Atlas Arteria stock dividend – Atlas Arteria Ltd Announces 0.2 Cash Dividend

March 24, 2023

Dividends Yield

Atlas Arteria ($ASX:ALX) Ltd has announced a 0.2 cash dividend on March 23 2023. This announcement follows a consistent track record of issuing an annual dividend per share at 0.39 AUD for each of the past three years (2021-2023), resulting in an average dividend yield of 5.26%. If you are searching for a dividend stock, ATLAS ARTERIA could be an appealing option.

It is important to note that the ex-dividend date for this stock is March 28 2023. Therefore, investors must own the stock prior to the ex-dividend date in order to be eligible to receive the dividend.

Share Price

On Thursday, Atlas Arteria Ltd. The news caused ATLAS’s share price to increase by 0.8% from the previous closing price of 6.4, with the stock opening at AU$6.4 and closing at AU$6.5. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Atlas Arteria. More…

| Total Revenues | Net Income | Net Margin |

| 116.73 | 266.96 | 228.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Atlas Arteria. More…

| Operations | Investing | Financing |

| 73.79 | -2.61k | 2.57k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Atlas Arteria. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.32k | 1.83k | 4.47 |

Key Ratios Snapshot

Some of the financial key ratios for Atlas Arteria are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -11.2% | – | 287.1% |

