6HC stock dividend – Choice Properties Real Estate Investment Trust Declares 0.0625 Cash Dividend

May 26, 2023

Dividends Yield

On May 25th 2023, Choice Properties Real ($BER:6HC) Estate Investment Trust declared a 0.0625 cash dividend per share. For the past three years, the trust has distributed an annual dividend per share of CAD 0.74. This has resulted in a dividend yield of 5.13%, 5.13% and 5.17% from 2021 to 2023 respectively, with an average dividend yield of 5.14%. These results indicate that Choice Properties Real Estate Investment Trust is a reliable source of dividends for investors.

The ex-dividend date for the dividend is set on May 30th 2023, meaning that those who purchase the stock prior to this date are eligible to receive the dividend. Those who are looking for reliable dividend stocks could take into account Choice Properties Real Estate Investment Trust.

Market Price

The stock opened at €9.4 and closed at the same price. This dividend is part of the trust’s ongoing commitment to share the benefits of their stable and efficient real estate investments with their shareholders. This increase in dividends demonstrates the trust’s confidence in their ability to generate returns for their investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 6HC. More…

| Total Revenues | Net Income | Net Margin |

| 1.26k | 628.07 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 6HC. More…

| Operations | Investing | Financing |

| 652.34 | -764.8 | 140.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 6HC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.97k | 12.94k | 12.28 |

Key Ratios Snapshot

Some of the financial key ratios for 6HC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 67.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

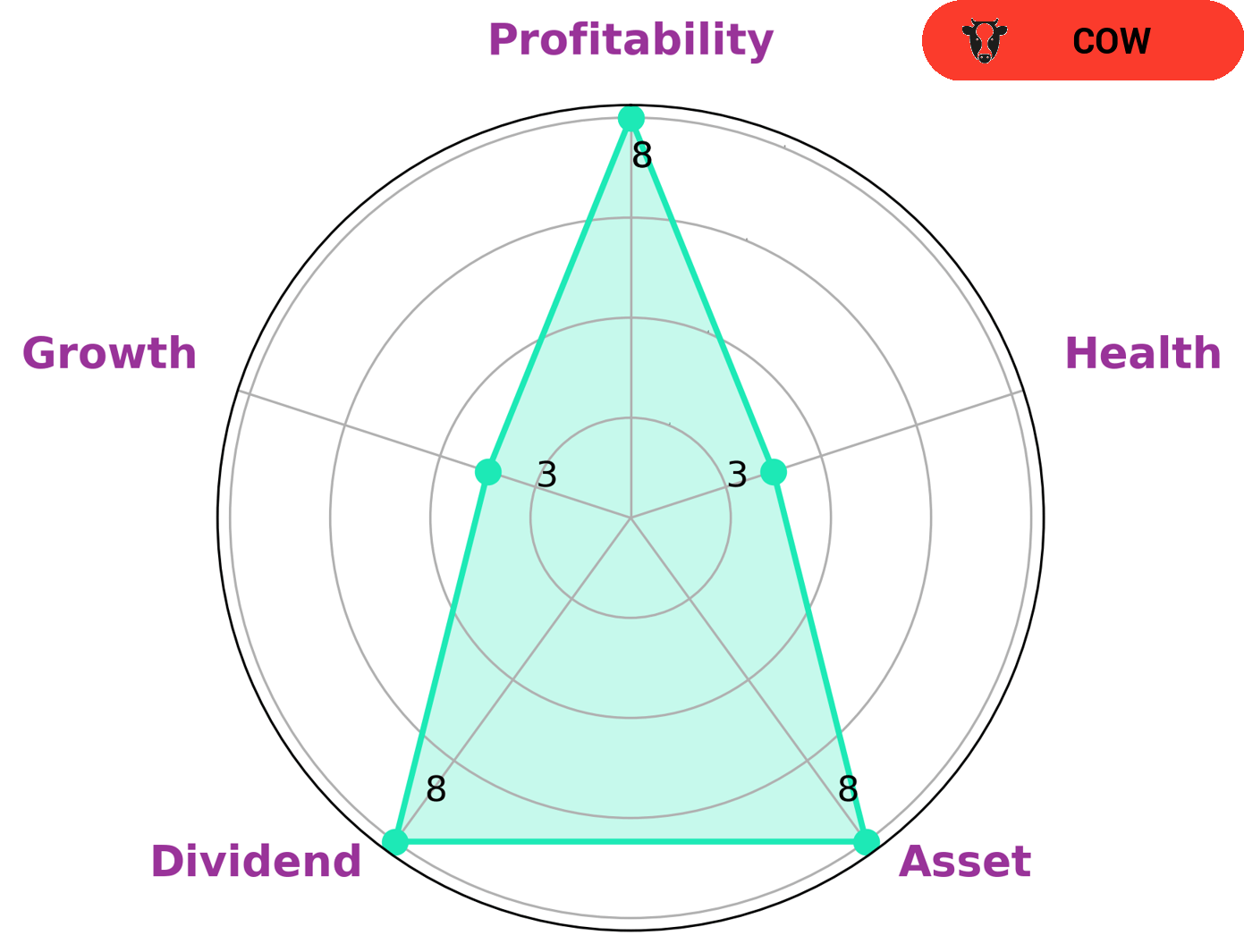

GoodWhale analyzed the fundamentals of Choice Properties Real Estate Investment Trust (REIT) and found that it is classified as a “cow”, a type of company that has a track record of paying out consistent and sustainable dividends. This makes it a good investment for long-term investors looking for steady income with moderate returns. In terms of financial performance, Choice Properties REIT is strong in asset value, dividend payments, and profitability, but is weak in growth. However, it has a low health score of 3/10 considering its cashflows and debt, which means it is less likely to safely ride out any crisis without the risk of bankruptcy. This could be concerning to some investors who are looking for a reliable option for long-term investments. More…

Summary

Choice Properties Real Estate Investment Trust is a sound investment option for those looking to benefit from a steady and reliable dividend yield. For the past three years, the company has distributed an annual dividend of CAD 0.74 per share, with a yield of between 5.13% and 5.17% over that period. This makes Choice Properties a great opportunity for investors seeking a secure and reliable dividend income. With a consistent yield and regular distributions, Choice Properties offers an attractive and promising investment prospect.

Recent Posts