Walmart to Close Technology Hubs Across U.S., Impacting Hundreds of Workers

February 16, 2023

Trending News 🌥️

Walmart Inc ($NYSE:WMT). is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores. According to The Wall Street Journal, Walmart is set to close its technology hubs in Austin, Texas, Carlsbad, California, and Portland, Oregon and consolidate its tech operations in San Bruno, California and Bentonville, Arkansas. This news will have a drastic impact on hundreds of employees who had been employed at Walmart’s technology hubs. Employees at the hubs were expected to come into the office at least two days a week, making the decision to close them all the more difficult. The consolidation of Walmart’s technology centers is part of a larger effort to reduce costs while streamlining operations and technology. Walmart is hoping to use the resources from the closed hubs to invest in other areas. Walmart has made it clear that the consolidation will not affect its commitment to providing customers with top-notch services and products. They plan on using the resources of the closed centers to continue investing in digital capabilities. Walmart’s spokesperson, Randy Hargrove, has said that the company is “committed to ensuring our associates are treated fairly during this transition.” The closure of Walmart’s technology hubs will undoubtedly be a difficult period for many of its employees as they face uncertainty.

However, this should not be taken as a sign of any long-term decline in Walmart’s commitment to providing top-notch services and products to its customers. The consolidation of these centers is simply part of a larger effort to improve efficiency and streamline operations.

Market Price

On Tuesday, WALMART INC stock opened at $145.7 and closed at $145.5, down by 0.3% from previous closing price of 145.9. The company has announced plans to close multiple technology hubs across the United States, impacting hundreds of workers. This move is likely to result in hundreds of layoffs, as the company has stated that it will be reducing its workforce in order to cut costs. The technology hubs that are set to be closed are located in West Virginia, Oregon, Missouri, and Texas. These facilities were established to develop the company’s technology infrastructure and support the e-commerce operation.

However, WALMART INC has said that with the current market climate, it’s necessary to make cuts in order to remain competitive. The company has also said that it will be providing job training and assistance for affected employees to find new employment following the cutbacks. This may include additional education or vocational training opportunities, as well as job placement services. It’s unclear how this decision will impact WALMART INC’s ability to continue to offer its customers a wide range of products and services. The company has faced increasing competition from other retail giants, such as Amazon and Target, which have both invested heavily in their online presence and logistics capabilities. WALMART INC has yet to provide any further details on the impacts of the closure of its technology hubs, but it is clear that this move could have a significant impact on the company’s operations and overall profitability. The company’s stock price fell slightly on Tuesday, indicating some uncertainty from investors about the future of the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Walmart Inc. More…

| Total Revenues | Net Income | Net Margin |

| 600.11k | 8.97k | 1.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Walmart Inc. More…

| Operations | Investing | Financing |

| 23.59k | -17.45k | -10.3k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Walmart Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 247.66k | 167.27k | 27.98 |

Key Ratios Snapshot

Some of the financial key ratios for Walmart Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.8% | -0.9% | 2.5% |

