COSTCO WHOLESALE Reports Second Quarter FY2023 Earnings Results on March 3, 2023

March 20, 2023

Earnings Overview

COSTCO WHOLESALE ($NASDAQ:COST) announced the financial results for its second quarter of FY2023, ending on January 31, 2023 on March 3, 2023. Revenue for the quarter was a record USD 1.5 billion, up 13.1% from the same quarter in the previous year. Net income also increased 6.5% to USD 55.3 billion.

Price History

COSTCO WHOLESALE stock opened at $474.8 and closed at $475.3, a decrease of 2.1% from the previous closing price of $485.7. The results of the second quarter were relatively in line with expectations and market analysts have reacted positively to the news. Gross margins also increased by 1%, indicating that the company is successfully managing its operating costs, while maintaining its overall growth strategy. Costco Wholesale has continued to gain traction in the retail market, as evidenced by its strong second quarter earnings results. This positive performance can be attributed to the company’s strategic decisions to invest in e-commerce, digital services, and new product offerings.

The company’s commitment to providing quality products and services is reflected in their continued success and growth. Going forward, the company remains focused on its growth strategy and plans to continue expanding into new markets and product offerings. At the same time, it will be important for the company to effectively manage its operating costs in order to maintain a healthy profit margin. Overall, investors should take comfort in the fact that Costco Wholesale continues to report strong earnings results despite a challenging retail landscape. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Costco Wholesale. More…

| Total Revenues | Net Income | Net Margin |

| 234.39k | 6.05k | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Costco Wholesale. More…

| Operations | Investing | Financing |

| 6.74k | -3.92k | -4.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Costco Wholesale. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.03k | 44.55k | 48.41 |

Key Ratios Snapshot

Some of the financial key ratios for Costco Wholesale are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.0% | 17.4% | 3.5% |

