Syneos Health Intrinsic Value – FivepHusion and Treehill Partners Partner with Syneos Health to Advance Healthcare Solutions

May 27, 2023

Trending News ☀️

Syneos Health ($NASDAQ:SYNH) is an American multinational biopharmaceutical solutions company that focuses on helping biopharmaceutical and medical companies bring their products to market. They provide end-to-end solutions for drug development, clinical trial management, and commercialization. Recently, they have partnered with FivepHusion and Treehill Partners to further advance healthcare solutions. FivepHusion is a global healthcare tech and analytics platform that brings together data and insights from multiple sources to deliver comprehensive healthcare solutions.

Treehill Partners is a venture capital firm that focuses on investing in early-stage healthcare companies. Together, these three partners will collaborate to bring innovative and cost-effective healthcare solutions to their clients with the goal of improving outcomes for patients. By working together, they will be able to leverage the vast resources available to them to develop and bring to market innovative products and services that will benefit patients and the industry at large.

Share Price

The partnership will leverage FivepHusion and Treehill Partners’ knowledge and technology to create innovative solutions that will be adopted by SYNEOS HEALTH. Moreover, it is expected to drive growth and value for the company. As a result, SYNEOS HEALTH stock opened at $41.6 on Friday and closed at the same price that day.

This agreement is the latest in a series of collaborations between SYNEOS HEALTH and leading companies in the healthcare industry. The company is committed to delivering best-in-class solutions that meet the needs of its customers and ultimately improve patient outcomes. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Syneos Health. More…

| Total Revenues | Net Income | Net Margin |

| 5.41k | 148.17 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Syneos Health. More…

| Operations | Investing | Financing |

| 386.52 | -107.76 | -302.39 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Syneos Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.1k | 4.64k | 33.33 |

Key Ratios Snapshot

Some of the financial key ratios for Syneos Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.7% | 6.0% | 5.2% |

