BOS dividend yield calculator – AirBoss of America Corp Announces 0.1 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 1st, 2023, AIRBOSS OF AMERICA ($TSX:BOS) Corp. announced a 0.1 cash dividend to be paid out to its shareholders. This is the fourth consecutive year that the company has taken this approach, with dividends of $0.30, $0.30, and $0.29 per share in 2021, 2022, and 2023, respectively. These dividends have yielded an average of 2.11% over the past three years. Investors looking for stocks with reliable dividend yields may want to consider AIRBOSS OF AMERICA as a viable option.

The ex-dividend date for the dividend is June 29th, 2023, meaning that shareholders must own the stock before that date to qualify for the dividend payment. AIRBOSS OF AMERICA’s timely dividends and consistent yield make it an attractive option for those seeking secure and steady returns on their investments.

Market Price

This news caused the company’s stock to open at CA$6.2 and close at CA$6.3, an increase of 0.8% from the previous closing price of 6.3. This dividend is a sign of the company’s financial health and strength, and a reward to its shareholders for their continued loyalty and support. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BOS. More…

| Total Revenues | Net Income | Net Margin |

| 449.76 | -40.01 | -8.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BOS. More…

| Operations | Investing | Financing |

| 7.91 | -8.87 | 3.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BOS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 436.89 | 240.12 | 7.26 |

Key Ratios Snapshot

Some of the financial key ratios for BOS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.8% | 58.6% | -9.8% |

