WALMART INC Announces Financial Results for FY2023 Q4 on January 31, 2023

March 7, 2023

Earnings report

On January 31 2023, WALMART INC ($NYSE:WMT) reported the financial results for their fourth quarter of FY2023 ending on that day. The company achieved total revenue of USD 6.3 billion, a significant 76.4% increase from the same period of the previous year. Further, net income also saw a 7.3% rise to USD 164.1 billion compared to the year before.

This growth in revenue and profitability further solidifies WALMART INC’s position as one of the world’s largest retailers and also indicates the company is on track to achieve its long-term goals. Even with the current global economic uncertainties, WALMART INC has managed to sustain their success and financial health, thanks to their focus on customer satisfaction and commitment to innovation.

Stock Price

On January 31st, 2023, WALMART INC announced its financial results for the fourth quarter of Fiscal Year 2023. The announcement was made at the start of regular trading hours on Tuesday. Consequently, WALMART INC’s stock opened at $142.9 and closed at $147.3, a 0.6% increase compared to the previous day’s closing price of 146.4. Investors responded positively to the financial results, and the WALMART INC share price experienced steady growth throughout the day. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Walmart Inc. More…

| Total Revenues | Net Income | Net Margin |

| 611.29k | 11.68k | 1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Walmart Inc. More…

| Operations | Investing | Financing |

| 29.1k | -17.72k | -17.04k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Walmart Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 243.46k | 159.47k | 26.75 |

Key Ratios Snapshot

Some of the financial key ratios for Walmart Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.3% | -0.2% | 3.1% |

