0LYX dividend – Stalexport Autostrady SA Declares 0.2 Cash Dividend

April 9, 2023

Dividends Yield

On April 1 2023, Stalexport Autostrady SA announced its declaration of a 0.2 Cash Dividend. This rise in dividend payments marks a return to the prior three-year trend of dividend distributions, as the company had previously distributed annual dividends per share of 0.24 PLN each year, providing dividend yields of 8.18% for the period from 2022 to 2023. Given this news, investors who are in search of dividend stocks may want to consider STALEXPORT AUTOSTRADY SA ($LTS:0LYX), as the ex-dividend date is April 12 2023. The company’s commitment to regular dividends is one of the reasons it has been a popular choice for investors, providing a steady stream of income and growth potential over time.

Share Price

This news was met with enthusiasm, as the STALEXPORT AUTOSTRADY SA stock opened at €2.8 in the morning and closed at the same price at the end of the day. The dividend marks a strong financial position of the company and is an important step in increasing shareholder value. This dividend is expected to benefit shareholders in the long run and affirms STALEXPORT AUTOSTRADY SA’s commitment to delivering value to its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 0LYX. More…

| Total Revenues | Net Income | Net Margin |

| 413.89 | 79.28 | 19.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 0LYX. More…

| Operations | Investing | Financing |

| 227.85 | -155.19 | -64.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 0LYX. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.43k | 610.29 | 3.29 |

Key Ratios Snapshot

Some of the financial key ratios for 0LYX are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | -6.0% | 34.2% |

