Natera Intrinsic Value – Natera, Stock Soars as Steven Leonard Chapman Invests 4736 Shares in 2023

March 30, 2023

Trending News ☀️

Natera ($NASDAQ:NTRA) Inc., (NASDAQ:NTRA) has seen a recent surge in stock prices as Steven Leonard Chapman has invested 4736 shares of the company in the year 2023. Natera is a biotechnology company focused on providing innovative genetic testing and diagnostics services through its proprietary technology. Its services are used to diagnose and monitor various genetic disorders, as well as to provide insights into reproductive health. Natera’s mission is to transform the diagnosis and management of genetic diseases, and its products are designed to make genetic testing more accessible, affordable and convenient for everyone. Its range of products includes cancer testing, non-invasive prenatal testing, miscarriage testing, and hereditary cancer testing.

In addition, it provides services for laboratory-based testing, as well as genetic counselling services. Natera’s stock has been on the rise in recent years, due in part to the latest investment from Steven Leonard Chapman. With the additional 4736 shares invested in the year 2023, Natera’s stock has seen a significant increase in value. This surge in stock prices shows that investors have faith in the company’s ability to deliver high-quality testing and diagnostic services. The company is delivering innovative products and services that are revolutionizing the diagnosis and management of genetic diseases. As a result, investors are showing increased confidence in Natera’s stock, which could lead to continued growth in the years to come.

Market Price

On Monday, Natera, Inc. stock opened at $56.7 and closed at $56.0, a decrease of 1.2% from the prior closing price of 56.6. The stock prices for Natera took a dip, but the news of Steven Leonard Chapman investing 4736 shares in the company boosted its stock prices back up. This significant investment of 4736 shares saw the Natera’s stock prices soaring and marked a successful start to 2023 for the company. natera,-stock-soars-as-steven-leonard-chapman-invests-4736-shares-in-2023″>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Natera. natera,-stock-soars-as-steven-leonard-chapman-invests-4736-shares-in-2023″>More…

| Total Revenues | Net Income | Net Margin |

| 820.22 | -547.8 | -66.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Natera. natera,-stock-soars-as-steven-leonard-chapman-invests-4736-shares-in-2023″>More…

| Operations | Investing | Financing |

| -431.5 | 330.34 | 482.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Natera. natera,-stock-soars-as-steven-leonard-chapman-invests-4736-shares-in-2023″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.39k | 688.73 | 6.34 |

Key Ratios Snapshot

Some of the financial key ratios for Natera are shown below. natera,-stock-soars-as-steven-leonard-chapman-invests-4736-shares-in-2023″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 39.5% | – | -65.5% |

