Walmart Foundation Aims to Reach One Million Smallholder Farmers, Including 50% Women, by 2028 in Andhra Pradesh

March 26, 2023

Trending News 🌥️

This is part of the Walmart ($NYSE:WMT) Foundation’s commitment to empower smallholder farmers through sustainable agricultural practices, access to resources and skills training. The Walmart Foundation’s goal is to increase the number of smallholder farmers and to make sure that half of them are women farmers. This will be achieved through the implementation of sustainable agricultural practices, access to resources and skills training. The foundation will also invest in projects that will create jobs and strengthen local economies in Andhra Pradesh.

This includes improving the quality of their crops, reducing their costs of production, and increasing the adoption of sustainable agricultural practices. The foundation’s investments will also support the creation of new economic opportunities for smallholder farmers in Andhra Pradesh. The foundation’s effort will help to create economic opportunities, improve the lives of smallholder farmers, and promote sustainable agriculture in Andhra Pradesh.

Stock Price

The initiative, which was announced on Friday, has sparked mixed responses from the media. On the same day, Walmart Inc.’s stock opened at $141.0 and closed at $141.8, representing a 0.8% increase from its last closing price of 140.6. This is indicative of the positive sentiment surrounding Walmart Inc.’s efforts to diversify its agricultural investments and promote development in an emerging market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Walmart Inc. More…

| Total Revenues | Net Income | Net Margin |

| 611.29k | 11.68k | 1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Walmart Inc. More…

| Operations | Investing | Financing |

| 29.1k | -17.72k | -17.04k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Walmart Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 243.46k | 159.47k | 26.75 |

Key Ratios Snapshot

Some of the financial key ratios for Walmart Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.3% | -0.2% | 3.1% |

