Waters Corporation Reports Missed Q1 Expectations and Updates FY23 Outlook

May 11, 2023

Trending News 🌧️

Looking forward, Waters Corporation ($NYSE:WAT) has initiated its outlook for Q2 and updated its FY23 guidance. Going forward, investors will be watching for Waters Corporation’s ability to execute its growth strategy and deliver on its long-term goals, as well as its progress in developing innovative products and services that meet the needs of its customers.

Price History

On Tuesday, WATERS CORPORATION reported that they had missed their expected first quarter results and subsequently updated their FY23 outlook. This news caused their stock to open at $268.1 and close at $276.8, a decrease of 6.7% from their previous closing price of $296.5. WATERS CORPORATION also noted that the results were in line with their expectations and that they are continuing to invest in their long-term strategies. They remain confident in the company’s future prospects despite the current market situation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Waters Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.97k | 707.75 | 24.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Waters Corporation. More…

| Operations | Investing | Financing |

| 611.66 | -107.97 | -509.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Waters Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.28k | 2.78k | 8.54 |

Key Ratios Snapshot

Some of the financial key ratios for Waters Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.3% | 7.6% | 29.8% |

| FCF Margin | ROE | ROA |

| 14.4% | 124.6% | 16.9% |

Analysis

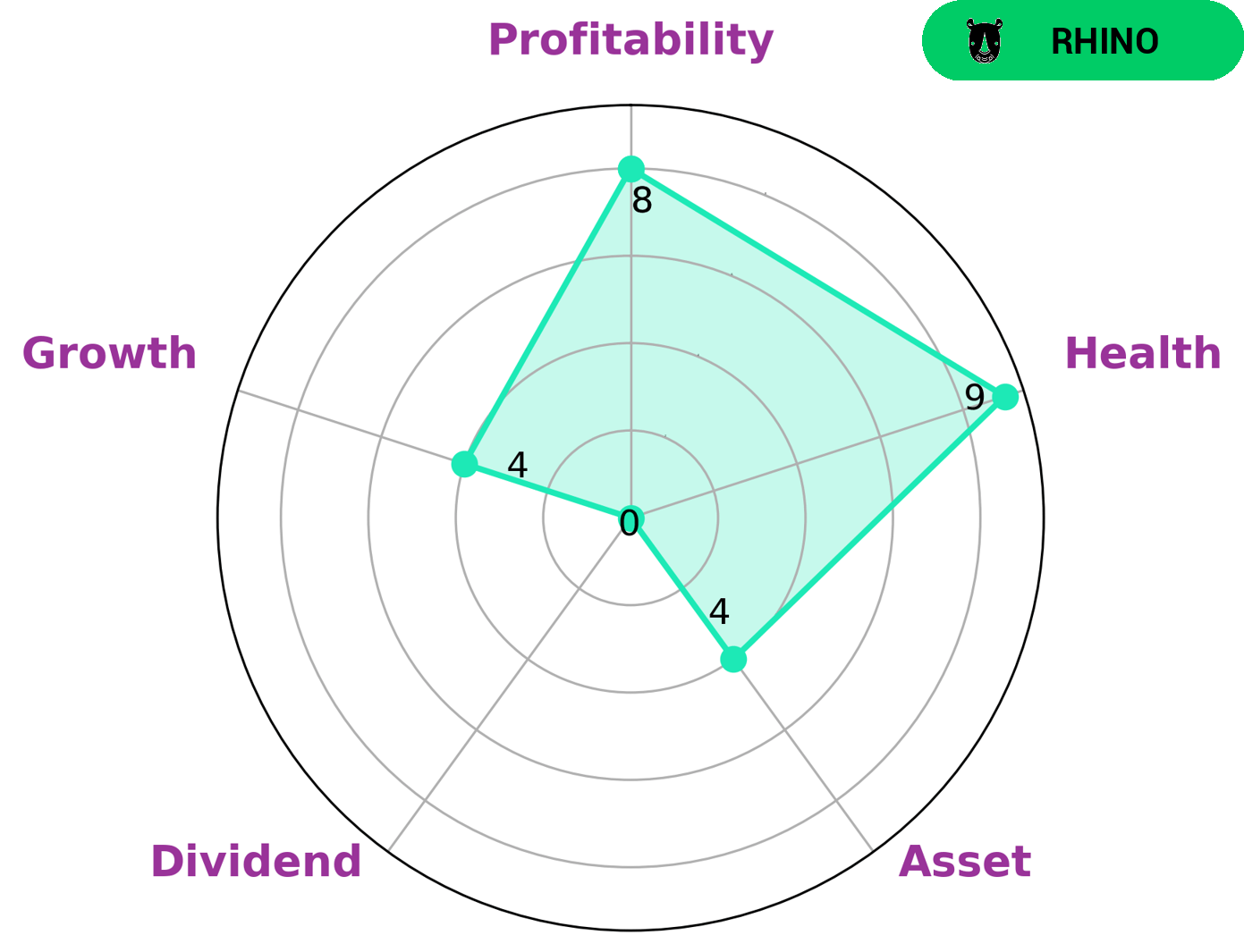

At GoodWhale, we recently conducted an analysis of WATERS CORPORATION‘s wellbeing. According to our Star Chart, WATERS CORPORATION has a strong rating for profitability, a medium rating for asset growth, and a weak rating for dividend payments. Additionally, WATERS CORPORATION has a very high health score of 9/10 with regard to its cashflows and debt, meaning that it can safely ride out any financial difficulties without the risk of bankruptcy. We categorize WATERS CORPORATION as a ‘rhino’, meaning it has achieved moderate revenue or earnings growth. Investors who are interested in such a company are likely to be attracted to its strong profitability, as well as its ability to remain financially stable in tough times. WATERS CORPORATION may also be attractive to investors who focus on long-term asset growth and are willing to accept lower dividends in the short-term. More…

Peers

