BIG LOTS Reports Fourth Quarter Earnings Results for FY2023.

March 16, 2023

Earnings Overview

On March 6, 2023, BIG LOTS ($NYSE:BIG) announced its financial results for the fourth quarter of FY2023, ending January 31, 2023. Total revenue for the quarter decreased by 125.0% year-over-year, amounting to USD -12.5 million. Net income for the quarter saw a drop of 10.9%, amounting to USD 1543.1 million.

Price History

The stock opened at $15.0 but closed at a lower price of $14.4, representing a 3.8% decrease from the previous closing price of $15.0. This decrease occurred despite BIG LOTS reporting higher profits than expected for the quarter due to increased sales in their core product categories. This was driven primarily by higher sales of furniture and seasonal products, as well as an increase in their online sales. However, the stock responded negatively to the news and closed at a lower price than when it opened on Monday, suggesting that investors were not overly impressed by BIG LOTS’ performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Big Lots. More…

| Total Revenues | Net Income | Net Margin |

| 5.47k | -210.71 | -3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Big Lots. More…

| Operations | Investing | Financing |

| -144.29 | -108.94 | 244.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Big Lots. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.69k | 2.93k | 27.02 |

Key Ratios Snapshot

Some of the financial key ratios for Big Lots are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.9% | 3.1% | -4.8% |

| FCF Margin | ROE | ROA |

| -2.6% | -20.8% | -4.4% |

Analysis

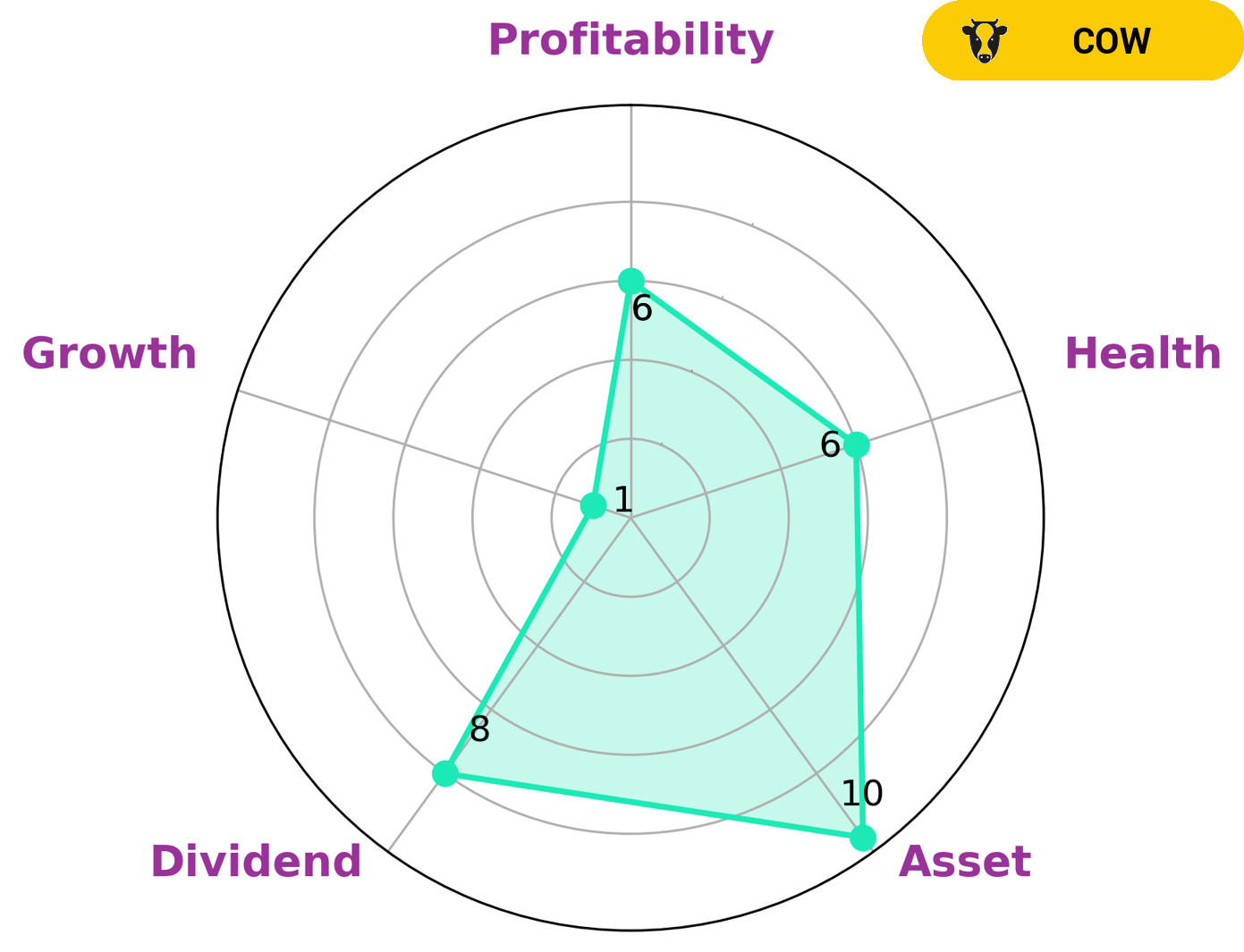

At GoodWhale, we conducted a thorough analysis of BIG LOTS‘ fundamentals. According to our Star Chart, BIG LOTS has an intermediate health score of 6/10, meaning it is likely to safely ride out any crisis without the risk of bankruptcy. We classify BIG LOTS as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. BIG LOTS is strong in asset, dividend, and medium in profitability, but weak in growth. As such, investors looking for consistent, low-risk dividends are likely to be interested in this company. Investors that are looking for high growth in their investments should be aware that BIG LOTS may not be the best fit. More…

Peers

Big Lots Inc is an American retail company that competes with other discount retailers such as B&M European Value Retail SA, Dollar General Corp, and Target Corp. Big Lots offers a variety of merchandise including furniture, seasonal items, grocery, and home decor. The company operates over 1,400 stores in 47 states.

– B&M European Value Retail SA ($LSE:BME)

B&M European Value Retail SA is a holding company that operates through its subsidiaries. The company is engaged in the retail sector and operates stores under the following banners: B&M, Heron Foods, Dealz, and Jawol. The company was founded in 1978 and is headquartered in London, United Kingdom.

– Dollar General Corp ($NYSE:DG)

Dollar General Corporation is an American chain of variety stores headquartered in Goodlettsville, Tennessee. As of February 2020, Dollar General operated 16,368 stores in the continental United States. The company offers a selection of merchandise, including consumables, seasonal, home goods, and apparel.

– Target Corp ($NYSE:TGT)

Target is one of the largest discount retailers in the United States. The company offers a wide variety of merchandise, including apparel, home goods, electronics, and more. Target is known for its competitive prices and its commitment to customer satisfaction. The company has a market cap of 74.48B as of 2022 and a return on equity of 34.09%. Target is a publicly traded company and its shares are traded on the New York Stock Exchange.

Summary

Investors have had a dismal reaction to BIG LOTS’ fourth quarter earnings results for FY2023, with the stock price declining on the day the results were announced. The company reported total revenue of -12.5 million, representing a 125.0% decrease from the same period in the prior year. Net income also declined by 10.9% from the previous year to 1543.1 million.

These weak figures suggest that the company may be struggling to stay afloat in a challenging economic environment. As such, investors should proceed with caution before investing in BIG LOTS stock.

Recent Posts