2023: Costco Wholesale Offers Exclusive Member Access to 838 Warehouses Worldwide!

February 8, 2023

Trending News ☀️

The members-only retail giant Costco Wholesale ($NASDAQ:COST) is set to make waves in 2023 as it expands its reach to 838 warehouses worldwide. Currently, Costco operates in the US, Puerto Rico, Canada, Mexico, Japan, United Kingdom, South Korea, Taiwan, Australia, Spain, France, China and Iceland, providing a wide array of products and services that appeal to a variety of customers. Costco’s signature “big barn” warehouses are well-known for their vast selection of goods, ranging from groceries to home appliances. Customers can also access a wide range of services, such as eyeglass fittings and even gas station pumps. With its combination of low prices and top-notch customer service, it’s no wonder that Costco is beloved by so many. In addition to its brick-and-mortar locations, Costco also offers an expansive ecommerce website. Customers can shop from the comfort of their own homes and have certain goods delivered to their doorsteps with ease.

The website also allows customers to take advantage of exclusive member discounts and promotions. Costco is dedicated to providing its customers with the best possible shopping experience. As such, the company has implemented various safety protocols in order to keep its customers and employees protected. These protocols include contactless payment options, regular surface sanitization and more. As 2023 approaches, the retail behemoth looks forward to welcoming even more customers into its 838 warehouses worldwide. With its world-class selection of goods and services, exclusive members discounts and dedication to safety, there’s no better time than now to become a Costco member.

Price History

2023 has been a great year for COSTCO WHOLESALE as they announce their plans to offer exclusive member access to 838 warehouses worldwide! News sentiment surrounding the company is largely positive, with stock prices increasing 0.2% from the previous day’s closing price. COSTCO WHOLESALE opened at $512.0 on Tuesday and closed at $516.5, showing that investors are confident in the company’s ability to expand its global reach. This move will provide members more opportunities to access the company’s exclusive products and services, as well as savings and convenience. COSTCO WHOLESALE’s decision to expand their offerings is in line with their goal of providing quality products and services at competitive prices. The company has positioned itself as a leader in the retail industry by providing products and services tailored to meet the needs of their customers. With the expansion of their services, customers will be able to enjoy all of the benefits that come with being a COSTCO WHOLESALE member, such as special discounts, exclusive access to products and services, and convenient shopping experiences. The expansion of COSTCO WHOLESALE will not only benefit their current members, but also help attract new customers. The added convenience of having access to multiple warehouses worldwide will be attractive to many potential members.

Additionally, the expansion of their global reach is expected to help increase their profitability in the long-term. COSTCO WHOLESALE’s decision to expand their global presence is a sign of their commitment to providing quality products and services at competitive prices. It is expected that the company’s stock prices will continue to increase as investors continue to show confidence in the company’s long-term success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Costco Wholesale. More…

| Total Revenues | Net Income | Net Margin |

| 231.03k | 5.88k | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Costco Wholesale. More…

| Operations | Investing | Financing |

| 7.39k | -3.92k | -4.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Costco Wholesale. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.03k | 44.55k | 48.38 |

Key Ratios Snapshot

Some of the financial key ratios for Costco Wholesale are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.3% | 17.4% | 3.5% |

