Amata Corporation dividend yield – Amata Corp PCL Announces 0.4 Cash Dividend

May 28, 2023

Dividends Yield

On May 25 2023, Amata Corp PCL Announces 0.4 Cash Dividend, making it the third consecutive year that the company has provided a dividend yield of 2.24%. In 2021 and 2022, the annual dividend per share was 0.5 and 0.5 THB respectively. The upcoming dividend is slightly lower, at 0.3 THB per share. The ex-dividend date for the upcoming dividend is May 3 2023.

If you are looking for a dividend stock, AMATA CORPORATION ($SET:AMATA) might be worth your consideration. The company has a consistent track record in providing dividend yields, and the upcoming dividend amount is still considerable. With the potential for future growth, AMATA CORPORATION is an attractive option for long-term investors who are looking for good returns.

Stock Price

This came as the company’s stock opened at THB22.1 and closed at THB22.3, representing a 0.9% increase from its previous closing price of 22.1. This dividend marks the next step in AMATA CORPORATION PCL’s commitment to delivering value to its shareholders. The company has a strong track record of delivering consistent returns and this dividend is set to build on that reputation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amata Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 7.6k | 2.28k | 21.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amata Corporation. More…

| Operations | Investing | Financing |

| 3.4k | -6k | 1.82k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amata Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 51.13k | 26.2k | 17.3 |

Key Ratios Snapshot

Some of the financial key ratios for Amata Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.4% | 9.4% | 52.4% |

