Asian Sea dividend yield calculator – Asian Sea Corp PCL Announces 0.4 Cash Dividend

May 29, 2023

Dividends Yield

On May 26 2023, Asian Sea ($SET:ASIAN) Corp PCL announced that they will be distributing a 0.4 cash dividend for the fiscal year. For the past three years, ASIAN SEA has distributed a dividend per share of 0.65, 0.65, and 0.8 THB respectively. As a result, the dividend yields from 2021 to 2023 are estimated to be 3.93%, 3.93%, and 5.79% respectively with an average dividend yield of 4.55%. This means that if you are interested in dividend paying stocks, ASIAN SEA could be an option with the ex-dividend date being May 8 2023.

Price History

The stock opened at THB10.0 and closed at the same price, up by 0.5% from the prior closing price of 10.0. This dividend will be the fifth dividend payment made by the company in the past two years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Asian Sea. More…

| Total Revenues | Net Income | Net Margin |

| 10.6k | 780.97 | 7.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Asian Sea. More…

| Operations | Investing | Financing |

| 979.88 | 589.73 | 3.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Asian Sea. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.63k | 1.73k | 7.76 |

Key Ratios Snapshot

Some of the financial key ratios for Asian Sea are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.7% | 79.1% | 10.3% |

| FCF Margin | ROE | ROA |

| 3.6% | 10.7% | 7.1% |

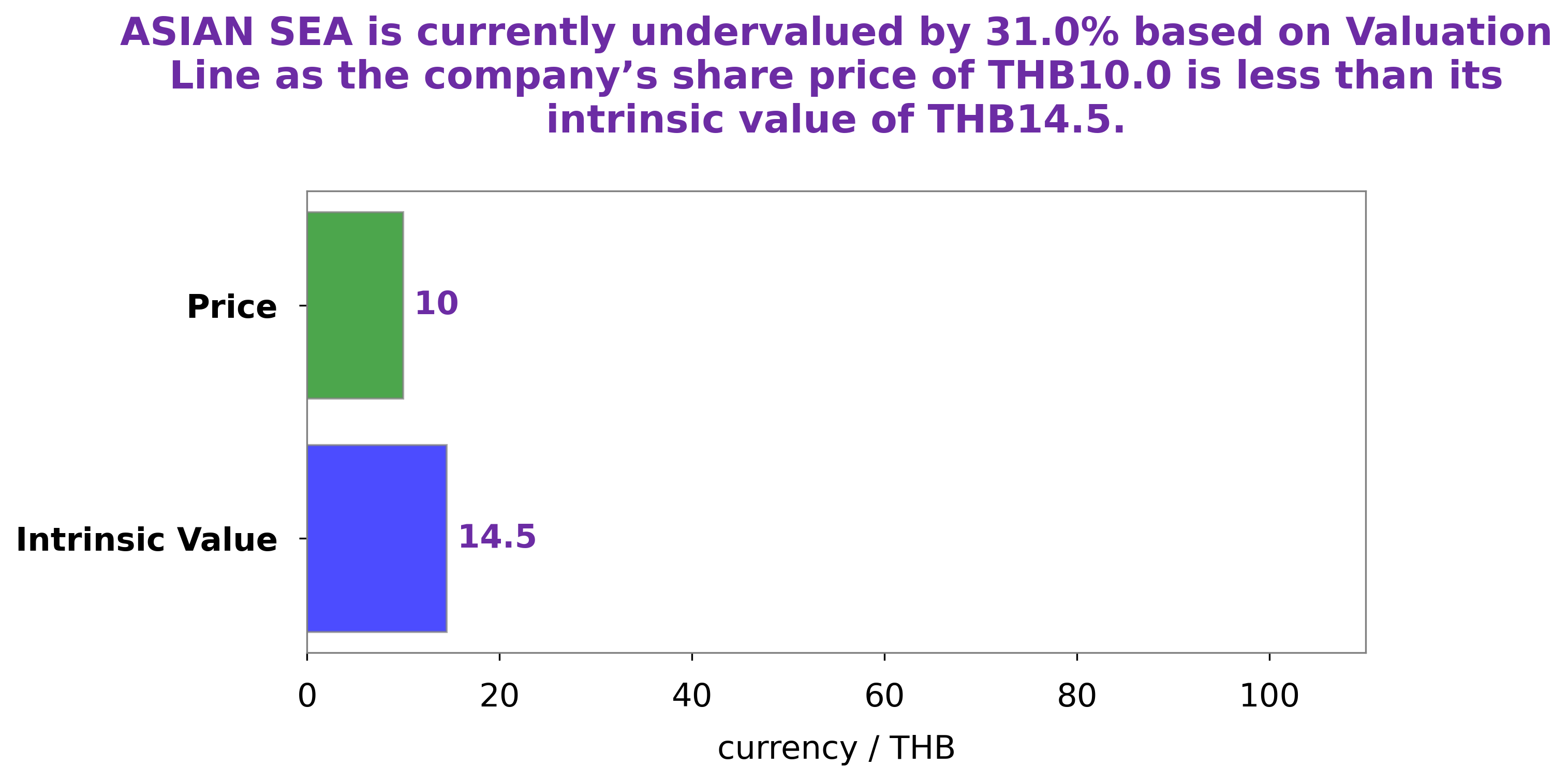

Analysis – Asian Sea Intrinsic Value

At GoodWhale, we conducted a comprehensive analysis of ASIAN SEA‘s wellbeing. Based on our proprietary Valuation Line, we calculated the fair value of ASIAN SEA shares to be around THB14.5. However, the current market value of the stock is only THB10, indicating an undervaluation by 31.3%. This presents a great opportunity to invest in ASIAN SEA stock at an attractive price. More…

Peers

All of these companies have established a successful presence in the Thai food industry, providing a variety of products and services to customers. Despite intense competition, Asian Sea Corp PCL has managed to remain an important player in the Thai food industry.

– Chin Huay PCL ($SET:CH)

Chin Huay PCL is a Thailand-based company that has grown to become one of the leading manufacturers of plastic products and components. The company’s market cap of 2.21B as of 2023 is a testament to its growing success. The company’s solid Return on Equity of 6.39% reflects its efficient capital management and strong performance in generating profits. Chin Huay’s focus on quality products, combined with strong market positioning, has allowed the company to remain competitive in the face of stiff competition and remain profitable.

