VolitionRx to Present Corporate Updates in May 2023

May 13, 2023

Trending News 🌥️

VOLITIONRX ($NYSEAM:VNRX): VolitionRx Limited (VNRX) is set to present corporate updates later this month in May 2023. The company is a life science company that specializes in developing innovative, next-generation blood-based diagnostic tests in order to detect a range of cancers and other diseases. The company’s tests are based on its unique NuQ technology, which is designed to identify combinations of biomarkers in blood. Through the utilization of its NuQ technology, VolitionRx is able to provide improved testing sensitivity and specificity compared to traditional methods.

In addition, VolitionRx has also established partnerships with numerous industry leaders, such as Siemens Healthineers, in order to expand its reach and bring its life-saving tests to more patients around the world. Thus, the upcoming corporate presentation in May 2023 is expected to be a comprehensive overview of the company’s accomplishments over the past decade. Investors and analysts should expect to gain insight into VolitionRx’s strategy for growth and expansion, along with updates on the progress of its current projects. The presentation will also provide a detailed look at the company’s financial performance and provide information regarding future prospects for the company. All in all, the upcoming presentation should provide valuable insight and information for all those interested in the future of VolitionRx Limited.

Share Price

VOLITIONRX LIMITED (VNRX) had a difficult day on Friday, with their stock opening at $1.9 and closing at $1.8, down by 6.3% from the previous closing price of $1.9. The company has not released any details of the updates yet, but investors are hoping to find out more information about how the company is progressing and how it plans to move forward in the competitive biotech sector. It is expected that the updates will give investors a better understanding of how VOLITIONRX LIMITED is positioned in the industry and how it plans on succeeding in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Volitionrx Limited. More…

| Total Revenues | Net Income | Net Margin |

| 0.31 | -30.27 | -9879.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Volitionrx Limited. More…

| Operations | Investing | Financing |

| -15.28 | -1.57 | 6.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Volitionrx Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.3 | 21.42 | 0.06 |

Key Ratios Snapshot

Some of the financial key ratios for Volitionrx Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 161.7% | – | -9930.2% |