Waters Corporation is an American analytical instrument manufacturing company that specializes in liquid chromatography, mass spectrometry, and thermal analysis instruments. It has annual sales of over $2 billion and employs more than 6,000 people worldwide. Its products are used in the life sciences, pharmaceutical, and chemical industries. Waters Corporation’s main competitors are IQVIA Holdings Inc, Agilent Technologies Inc, Vijaya Diagnostic Centre Ltd.

– IQVIA Holdings Inc ($NYSE:IQV)

The company’s market cap as of 2022 was 39.27B and its ROE was 21.52%. The company is a global provider of information, innovative technology solutions, and real-world insights that help customers improve their well-being. The company offers a broad range of products and services that enable customers to manage their health and wellbeing.

– Agilent Technologies Inc ($NYSE:A)

Agilent Technologies, Inc. is a provider of life sciences, diagnostics, and applied chemical markets solutions. It operates through three segments: Life Sciences and Applied Markets Group, Diagnostics and Genomics Group, and Agilent CrossLab Group. The Life Sciences and Applied Markets Group segment offers application solutions that include chromatography, mass spectrometry, chemical analysis, and cellular analysis. The Diagnostics and Genomics Group segment provides in vitro diagnostic products and services. The Agilent CrossLab Group segment offers a range of services and consumables. Agilent Technologies was founded in 1999 and is headquartered in Santa Clara, California.

– Vijaya Diagnostic Centre Ltd ($BSE:543350)

Vijaya Diagnostic Centre Ltd is a leading diagnostic centre in India with a market cap of 46.61B as of 2022. The company has a return on equity of 17.7%. The company offers a wide range of diagnostic services including X-rays, ultrasounds, MRI, and CT scans. The company also has a wide network of centres across India.

Summary

Waters Corporation is a leading provider of innovative laboratory instrumentation, software, services and consumables for the global life sciences industry. Recently, the company reported its 1Q results that missed both top and bottom estimates of analysts as well as its 2Q outlook and updated FY23 guidance. This news resulted in a drop of the stock price on the same day.

The investing analysis suggests that Waters Corporation needs to refine its financials in order to restore investor confidence and ensure higher returns in the future. Investors should monitor Waters Corporation for any further developments in order to make an informed decision when considering investing in this company.

Recent Posts