APLE dividend yield calculator – Apple Hospitality REIT Declares 0.08 Cash Dividend

April 20, 2023

Dividends Yield

On April 19 2023, Apple Hospitality REIT Inc. declared a 0.08 cash dividend per share. This dividend has been consistent for the last three years, with an annual dividend per share of $0.68 and a dividend yield of 4.08% for each year. If you are looking to invest in dividend stocks, Apple Hospitality REIT might be worth considering due to its consistent dividend yield of 4.08%. The ex-dividend date is April 27 2023, so if you want to qualify for the dividend, you must purchase APPLE HOSPITALITY REIT ($NYSE:APLE) shares before that date. This is an attractive option for investors looking to capture a steady stream of dividends payments. The company has invested in both full-service and limited-service hotels, which means its income is likely to remain strong in the long term.

It also offers a diversified portfolio of investments, which helps to reduce risk. The dividend payments are also a good indication of the strength of the company’s finances and its commitment to rewarding shareholders. Investors in APPLE HOSPITALITY REIT can expect to receive consistent and growing dividend payments as well as capital appreciation in the long term. With its current yield of 4.08%, it is certainly a good option for those looking for a reliable income stream. As always, however, it is important to carefully research any potential investment before committing to it.

Price History

The stock opened at $15.8, which was further decreased by the dividend news. The company acquires and invests in hospitality properties across the United States, primarily focusing on select-service and extended-stay hotels. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for APLE. More…

| Total Revenues | Net Income | Net Margin |

| 1.24k | 144.81 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for APLE. More…

| Operations | Investing | Financing |

| 368.45 | -135.91 | -228.97 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for APLE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.77k | 1.59k | 13.9 |

Key Ratios Snapshot

Some of the financial key ratios for APLE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 18.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

