COSTCO WHOLESALE Reports Second Quarter Earnings Results for FY2023 as of Jan. 31, 2023.

March 25, 2023

Earnings Overview

For the second quarter of its fiscal year 2023, COSTCO WHOLESALE ($NASDAQ:COST) saw an increase in revenues of 13.1% to USD 1.5 billion and a 6.5% year-over-year growth in net income, amounting to USD 55.3 billion, as of January 31st 2023.

Share Price

On Friday, COSTCO WHOLESALE reported their second quarter earnings results for fiscal year 2023 as of Jan. 31, 2023. The stock opened at $474.8 and closed at $475.3, a decrease of 2.1% from the last closing price of 485.7. The company attributed the decline to lower sales due to the pandemic, and higher operating expenses. Despite the decline in earnings, analysts remain optimistic about Costco’s long-term prospects.

Looking ahead, analysts are expecting Costco to continue to deliver strong results as the global economy recovers from the pandemic. As more people return to work, spending is expected to increase, which should benefit Costco’s sales and earnings. Analysts also anticipate that Costco’s online sales will continue to grow as the company invests in new technology and expands its delivery capabilities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Costco Wholesale. More…

| Total Revenues | Net Income | Net Margin |

| 234.39k | 6.05k | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Costco Wholesale. More…

| Operations | Investing | Financing |

| 6.74k | -3.92k | -4.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Costco Wholesale. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.03k | 44.55k | 48.41 |

Key Ratios Snapshot

Some of the financial key ratios for Costco Wholesale are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.0% | 17.4% | 3.5% |

