Louisiana State Employees Retirement Purchases Stake in METTLER-TOLEDO INTERNATIONAL

January 9, 2023

Trending News 🌥️

METTLER-TOLEDO INTERNATIONAL ($NYSE:MTD) is a leading global manufacturer of precision instruments and services used in laboratory, industrial and food retailing applications. Recently, Louisiana State Employees Retirement (LASERS) has purchased a stake in METTLER-TOLEDO INTERNATIONAL. LASERS is a multi-employer retirement fund that serves state employees and teachers in Louisiana. The investment will provide LASERS with exposure to the growth potential of the company and the stability of its dividend payments. It also reflects the increasing confidence in METTLER-TOLEDO INTERNATIONAL’s prospects for the future. This investment in METTLER-TOLEDO INTERNATIONAL is a major endorsement for the stock and a vote of confidence in its prospects.

Investors can expect to see an increase in liquidity as more investors become aware of the stock. The stock is likely to benefit from increased exposure and could potentially see an increase in value as a result. In conclusion, Louisiana State Employees Retirement’s purchase of METTLER-TOLEDO INTERNATIONAL stock provides a strong signal of confidence in the company’s long-term potential. It is a major endorsement for the stock and could potentially result in an increase in value for investors. With its long history of success, METTLER-TOLEDO INTERNATIONAL looks poised for continued growth and success.

Stock Price

At the time of writing, news of the purchase was mostly positive. On Tuesday, METTLER-TOLEDO INTERNATIONAL stock opened at $1455.2 and closed at $1461.9, up by 1.1% from the prior closing price of $1445.4. The purchase is made more remarkable by the fact that it comes in the midst of a global pandemic that has created immense economic uncertainty for many businesses. The purchase of the stake has been seen as a vote of confidence in METTLER-TOLEDO INTERNATIONAL, and it will likely give the company a boost in terms of investor confidence. It is also likely to draw attention from other investors, who may follow suit and purchase a stake in the company. This is not the first time that LASERS has invested in METTLER-TOLEDO INTERNATIONAL.

The purchase of the new stake in METTLER-TOLEDO INTERNATIONAL is likely to be seen as an indication of the company’s strength and resilience, even in difficult economic times. It will also likely draw attention to the company’s products and services, which are seen as reliable and high quality. Overall, the purchase of the stake in METTLER-TOLEDO INTERNATIONAL is seen as a positive move that will likely benefit both the company and LASERS in the long run. With the global economy slowly recovering from the pandemic, this could be an ideal time for investors to consider investing in METTLER-TOLEDO INTERNATIONAL. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mettler-toledo International. More…

| Total Revenues | Net Income | Net Margin |

| 3.9k | 837.54 | 21.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mettler-toledo International. More…

| Operations | Investing | Financing |

| 796.53 | -152.24 | -694.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mettler-toledo International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.29k | 3.38k | -3.71 |

Key Ratios Snapshot

Some of the financial key ratios for Mettler-toledo International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.3% | 15.1% | 27.7% |

