Is Dollar Tree at the Forefront of the Discount Stores Industry?

February 6, 2023

Trending News 🌥️

But is Dollar Tree ($NASDAQ:DLTR) Inc. at the forefront of the discount stores industry? Dollar Tree Inc. offers products at a fixed price of $1 or less, making it a great destination for bargain hunters looking for deals on household items, toys, beauty products, food, and more. The company has also seen success in acquiring other discount store chains, such as Family Dollar and Deals, which have expanded its reach even further.

Additionally, Dollar Tree Inc. has established itself as a leader in the digital space, with an active e-commerce presence and a rapidly growing mobile app. Furthermore, the company has remained debt-free throughout its history, allowing it to maintain a strong balance sheet and stable cash flow. Its success can be attributed to its focus on customer service and innovation, as well as its commitment to offering products at a low price point.

Market Price

The company has been making headlines for its strong stock performance, and as of Monday, its stock opened at $150.4 and closed at $148.8, down by 1.0% from the previous closing price of 150.4. The company offers a wide array of products at low prices which have made them popular among budget-conscious shoppers. Customers can find everything from food items and cleaning supplies to seasonal decorations and toys. The stores are also conveniently located in many parts of the country, making it easier for customers to find what they need without having to travel too far.

The company’s continued success can be attributed to its commitment to providing customers with quality products at affordable prices. This commitment has allowed them to remain competitive in a highly competitive industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dollar Tree. More…

| Total Revenues | Net Income | Net Margin |

| 27.69k | 1.62k | 5.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dollar Tree. More…

| Operations | Investing | Financing |

| 1.15k | -1.2k | -192.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dollar Tree. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 22.91k | 14.63k | 37.41 |

Key Ratios Snapshot

Some of the financial key ratios for Dollar Tree are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 11.3% | 7.9% |

