American Financial dividend calculator – First American Financial Co. to Offer Dividend Payout on June 7th

June 12, 2023

🌥️Trending News

On June 7th, First American Financial ($NYSE:AFG) Co. (FAM) will be ex-dividend, meaning investors will be eligible for the first dividend payout of the company. First American Financial Co. is a publicly traded finance company based in the United States that provides services including title insurance, escrow services and other financial services to real estate and mortgage lenders. This is an exciting opportunity for those interested in investing in the company as well as for those who are looking to diversify their portfolios. With this dividend payout, FAM is taking a step towards becoming more financially accessible by providing a steady stream of income to its investors.

Those who are interested in taking advantage of this dividend should purchase the stock before June 7th in order to receive the payout. This is a great opportunity for those looking to invest in a reliable financial company with a long history of success.

Dividends – American Financial dividend calculator

This is the third year in a row that the company has issued annual dividends per share, with the previous three years yielding 2.38, 2.31, and 2.06 USD respectively. According to recent estimations, the dividend yields from 2021 to 2023 are projected to be 1.82%, 1.81%, and 2.32%, with an average dividend yield of 1.98%.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Financial. More…

| Total Revenues | Net Income | Net Margin |

| 7.06k | 820 | 11.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Financial. More…

| Operations | Investing | Financing |

| 1.15k | -1.05k | -1.36k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 28.48k | 24.54k | 46.26 |

Key Ratios Snapshot

Some of the financial key ratios for American Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.0% | – | 15.7% |

| FCF Margin | ROE | ROA |

| 16.3% | 17.3% | 2.4% |

Share Price

On Monday, AMERICAN FINANCIAL’s stock opened at $115.8 and closed at $115.0, down by 1.5% from its prior closing price of 116.7. Live Quote…

