B-WORK-F dividend yield – Bualuang Office Leasehold REIT Announces 0.1807 Cash Dividend

June 12, 2023

🌥️Dividends Yield

Bualuang Office Leasehold ($SET:B-WORK-F) REIT (BUALUANG) recently announced a 0.1807 cash dividend on May 26 2023. This comes as no surprise as BUALUANG has issued annual dividends per share of 0.71, 0.72, and 0.78 THB over the past three years, with respective dividend yields of 7.01%, 7.16%, and 7.68%. This gives an average yield of 7.28%, which is an attractive rate for those looking to invest in dividend stocks.

The ex-dividend date for this payment is May 24 2023, so shareholders must own BUALUANG before that date in order to be eligible for the cash dividend. With an impressive historical track record of consistent dividends and a high average yield, you may be able to add some extra income to your portfolio with BUALUANG.

Share Price

The stock opened at THB 10.1 and closed at the same amount. This is the fourth consecutive quarter that this REIT has paid a dividend to shareholders, demonstrating its commitment to providing reliable returns. In order to qualify for this dividend, investors must have purchased the shares prior to the ex-dividend date. By investing in a REIT such as Bualuang Office Leasehold, investors can benefit from reliable returns and diversified portfolios. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for B-WORK-F. More…

| Total Revenues | Net Income | Net Margin |

| 604.09 | 421.73 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for B-WORK-F. More…

| Operations | Investing | Financing |

| 407.38 | – | -351.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for B-WORK-F. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.16k | 1.06k | 11.12 |

Key Ratios Snapshot

Some of the financial key ratios for B-WORK-F are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 60.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

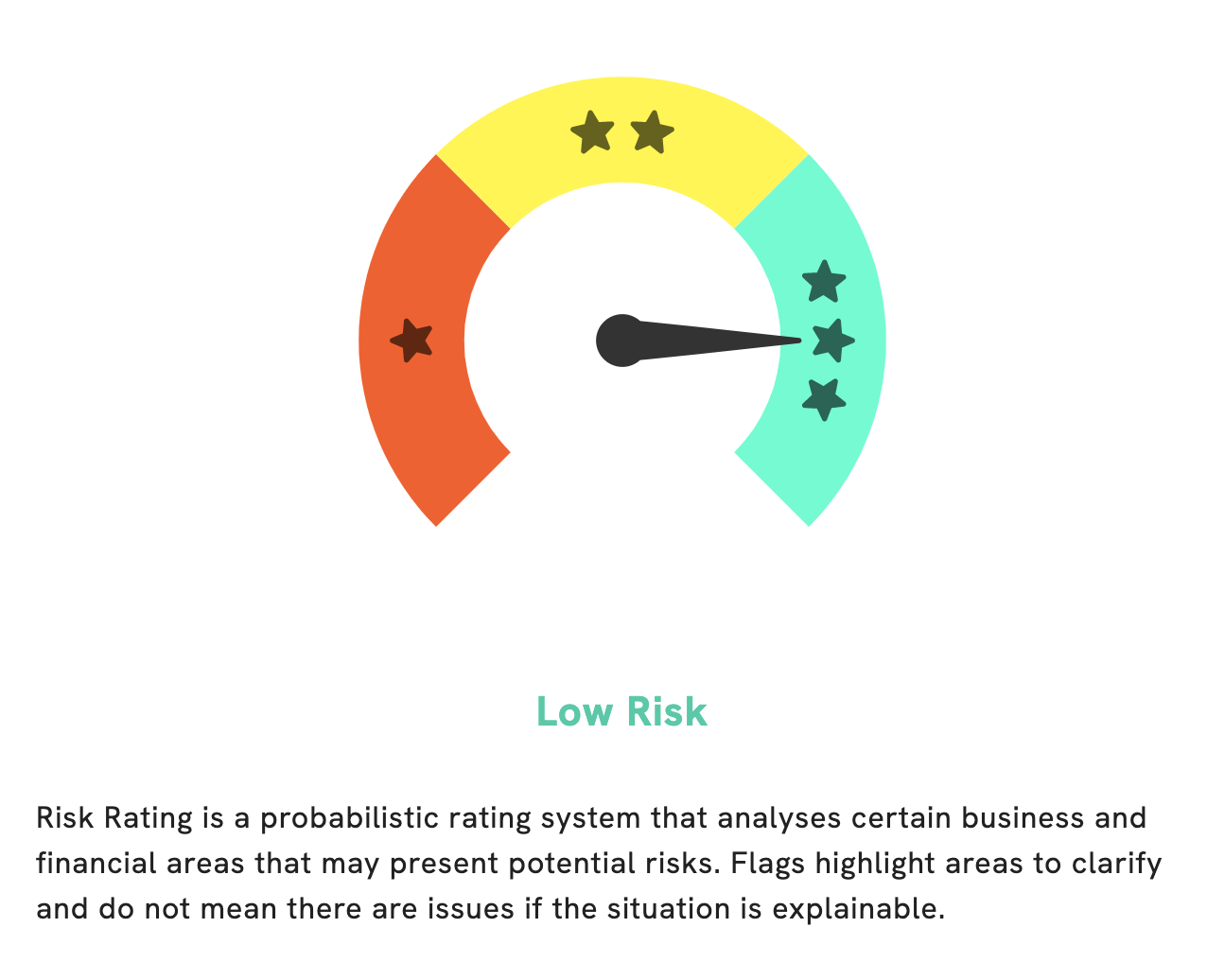

At GoodWhale, we believe in helping our customers make informed decisions by providing them with the most comprehensive analysis of BUALUANG OFFICE LEASEHOLD REIT. We’ve evaluated their financials and our Risk Rating suggests that BUALUANG OFFICE LEASEHOLD REIT is a low risk investment in terms of financial and business aspects. But to remain fully informed, you should also be aware of the 1 risk warnings we have detected in their balance sheet. If you register with us you can check out these warnings and make sure you’re making the best decision when investing in BUALUANG OFFICE LEASEHOLD REIT. More…

Summary

BUALUANG OFFICE LEASEHOLD REIT is an attractive dividend stock for investors to consider. Over the past three years, it has issued annual dividends per share of 0.71, 0.72, and 0.78 THB, respectively, with respective dividend yields of 7.01%, 7.16%, and 7.68%, resulting in an average yield of 7.28%. This demonstrates a healthy and consistent level of dividend payout which provides a good potential return for investors. Analyzing the company’s financials, such as its debt-to-equity ratio, current ratio, and earnings per share as well as the price-to-earnings ratio of the stock, can help investors make better decisions when considering investing in BUALUANG OFFICE LEASEHOLD REIT.

Recent Posts