Sotera Health Intrinsic Value – Sotera Health: Preparing to Weather the Uncertainty with Guidance Updates

April 6, 2023

Trending News 🌧️

As I await the guidance updates from Sotera Health ($NASDAQ:SHC), I am prepared to make adjustments as needed. Their products include everything from analytical testing to consulting services, and their commitment to innovation has allowed them to remain at the forefront of the industry. Given the current uncertainty in the market, Sotera Health has been providing their customers with updated guidance on how to best utilize their products and services so they can stay ahead of the curve. They have also released materials on understanding the risks and making adjustments to operations in light of the ever-changing environment.

Sotera Health has also been proactive in providing resources and information to their partners so they can make informed decisions. Their commitment to customer service has made them one of the most reliable providers in the health care industry, and they are well-positioned to weather the uncertainties of the market. By staying up to date with their guidance updates and making any necessary adjustments, I am confident that Sotera Health will continue to provide reliable services and products for years to come.

Share Price

SOTERA HEALTH‘s stock opened Wednesday at $17.0 and closed at the same price, signaling a slight 0.4% drop from its prior closing price of 17.1. This minor dip came amidst a backdrop of uncertainty in the healthcare industry, with changing regulations and new guidance updates. SOTERA HEALTH is taking steps to weather the uncertainty with their own updates and guidance, aiming to provide clarity to both the healthcare industry and its customers.

These updates are expected to help the company both more accurately predict changes in the market and better prepare for them. Ultimately, SOTERA HEALTH is looking to ensure stability in the midst of ever-evolving healthcare regulations. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sotera Health. More…

| Total Revenues | Net Income | Net Margin |

| 1k | -233.57 | 16.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sotera Health. More…

| Operations | Investing | Financing |

| 277.96 | -181.9 | 197.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sotera Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.12k | 2.77k | 1.24 |

Key Ratios Snapshot

Some of the financial key ratios for Sotera Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.8% | 9.5% | -16.2% |