Analysis

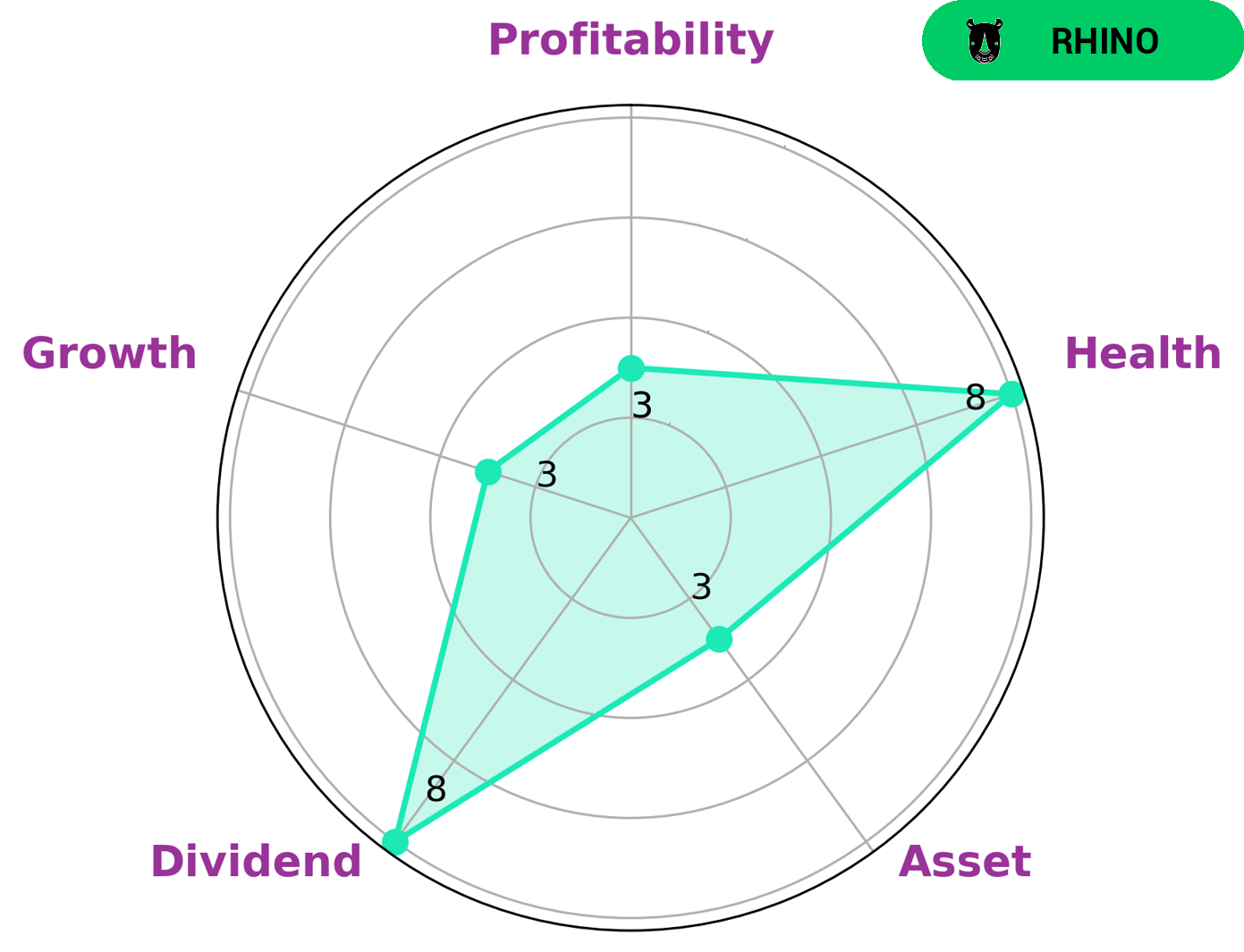

GoodWhale conducted an analysis of AMERICAN FINANCIAL‘s financials and found that, according to our Star Chart, the company is strong in dividend and weak in asset and growth. AMERICAN FINANCIAL achieved a relatively high Health Score of 8/10, indicating that the company is likely to be able to sustain operations in times of crisis. Based on this analysis, we classify AMERICAN FINANCIAL as a ‘rhino’, meaning a company that has achieved moderate revenue or earnings growth. Given the company’s moderate growth profile and strong dividend record, we suggest that investors who are looking for a relatively safe and steady return should consider investing in AMERICAN FINANCIAL. The company’s relatively high Health Score indicates that it is well-positioned to have a stable future even in times of economic uncertainty. It may be particularly attractive to conservative investors who are looking for a steady return on their investments. More…

Peers

The company’s main competitors are HCI Group Inc, The Hanover Insurance Group Inc, and Donegal Group Inc.

– HCI Group Inc ($NYSE:HCI)

The company’s market cap is 280.02M as of 2022 and its ROE is -1.61%. The company is a provider of healthcare services.

– The Hanover Insurance Group Inc ($NYSE:THG)

The Hanover Insurance Group, Inc., together with its subsidiaries, provides various property and casualty products and services in the United States. The company operates in three segments: Commercial Lines, Personal Lines, and Other. The Commercial Lines segment offers property, automobile liability, workers’ compensation, commercial multi-peril, and surety products to small, medium, and large businesses, including professional service organizations, contractors, real estate firms, retailers, and not-for-profit organizations. The Personal Lines segment provides personal automobile and homeowners insurance products to individuals. The Other segment offers reinsurance products. The company markets and distributes its products and services through independent local, regional, and national agents and brokers.

– Donegal Group Inc ($NASDAQ:DGICA)

As of 2022, Donegal Group Inc has a market cap of 461.86M. It has a return on equity of 0.82%. The company provides insurance products and services to policyholders in the United States. Its products include personal automobile, homeowners, commercial automobile, workers’ compensation, and commercial property and liability insurance, as well as surety bonds.

Summary

American Financial Co. is set to go ex-dividend on June 7th, meaning shareholders of record as of June 7th will be eligible to receive the dividend payment. This is an attractive opportunity for investors as the company has a strong dividend yield of 3%. Analysts believe this dividend will provide a good return for investors. The company’s stock has also been performing well in the market, with its share price increasing by over 10% in the past year.

Moreover, analysts are predicting further growth in the future, citing the company’s strong financial position. Going forward, investors may want to consider American Financial Co. as part of their portfolio given its attractive dividend yield and potential future growth.

Recent Posts