Assura Plc dividend calculator – Assura PLC Announces 0.0082 Cash Dividend

June 11, 2023

🌥️Dividends Yield

Assura PLC announced on June 1 2023, that it would be paying a 0.0082 Cash Dividend to all its shareholders. This dividend comes on the heels of the company’s steady annual dividend per share of 0.03 GBP for the 3-year period ending in 2023, resulting in a 5.24% average yield. With this new dividend, ASSURA PLC ($LSE:AGR) is demonstrating its commitment to returning value to its shareholders. If you are looking for dividend stocks to add to your portfolio, ASSURA PLC may be the perfect pick. With a reliable dividend track record and a healthy yield, this stock is sure to offer long-term returns.

However, before you make any investment decisions, please make sure to note the ex-dividend date for this stock which is June 7 2023.

Share Price

ASSURA PLC, a leading healthcare real estate investment company, announced on Thursday that their stockholders will receive a 0.0082 cash dividend. Following the announcement, ASSURA PLC’s stock opened at £0.5 and closed at the same price £0.5 on Thursday, showing a modest increase of 0.1% from their prior closing price of £0.5. Analysts are expecting the stock to remain steady in the near future, as investors view the dividend announcement positively and potentially move to invest in ASSURA PLC’s stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Assura Plc. More…

| Total Revenues | Net Income | Net Margin |

| 150.4 | -119.2 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Assura Plc. More…

| Operations | Investing | Financing |

| 94.1 | -130.4 | -89.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Assura Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.92k | 1.34k | 0.54 |

Key Ratios Snapshot

Some of the financial key ratios for Assura Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 82.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