| FCF Margin | ROE | ROA |

| 1.2% | 24.0% | 7.8% |

Analysis

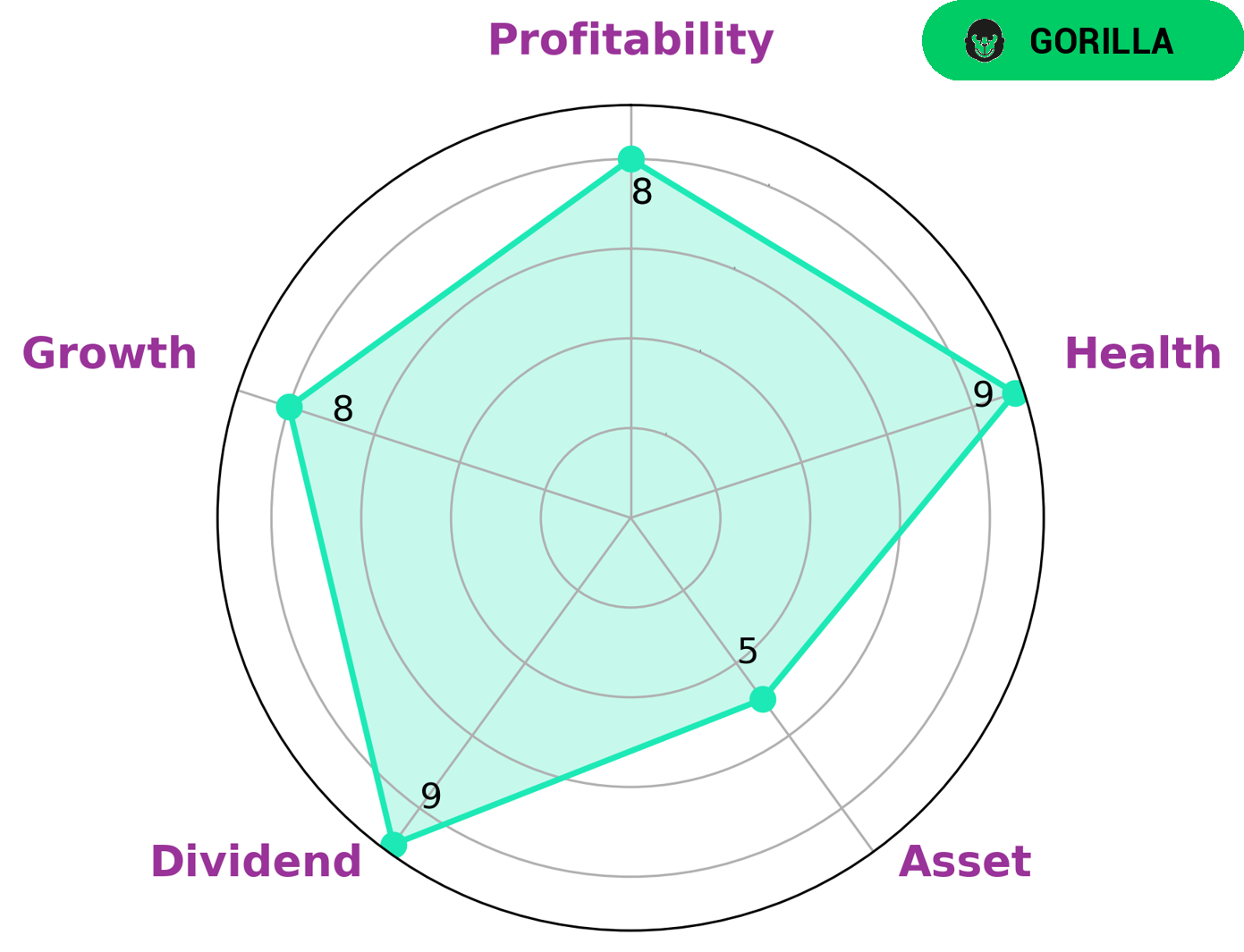

GoodWhale has conducted an analysis of COSTCO WHOLESALE‘s wellbeing. After assessing its performance in the market, we’ve concluded that the company is strong in dividend, growth, and profitability. The Star Chart shows that it is medium in asset, signifying its strong competitive advantage. This type of company is classified as ‘gorilla’, meaning it has achieved stable and high revenue or earning growth. Investors looking for reliable and consistent returns may be interested in a company like COSTCO WHOLESALE. Additionally, its health score of 9/10 indicates the company’s capability to safely ride out any crisis without the risk of bankruptcy, which makes it even more attractive to investors. More…

Peers

The retail industry is highly competitive, with companies constantly vying for market share. Costco Wholesale Corp is no exception, and it competes directly with the likes of Target Corp, Takayoshi Inc, and Walmart Inc. All four companies are leaders in the retail space, and each has its own strengths and weaknesses.

– Target Corp ($NYSE:TGT)

Target Corporation is an American retail company that operates in the discount retailing industry. The company was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target Corporation operates 1,851 stores in the United States and Canada, and has a market cap of 71.52B as of 2022. The company’s return on equity is 34.09%. Target Corporation’s main competitors are Walmart and Amazon.

– Takayoshi Inc ($TSE:9259)

Takayoshi Inc is a Japanese company that manufactures and sells electronic products. It has a market cap of 8.99B as of 2022 and a ROE of -45.41%. The company’s products include computers, mobile phones, digital cameras, and other electronic devices. Takayoshi Inc has been in business for over 50 years and is a well-known brand in Japan.

– Walmart Inc ($NYSE:WMT)

With a market cap of 363.06B as of 2022, Walmart Inc. is a retail giant with a 16.44% return on equity. The company operates a chain of hypermarkets, discount department stores, and grocery stores. Walmart is the world’s largest company by revenue, with US$514.405 billion in 2020.

Summary

COSTCO WHOLESALE reported strong financial results for the second quarter of their fiscal year 2023. Total revenue increased by 13.1%, while net income grew 6.5% year-over-year. This indicates a healthy financial position for the company, and investors should look at the company’s positive results as a sign of a good investment opportunity.

With solid growth in both sales and income, Costco is showing that it is well-positioned for future success. Investors should take note of the company’s impressive financial performance and consider investing in it in the near future.

Recent Posts