KeyCorp Analysts Forecast Big Lots, to Report Q4 2024 Earnings of $0.77 Per Share.

March 9, 2023

Trending News ☀️

If these predictions prove to be accurate, it would be a positive indicator for the company and its investors. The $0.77 earnings per share figure would also be a welcome development for Big Lots ($NYSE:BIG), Inc., as the company has struggled to maintain consistent profits in recent years. The analysts at KeyCorp are confident that the strategies implemented by the company will result in improved earnings over the coming quarters. Big Lots, Inc. has made significant investments in their supply chain and customer satisfaction initiatives, which have allowed them to better compete with other retailers in their sector.

As a result, the company has seen an increase in sales for several consecutive quarters. The $0.77 per share that is being forecasted by KeyCorp analysts would be a strong indicator of these improvements and demonstrate the success of Big Lots, Inc.’s efforts. Regardless of the outcome, it is clear that the company has taken steps to improve their profitability and is on the right path to achieving long-term success.

Price History

Media coverage of this forecast has been mostly positive. On Tuesday, the stock opened at $14.5 and closed at $14.3, representing a decrease of 0.9% from the prior closing price of $14.4. This slight decrease in stock value reflects the market’s reaction to the analyst report, although it is likely to be temporary. Investors can expect to see the stock value increase as the company approaches its fourth quarter earnings report. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Big Lots. More…

| Total Revenues | Net Income | Net Margin |

| 5.47k | -210.71 | -3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Big Lots. More…

| Operations | Investing | Financing |

| -144.29 | -108.94 | 244.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Big Lots. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.69k | 2.93k | 27.02 |

Key Ratios Snapshot

Some of the financial key ratios for Big Lots are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.9% | 3.1% | -4.8% |