| FCF Margin | ROE | ROA |

| -0.2% | -14.0% | -6.3% |

Analysis

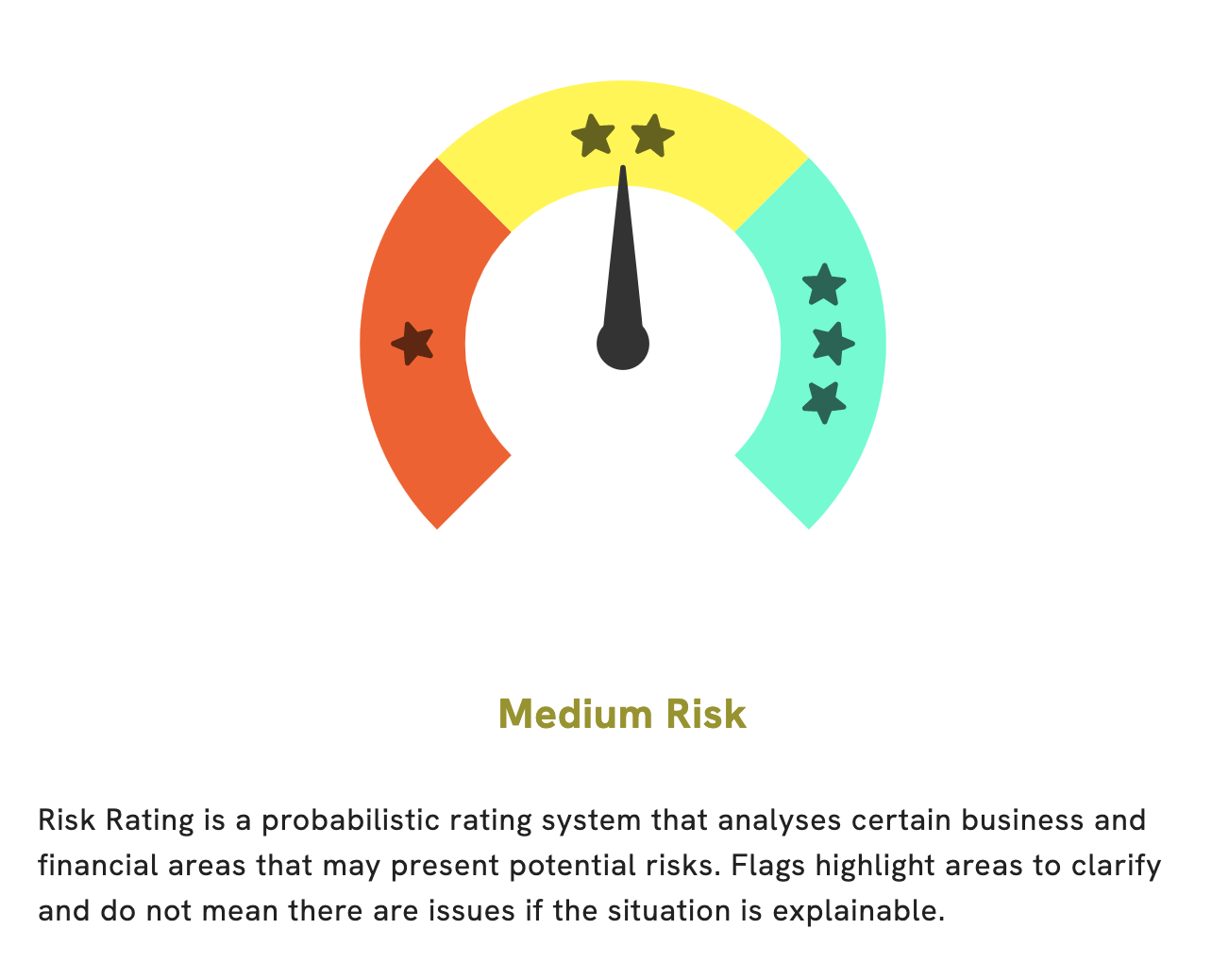

At GoodWhale, we have conducted an analysis of AIRBOSS OF AMERICA’s financials. We assign AIRBOSS OF AMERICA a medium risk rating, indicating that it poses neither an excessively high nor an excessively low risk in terms of financial and business aspects. Our analysis has identified two risks in AIRBOSS OF AMERICA’s income sheet and balance sheet. If you think this is an organization you would like to invest in, we encourage you to register with us to view the details of our analysis. We believe that having the most up-to-date information is essential for making informed decisions when it comes to investing. More…

Peers

The company operates in three segments: North American Customized Compounding, North American AirBoss Engineered Products, and International. It offers a wide range of products, including rubber compounds, molded and extruded products, and chemical products, to a variety of industries, such as automotive, aerospace, mining, and construction. AirBoss of America Corp has a strong competitive advantage in the rubber compounding industry, with a market share of approximately 21%. The company’s closest competitors are Vikas EcoTech Ltd, China General Plastics Corp, and Eastern Polymer Group PCL.

– Vikas EcoTech Ltd ($BSE:530961)

Vikas EcoTech Ltd is an Indian company that provides environmental solutions. The company has a market cap of 3.53 billion as of 2022 and a return on equity of 6.52%. Vikas EcoTech Ltd provides environmental solutions such as waste management, water treatment, and air pollution control. The company also offers environmental consulting services.

– China General Plastics Corp ($TWSE:1305)

General Plastics Corporation is a publicly traded company with a market capitalization of $11.36 billion as of 2022. The company has a return on equity of 11.04%. General Plastics Corporation is a leading manufacturer of plastics and related products. The company’s products are used in a variety of industries, including automotive, aerospace, construction, and consumer goods.

– Eastern Polymer Group PCL ($SET:EPG)

Eastern Polymer Group is one of Thailand’s largest manufacturers and suppliers of plastic resins. The company has a market cap of 28.56 billion as of 2022 and a return on equity of 8.01%. Eastern Polymer Group produces a wide range of plastic resins used in a variety of applications, including food and beverage packaging, personal care products, and medical devices. The company has a strong presence in Southeast Asia and is expanding its operations into other regions.

Summary

AIRBOSS OF AMERICA is an attractive investment option for dividend-seeking investors. For the past three years, the company has paid an average dividend of $0.30 per share, resulting in a dividend yield of 2.11%. The dividend yield has ranged from 3.12% in 2021 to 1.08% in 2023, providing investors with consistent returns. Furthermore, the company’s history of consistent dividend payments is a sign of a healthy balance sheet and a strong financial position.

Recent Posts