| FCF Margin | ROE | ROA |

| 9.5% | -21.3% | -3.3% |

Analysis – Sotera Health Intrinsic Value

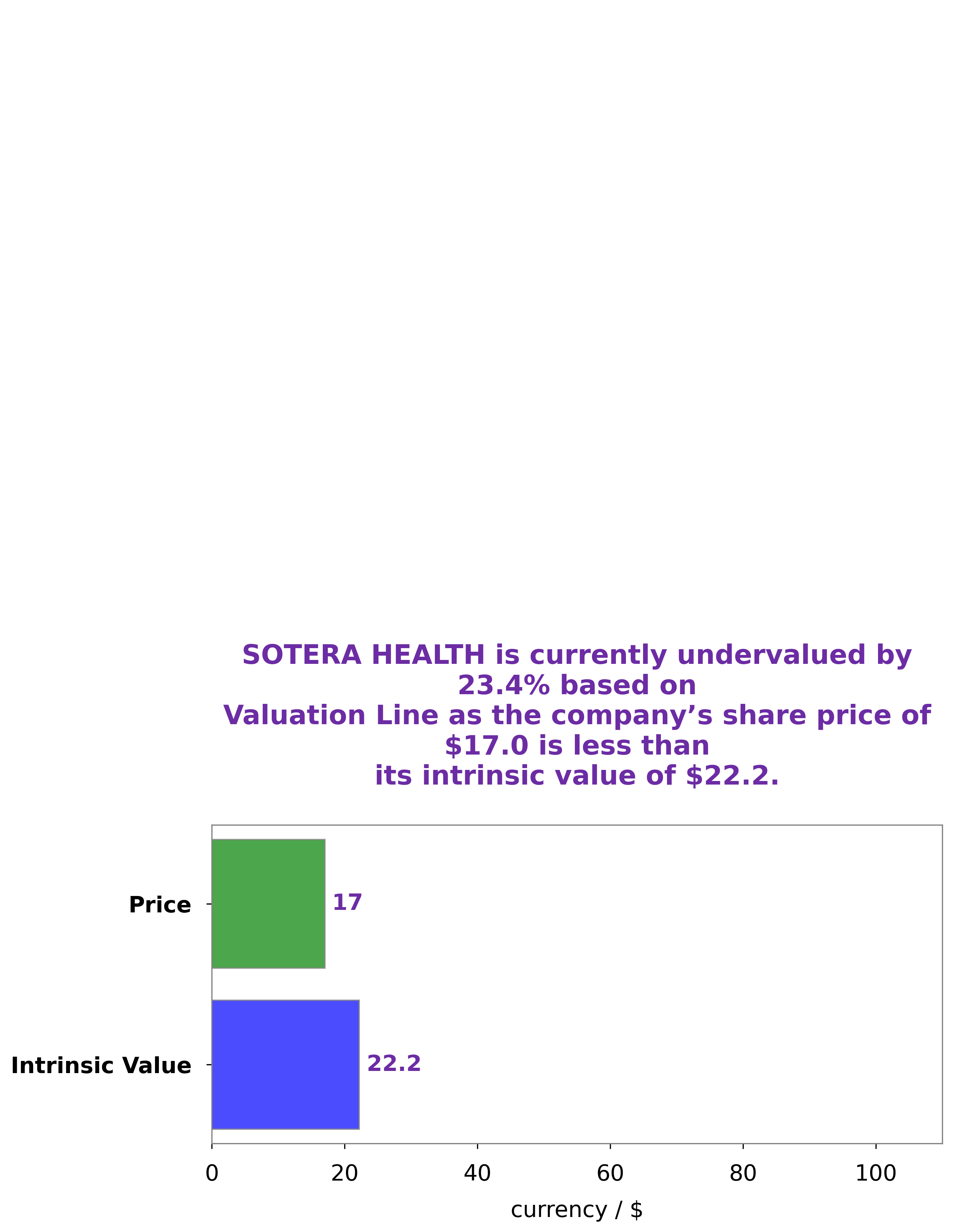

At GoodWhale, we have conducted an analysis of SOTERA HEALTH‘s financials and have determined that the intrinsic value of its share is approximately $22.2. This calculation was made using our proprietary Valuation Line. We have discovered that the current market price of the stock is $17.0, which means that it is undervalued by 23.6%. This makes it an attractive investment opportunity for investors who wish to capitalize on its potential. We recommend doing further research and understanding the risks associated before investing in SOTERA HEALTH’s stock. More…

Peers

The company has a strong presence in the United States, Europe, and Asia. Pharmigene Inc, Inotiv Inc, and Centogene NV are all major competitors of Sotera Health Co.

– Pharmigene Inc ($TPEX:7595)

Pharmigene Inc is a clinical-stage biopharmaceutical company focused on developing precision medicines for the treatment of cancer and other diseases. The company’s lead product candidate is PG-301, a precision cancer medicine targeting the EZH2 protein. Pharmigene is also developing PG-201, a precision medicine targeting the KRAS protein, and PG-102, a precision medicine targeting the BRAF protein.

Pharmigene’s market cap is $658.49 million as of 2022. The company’s return on equity is -6.26%.

Pharmigene’s lead product candidate, PG-301, is a precision cancer medicine targeting the EZH2 protein. The company is also developing PG-201, a precision medicine targeting the KRAS protein, and PG-102, a precision medicine targeting the BRAF protein.

– Inotiv Inc ($NASDAQ:NOTV)

Inotiv Inc is a biotechnology company that focuses on the discovery and development of innovative therapies to treat patients with cancer and other serious diseases. The company’s market cap is $486.81M as of 2022, and its ROE is -6.96%. Inotiv’s products are designed to target the underlying cause of disease and improve patient outcomes. The company’s lead product candidates are in clinical trials for the treatment of solid tumors and blood cancers. Inotiv is headquartered in San Diego, California.

– Centogene NV ($NASDAQ:CNTG)

As of 2022, Centogene NV has a market cap of 28.16M. The company’s return on equity is -141.43%. Centogene NV is a biotechnology company that focuses on the diagnosis, treatment, and prevention of rare diseases. The company was founded in 2002 and is headquartered in Rostock, Germany.

Summary

Sotera Health is an American healthcare company specialized in providing comprehensive testing, diagnostics, and consulting services for the global healthcare industry. It has a strong balance sheet with no debt and a wide range of partnerships and products. Analysts believe that Sotera has the capability to provide exceptional value to its customers through diversified offerings, and its profits and market share are expected to increase over the coming years.

With strong customer loyalty, and positive relationships with health care providers, Sotera has a strong position in the market. The company’s guidance on future performance can be monitored to better assess its prospects.

Recent Posts