Costco Wholesale Stock Fair Value Calculator – William Blair Gives Thumbs Up to Costco Wholesale’s Unique Value Proposition

April 14, 2023

Trending News ☀️

William Blair recently gave its thumbs up to Costco Wholesale ($NASDAQ:COST)’s unique value proposition. The investment firm believes that Costco’s coverage is exemplary, having begun at the Buy level. Costco Wholesale is a retail company that provides a wide range of consumer goods and services. It operates in the United States, Canada, Mexico, the United Kingdom, Taiwan, Japan, South Korea, Australia, and Spain. The company has a variety of membership options that range from basic to executive.

Their stores offer discounted groceries, consumer electronics, home goods, apparel, and more. Furthermore, Costco offers a variety of services such as mail order catalogs, online shopping, and business delivery. As well as providing value for its members, Costco also works hard to reduce their environmental footprint through its sustainability initiatives. These include the operation of efficient warehouses, reducing packaging waste and utilizing resources from sustainable sources.

Share Price

Thursday saw a highly positive day for COSTCO WHOLESALE, with their stock opening at $493.5 and closing at $497.9, representing an increase of 1.7% from the previous closing price of 489.4. Blair pointed to COSTCO’s impressive ability to consistently provide high-quality products at competitive prices, noting that its loyal customer base has kept the company successful for decades. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Costco Wholesale. More…

| Total Revenues | Net Income | Net Margin |

| 234.39k | 6.05k | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Costco Wholesale. More…

| Operations | Investing | Financing |

| 9.54k | -4.39k | -3.83k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Costco Wholesale. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.85k | 44.05k | 51.39 |

Key Ratios Snapshot

Some of the financial key ratios for Costco Wholesale are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.0% | 17.4% | 3.5% |