| FCF Margin | ROE | ROA |

| 62.9% | 4.2% | 2.5% |

Analysis

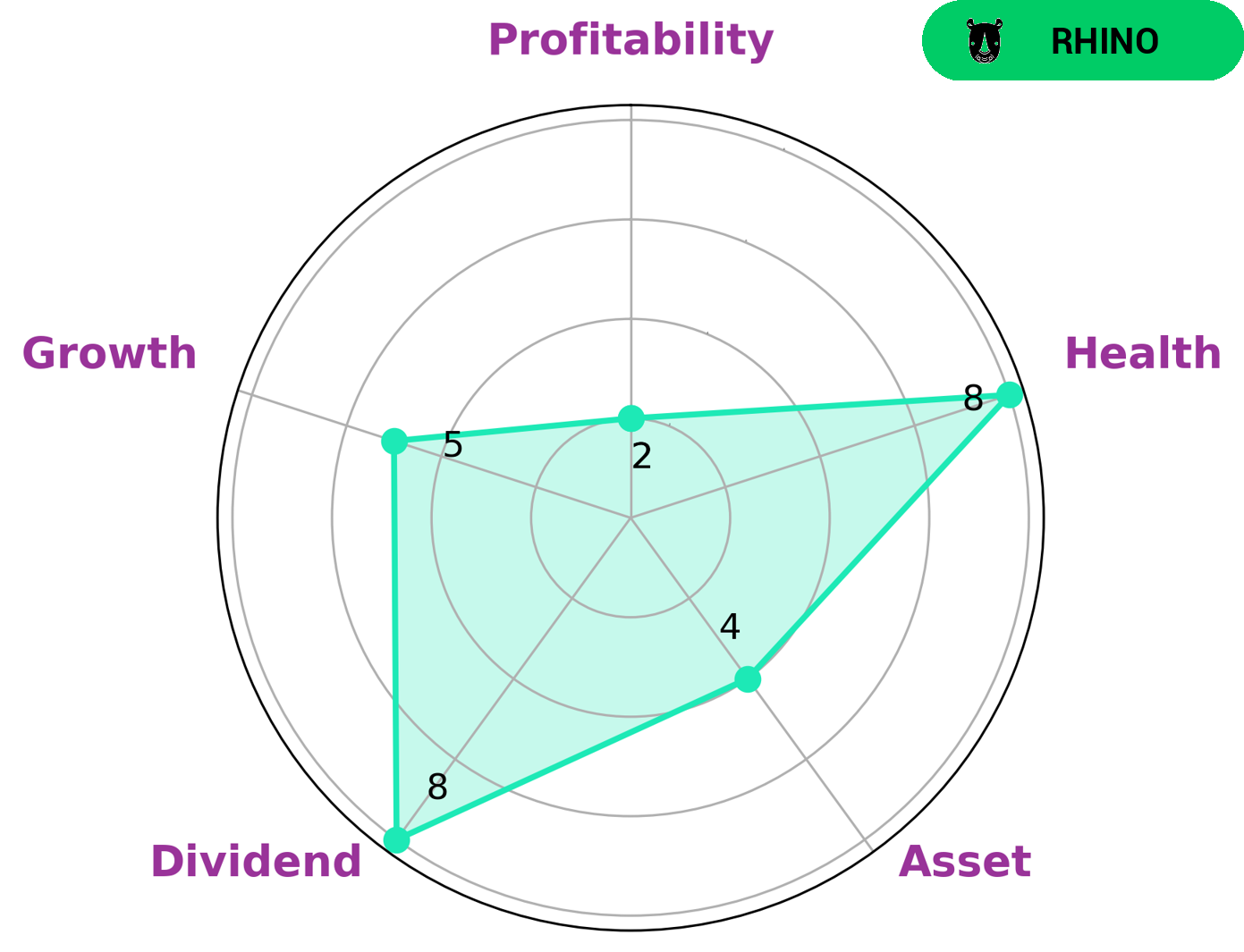

GoodWhale conducted a financial analysis of ATLAS ARTERIA and the results show that it has a high health score of 8/10. According to our Star Chart, ATLAS ARTERIA is capable of paying off debt and funding future operations. In terms of its financials, ATLAS ARTERIA is strong in dividend, medium in asset, growth and weak in profitability. Based on our analysis, we’ve classified ATLAS ARTERIA as a ‘rhino’. A rhino is a type of company that we conclude has achieved moderate revenue or earnings growth. Given the healthiness of ATLAS ARTERIA and the moderate revenue/earnings growth, we suggest that investors looking for relatively safe investments may find ATLAS ARTERIA attractive. Investors who are seeking more aggressive investments may look elsewhere. More…

Peers

It is one of the world’s largest toll road operators with a presence in Australia, New Zealand and Europe, operating more than 3,000km of roads. Other major players in the infrastructure sector include GMR Power and Urban Infra Ltd, AJR Infra & Tolling Ltd and Vinci SA. These companies are all engaged in the construction and operation of transport infrastructure networks, with a focus on toll roads and other public-private partnerships.

– GMR Power and Urban Infra Ltd ($BSE:543490)

GMR Power and Urban Infra Ltd is an Indian infrastructure development company involved in the development of power, urban infrastructure and transportation projects. The company has a market cap of 13.73B as of 2022 and a Return on Equity (ROE) of -63.11%. This market cap indicates that the company is highly valued by investors and has a large presence in the sector. The negative ROE indicates that the company is not generating enough profits to support its current operations. The company is likely to have to make significant changes to its operations in order to improve its ROE in the coming years.

– AJR Infra & Tolling Ltd ($BSE:532959)

AJR Infra & Tolling Ltd is a leading infrastructure and tolling services provider based in India. The company has a market cap of 1.41B as of 2022, which is indicative of its strong financial performance in the industry. Its Return on Equity (ROE) stands at 131.98%, indicating a high return on its shareholders’ equity. The company offers comprehensive infrastructure solutions such as toll collection, construction, and maintenance services for highways and expressways. It also provides project management services for various road and highway projects. AJR Infra & Tolling Ltd has built an impressive portfolio of projects across India and is well-positioned to continue to grow and prosper in the years ahead.

– Vinci SA ($OTCPK:VCISF)

DaVinci SA is a multinational conglomerate based in France that specializes in various industries, including aerospace, defense, energy, and healthcare. The company has a market cap of 55.74 billion as of 2022 and a Return on Equity (ROE) of 16.12%. This signifies a strong financial performance and a high rate of return on the capital that shareholders have invested in the company. DaVinci SA has been successful in utilizing its expansive range of industries and products to create a financially sound and diversified business model. The company continues to grow and expand into new markets, generating increased returns for shareholders.

Summary

ATLAS ARTERIA is a reliable dividend stock that has consistently paid out 0.39 AUD per share in dividends for the past three years, resulting in an average dividend yield of 5.26%. This is an attractive option for investors looking for a stable and reliable income stream from their portfolio. The company has a strong track record of dividend payments, and its stock price has remained relatively stable over the past few years. Thus, ATLAS ARTERIA is an ideal choice for investors seeking a secure and predictable rate of return.

Recent Posts