Mettler Toledo International Beats Earnings Expectations for Q4 2023 with Non-GAAP EPS of $12.00.

February 11, 2023

Trending News 🌥️

METTLER-TOLEDO ($NYSE:MTD): Mettler Toledo International is a multinational manufacturer of precision instruments and weighing systems for use in the laboratory, industrial, and food retail markets. Recently, Mettler Toledo beat earnings expectations for the fourth quarter of 2023 with a Non-GAAP Earnings Per Share (EPS) of $12.00, $0.32 more than anticipated. In particular, the U.S. and Europe saw significant growth in sales compared to the same time period last year. This growth was driven by the demand for Mettler Toledo’s precision instruments and weighing systems in both industries and retail settings. These cost cutting measures included reducing operational costs such as reducing headcount and cutting back on travel expenses.

In addition, Mettler Toledo has also focused on streamlining its product portfolio to focus on its more profitable offerings. The company’s cost cutting initiatives have enabled it to produce a non-GAAP EPS of $12.00, significantly higher than expected, while still providing quality products and services. Mettler Toledo’s success in the fourth quarter is a positive sign for the company’s future prospects.

Market Price

On Thursday, Mettler Toledo International stock opened at $1573.4 and closed at $1534.6, down by 1.3% from the previous closing price of $1554.7. The strong quarterly earnings results are attributed to Mettler Toledo’s successful strategies and innovation in the industrial division.

Additionally, Mettler Toledo plans to invest heavily in research and development to create new products that will help them to stay competitive in the global market. Mettler Toledo also noted that their integration of newly acquired business units is progressing smoothly and according to plan. The company is confident that this will result in additional cost savings and operational efficiency in the near future. Overall, Mettler Toledo had a successful fourth quarter, beating expectations and solidifying their position as a global leader in industrial instrumentation. With a strong balance sheet and solid prospects for the future, investors should be optimistic about the company’s outlook going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mettler-toledo International. More…

| Total Revenues | Net Income | Net Margin |

| 3.9k | 837.54 | 21.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mettler-toledo International. More…

| Operations | Investing | Financing |

| 796.53 | -152.24 | -694.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mettler-toledo International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.29k | 3.38k | -3.71 |

Key Ratios Snapshot

Some of the financial key ratios for Mettler-toledo International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.3% | 15.1% | 27.7% |