| FCF Margin | ROE | ROA |

| 5.3% | 5.0% | 2.2% |

Analysis – Syneos Health Intrinsic Value

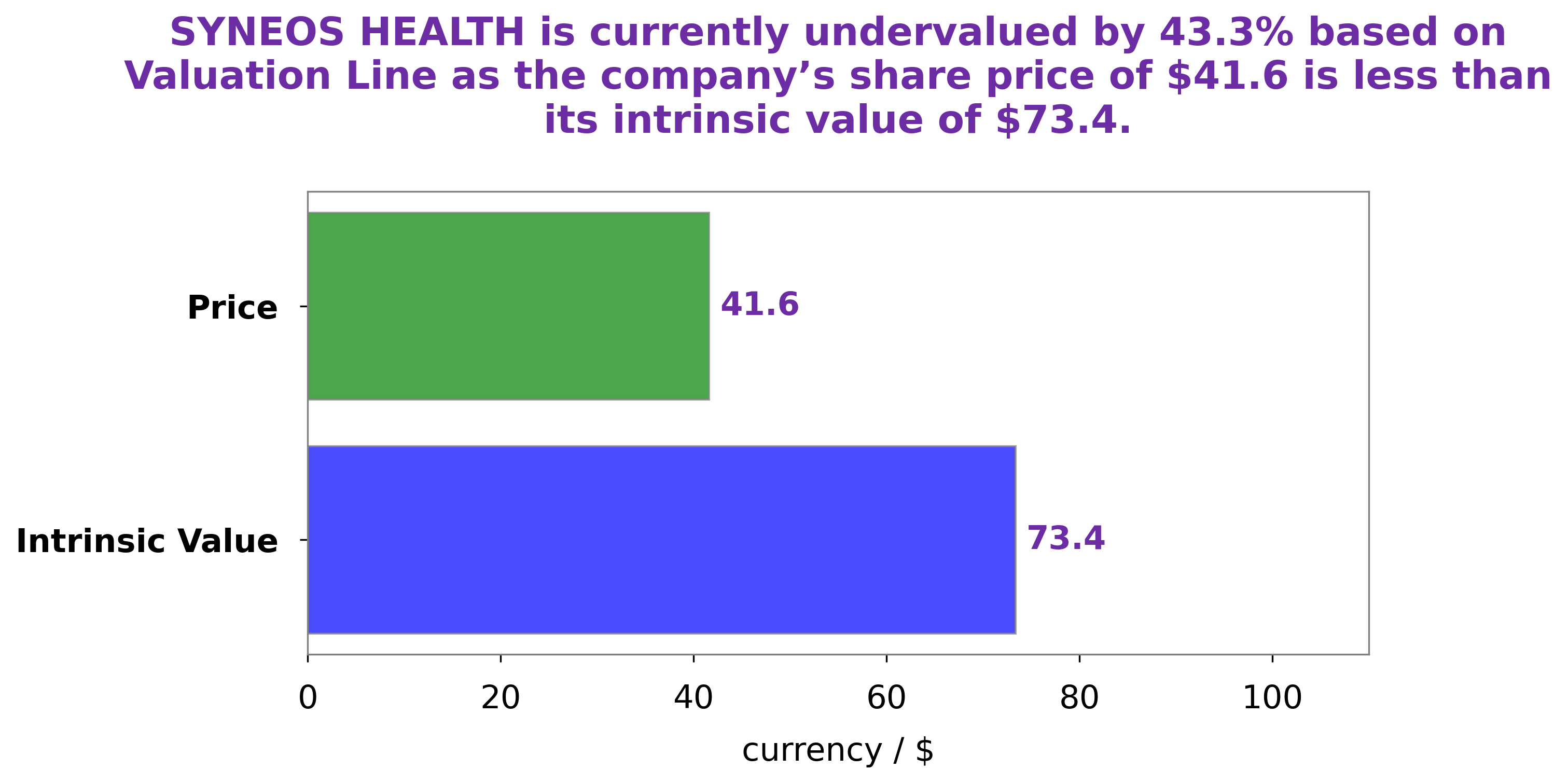

At GoodWhale, we have conducted a detailed analysis of SYNEOS HEALTH‘s financials. According to our proprietary Valuation Line, the intrinsic value of SYNEOS HEALTH’s share is estimated to be around $73.4. As of now, SYNEOS HEALTH’s stock is trading at $41.6, which implies that it is currently undervalued by 43.4%. More…

Peers

The company competes with Shin Nippon Biomedical Laboratories Ltd, Icon PLC, and Guardant Health Inc, among a few other companies in the biopharmaceutical services industry. Syneos Health Inc provides an end-to-end solution for customers with deep expertise and a focus on service excellence.

– Shin Nippon Biomedical Laboratories Ltd ($TSE:2395)

Shin Nippon Biomedical Laboratories Ltd, or SNBL, is a Japanese-based company specializing in the development and manufacture of laboratory animal models for the pharmaceutical and medical industries. The company has a market cap of 94.46B as of 2022, which reflects its strong financial performance and industry leadership. Additionally, SNBL has a Return on Equity of 27.97%, indicating a strong return on its investments. SNBL is well-positioned to continue to deliver strong returns for investors and to remain a leader in the laboratory animal model industry.

– Icon PLC ($NASDAQ:ICLR)

Icon PLC, founded in 1977, is a global provider of outsourced development services to the pharmaceutical, biotechnology and medical device industries. Based in Dublin, Ireland, the company operates in over 30 countries and employs over 11,500 professionals. With a market capitalization of 15.9 billion as of 2022, Icon PLC is one of the largest companies in its space. The company boasts a Return on Equity of 4.96%, indicating a strong level of profitability and efficient use of capital. Icon PLC focuses on providing a wide range of services such as clinical trial management, regulatory affairs outsourcing, safety and pharmacovigilance, biometrics, and medical writing.

– Guardant Health Inc ($NASDAQ:GH)

Guardant Health Inc is a biotechnology company based in Redwood City, California, and is focused on developing non-invasive cancer diagnostics. The company has a market cap of 4.75 billion as of 2022. Guardant Health Inc had a return on equity of -150.22%, which illustrates that the company had a negative profitability from its investments. This suggests that the company has not been able to generate enough profits from its investments to cover its cost of capital and grow its value for shareholders. Although this is not a positive sign for investors, it may be a sign that the company is investing heavily into research and development of new products and technologies that could eventually bring profits in the future.

Summary

Syneos Health is an American biopharmaceutical services company that provides comprehensive solutions for biopharma and life sciences companies. Through its suite of offerings, Syneos Health offers services covering the entire product lifecycle from pre-clinical development through commercialization. The company recently announced a new partnership with FivepHusion and Treehill Partners to invest in technology and services that transform the way biopharma companies conduct clinical trials and commercial operations. This investment is expected to improve the efficiency and effectiveness of Syneos Health’s services and enhance its competitive position in the market.

Recent Posts