| FCF Margin | ROE | ROA |

| -58.4% | -62.9% | -24.1% |

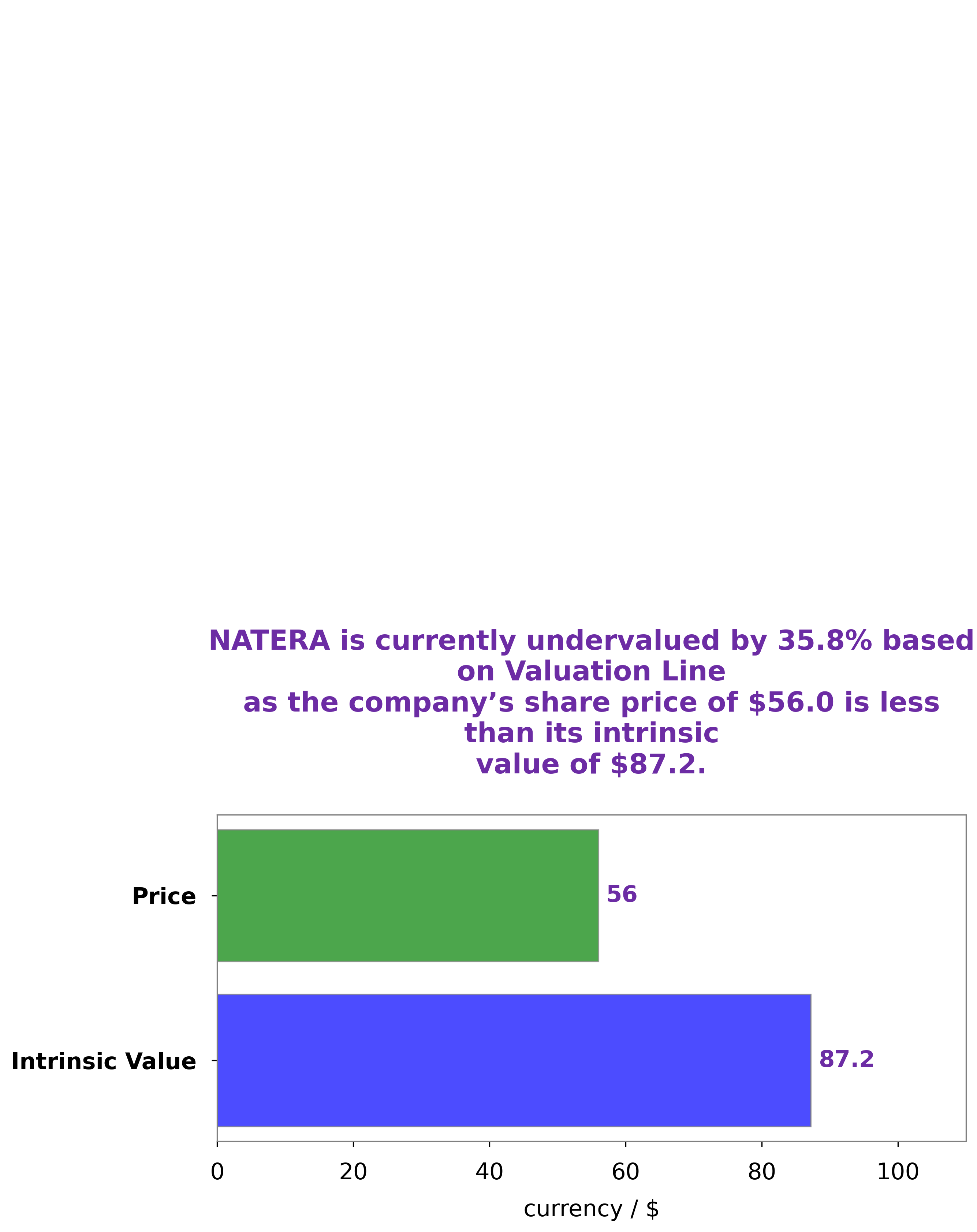

Analysis – Natera Intrinsic Value

GoodWhale has examined the financials of NATERA and our proprietary Valuation Line indicates that the fair value of the NATERA share is around $87.2. At the current market price of $56.0, the stock is undervalued by 35.8%. We believe that the potential upside of the stock is quite attractive considering the current price. We suggest investors take a closer look at NATERA and consider investing in it if they believe that the company has potential for long-term growth. We believe that the company’s fundamentals support an increase in share price and that investors may benefit from buying at these low prices. Additionally, with the current low valuations, NATERA may be an excellent target for investors looking to capitalize on value investing opportunities. natera,-stock-soars-as-steven-leonard-chapman-invests-4736-shares-in-2023″>More…

Peers

The company’s products are used for pregnancy and fertility testing, as well as for cancer and inherited disease risk assessment. Natera‘s competitors include Genetic Technologies Ltd, Dr Lalchandani Labs Ltd, and NeoGenomics Inc.

– Genetic Technologies Ltd ($ASX:GTG)

Genetic Technologies Ltd is a biotechnology company that develops and commercializes molecular diagnostic tests. The company has a market cap of 27.7M as of 2022 and a Return on Equity of -24.9%. The company’s products are used for the detection of genetic disorders and cancer.

– Dr Lalchandani Labs Ltd ($BSE:541299)

Lalchandani Labs Ltd is a pharmaceutical company with a market cap of 141.91M as of 2022. The company has a Return on Equity of 12.87%. The company manufactures and sells pharmaceutical products and services. It offers products and services in the areas of diagnostics, therapeutics, and general health care. The company also provides services in the areas of research and development, manufacturing, marketing, and sales.

– NeoGenomics Inc ($NASDAQ:NEO)

NeoGenomics, Inc. is a holding company, which engages in the business of providing cancer-focused genetic testing services. It operates through the Clinical Services and Pharma Services segments. The Clinical Services segment includes tumor tissue tests, fluid tests, and other ancillary tests. The Pharma Services segment provides genomic services to pharmaceutical clients to support their drug development programs. The company was founded by Douglas M. Ross in 2001 and is headquartered in Fort Myers, FL.

Summary

Natera, Inc. has seen a significant rise in its stock value after Steven Leonard Chapman invested 4736 of his own shares in the company in 2023. The investment came as a surprise to many, yet has been a profitable move for Mr. Chapman and many other shareholders, indicating that Natera may be a worthwhile stock to buy. Analysts predict that Natera’s performance will continue to be positive due to its strong track record and potential for high returns. Investors should be aware of the risks associated with investing in Natera but should also have confidence that the company is well-positioned for continued success.

Recent Posts