| FCF Margin | ROE | ROA |

| 17.2% | -1789.8% | 20.5% |

Analysis

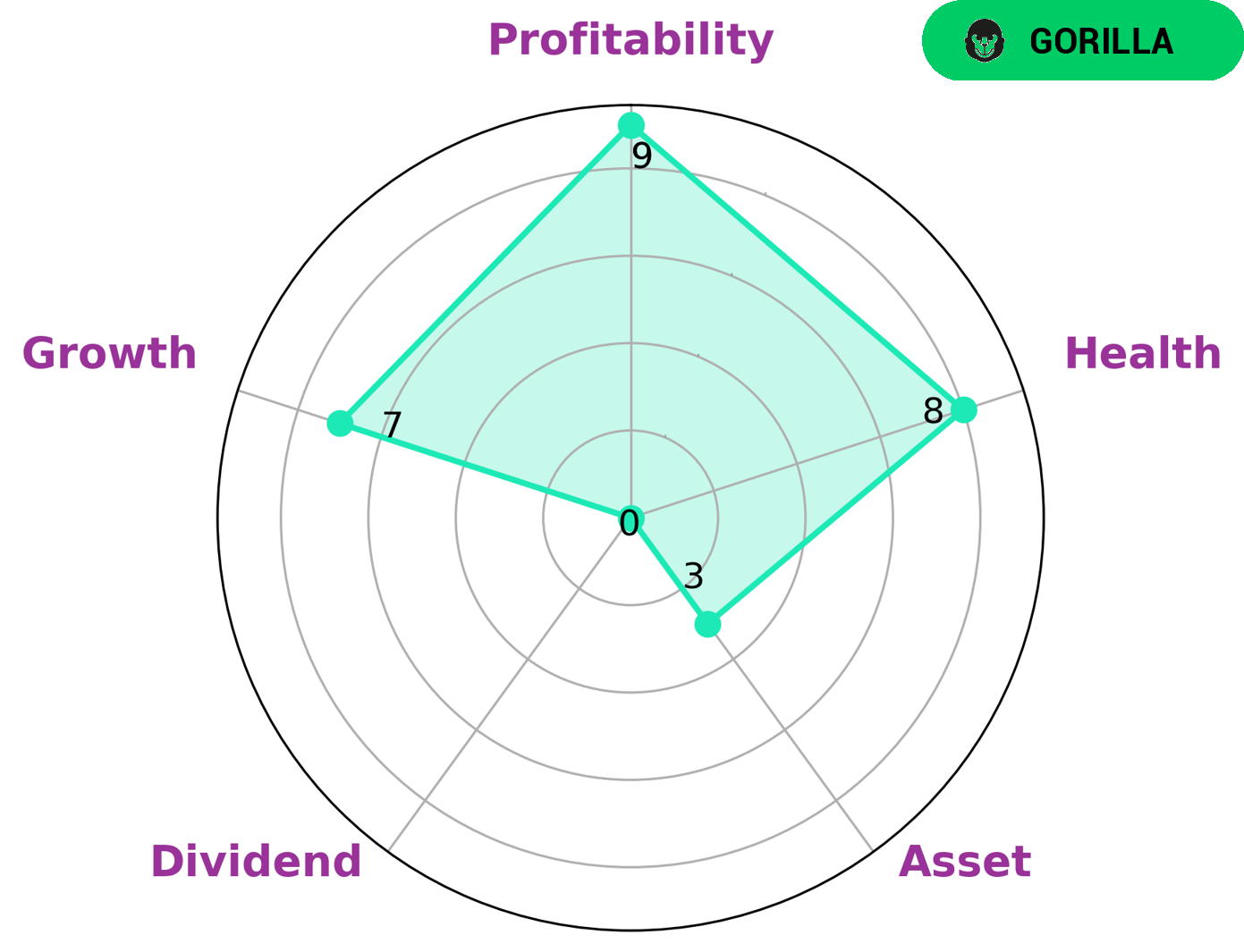

METTLER-TOLEDO INTERNATIONAL has received a high health score of 8/10 from GoodWhale’s Star Chart due to its strong cashflow and debt capabilities. This indicates that the company is able to sustain itself in times of crisis, making it attractive to investors. Such investors may include those who are looking for companies that have achieved stable and high revenue or earnings growth due to their competitive advantage. METTLER-TOLEDO INTERNATIONAL is considered a ‘gorilla’ company, standing out in terms of growth and profitability. Although the company has a strong competitive advantage, its asset and dividend are comparatively weaker points. Despite this, the solid cashflow and debt capabilities make METTLER-TOLEDO INTERNATIONAL a strong investment choice for investors. In summary, METTLER-TOLEDO INTERNATIONAL is a great choice for investors who are looking for a company that is in a strong financial position, with a competitive advantage that has enabled them to achieve steady and high revenue or earnings growth. More…

Peers

Mettler-Toledo International Inc is a leading manufacturer of weighing instruments for use in laboratory, industrial, and food retailing applications. The company operates in a highly competitive market with various international competitors such as Agilent Technologies Inc, Neogen Corp, and Sonova Holding AG.

– Agilent Technologies Inc ($NYSE:A)

Agilent Technologies Inc is a publicly traded company with a market capitalization of 38.18 billion as of 2022. The company’s return on equity for the same year was 19.27%. Agilent Technologies is a leading global provider of scientific instruments, software, services, and solutions. The company offers a wide range of products and services for the life sciences, diagnostics, and applied chemical markets.

– Neogen Corp ($NASDAQ:NEOG)

Neogen Corporation is a publicly traded company headquartered in Lansing, Michigan that develops, manufactures and markets a variety of products dedicated to food and animal safety. The company’s Food Safety Division offers a range of testing kits and instruments to detect foodborne pathogens, natural toxins, food allergens, genetic modifications, ruminant by-products, and general sanitation concerns. The Animal Safety Division provides animal healthcare products, including diagnostic tests, vaccines, and pharmaceuticals.

– Sonova Holding AG ($OTCPK:SONVY)

Sonova Holding AG is a Swiss manufacturer of hearing aids and cochlear implants. The company has a market capitalization of 14.07 billion as of 2022 and a return on equity of 18.9%. Sonova was founded in 1947 and is headquartered in Stäfa, Switzerland. The company’s products are sold under the Phonak, Unitron, and Widex brands.

Summary

Mettler Toledo International recently reported their financial results for the fourth quarter of 2023, surpassing analyst expectations with Non-GAAP earnings per share of $12.00. Investors may find this performance encouraging, as it suggests the company is on a solid financial footing. Shares of Mettler Toledo International are also trading at its all-time high, indicating strong investor sentiment for the company’s future prospects. Potential investors should take note of Mettler Toledo International’s current financial performance and consider the company’s long-term growth prospects before making an investment decision.

Recent Posts