1WE dividend calculator – La Francaise Des Jeux SA Announces 1.37 Cash Dividend

May 30, 2023

Dividends Yield

On May 26, 2023, La Francaise Des ($BER:1WE) Jeux SA announced a cash dividend of 1.37 EUR per share. This dividend exceeds the annual dividend per share of 1.24 EUR that the company has distributed for the last three years. With this dividend, the company has a dividend yield from 2022 to 2023 of 3.3%, with an average yield of 3.3%. The ex-dividend date for the company’s dividend is set for May 5, 2023, so investors can start receiving their dividends soon after.

Share Price

This was followed by the stock exchange showing the stock opening at €36.8 and closing at €37.3, an increase of 1.4% from the last closing price of €36.8. The dividend announcement was well-received by investors, who now expect a further increase in value of the FDJ stock. This positive outlook comes despite the current economic uncertainty being felt across various industries in France and around the world. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 1WE. More…

| Total Revenues | Net Income | Net Margin |

| 2.46k | 307.91 | 13.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 1WE. More…

| Operations | Investing | Financing |

| 406.11 | -178.7 | -320.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 1WE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.32k | 2.39k | 4.85 |

Key Ratios Snapshot

Some of the financial key ratios for 1WE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.0% | 21.2% | 17.4% |

| FCF Margin | ROE | ROA |

| 12.3% | 31.6% | 8.1% |

Analysis

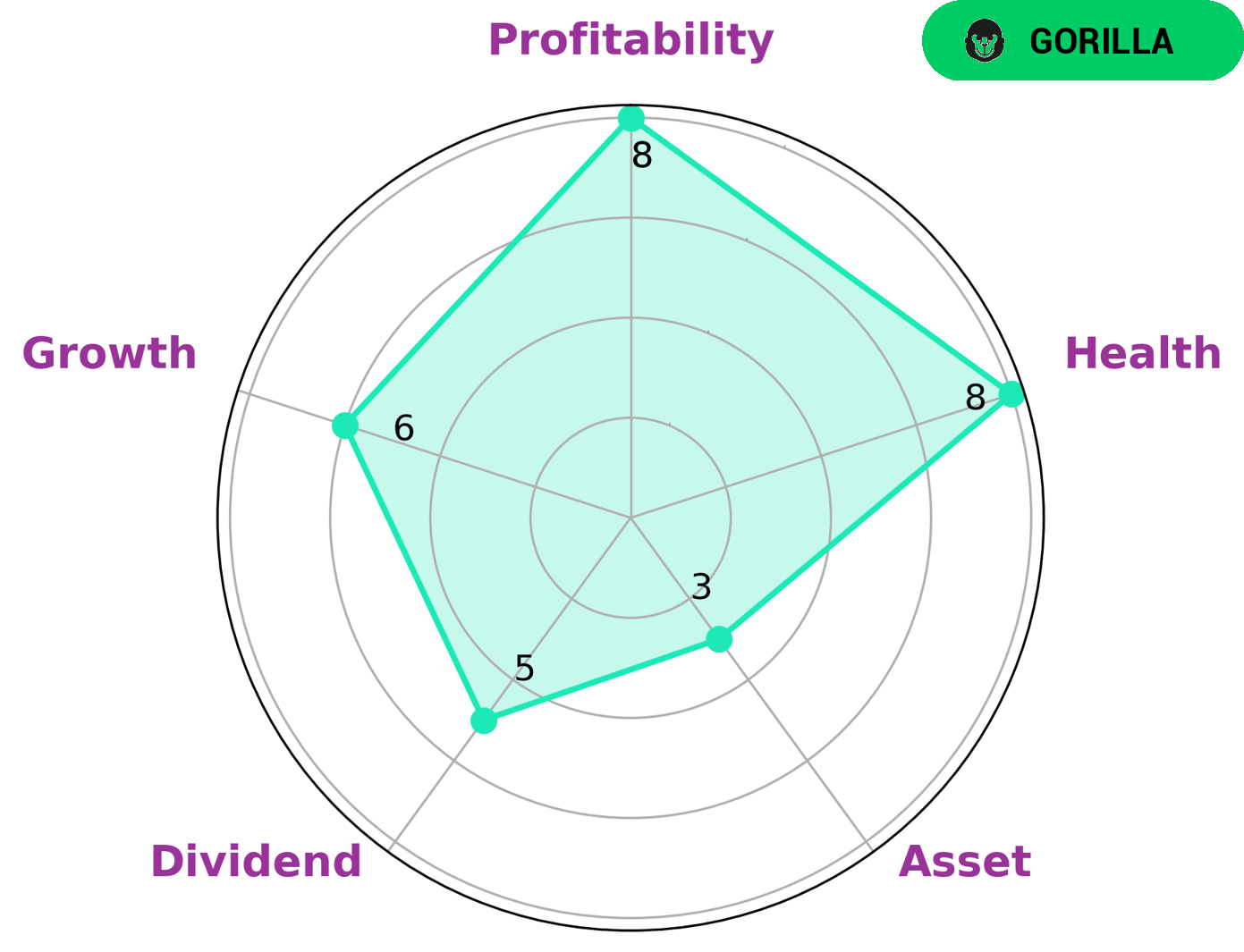

GoodWhale conducted an analysis of the fundamentals of LA FRANCAISE DES JEUX SA. According to the Star Chart, the company scored strongly in profitability, medium in dividend, growth and weak in asset. Additionally, LA FRANCAISE DES JEUX SA has a high Health Score of 8/10 which indicates that it is capable to pay off debt and fund future operations through its cashflows and debt. Based on our analysis, we classified LA FRANCAISE DES JEUX SA as a ‘gorilla’ type of company. This is due to its strong competitive advantage which enables it to achieve stable and high revenue or earning growth. Investors who are looking for stable growth in their portfolios would be interested in such companies. More…

Summary

Investing in LA FRANCAISE DES JEUX SA can be a viable option for investors looking for steady dividend payments. Over the past three years, the company has consistently distributed an annual dividend of 1.24 EUR per share.

In addition, the dividend yield from 2022 to 2023 is estimated to be 3.3%, making it an attractive high-yield investment option. The average dividend yield over the same time period is also 3.3%, suggesting that investors can depend on steady returns from LA FRANCAISE DES JEUX SA. The company’s consistent track record of dividend payments makes it a reliable investment option for those seeking steady income and capital preservation.

Recent Posts