| FCF Margin | ROE | ROA |

| -0.2% | 16.5% | 6.0% |

Analysis

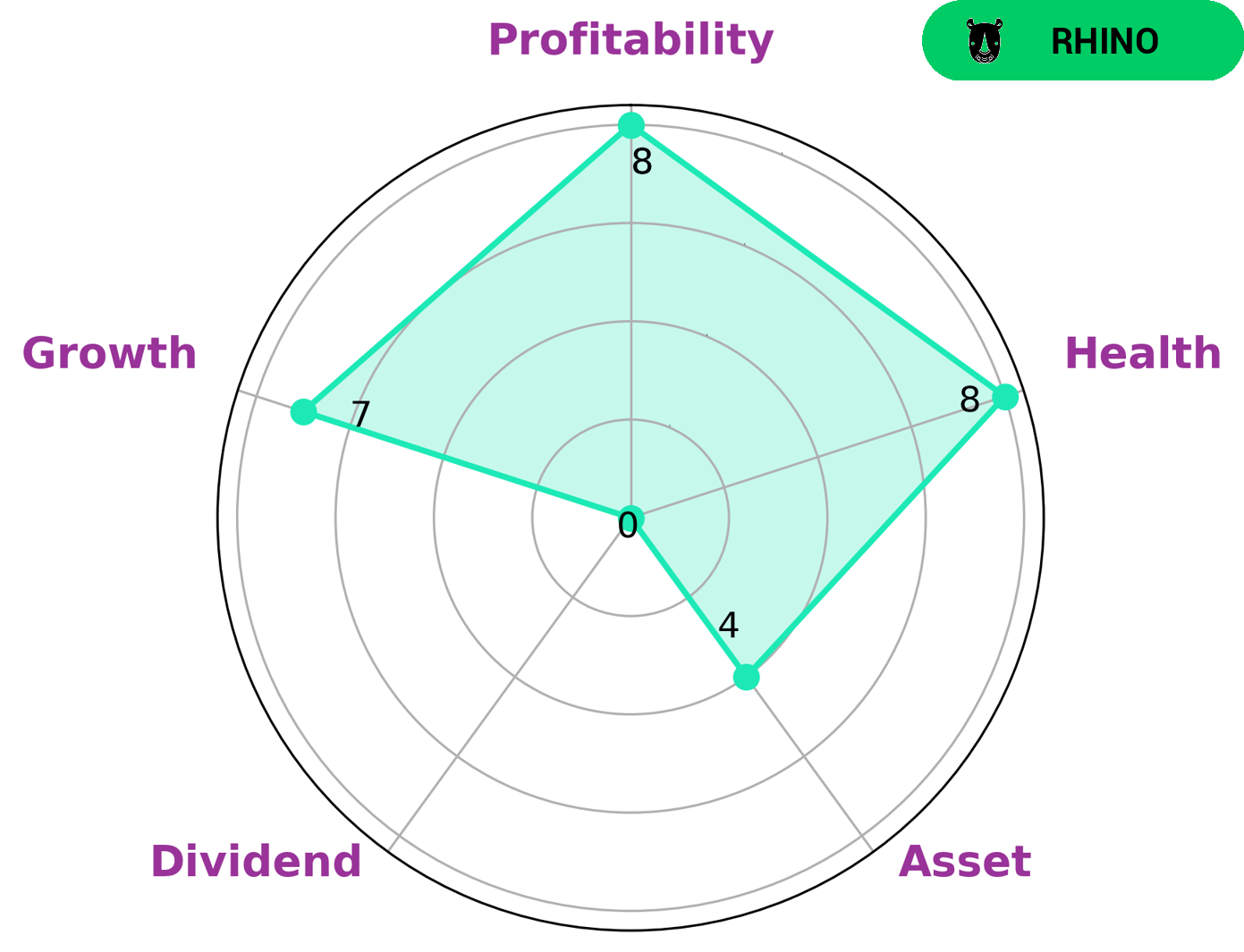

GoodWhale has conducted an analysis of DOLLAR TREE‘s fundamentals and, according to their Star Chart, the company is strong in growth, profitability, and medium in asset. Despite being weak in dividend, DOLLAR TREE can be classified as a ‘rhino’—a type of company that has achieved moderate revenue or earnings growth. Investors who are looking for a company with stable growth and reasonable returns may be interested in DOLLAR TREE. The company has a high health score of 8/10, meaning it is capable of safely riding out any crisis without the risk of bankruptcy. Its strong growth and profitability performance is likely to continue in the future, providing a steady stream of returns for investors. DOLLAR TREE is also likely to be attractive to those looking for a lower-risk investment. With a strong asset portfolio and low debt, the company has a solid foundation on which to weather any economic downturns. Furthermore, its dividend performance is not expected to suffer too much in the long run, as growth and profitability should remain consistent over time. Overall, DOLLAR TREE’s fundamentals make it an attractive option for investors who are looking for a steady return on their investment without too much risk. More…

Peers

The company offers a variety of merchandise at a single price point of $1.00. Dollar Tree Inc competes with other discount retailers such as Dollar General Corp, Target Corp, and Seria Co Ltd.

– Dollar General Corp ($NYSE:DG)

Dollar General Corporation is an American chain of variety stores headquartered in Goodlettsville, Tennessee. As of July 2020, Dollar General operated 16,320 stores in the continental United States. The company first began as a family-owned business in 1939. Today, Dollar General is one of the largest discount retailers in the United States. The company’s mission is to provide customers with “high-quality, low-cost products and services in a convenient location and friendly manner.”

– Target Corp ($NYSE:TGT)

Target Corp is an American retail corporation that operates Target stores, a chain of hypermarkets. As of 2022, it has a market cap of 75.6B and a ROE of 34.09%. The company was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target stores are located in the United States, Canada, and India.

– Seria Co Ltd ($TSE:2782)

Seria Co Ltd is a Japanese conglomerate with a market cap of 182.98B as of 2022. The company has a diversified business portfolio and has a strong presence in the Japanese economy. The company has a return on equity of 13.73%. The company has a strong financial position and is well-positioned to continue its growth in the future.

Summary

Dollar Tree Inc, one of the leading discount stores in the industry, has been garnering positive news sentiment in the investing community. Analysts have noted the company’s strong financial performance and its ability to sustain growth and profitability despite a challenging economic environment. Furthermore, Dollar Tree has established a strong presence in the competitive discount retail landscape.

It has a wide variety of products to offer, ranging from seasonal items to everyday essentials, as well as a convenient shopping experience. With a strong competitive advantage and market share, Dollar Tree is well-positioned to continue its success in the discount stores industry.

Recent Posts