| FCF Margin | ROE | ROA |

| 38.4% | 12.7% | 4.9% |

Analysis

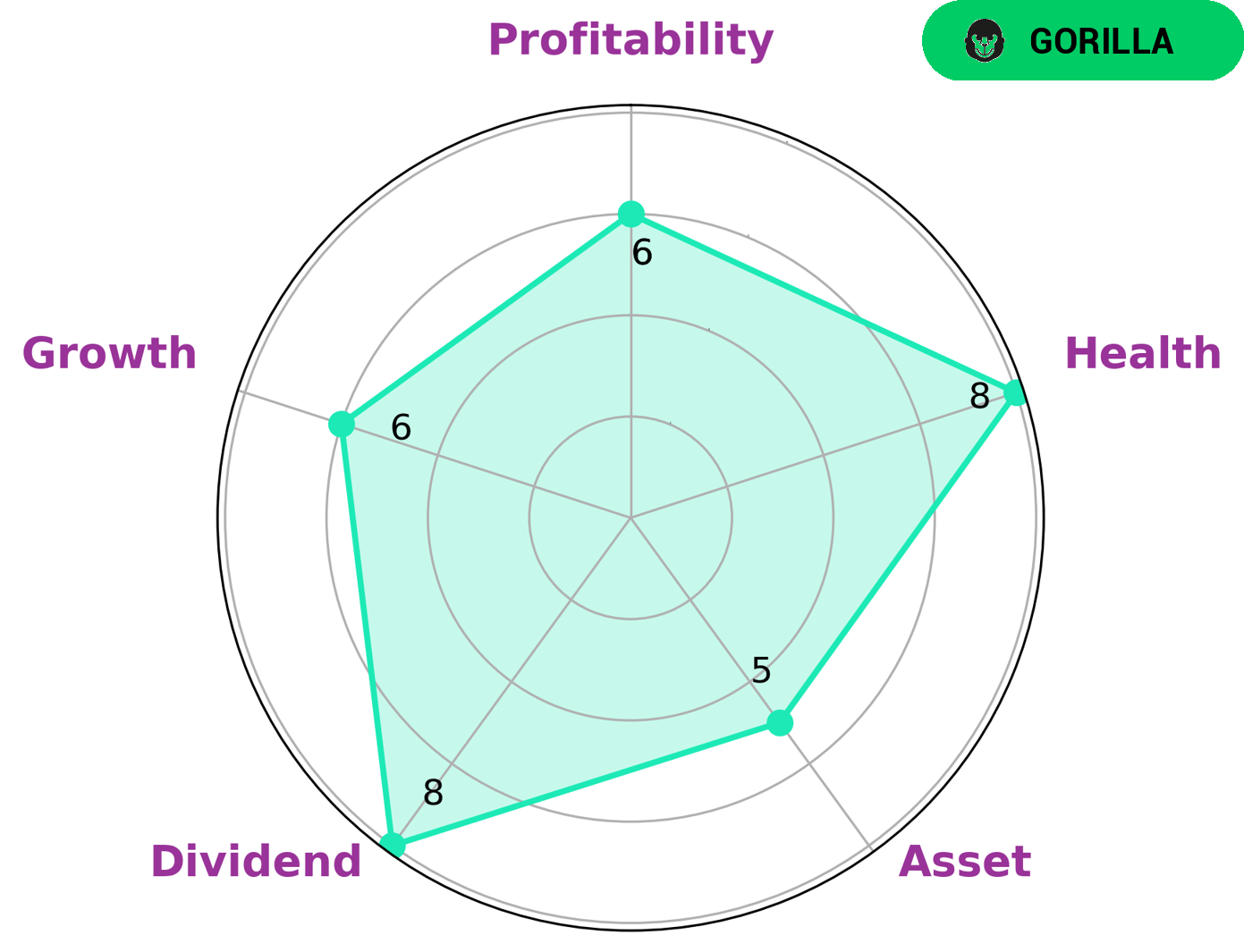

GoodWhale has conducted an analysis of the fundamentals of AMATA CORPORATION. Based on our Star Chart system, AMATA CORPORATION is strong in dividend and medium in asset, growth, and profitability. We classify AMATA CORPORATION as a ‘gorilla’ company, one that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Given this classification and its high health score of 8/10 with regard to its cashflows and debt, AMATA CORPORATION is an attractive investment opportunity for a variety of investors. Those seeking a dividend return may be drawn to the company’s high dividend strength rating, while those looking for stability in times of crisis may be reassured by its ability to sustain future operations. Furthermore, those seeking solid growth may be attracted to the company’s well-balanced medium ratings in growth and profitability. All told, AMATA CORPORATION is an ideal investment opportunity for a variety of different investors. More…

Peers

The competition between Amata Corp PCL and its competitors Kojamo Oyj, PT Duta Anggada Realty Tbk, and Inland Homes PLC is fierce, with each company striving to outdo the others in terms of offering competitive services and products. All four companies are looking to secure a larger share of the market, and they are constantly adapting their strategies in order to do so.

– Kojamo Oyj ($LTS:0A0E)

Kojamo Oyj is a Finnish property investment company focused on investing in rental apartments and related services. As of 2023, the company has a market capitalization of $2.36 billion, reflecting its position as one of the largest real estate companies in Finland. Its Return on Equity (ROE) is -7.78%, indicating that the company is not generating adequate returns relative to the invested capital. Kojamo Oyj is actively looking to expand its portfolio by acquiring more rental properties, particularly in the Helsinki area, in order to increase its revenue and improve its ROE.

– PT Duta Anggada Realty Tbk ($IDX:DART)

Duta Anggada Realty Tbk is a publicly-traded property development and real estate investment company based in Indonesia. The company has a market capitalization of 389.53 billion as of 2023, making it one of the largest market caps in the region. The company’s return on equity (ROE) is -1.73%, which indicates that it is not generating sufficient profits to cover its equity investments. Despite this, the company is still a leader in property development and real estate investment in Indonesia and continues to strive for growth and profitability.

– Inland Homes PLC ($BER:Q9J)

Inland Homes PLC is a British property development and regeneration company that specializes in developing sustainable, specialist residential and mixed-use projects. As of 2023, the company has a market cap of 26.94M and a Return on Equity of 6.61% indicating good financial health. The company has been successful in creating increasing value for shareholders through its focus on environmental sustainability, innovative design, and strategic partnerships. The company’s market cap provides it with the resources to finance further projects, as well as the ability to access additional capital from investors. In addition, the company’s Return on Equity indicates that it is generating significant value from its investments.

Summary

Investing in AMATA CORPORATION for dividends is a relatively safe bet, as the company has provided an average yield of 2.24% over the past three years. The upcoming dividend is set to be paid on May 3 2023, with a per share price of 0.3 THB. Despite the low yields, investing in AMATA CORPORATION is still a good option for dividend investors, as it offers a dependable and consistent income. The company is a reliable source of income, as dividends have been paid consistently over the past three years.

Furthermore, the company is financially stable and has a well-established track record in providing consistent returns. Therefore, dividend investors should consider investing in AMATA CORPORATION for a safe and reliable income stream.

Recent Posts