| FCF Margin | ROE | ROA |

| 41.0% | 10.8% | 6.2% |

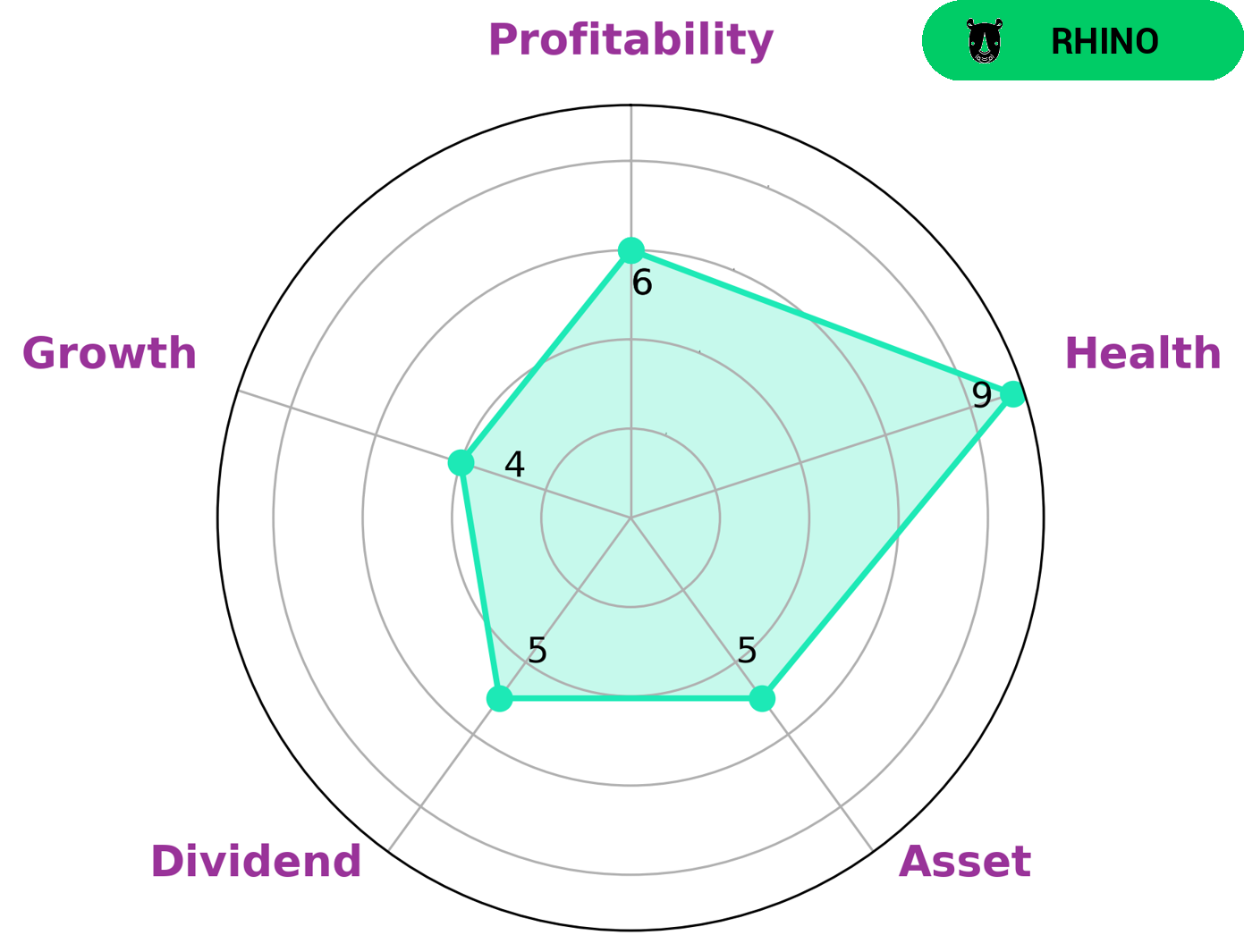

Analysis

At GoodWhale, we have taken a deep dive into the fundamentals of STALEXPORT AUTOSTRADY SA (STALEXPORT). According to our Star Chart analysis, STALEXPORT is strong in asset, dividend and growth, and medium in profitability. Our classification of STALEXPORT as ‘rhino’ indicates that the company has achieved moderate revenue or earnings growth. Investors looking for stability and predictability may be interested in STALEXPORT AUTOSTRADY SA, as it has a high health score of 9/10 with regard to its cashflows and debt. This indicates that STALEXPORT is able to sustain future operations in times of crisis. Given the consistent growth and robust financial health, STALEXPORT AUTOSTRADY SA may be an attractive investment for investors. More…

Peers

Stalexport Autostrady SA is one of the major players in the international infrastructure construction industry. It is a leader in the construction of highways, roads, bridges, and other related infrastructure in Poland and beyond. It faces competition from several other companies such as MBL Infrastructures Ltd, Atlanta Ltd, GMR Power and Urban Infra Ltd. These companies are all engaged in the building of infrastructure for transportation and energy solutions and have different structures, capabilities, and strategies. Despite the competitive environment, Stalexport Autostrady SA has managed to remain at the forefront of the industry.

– MBL Infrastructures Ltd ($BSE:533152)

MBL Infrastructures Ltd is an infrastructure development and construction company based in India. The company focuses on developing and executing large scale projects for industrial, residential, commercial and infrastructure sectors. As of 2023, MBL Infrastructures Ltd has a market cap of 1.79B and a Return on Equity of -3.65%. Market cap is an indicator of the company’s size and its potential for growth, which is relatively large for MBL Infrastructures Ltd. The company’s negative ROE is indicative of its weak profitability and ability to generate returns for shareholders.

– Atlanta Ltd ($BSE:532759)

Atlanta Ltd is a leading provider of services and products in the technology industry. Founded in 2017, the company has a market cap of 1.39B as of 2023, making it a top player in the market. Additionally, Atlanta Ltd has achieved an impressive Return on Equity (ROE) of 72.2%, showcasing its success in using equity to generate earnings. This indicates that the company is leveraging its shareholders’ investments for greater profits.

– GMR Power and Urban Infra Ltd ($BSE:543490)

GMR Power and Urban Infra Ltd is an Indian infrastructure development company that primarily focuses on the development of power and urban infrastructure projects. It has a market capitalization of 10.29B as of 2023, which indicates the company’s strong financial standing and potential for growth. The Return on Equity (ROE) of -68.56% reflects the company’s financial results over the past year, indicating a large loss in its profitability. However, the company’s current market capitalization indicates that there is potential for growth, and with a shift in focus to more profitable projects, the Return on Equity may improve in the future.

Summary

Investing in STALEXPORT AUTOSTRADY SA is attractive due to its attractive dividend yields of 8.18% for the last three years. The company has consistently paid out dividends of 0.24 PLN per share, providing investors with a solid return on their investments. It is noteworthy that the company has achieved this level of dividend yield despite the current economic climate.

From an analysis of the financials, there appears to be good potential for continued dividend growth in the future due to the healthy balance sheet, strong cash flow, and conservative leverage ratios. With these promising signs of long-term stability, it seems that STALEXPORT AUTOSTRADY SA is a wise investment decision.

Recent Posts