| FCF Margin | ROE | ROA |

| -2.6% | -20.8% | -4.4% |

Analysis

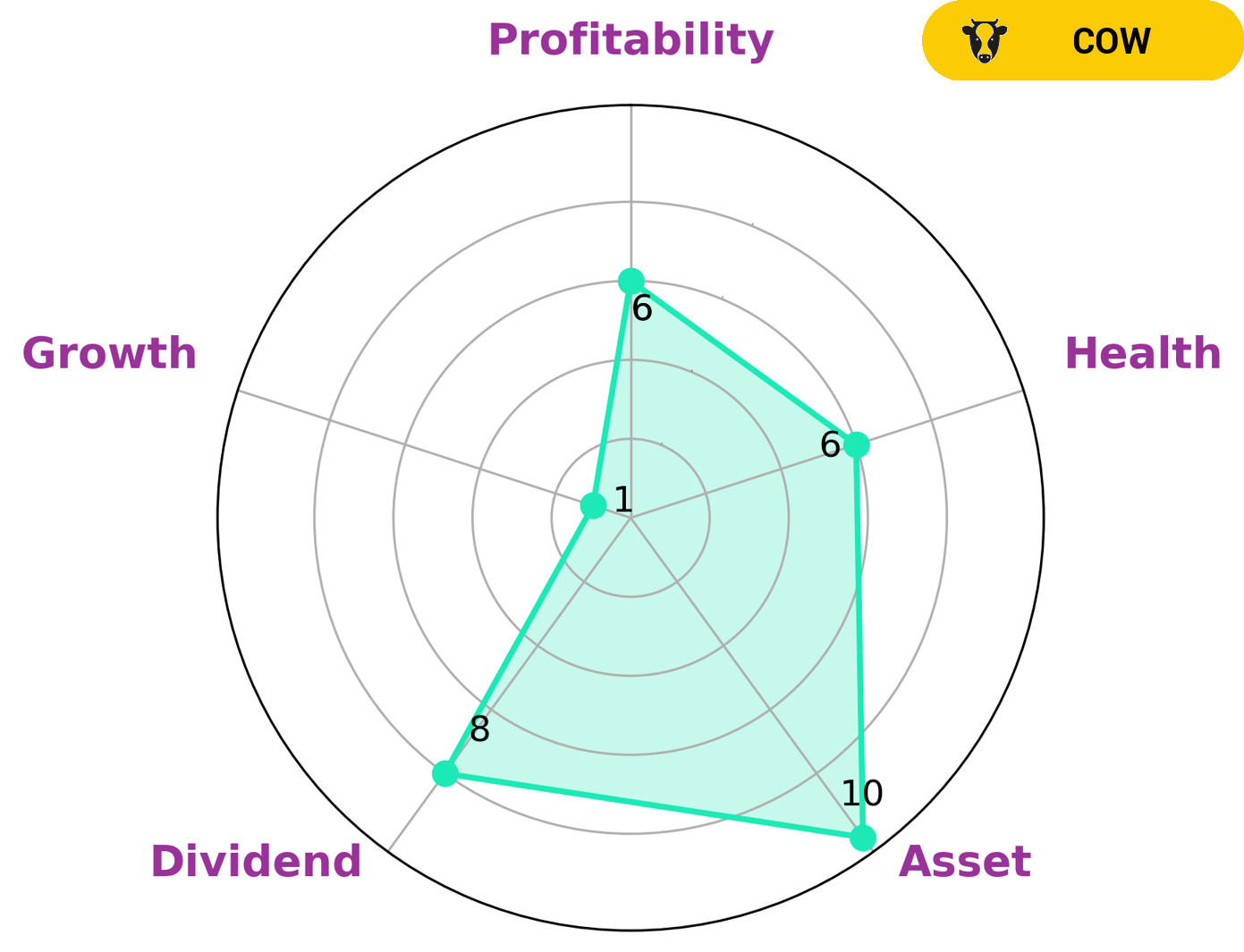

GoodWhale has performed an analysis of BIG LOTS‘s wellbeing. According to the Star Chart, BIG LOTS has a health score of 6/10, indicating that it might be able to safely ride out any crisis without the risk of bankruptcy. Looking deeper into the data, BIG LOTS is strong in asset and dividend, and medium in profitability. However, it is weak in terms of growth. BIG LOTS falls into the category of ‘cow’, which is a type of company that has the track record of paying out consistent and sustainable dividends. This makes it an attractive investment for value investors who are looking for steady returns. It may also be interesting to income investors who are interested in receiving regular dividends. More…

Peers

Big Lots Inc is an American retail company that competes with other discount retailers such as B&M European Value Retail SA, Dollar General Corp, and Target Corp. Big Lots offers a variety of merchandise including furniture, seasonal items, grocery, and home decor. The company operates over 1,400 stores in 47 states.

– B&M European Value Retail SA ($LSE:BME)

B&M European Value Retail SA is a holding company that operates through its subsidiaries. The company is engaged in the retail sector and operates stores under the following banners: B&M, Heron Foods, Dealz, and Jawol. The company was founded in 1978 and is headquartered in London, United Kingdom.

– Dollar General Corp ($NYSE:DG)

Dollar General Corporation is an American chain of variety stores headquartered in Goodlettsville, Tennessee. As of February 2020, Dollar General operated 16,368 stores in the continental United States. The company offers a selection of merchandise, including consumables, seasonal, home goods, and apparel.

– Target Corp ($NYSE:TGT)

Target is one of the largest discount retailers in the United States. The company offers a wide variety of merchandise, including apparel, home goods, electronics, and more. Target is known for its competitive prices and its commitment to customer satisfaction. The company has a market cap of 74.48B as of 2022 and a return on equity of 34.09%. Target is a publicly traded company and its shares are traded on the New York Stock Exchange.

Summary

So far, media coverage of the company has been largely positive. As such, investors are optimistic about Big Lots‘ potential performance in the coming quarter, and many are considering investing in Big Lots’ stock. Analysts suggest that investors should watch for upcoming updates on Big Lots, such as financial reports and press releases, in order to gain a better understanding of the company’s current financial health.

Furthermore, investors should research the company’s competitors and market trends to stay informed of industry developments. In the long-term, investors should consider Big Lots’ strategic investments, risk management strategies, and overall financial performance when evaluating the company’s potential profitability.

Recent Posts