| FCF Margin | ROE | ROA |

| 1.2% | 24.0% | 7.8% |

Analysis

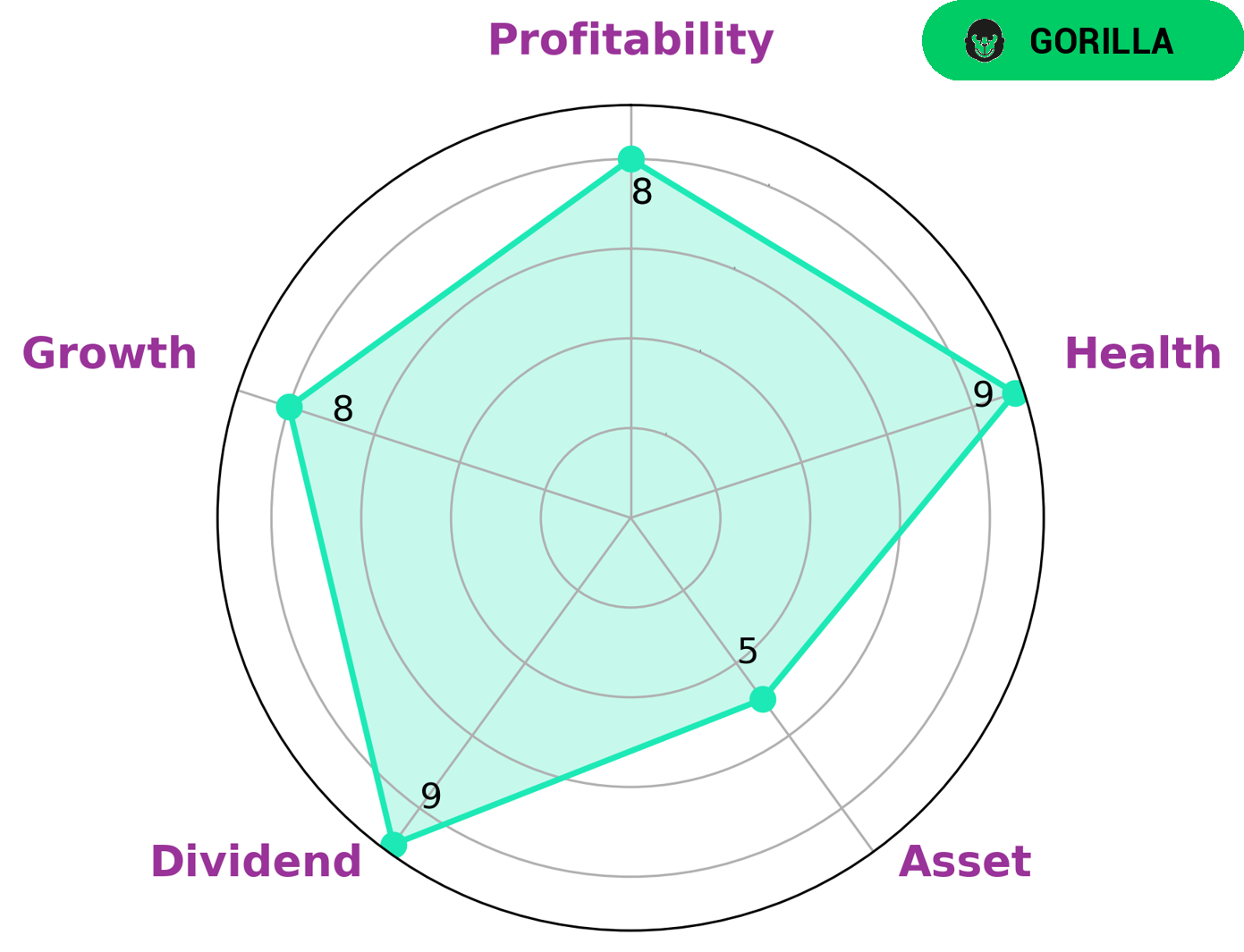

GoodWhale has conducted an analysis of COSTCO WHOLESALE‘s financials. According to our Star Chart, COSTCO WHOLESALE is classified as a ‘gorilla’, a type of company which has achieved strong and stable revenue or earnings growth due to its strong competitive advantage. This makes COSTCO WHOLESALE an attractive investment opportunity for investors looking for a combination of dividend yield, growth potential, and profitability. In addition, COSTCO WHOLESALE has a medium rating in terms of its asset base, indicating that it is a reliable income source with a well-balanced portfolio of investments. Furthermore, our health score for COSTCO WHOLESALE is 9/10. This means that COSTCO WHOLESALE is in a strong position to sustain future operations in times of crisis. More…

Peers

The retail industry is highly competitive, with companies constantly vying for market share. Costco Wholesale Corp is no exception, and it competes directly with the likes of Target Corp, Takayoshi Inc, and Walmart Inc. All four companies are leaders in the retail space, and each has its own strengths and weaknesses.

– Target Corp ($NYSE:TGT)

Target Corporation is an American retail company that operates in the discount retailing industry. The company was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target Corporation operates 1,851 stores in the United States and Canada, and has a market cap of 71.52B as of 2022. The company’s return on equity is 34.09%. Target Corporation’s main competitors are Walmart and Amazon.

– Takayoshi Inc ($TSE:9259)

Takayoshi Inc is a Japanese company that manufactures and sells electronic products. It has a market cap of 8.99B as of 2022 and a ROE of -45.41%. The company’s products include computers, mobile phones, digital cameras, and other electronic devices. Takayoshi Inc has been in business for over 50 years and is a well-known brand in Japan.

– Walmart Inc ($NYSE:WMT)

With a market cap of 363.06B as of 2022, Walmart Inc. is a retail giant with a 16.44% return on equity. The company operates a chain of hypermarkets, discount department stores, and grocery stores. Walmart is the world’s largest company by revenue, with US$514.405 billion in 2020.

Summary

COSTCO WHOLESALE has seen a surge in its financial performance in the second quarter of FY2023. Revenue rose 13.1% year-on-year to USD 1.5 billion, and net income increased 6.5% to USD 55.3 billion. This strong performance can be attributed to the company’s prudent cost management and strong focus on customer service, as well as its diversified product selection and continued expansion of its retail footprint. The positive financial results and potential for further growth make COSTCO WHOLESALE an attractive investment for those looking for long-term returns.

Recent Posts