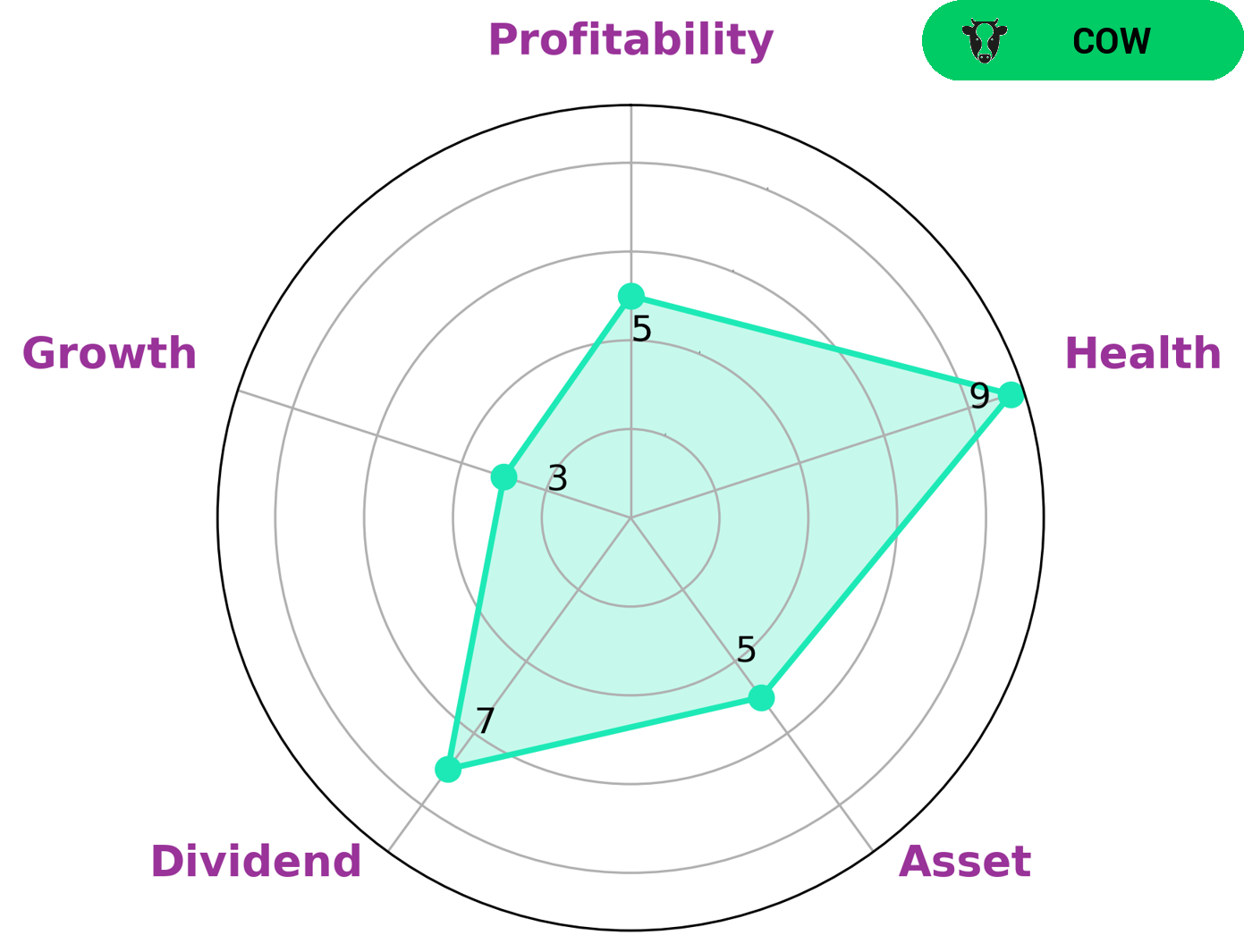

At GoodWhale, we have taken an in-depth look at the fundamentals of APPLE HOSPITALITY REIT in order to make an informed analysis. Our Star Chart rating for the company shows that it is strong in dividend and medium in asset, profitability and growth. We also find that APPLE HOSPITALITY REIT has a high health score of 9/10 with regard to its cashflows and debt, meaning that it is capable of sustaining future operations in times of crisis. From this, we have classified APPLE HOSPITALITY REIT as a ‘cow’, meaning it has a track record of paying out consistent and sustainable dividends. This kind of company is typically favored by investors who are looking to make a reliable, steady return over the long term. APPLE HOSPITALITY REIT’s combination of strong dividend payments and a high health score make it an attractive option for investors seeking relatively low-risk investments with the potential to generate returns over the long-term. More…

Peers

The company’s competitors include Sunstone Hotel Investors Inc, Braemar Hotels & Resorts Inc, and CDL Hospitality Trusts.

– Sunstone Hotel Investors Inc ($NYSE:SHO)

Stone Hotel Investors Inc is a real estate investment trust that invests in hotel properties. The company’s portfolio includes properties in the United States, Canada, and Europe. As of 2022, Stone Hotel Investors Inc had a market cap of 2.28 billion. The company’s primary business is owning and operating hotel properties.

– Braemar Hotels & Resorts Inc ($NYSE:BHR)

Braemar Hotels & Resorts Inc. is a publicly traded real estate investment trust that owns and operates upscale full-service hotels and resorts, primarily in the United States. The company was founded in 1993 and is headquartered in Dallas, Texas. As of December 31, 2020, Braemar’s portfolio consisted of 36 hotels and resorts with a total of 11,917 guest rooms.

– CDL Hospitality Trusts ($SGX:J85)

CDL Hospitality Trusts is a hospitality real estate investment trust that owns a portfolio of hotels and resorts in Asia Pacific. The company’s market cap is $1.41 billion as of 2022. CDL Hospitality Trusts is headquartered in Singapore.

Summary

APPLE HOSPITALITY REIT is a strong dividend-paying stock, offering an average annual dividend yield of 4.08% over the last three years. This makes it an attractive option for investors who are looking for a reliable income stream. The company also has a solid balance sheet, with a healthy amount of cash and debt, as well as a steady stream of income from its portfolio of hotel properties.

Its share price has remained reasonably stable over the years, providing investors with a safe way to generate passive income from the stock market. With its track record of consistent dividend payments and good capital appreciation, APPLE HOSPITALITY REIT is an attractive investment for those seeking to add a low-risk stock to their portfolio.

Recent Posts