| FCF Margin | ROE | ROA |

| 1.2% | 12.4% | 3.7% |

Analysis

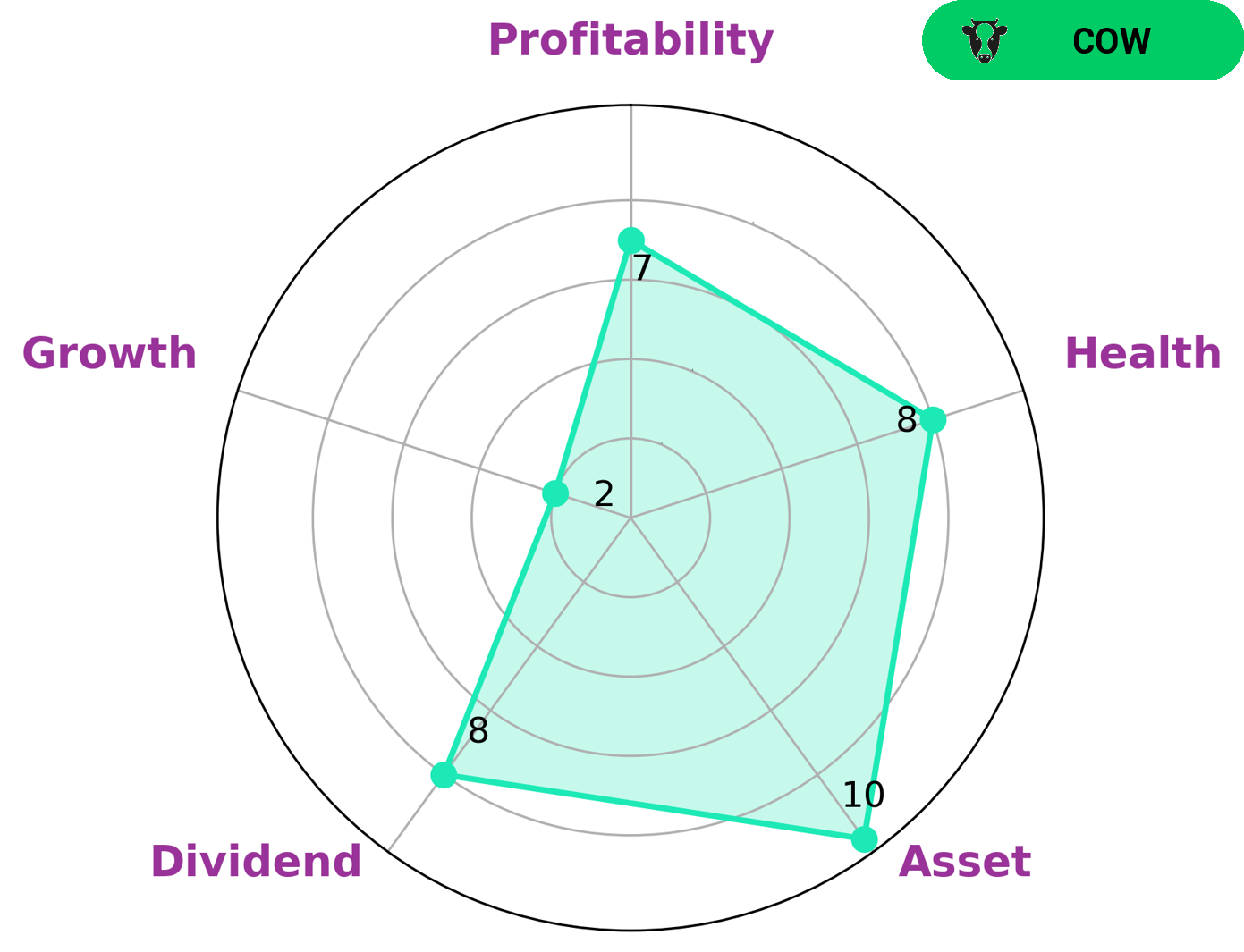

WALMART INC has received a high health score of 8/10 according to GoodWhale’s financial analysis. This score suggests that the company is in a good position to withstand any crisis without the risk of bankruptcy. WALMART INC is classified as ‘cow’, indicating that the company is capable of providing consistent and sustainable dividends. This makes it attractive to investors looking for companies that pay out steady dividends over time. The company is strong in terms of its asset, dividend, and profitability and weak in terms of growth. Investors may be interested in WALMART INC due to its strong fundamentals and ability to pay consistent dividends over the long-term. In addition, WALMART INC has a high health score, suggesting that it can remain afloat during any potential crises. All these factors make WALMART INC an attractive option for long-term, passive investors. More…

Peers

The retail industry is highly competitive, with Walmart Inc competing against Target Corp, Sprouts Farmers Market Inc, and Costco Wholesale Corp. All four companies are vying for market share in the retail sector. Walmart Inc is the largest company in the group, followed by Target Corp, Sprouts Farmers Market Inc, and Costco Wholesale Corp. All four companies are publicly traded on the stock exchange.

– Target Corp ($NYSE:TGT)

Target Corp is an American retail corporation. The company was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target operates 1,851 stores across the United States. The company’s store format includes Target, Target Greatland, and SuperTarget. Target is the second-largest discount retailer in the United States, behind Walmart. The company’s revenue for 2018 was $75.4 billion, and its operating income was $5.9 billion. Target’s net income for 2018 was $3.6 billion, and its total assets were $42.5 billion as of December 31, 2018.

– Sprouts Farmers Market Inc ($NASDAQ:SFM)

Sprouts Farmers Market Inc is a grocery store chain that specializes in selling fresh, natural, and organic food. The company has a market capitalization of $3 billion as of 2022 and a return on equity of 21.14%. Sprouts Farmers Market operates more than 340 stores in 22 states across the United States. The company was founded in 2002 and is headquartered in Phoenix, Arizona.

– Costco Wholesale Corp ($NASDAQ:COST)

Costco Wholesale Corporation is the largest membership warehouse club in the United States. As of 2022, it had a market capitalization of 209.47 billion and a return on equity of 24.62%. Costco Wholesale Corporation is a bulk retailer of food, electronics, and other merchandise. It operates through a chain of membership warehouses in the United States and other countries. Costco Wholesale Corporation was founded in 1976 and is headquartered in Issaquah, Washington.

Summary

Walmart Inc. is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores. The company recently announced the closing of several technology hubs across the United States, impacting hundreds of workers. Despite this, Walmart remains a strong investment prospect in the retail and hypermarket sector.

Walmart continues to embrace technology, introducing online ordering and delivery, and investing heavily in analytics and data-driven decision making. Walmart remains a sound investment for those looking to diversify their portfolio.

Recent Posts