Acuity Brands dividend calculator – Acuity Brands Declares Quarterly Dividend of $0.13 per Share

January 30, 2023

Trending News ☀️

Acuity Brands dividend calculator – Acuity Brands ($NYSE:AYI) Inc. (NYSE: AYI) is a publicly traded company and the leading provider of innovative lighting and controls solutions for commercial, institutional, industrial, infrastructure, and residential applications. The company recently announced that it has declared a quarterly dividend of $0.13 per share, which is consistent with its previous payout. This dividend is payable on February 14th to shareholders of record on February 6th and will be ex-dividend on February 3rd. Acuity Brands has a long history of providing innovative lighting and controls solutions to a range of customers and industries, from residential and commercial buildings to healthcare and hospitality. Their products are designed to increase energy efficiency, reduce energy costs, and improve the overall quality of life. They are constantly innovating and developing new products to meet the needs of their customers. Investors who are looking for reliable dividend income may want to consider Acuity Brands. With its consistent dividend payouts, investors can count on a steady income stream from the company.

Additionally, it has a solid balance sheet and strong cash flow, which can provide investors with added assurance of its stability. The company’s dividend scorecard, yield chart, and dividend growth rate provide an easy way to track its dividend performance over time. Its long history of providing innovative solutions for a variety of industries, combined with its consistent dividend payouts, make it an attractive option for those looking for yield and stability. For more information on Acuity Brands and its dividend policies, please refer to the company’s dividend scorecard, yield chart, and dividend growth rate.

Dividends – Acuity Brands dividend calculator

Acuity Brands Inc. recently announced that they will be issuing a quarterly dividend of 0.13 USD per share. This is the same as the dividend per share issued for the last three years, which was 0.52 USD annually. The dividend yields for 2021 to 2023 are 0.28%, 0.27%, and 0.45%, respectively, with an average dividend yield of 0.33%. This dividend payment is a great opportunity for investors looking to make a return on their investment, especially those who have been with the company for some time. The dividend yields are expected to remain steady and the company has a long history of consistent dividend payments. This makes Acuity Brands Inc. a great choice for those looking for a reliable and consistent income stream.

The company has also recently announced plans to increase its capital spending in 2021, which could lead to greater returns for investors in the future. This increased investment could also help the company continue to grow and expand its market share, which would be beneficial to shareholders in the long run. Overall, Acuity Brands Inc. looks to be a great option for investors looking to benefit from a reliable dividend yield and increasing capital spending. With a history of consistent dividend payments, investors can be sure that their returns are going to remain steady over time. The company’s plans for increased capital spending also presents an opportunity for future growth and potential returns in the long run.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Acuity Brands. More…

| Total Revenues | Net Income | Net Margin |

| 4.08k | 371.3 | 9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Acuity Brands. More…

| Operations | Investing | Financing |

| 419.2 | -67.5 | -563.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Acuity Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.44k | 1.53k | 59.21 |

Key Ratios Snapshot

Some of the financial key ratios for Acuity Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.5% | 5.2% | 12.4% |

| FCF Margin | ROE | ROA |

| 8.7% | 16.6% | 9.2% |

Price History

Acuity Brands Inc. declared a quarterly dividend of $0.13 per share on Thursday, with the stock opening at $182.1 and closing at $182.1, marking a rise of 1.0% from its last closing price of $180.3. Acuity Brands Inc. is an American lighting manufacturer that serves commercial, industrial, institutional, and residential markets. Their products include lighting fixtures, control systems, and fixture accessories. They also offer a range of products related to the Internet of Things (IoT) and connected lighting solutions. The company’s dividend policy is based on their business performance and financial condition, their ability to generate cash from operations, their capital requirements, competitive considerations, and other factors.

The board of directors reviews their dividend policy each year and makes adjustments as appropriate. This dividend announcement is a reflection of the company’s confidence in its financial performance and long-term prospects for growth. This dividend payment is part of their ongoing effort to reward investors for their loyalty and to further strengthen their financial position. Live Quote…

