Barnes Group dividend calculator – Barnes Group Confirms Dividend of $0.16 Per Share

November 3, 2023

☀️Trending News

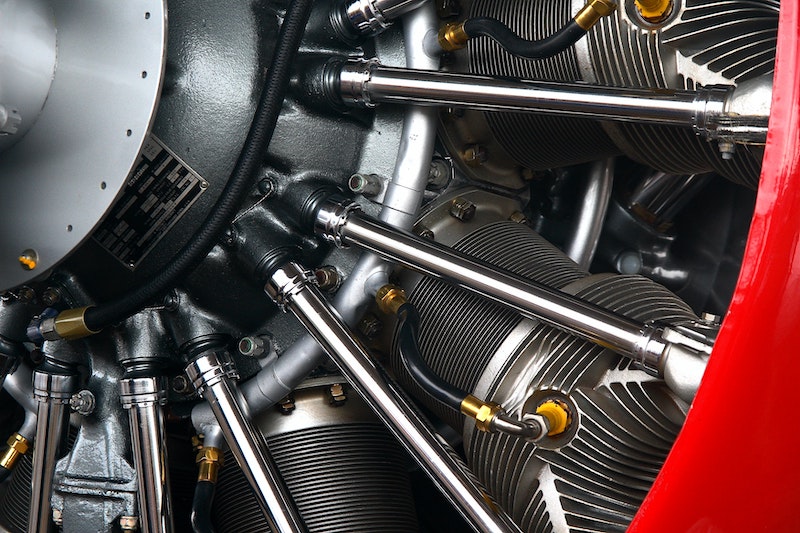

The Barnes Group ($NYSE:B) has confirmed a dividend of $0.16 per share to its shareholders. The Barnes Group is a global industrial and aerospace manufacturer and service provider. The company operates in four core segments: Industrial, Aerospace, Specialty Products, and Distribution.

Its products include precision engineered components, assemblies, and services across multiple industries such as automotive, aerospace, defense, medical device, and energy. With a diverse portfolio of brands, the Barnes Group continues to deliver high-quality solutions that serve customers around the world.

Dividends – Barnes Group dividend calculator

This continues the trend from the last three years, in which the company has issued annual dividends of $0.64 per share. The average dividend yield over the 2021-2023 period is estimated to be 1.62%, with yields for 2021, 2022, and 2023 estimated at 1.72%, 1.82%, and 1.31%, respectively. With this announcement, Barnes Group has further solidified its commitment to providing regular returns to its shareholders.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Barnes Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.3k | 63.06 | 4.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Barnes Group. More…

| Operations | Investing | Financing |

| 109.51 | -43.1 | -64.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Barnes Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.44k | 1.06k | 27.28 |

Key Ratios Snapshot

Some of the financial key ratios for Barnes Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.2% | -18.1% | 7.8% |

| FCF Margin | ROE | ROA |

| 5.1% | 4.6% | 2.6% |

Share Price

On Monday, BARNES GROUP confirmed the payment of a dividend of $0.16 per share, and its stock opened at $20.6 and closed at $19.8, a decrease of 1.5% from its last closing price of 20.1. Investors should take note that they must be on the record date to receive the dividend. Live Quote…

Analysis – Barnes Group Stock Intrinsic Value

At GoodWhale, we have conducted an analysis of BARNES GROUP‘s fundamentals. After extensive evaluation, our proprietary Valuation Line places the fair value of a BARNES GROUP share at approximately $41.2. Currently, however, BARNES GROUP stock is trading at just $19.8, suggesting that the shares are significantly undervalued by 52.0%. This could represent an attractive opportunity for value investors to add this stock to their portfolios. More…

Peers

Since its inception in 1857, Barnes Group Inc has been engaged in a cutthroat competition with Cummins Inc, Schumag AG, and Harmonic Drive Systems Inc. All four companies have been vying for the top spot in the market share.

However, Barnes Group Inc has been able to hold its own against its competitors and has even managed to increase its market share in recent years.

– Cummins Inc ($NYSE:CMI)

Cummins Inc is a global power leader that designs, manufactures, sells, and services diesel and alternative fuel engines from 2.8 to 95 liters, diesel and alternative-fueled electrical generator sets, and related components and technology. Headquartered in Columbus, Indiana, (USA) Cummins currently employs approximately 55,600 people committed to powering a more prosperous world through three principal business segments: Engine, Electrical, and Components.

– Schumag AG ($LTS:0NIY)

Schumag AG is a publicly traded company with a market capitalization of 8.72 million as of 2022. The company has a return on equity of 1981.48%. Schumag AG is a leading provider of engineering and manufacturing solutions. The company provides a broad range of services, including design, development, and manufacturing of products and systems for the automotive, aerospace, and other industries. Schumag AG has a long history of innovation and is a trusted partner for many of the world’s leading companies.

– Harmonic Drive Systems Inc ($TSE:6324)

Harmonic Drive Systems Inc, headquartered in Tokyo, Japan, is a manufacturer of motion control products. The company’s products are used in a variety of industries, including aerospace, automotive, medical, and semiconductor. Harmonic Drive Systems Inc has a market cap of 458.21B as of 2022 and a Return on Equity of 5.85%. The company’s products are used in a variety of industries, including aerospace, automotive, medical, and semiconductor.

Summary

Barnes Group Inc. is a diversified holding company, primarily engaged in industrial services, aerospace and automotive components. However, it has been trading at a discount to its book value and market to book ratio. This may offer potential investors an attractive entry point into the stock.

Recent Posts