BATS dividend yield – British American Tobacco PLC Announces 0.5772 Cash Dividend.

March 23, 2023

Dividends Yield

On March 1 2023, British American Tobacco ($LSE:BATS) PLC announced an impressive 0.5772 cash dividend for its shareholders. This is a notable achievement for the company, as it has maintained a steady annual dividend of 2.18 GBP per share for the past three years, with a dividend yield of 6.47% each year. This makes BRITISH AMERICAN TOBACCO P.L.C a great option for those looking for an investment in dividend stocks.

The ex-dividend date of March 23 2023 gives investors plenty of time to consider their options and make a decision. With an impressive average yield of 6.47%, BRITISH AMERICAN TOBACCO P.L.C has proven itself to be a safe and reliable choice for those looking to invest in dividend stocks.

Stock Price

Following the announcement, the stock opened at £31.4 and closed at £31.3, down by 0.4% from the previous closing price of £31.4. The dividend payment will diminish the liquidity of the company, reducing BAT’s financial flexibility. Nonetheless, the board believes that this dividend is in the best interests of shareholders and will help them maximize their total return on investment. Overall, BAT’s announcement of the 0.5772 cash dividend is a testament to the stability of their financial position and their commitment to providing returns to shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BATS. More…

| Total Revenues | Net Income | Net Margin |

| 27.66k | 6.62k | 25.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BATS. More…

| Operations | Investing | Financing |

| 10.39k | -705 | -8.88k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BATS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 153.55k | 77.84k | 33.71 |

Key Ratios Snapshot

Some of the financial key ratios for BATS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.2% | 7.1% | 39.7% |