| FCF Margin | ROE | ROA |

| 2.0% | 16.1% | 4.9% |

Analysis

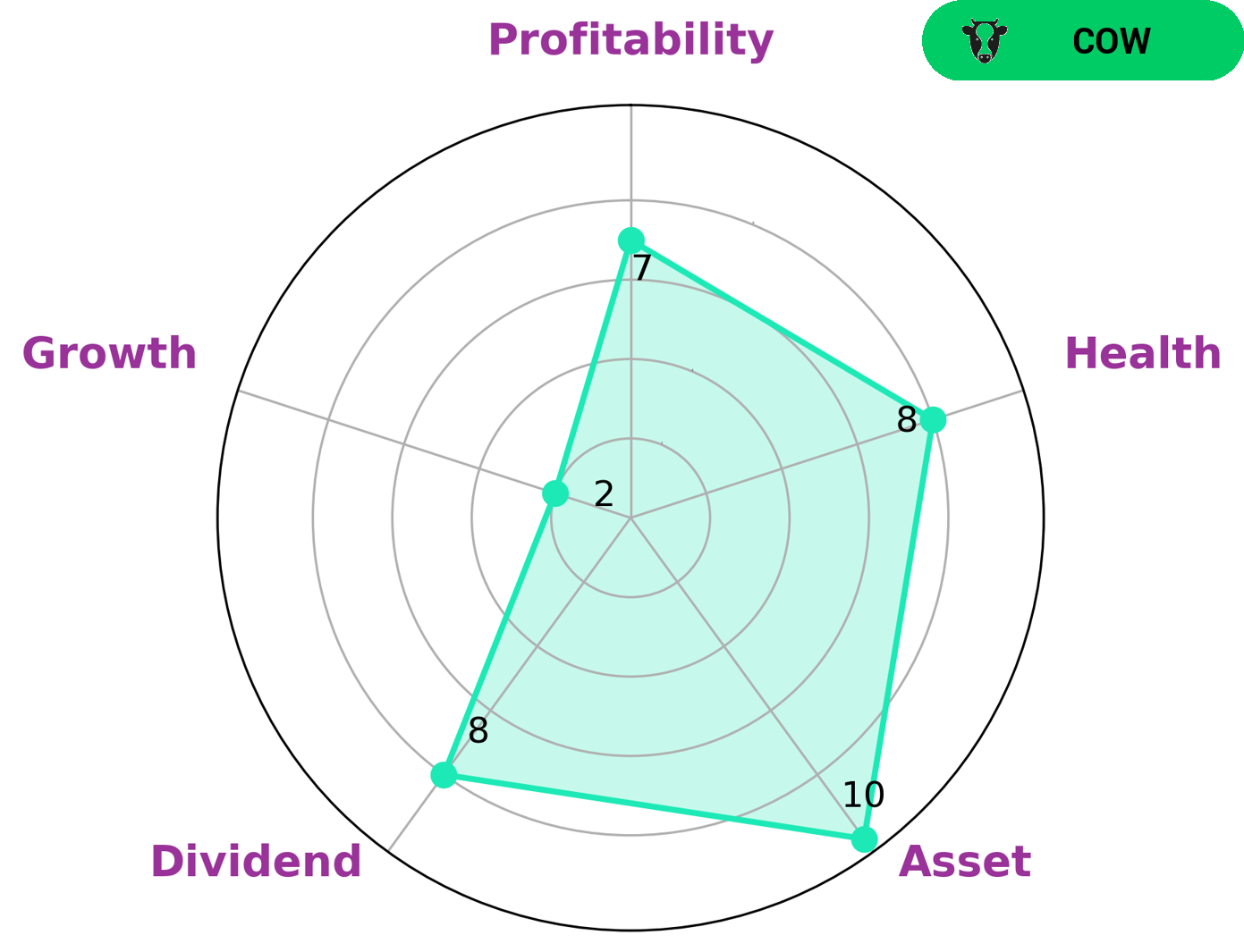

At GoodWhale, we conducted an analysis of WALMART INC‘s financials and classified it as a ‘cow’, based on our Star Chart. This type of company is characterized by a track record of paying out consistent, sustainable dividends. Given these traits, WALMART INC is an attractive prospect for investors looking for solid returns on a reliable basis. The strong asset, dividend and profitability scores make this an especially attractive investment prospect, albeit with a moderate growth score. Its cashflows and debt are healthy, and there is no indication that the company would have problems paying off debt or funding future operations. More…

Peers

The retail industry is highly competitive, with Walmart Inc competing against Target Corp, Sprouts Farmers Market Inc, and Costco Wholesale Corp. All four companies are vying for market share in the retail sector. Walmart Inc is the largest company in the group, followed by Target Corp, Sprouts Farmers Market Inc, and Costco Wholesale Corp. All four companies are publicly traded on the stock exchange.

– Target Corp ($NYSE:TGT)

Target Corp is an American retail corporation. The company was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target operates 1,851 stores across the United States. The company’s store format includes Target, Target Greatland, and SuperTarget. Target is the second-largest discount retailer in the United States, behind Walmart. The company’s revenue for 2018 was $75.4 billion, and its operating income was $5.9 billion. Target’s net income for 2018 was $3.6 billion, and its total assets were $42.5 billion as of December 31, 2018.

– Sprouts Farmers Market Inc ($NASDAQ:SFM)

Sprouts Farmers Market Inc is a grocery store chain that specializes in selling fresh, natural, and organic food. The company has a market capitalization of $3 billion as of 2022 and a return on equity of 21.14%. Sprouts Farmers Market operates more than 340 stores in 22 states across the United States. The company was founded in 2002 and is headquartered in Phoenix, Arizona.

– Costco Wholesale Corp ($NASDAQ:COST)

Costco Wholesale Corporation is the largest membership warehouse club in the United States. As of 2022, it had a market capitalization of 209.47 billion and a return on equity of 24.62%. Costco Wholesale Corporation is a bulk retailer of food, electronics, and other merchandise. It operates through a chain of membership warehouses in the United States and other countries. Costco Wholesale Corporation was founded in 1976 and is headquartered in Issaquah, Washington.

Summary

Walmart Inc.’s financial performance in the previous year was impressive; total revenue of USD 6.3 billion, an increase of 76.4%, and net income increasing to USD 164.1 billion, a 7.3% year-over-year increase. This signals positive investor sentiment in the company, as well as the potential for further growth in the future. Walmart’s success can be attributed to its wide range of products and services, as well as its ability to reach customers quickly through online and brick-and-mortar stores. Investors should continue to monitor this company’s financial performance and take advantage of the opportunities it offers.

Recent Posts