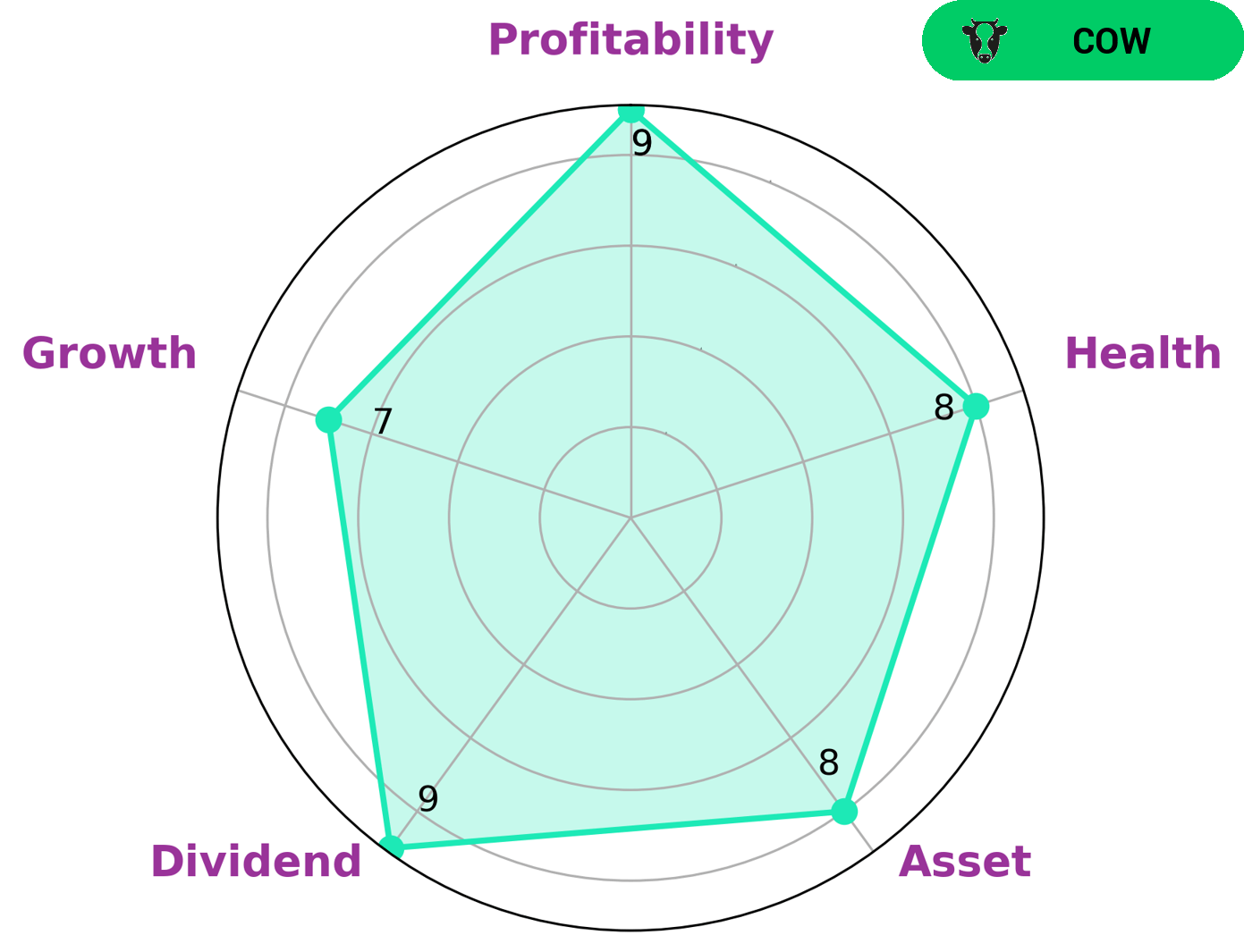

GoodWhale has conducted an analysis of ASSURA PLC‘s wellbeing, and through our Star Chart we classified the company as a ‘cow’, a type of company with a track record of paying out consistent and sustainable dividends. This would make the company an attractive investment opportunity for dividend investors. In terms of financial health, ASSURA PLC scored 8/10 due to its strong cashflows and debt. This indicates that the company is in a good position to weather any crisis without putting itself at risk of bankruptcy. Additionally, the company performed well in terms of asset growth, dividend performance, and profitability. All these factors contribute to ASSURA PLC’s strong overall financial health. More…

Peers

It is the largest healthcare REIT in the UK and competes with other REITs such as First Real Estate Investment Trust, Welltower Inc, and Strawberry Fields REIT Inc. All four companies aim to deliver strong returns for their investors through a portfolio of carefully selected properties, but each has a different approach to doing so.

– First Real Estate Investment Trust ($SGX:AW9U)

Real Estate Investment Trust (REIT) is a publicly traded company that owns, operates and finances income-producing real estate. It has a market capitalization of 545.52M as of 2023, making it one of the largest REITs in the world. The trust focuses on buying, selling, and managing real estate investments, and it is a great way to diversify a portfolio while earning income. REITs are popular among investors because they offer a steady stream of income and have the potential for capital appreciation. The trust also provides investors with access to a wide range of real estate investments, including residential and commercial properties. As such, REITs provide investors with the opportunity to participate in the real estate market while mitigating some of the risks associated with investing in a single property.

– Welltower Inc ($NYSE:WELL)

Welltower Inc is a real estate investment trust (REIT) that invests in senior housing and healthcare real estate. As of 2023, the company had a market capitalization of 32.53 billion, making it one of the largest REITs in the United States. The company owns or has investments in over 1,600 properties in the United States, Canada, and the United Kingdom. Welltower’s portfolio consists of seniors housing properties such as independent living, assisted living, and memory care, as well as medical office buildings, outpatient medical centers, and post-acute and long-term care facilities. The company also provides management and leasing services for its properties.

– Strawberry Fields REIT Inc ($OTCPK:STRW)

Strawberry Fields REIT Inc is a real estate investment trust that focuses on acquiring, owning and operating multifamily residential and commercial real estate properties. As of 2023, Strawberry Fields REIT Inc has a market cap of 49.86M. A market cap is the total value of a company’s shares and is calculated by multiplying the number of shares outstanding by the current stock price. In other words, the market cap of Strawberry Fields REIT Inc is an indication of its size and financial strength.

Summary

ASSURA PLC is an attractive investment for those looking for a consistent dividend yield. Over the three-year period from 2021 to 2023, the company has paid a constant annual dividend per share of 0.03 GBP which yields an average of 5.24%. This return is above the market average and makes ASSURA PLC a viable option for dividend investors. With a consistent dividend yield and a steady performance, ASSURA PLC is an ideal long-term investment for those looking for a reliable return.

Recent Posts