| FCF Margin | ROE | ROA |

| 35.2% | 9.2% | 4.5% |

Analysis

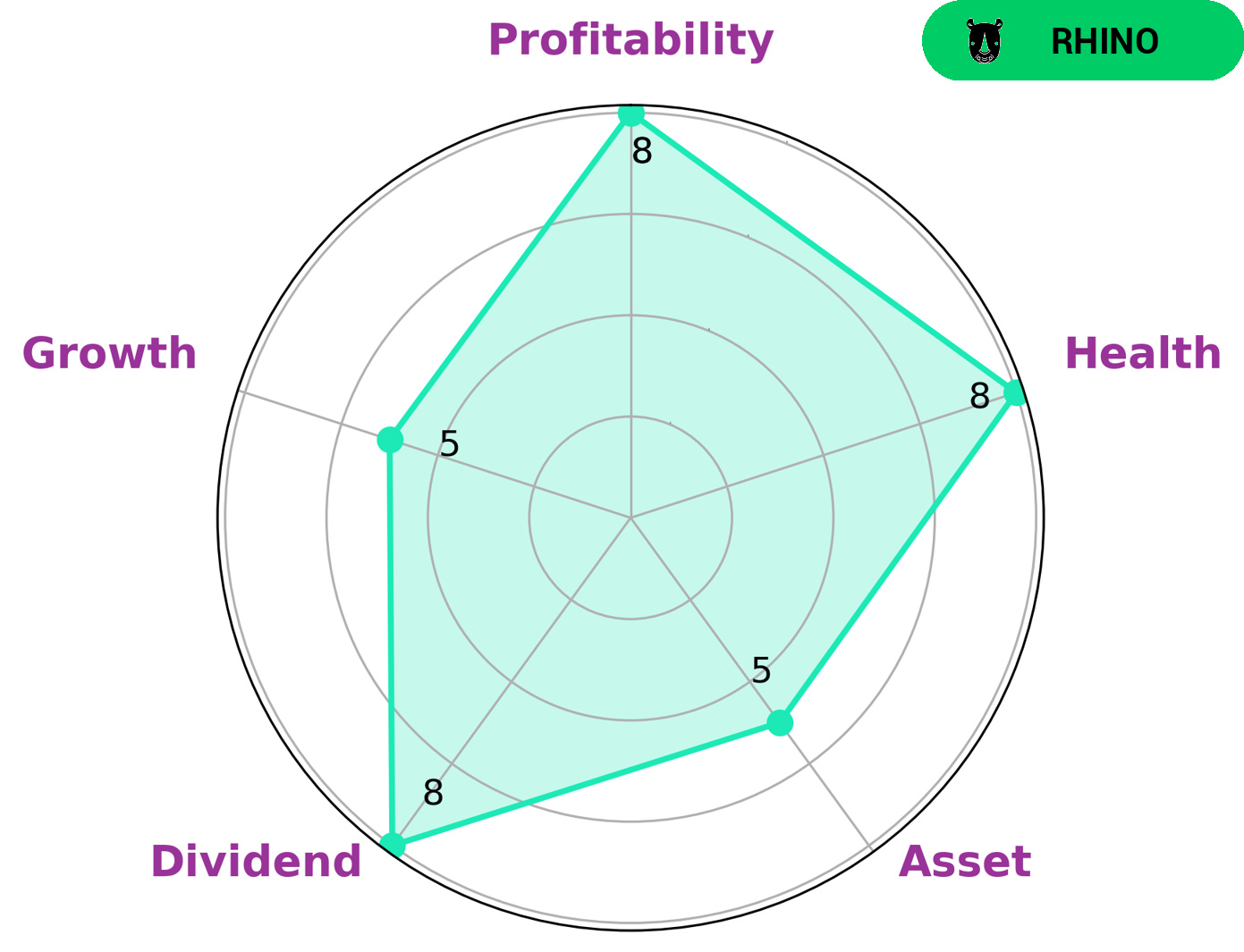

GoodWhale has conducted an in-depth analysis of BRITISH AMERICAN TOBACCO P.L.C’s wellbeing. Our Star Chart revealed that BRITISH AMERICAN TOBACCO P.L.C has a high health score of 8/10 with regard to its cashflows and debt, meaning that it is capable to safely ride out any crisis without the risk of bankruptcy. BRITISH AMERICAN TOBACCO P.L.C is strong in dividend, profitability, and medium in asset and growth. Based on this, we classified BRITISH AMERICAN TOBACCO P.L.C as a ‘rhino’, a type of company with moderate revenue or earnings growth. Given this information, investors who are looking for stable businesses that can provide reliable cash flow and dividends may be interested in BRITISH AMERICAN TOBACCO P.L.C. More…

Peers

British American Tobacco PLC is a leading international tobacco company. Its main competitors are Imperial Brands PLC, Heineken NV, Ambev SA.

– Imperial Brands PLC ($LSE:IMB)

Imperial Brands PLC is a British multinational tobacco company headquartered in Bristol, United Kingdom. It is the world’s fourth-largest international cigarette company measured by market share after Philip Morris International, British American Tobacco, and Japan Tobacco, and the world’s largest producer of cigars, fine-cut tobacco, and tobacco papers.

The company has a market cap of 19.26B as of 2022 and a Return on Equity of 50.52%. Imperial Brands PLC is a leading international tobacco company with a strong portfolio of well-known brands including Gauloises Blondes, West, and JPS. The company’s products are sold in more than 160 countries and its products are manufactured in 44 factories in 16 countries.

– Heineken NV ($OTCPK:HINKF)

Heineken NV is a Dutch brewing company, founded in 1864 by Gerard Adriaan Heineken in Amsterdam. The company is now the world’s second-largest brewer by volume, after Anheuser-Busch InBev. Heineken’s Dutch breweries are located in Zoeterwoude and Wijlre. The original brewery in Amsterdam, now part of the company headquarters, is preserved as a museum called Heineken Experience.

Heineken has a market capitalization of 49.75 billion as of 2022 and a return on equity of 17.82%. The company is the world’s second-largest brewer by volume and has a strong presence in Europe, Africa, and Asia. Heineken is committed to sustainable brewing and has set a goal to reduce its water usage by 20% by 2025.

– Ambev SA ($NYSE:ABEV)

Ambew SA is a Brazilian brewing company that was founded in 1999. The company has a market cap of 44.71B as of 2022 and a ROE of 11.57%. Ambew is the largest brewing company in Brazil and South America, and the fifth largest brewing company in the world. The company’s main products are beer, malt, and carbonated soft drinks.

Summary

Investing in British American Tobacco P.L.C. (BAT) presents an attractive opportunity for income-seeking investors. Over the past three years, BAT has provided an annual dividend per share of 2.18 GBP and a dividend yield of 6.47%, with an average yield of 6.47%. Its strong balance sheet, which boasts a healthy return on equity, provides an additional layer of safety and stability to the stock. Over all, BAT provides a compelling combination of dividend income and capital appreciation potential that makes it an attractive investment opportunity for many investors.

Recent Posts