| FCF Margin | ROE | ROA |

| 2.0% | 16.1% | 4.9% |

Analysis

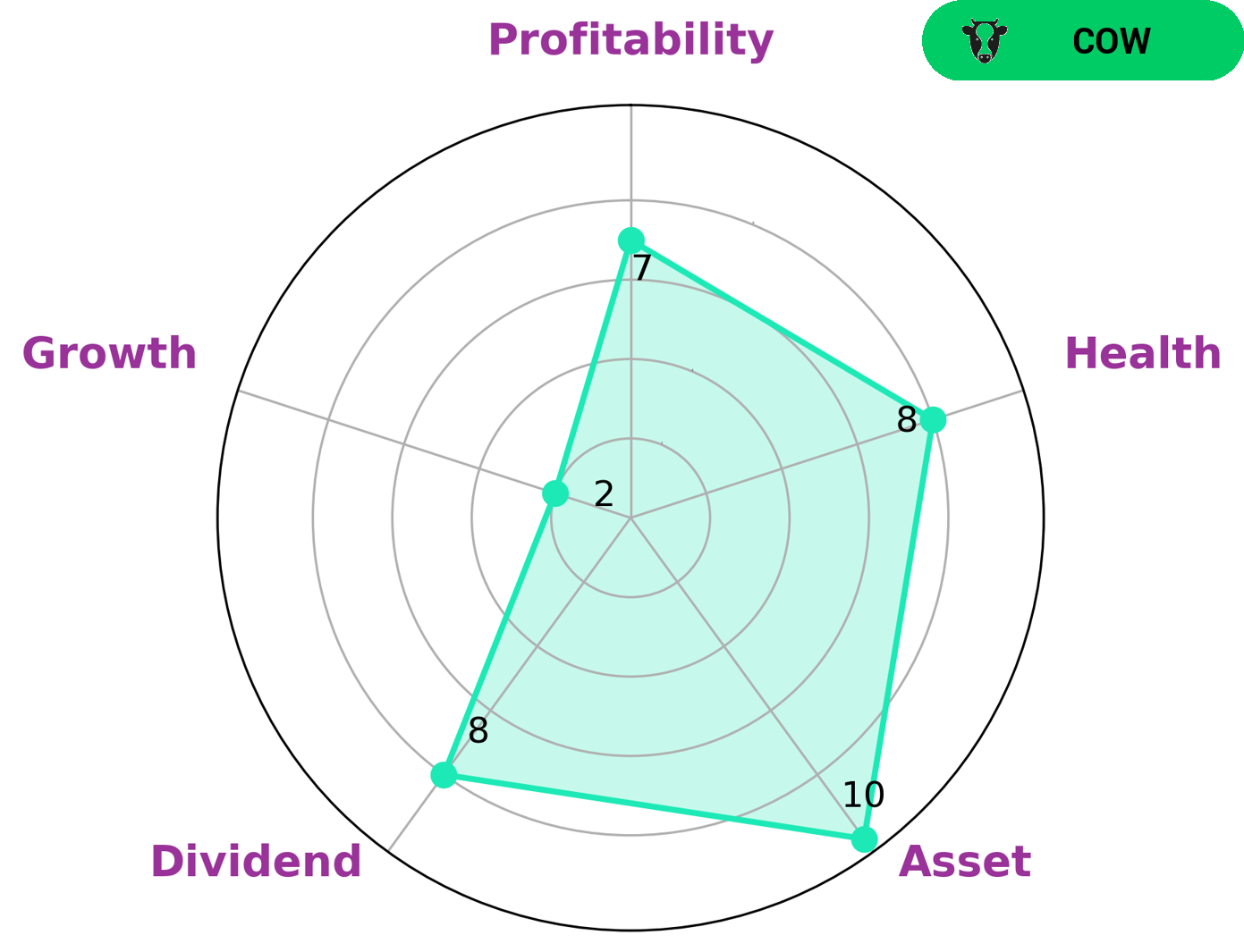

At GoodWhale, we recently analyzed the fundamentals of WALMART INC and our Star Chart classified it as a ‘cow’. We define this as a company with a track record of paying out consistent and sustainable dividends. As such, we believe WALMART INC may be of interest to conservative investors who are more focused on generating income from their investment. On the financial side, WALMART INC had a high health score of 8/10, which is based on its cashflows and debt. This indicates that WALMART INC is capable of paying off debts and potentially funding future operations – an important factor for all kinds of investors. In addition, our analysis found that WALMART INC was strong in asset, dividend, and profitability, but weak in growth. Therefore investors should understand the risk-return profile prior to investing. More…

Peers

The retail industry is highly competitive, with Walmart Inc competing against Target Corp, Sprouts Farmers Market Inc, and Costco Wholesale Corp. All four companies are vying for market share in the retail sector. Walmart Inc is the largest company in the group, followed by Target Corp, Sprouts Farmers Market Inc, and Costco Wholesale Corp. All four companies are publicly traded on the stock exchange.

– Target Corp ($NYSE:TGT)

Target Corp is an American retail corporation. The company was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target operates 1,851 stores across the United States. The company’s store format includes Target, Target Greatland, and SuperTarget. Target is the second-largest discount retailer in the United States, behind Walmart. The company’s revenue for 2018 was $75.4 billion, and its operating income was $5.9 billion. Target’s net income for 2018 was $3.6 billion, and its total assets were $42.5 billion as of December 31, 2018.

– Sprouts Farmers Market Inc ($NASDAQ:SFM)

Sprouts Farmers Market Inc is a grocery store chain that specializes in selling fresh, natural, and organic food. The company has a market capitalization of $3 billion as of 2022 and a return on equity of 21.14%. Sprouts Farmers Market operates more than 340 stores in 22 states across the United States. The company was founded in 2002 and is headquartered in Phoenix, Arizona.

– Costco Wholesale Corp ($NASDAQ:COST)

Costco Wholesale Corporation is the largest membership warehouse club in the United States. As of 2022, it had a market capitalization of 209.47 billion and a return on equity of 24.62%. Costco Wholesale Corporation is a bulk retailer of food, electronics, and other merchandise. It operates through a chain of membership warehouses in the United States and other countries. Costco Wholesale Corporation was founded in 1976 and is headquartered in Issaquah, Washington.

Summary

Walmart Inc. is an American multinational retail corporation that has seen a steady increase in stock prices over the past few years. The company has strong financials and has seen consistent growth in revenue and earnings. Walmart’s investments in technology, initiatives to improve its supply chain, and acquisition of digital companies have enabled the company to maintain an edge over competitors.

Recent Posts