| FCF Margin | ROE | ROA |

| 2.3% | 23.3% | 7.7% |

Analysis – Costco Wholesale Stock Fair Value Calculator

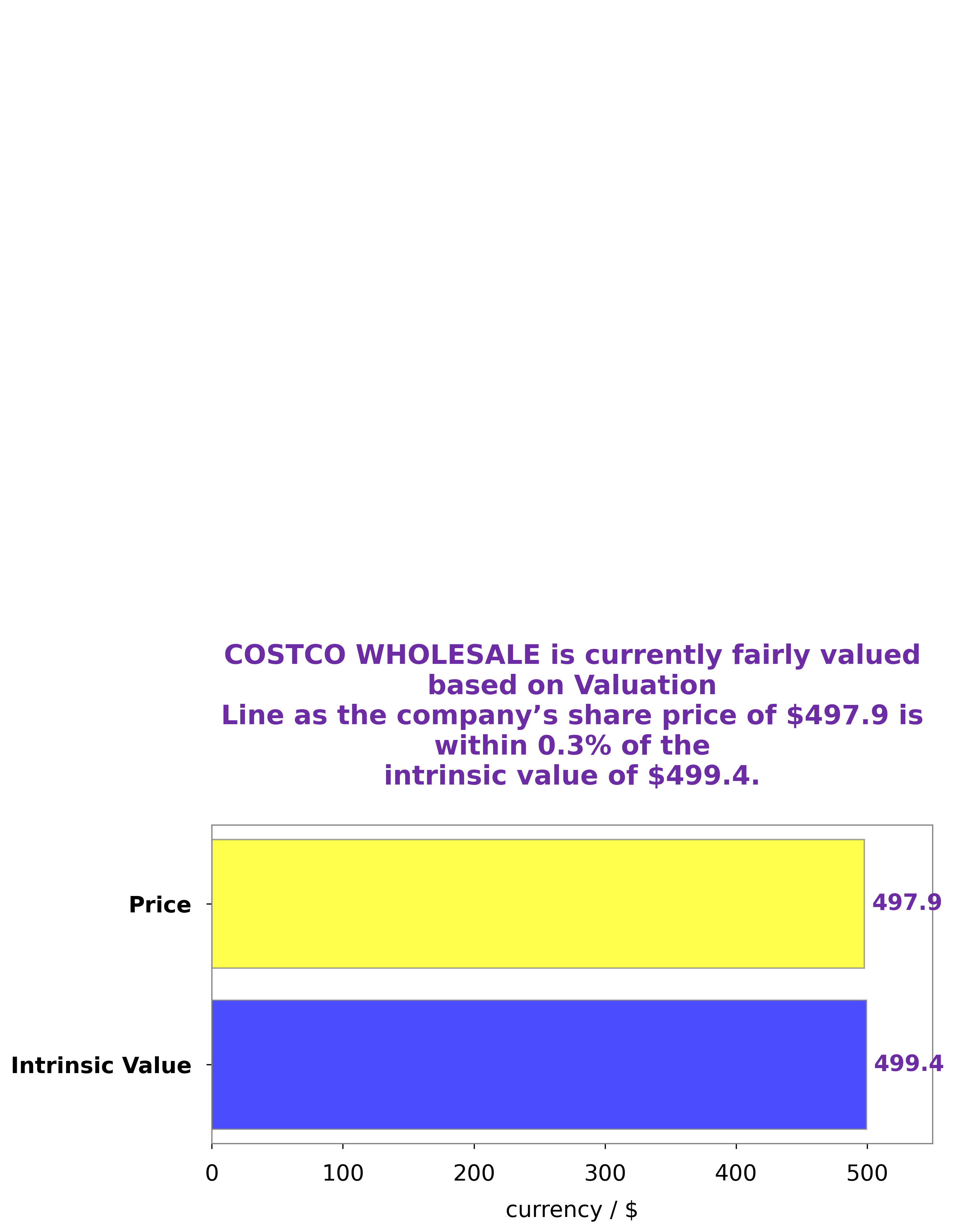

At GoodWhale, we recently conducted an analysis of COSTCO WHOLESALE‘s wellbeing. We found that the intrinsic value of COSTCO WHOLESALE share is around $499.4, calculated by our proprietary Valuation Line. This means that now COSTCO WHOLESALE stock is traded at a fair price of $497.9. This indicates that the current trading price is in line with the intrinsic value of the company and investors are getting a good deal right now. More…

Peers

The retail industry is highly competitive, with companies constantly vying for market share. Costco Wholesale Corp is no exception, and it competes directly with the likes of Target Corp, Takayoshi Inc, and Walmart Inc. All four companies are leaders in the retail space, and each has its own strengths and weaknesses.

– Target Corp ($NYSE:TGT)

Target Corporation is an American retail company that operates in the discount retailing industry. The company was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target Corporation operates 1,851 stores in the United States and Canada, and has a market cap of 71.52B as of 2022. The company’s return on equity is 34.09%. Target Corporation’s main competitors are Walmart and Amazon.

– Takayoshi Inc ($TSE:9259)

Takayoshi Inc is a Japanese company that manufactures and sells electronic products. It has a market cap of 8.99B as of 2022 and a ROE of -45.41%. The company’s products include computers, mobile phones, digital cameras, and other electronic devices. Takayoshi Inc has been in business for over 50 years and is a well-known brand in Japan.

– Walmart Inc ($NYSE:WMT)

With a market cap of 363.06B as of 2022, Walmart Inc. is a retail giant with a 16.44% return on equity. The company operates a chain of hypermarkets, discount department stores, and grocery stores. Walmart is the world’s largest company by revenue, with US$514.405 billion in 2020.

Summary

Investment analysis of COSTCO WHOLESALE is largely positive, with William Blair recently lauding its value proposition. Analysts expect the company to continue to outperform the market, with the potential for further upside. Investors should keep a close eye on COSTCO WHOLESALE, as their success could lead to further gains in the stock market.

Recent Posts