VI Analysis

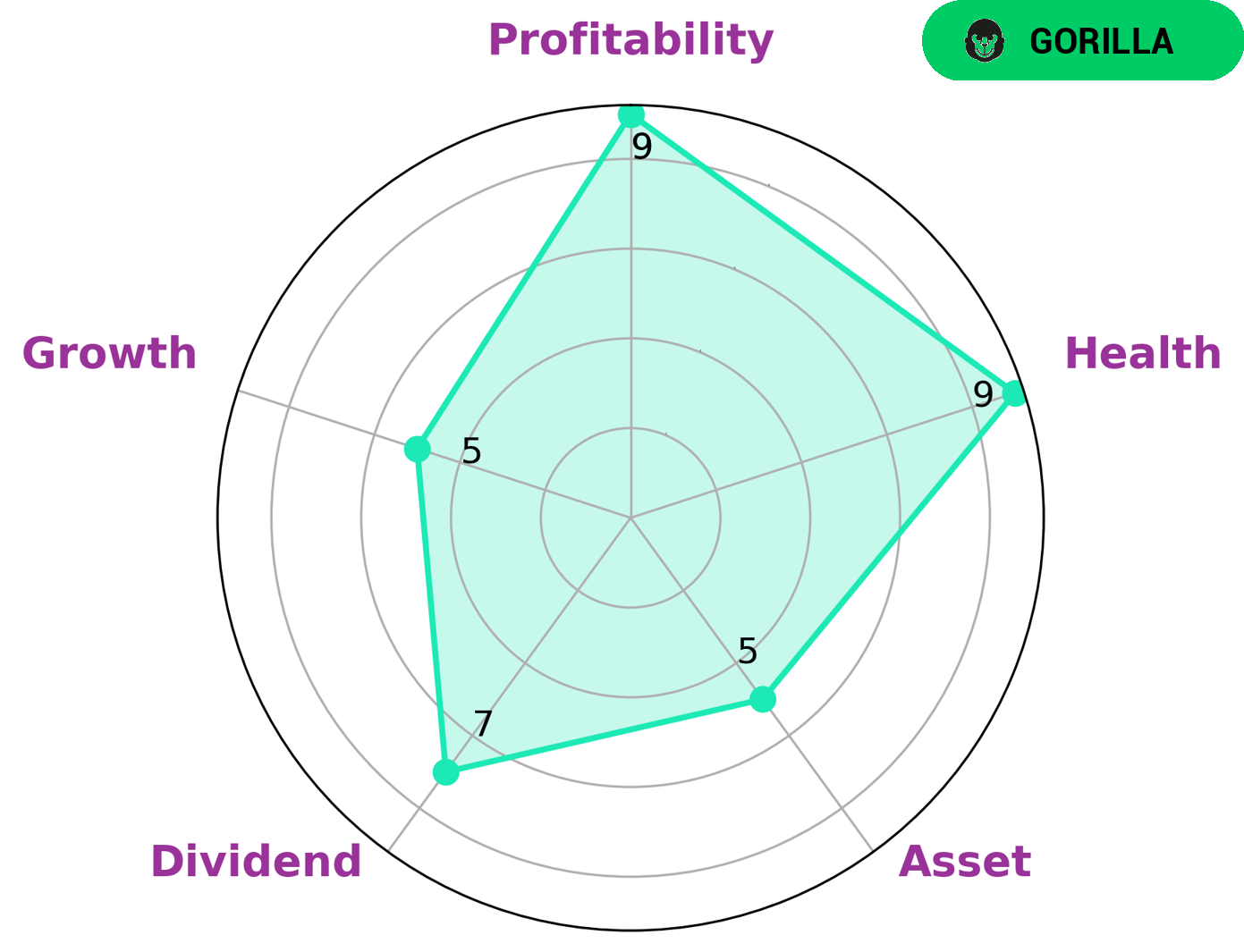

Investors looking for a long term potential are likely to be interested in the fundamentals of a company. The VI app makes it easy to analyze the fundamentals of companies like ACUITY BRANDS. It gives a high health score of 9/10, indicating that the company is capable of paying off its debt and funding future operations. The company is classified as a ‘gorilla’ due to its strong competitive advantage and its ability to achieve stable and high revenue or earning growth. Companies with such strong competitive advantage are usually attractive to investors due to their ability to generate higher returns than other companies. The company also has a strong dividend, high profitability, and medium asset and growth. These factors make it attractive for investors looking for a long-term investment that can provide returns over time. Overall, ACUITY BRANDS has many attractive features for investors looking for a long-term investment. Its strong competitive advantage, high health score, and strong dividends are all attractive features that make it an attractive option for investors. With its high-quality fundamentals, ACUITY BRANDS is an attractive option for investors looking for a long-term investment. More…

VI Peers

The competition in the lighting industry is fierce, with Acuity Brands Inc being one of the most prominent competitors. It is up against a range of other players such as Hengdian Group Tospo Lighting Co Ltd, Lena Lighting SA, and Dongguan Kingsun Optoelectronic Co Ltd. Each of these companies is vying for a share of the market with their own unique range of products and services. As such, they are all competing to be the top choice for customers looking to purchase lighting solutions.

– Hengdian Group Tospo Lighting Co Ltd ($SHSE:603303)

Hengdian Group Tospo Lighting Co Ltd is a Chinese lighting manufacturer and distributor that specializes in LED lighting products. As of 2022, the company has a market capitalization of 8.88 billion, indicating that it is a large and successful enterprise. Furthermore, the company has achieved a Return on Equity of 6.08%, which is an impressive figure for such a large company. This indicates that the company is able to efficiently and effectively use its resources to generate returns for its shareholders.

– Lena Lighting SA ($LTS:0O7K)

Lena Lighting SA is a leading provider of lighting solutions for commercial, industrial, and residential applications. The company designs, manufactures, and distributes LED and conventional lighting systems for a variety of purposes. As of 2022, Lena Lighting SA has a market cap of 95.27M and a Return on Equity of 8.26%. Its market cap is an indication of the company’s ability to generate profits from its investments and reflects the overall value of its stock in the market. Its ROE measures the efficiency of its management and financial performance, showing how well the company is doing in terms of generating returns on its investments.

– Dongguan Kingsun Optoelectronic Co Ltd ($SZSE:002638)

Dongguan Kingsun Optoelectronic Co Ltd is a Chinese based company that specializes in the design and manufacture of optoelectronic components for a variety of industries. The company has a market cap of 3.42B as of 2022, making it one of the larger companies in its sector. Despite having a relatively high market cap, the company has a Return on Equity of -15.89%, which is lower than many of its competitors. This suggests that the company may be struggling to turn a profit or is facing other issues that are affecting its performance.

Summary

Acuity Brands Inc. is a leading provider of innovative lighting, controls and building management solutions for commercial, institutional, industrial, infrastructure and residential applications. The company recently announced a quarterly dividend of $0.13 per share, reflecting the strong performance of its stock over the past year and confidence in its continued growth. Investors considering Acuity Brands should note the company’s steady revenue growth and consistent profitability.

In addition, the company’s robust balance sheet and strong cash flow provide a cushion against economic downturns and offer investors further assurance of their capital’s safety. With a solid base of products and an experienced management team, Acuity Brands appears to be well positioned to continue delivering value to its shareholders.

Recent Posts