| FCF Margin | ROE | ROA |

| 1.5% | 23.9% | 7.6% |

Analysis

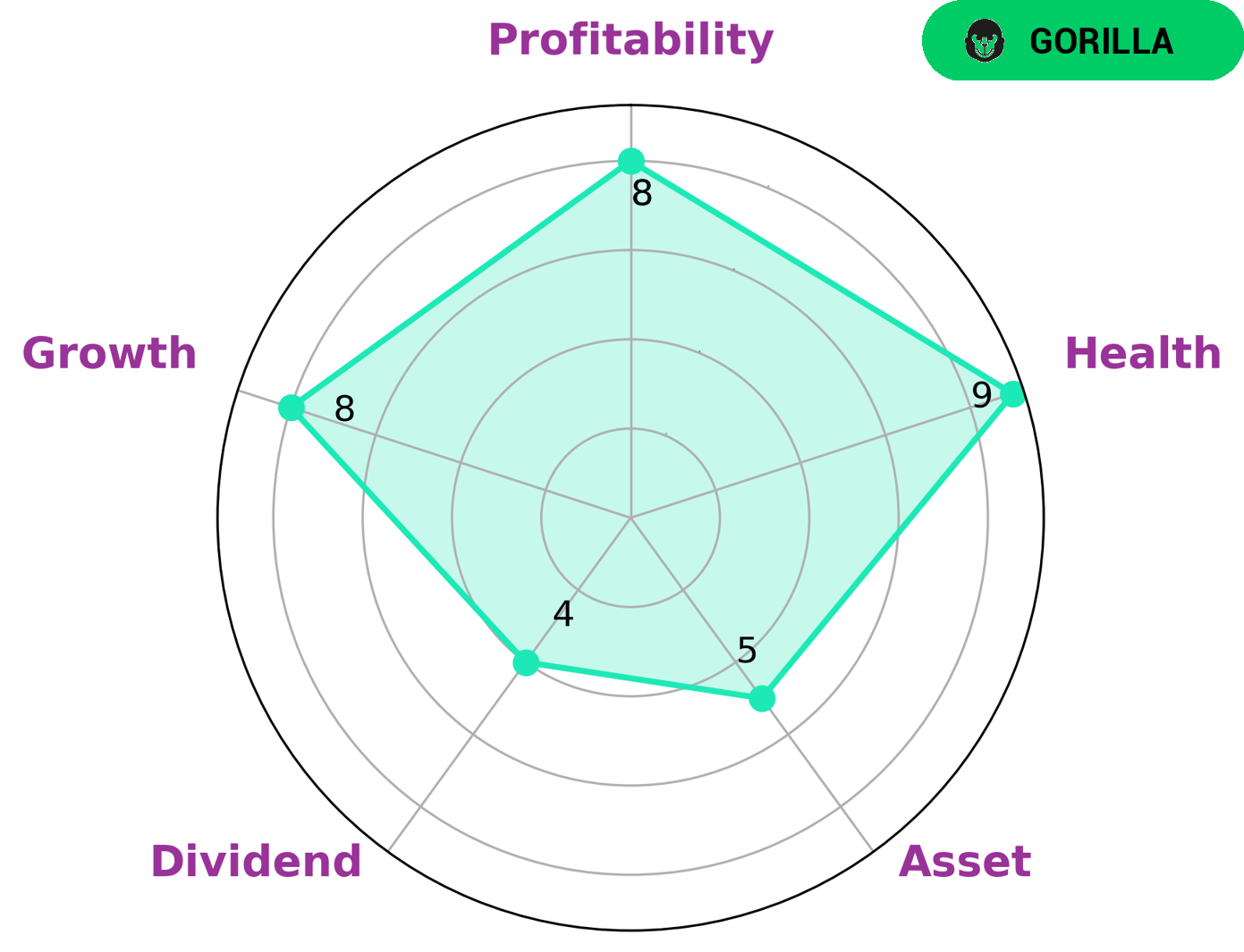

Investors looking for a company with strong fundamentals should consider COSTCO WHOLESALE. GoodWhale’s analysis of the company’s fundamentals shows a high health score of 9/10, indicating that it is capable of paying off its debts and financing future operations. COSTCO WHOLESALE has strong growth and profitability, while its asset and dividend scores are medium. The company is classified as a “gorilla”, which means that it has achieved steady and high revenue or earnings growth due to its competitive advantage. Investors seeking a company with a solid foundation should consider COSTCO WHOLESALE as an option. It has a high health score, with strong growth, profitability, and medium asset and dividend scores. It has a competitive advantage that has allowed it to maintain steady and high earnings growth over time. Investors looking for long-term stability and growth should consider investing in COSTCO WHOLESALE. More…

Peers

The retail industry is highly competitive, with companies constantly vying for market share. Costco Wholesale Corp is no exception, and it competes directly with the likes of Target Corp, Takayoshi Inc, and Walmart Inc. All four companies are leaders in the retail space, and each has its own strengths and weaknesses.

– Target Corp ($NYSE:TGT)

Target Corporation is an American retail company that operates in the discount retailing industry. The company was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target Corporation operates 1,851 stores in the United States and Canada, and has a market cap of 71.52B as of 2022. The company’s return on equity is 34.09%. Target Corporation’s main competitors are Walmart and Amazon.

– Takayoshi Inc ($TSE:9259)

Takayoshi Inc is a Japanese company that manufactures and sells electronic products. It has a market cap of 8.99B as of 2022 and a ROE of -45.41%. The company’s products include computers, mobile phones, digital cameras, and other electronic devices. Takayoshi Inc has been in business for over 50 years and is a well-known brand in Japan.

– Walmart Inc ($NYSE:WMT)

With a market cap of 363.06B as of 2022, Walmart Inc. is a retail giant with a 16.44% return on equity. The company operates a chain of hypermarkets, discount department stores, and grocery stores. Walmart is the world’s largest company by revenue, with US$514.405 billion in 2020.

Summary

This company offers exclusive membership access to its members, allowing them to access exclusive savings on a variety of products. Investing in COSTCO Wholesale could provide investors with a combination of long-term growth potential, dividend income and stability, due to their impressive track record of success and diverse product offerings. COSTCO has a strong financial standing, with a healthy balance sheet and strong cash flows that have enabled them to return value to shareholders in the form of dividends and share repurchases. As the company continues to expand and innovate, investors may be able to benefit from increased growth opportunities.

Recent Posts