios Snapshot

Some of the financial key ratios for CAR.UN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 58.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

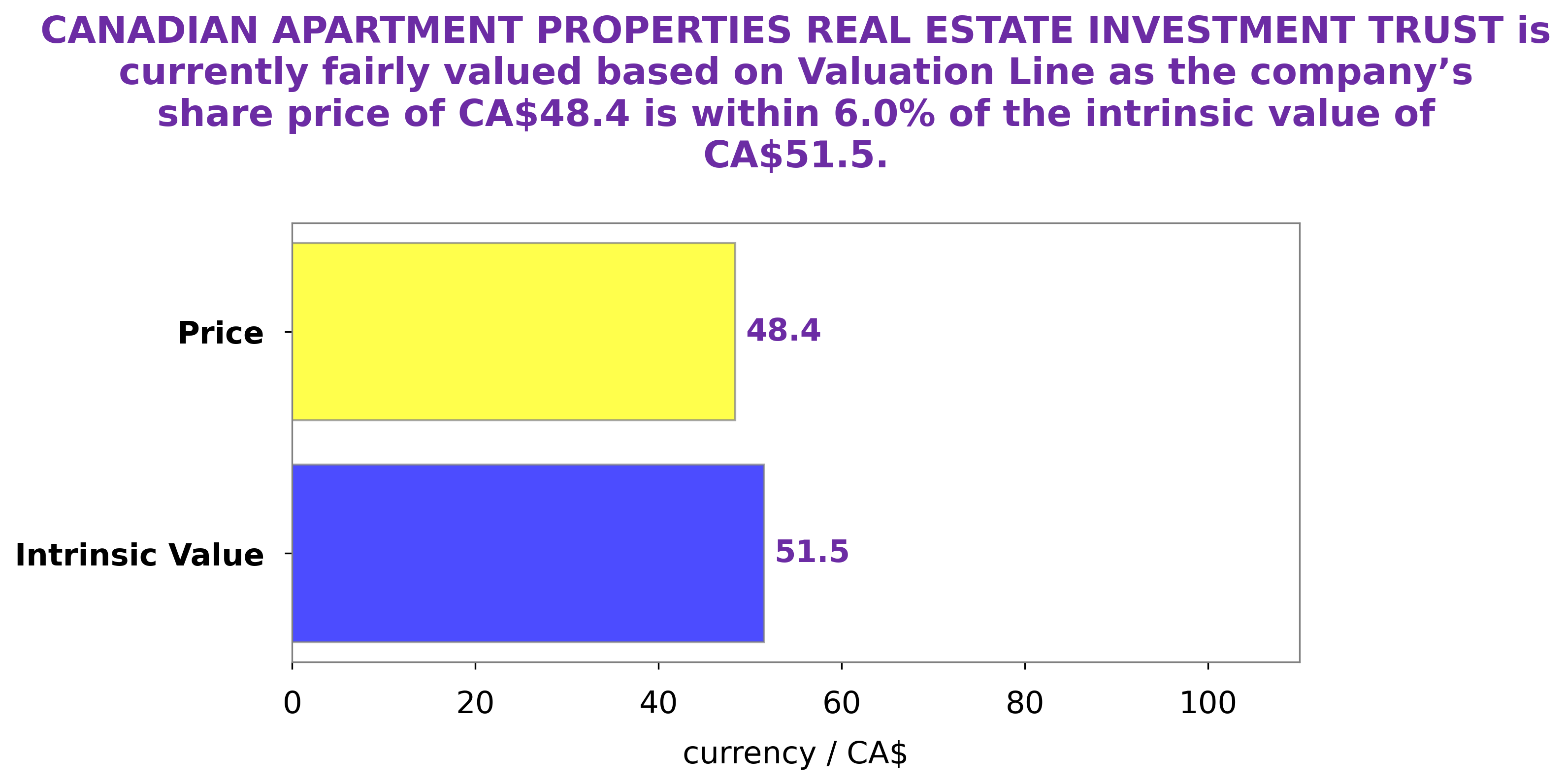

Analysis – CAR.UN Intrinsic Value

This figure was derived using our proprietary Valuation Line formula. Currently, the stock is traded at CA$48.4, which is a fair price but is undervalued by 6.0%. Therefore, this presents an opportunity for investors to purchase the stock at a discounted rate. More…

Peers

The company’s portfolio includes approximately 38,000 rental units in more than 200 properties across Canada. The company’s competitors include Altarea SCA, Sun Communities Inc, Boardwalk Real Estate Investment Trust.

– Altarea SCA ($LTS:0IRK)

Altarea SCA is a French real estate company. It is headquartered in Paris and was founded in 2001. The company is engaged in the development, investment, and management of retail and office properties in France and Spain. As of December 2020, the company had a market capitalization of €2.7 billion.

– Sun Communities Inc ($NYSE:SUI)

Sun Communities Inc. is a real estate investment trust that invests in manufactured housing communities. The company’s market cap as of 2022 is $17.72 billion. Sun Communities owns and operates over 200 manufactured housing communities in the United States. The company was founded in 1975 and is headquartered in Southfield, Michigan.

– Boardwalk Real Estate Investment Trust ($TSX:BEI.UN)

Boardwalk Real Estate Investment Trust is a Canadian real estate investment trust, which owns, operates and manages a diversified portfolio of residential and commercial properties. As of December 31, 2020, the Company’s portfolio consisted of 3,842 properties, with a total gross leasable area of approximately 44.8 million square feet.

Summary

Investing in Canadian Apartment Properties Real Estate Investment Trust (CAPREIT) is a smart choice for those looking to benefit from dividend income. CAPREIT has consistently paid out an annual dividend per share of 1.45 CAD over the last three years, resulting in attractive dividend yields of 3.16%, 3.04% and 2.46% for 2021, 2022 and 2023, respectively, with an average dividend yield of 2.89%. This makes it an attractive option for dividend-seeking investors looking to diversify their portfolio and benefit from a steady income stream.

Recent Posts