– Premier Foods PLC ($LSE:PFD)

Premier Foods PLC is a leading food manufacturer and distributor in the United Kingdom. The company has a market cap of 1.17B and a Return on Equity (ROE) of 5.64% as of 2023. This is indicative of the company’s strong financial health and its ability to generate returns for its shareholders. The company’s products include brands like Oxo, Bisto, Batchelors, Ambrosia, and Loyd Grossman. Premier Foods PLC operates through four main divisions: Grocery, Sweet Treats, International and Foodservice. The Grocery division consists of the company’s well-known brands, while the Sweet Treats division focuses on the production and distribution of cakes, desserts and puddings. The International division is responsible for the overseas sales and distribution of the company’s products. Lastly, the Foodservice division refers to the supply of food products to catering establishments.

– S Khonkaen Foods PCL ($SET:SORKON)

Khonkaen Foods PCL is a publicly traded Thai food and beverage conglomerate that produces a variety of products, ranging from snack foods to energy drinks. As of 2023, the company has a market capitalization of 1.62 billion, which places it among the top listed companies in Thailand. Additionally, it has a Return on Equity of 6.16%, indicating that the company is generating a good return for the shareholders. The company has grown significantly in recent years, with a focus on expanding its product line and market reach. Its strong financial performance makes it well positioned to take advantage of opportunities within the industry.

Summary

As an investor in ASIAN SEA, it is important to analyze the company’s dividend yield to determine the potential return on investment. For the past three years, ASIAN SEA has distributed annual dividends per share of 0.65, 0.65, and 0.8 THB respectively. This results in estimated dividend yields of 3.93%, 3.93%, and 5.79% from 2021 to 2023 respectively, with an average yield of 4.55%.

The dividend payout record of ASIAN SEA demonstrates the company’s commitment to rewarding shareholders for their investments. Thus, it is a good indication that investing in ASIAN SEA can potentially result in a steady return over time.

Recent Posts