| FCF Margin | ROE | ROA |

| -5498.8% | -5262.3% | -103.9% |

Analysis

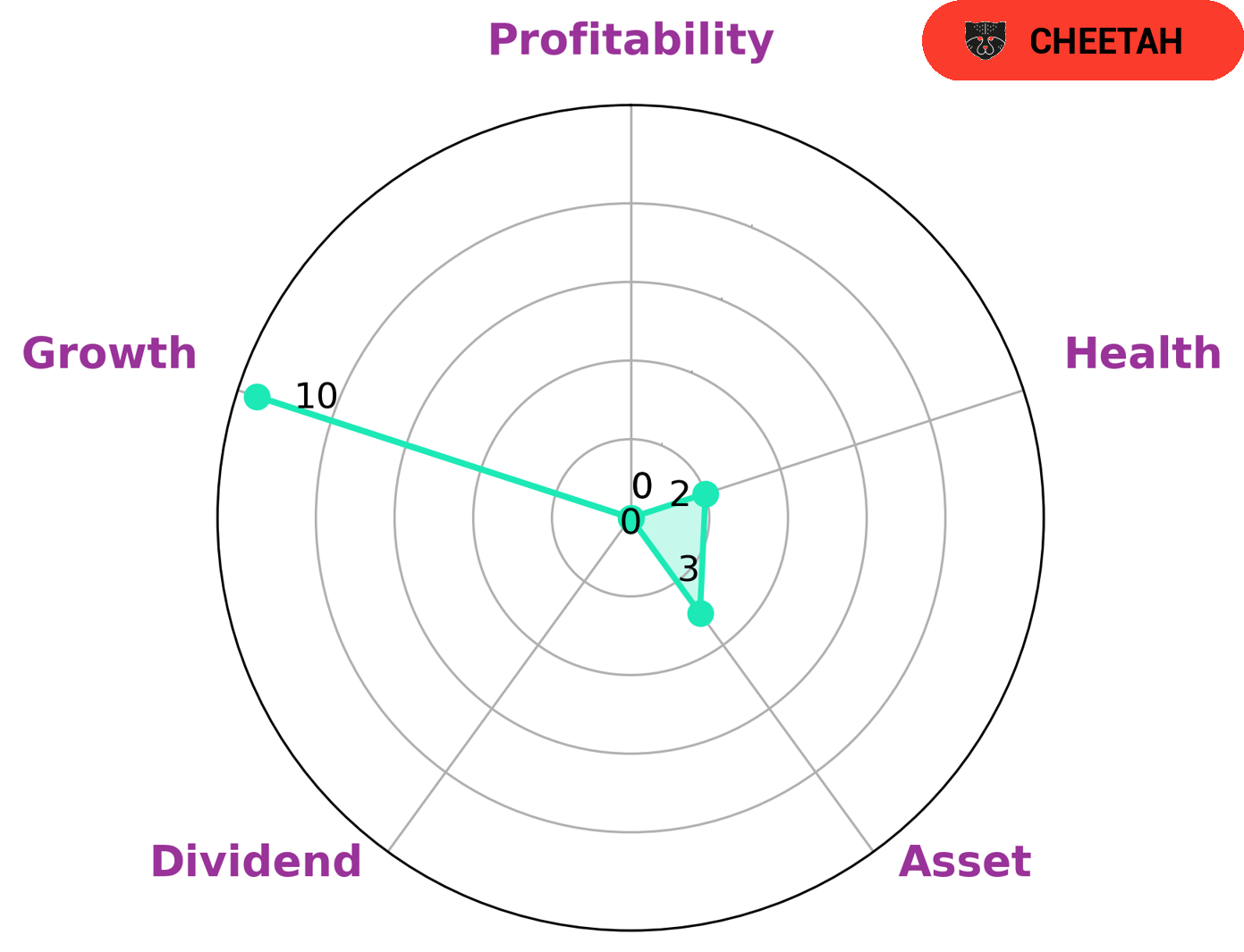

As a part of our analysis of VOLITIONRX LIMITED‘s financials, GoodWhale generated a Star Chart to assess its strengths and weaknesses. We concluded that the company is strong in terms of growth, but weak in asset, dividend and profitability. Additionally, our Health Score for VOLITIONRX LIMITED was 2/10, indicating that it is less likely to pay off debt and fund future operations. Based on these findings, we classified VOLITIONRX LIMITED as a ‘cheetah’ type of company. This means that it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors interested in such a company may be looking to capitalize on short-term gains, as the company lacks long-term stability. More…

Peers

It is a publicly traded company on the Nasdaq exchange under the symbol VNRX. VolitionRX Ltd is in competition with a number of other biotechnology companies, such as Many Bright Ideas Technologies Inc, ENDRA Life Sciences Inc, and LungLife AI Inc, all of which are working to develop and commercialize innovative diagnostic tests for cancer.

– Many Bright Ideas Technologies Inc ($TSXV:MBI.H)

Bright Ideas Technologies Inc is a technology company that focuses on providing innovative solutions to businesses and individuals. The company has a market capitalization of 431.44k as of 2022, which indicates its relative size in comparison to other companies in the same industry. Additionally, Bright Ideas Technologies Inc has a Return on Equity (ROE) of 81.65%, demonstrating its financial success and efficiency in utilizing its assets to generate profits. This strong ROE indicates that the company is effectively managing its resources, making it a preferred choice for investors.

– ENDRA Life Sciences Inc ($NASDAQ:NDRA)

ENDRA Life Sciences Inc is a medical technology company based in the United States that specializes in the development and commercialization of advanced ultrasound technologies. The company has a market capitalization of 12.86 million as of 2022 and a Return on Equity of -67.17%. Market capitalization is an indicator of the company’s size and reflects the total value of a company’s outstanding shares. The negative return on equity indicates that the company is not efficiently utilizing its shareholders’ equity to generate profits. The company is focused on improving ultrasound imaging capabilities and utilizing its proprietary ThermoAcoustic Enhanced UltraSound (TAEUS) platform to address the unmet needs of the global medical imaging market.

– LungLife AI Inc ($LSE:LLAI)

LungLife AI Inc is a healthcare technology company that specializes in the diagnosis, treatment and management of respiratory diseases. Founded in 2020, the company leverages its proprietary AI-based platform to help clinicians and patients better understand their respiratory health. As of 2022, LungLife AI Inc has a market cap of 21.66M and a Return on Equity of -24.88%. The company’s market cap reflects the amount of money investors are willing to pay for the company’s shares and its ROE indicates how well the company is performing financially. The negative ROE indicates that the company is currently not able to generate profits from its investments, however, it is likely that LungLife AI Inc’s performance will improve over time as the company continues to develop and expand its services.

Summary

VolitionRx Limited is an in-vitro diagnostic company focused on developing and commercializing blood-based diagnostic tests. The company’s stock price has moved down in response to the May 2023 Corporate Presentation, indicating investors’ expectations of the company’s future performance. A thorough analysis of VolitionRx should consider its financial position, recent technological developments, and competitive landscape. Investors should pay attention to factors such as the company’s cash flow, debt structure, and income statement. Furthermore, it is important to evaluate the degree to which the company’s new technologies are competitive and the potential impact they will have on the market.

Additionally, considering VolitionRx’s competitive environment and its competitors’ strengths and weaknesses may provide insight into the company’s future prospects. Through a comprehensive analysis of these areas, investors can make a more informed decision about whether or not to invest in VolitionRx.

Recent Posts