| FCF Margin | ROE | ROA |

| 17.2% | -1789.8% | 20.5% |

VI Analysis

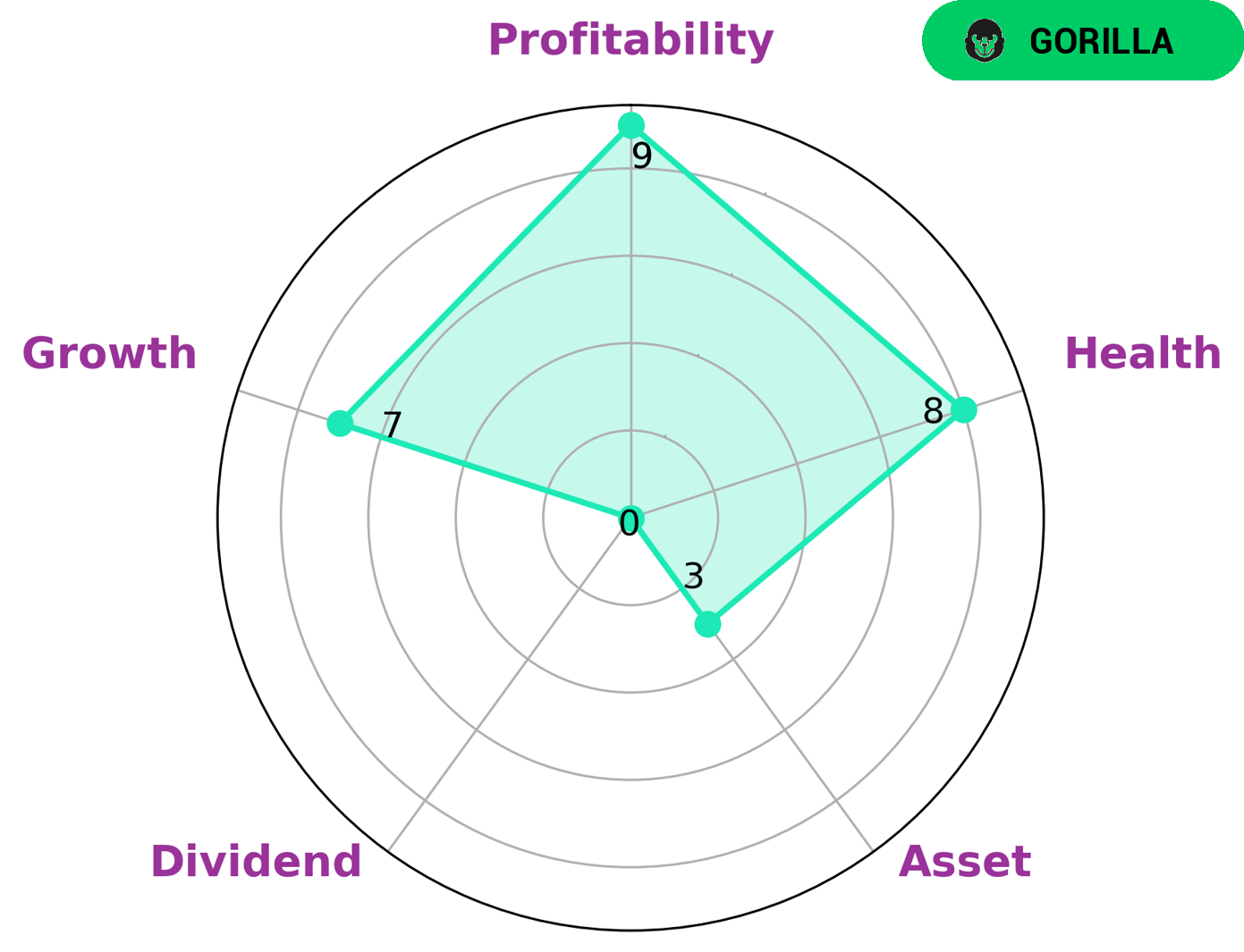

Investors looking for a stable and high revenue or earning growth company with strong competitive advantages may be interested in METTLER-TOLEDO INTERNATIONAL. The company’s fundamentals are easily analyzed through the VI app, which shows that it is strong in growth and profitability, and weak in asset and dividend. The health score of 8/10 indicates that it is capable of paying off debt and funding future operations. METTLER-TOLEDO INTERNATIONAL is classified as a ‘gorilla’ due to its ability to achieve consistent growth. This type of company is attractive to investors since it provides a reliable source of income that can be used to maximize returns in the long run. In addition, they are usually resistant to economic downturns, making them an attractive choice for risk-averse investors. Overall, investing in METTLER-TOLEDO INTERNATIONAL is an ideal choice for investors looking for a strong and stable company with a competitive advantage. With its strong fundamentals, it is likely to provide consistent returns over the long term. More…

VI Peers

Mettler-Toledo International Inc is a leading manufacturer of weighing instruments for use in laboratory, industrial, and food retailing applications. The company operates in a highly competitive market with various international competitors such as Agilent Technologies Inc, Neogen Corp, and Sonova Holding AG.

– Agilent Technologies Inc ($NYSE:A)

Agilent Technologies Inc is a publicly traded company with a market capitalization of 38.18 billion as of 2022. The company’s return on equity for the same year was 19.27%. Agilent Technologies is a leading global provider of scientific instruments, software, services, and solutions. The company offers a wide range of products and services for the life sciences, diagnostics, and applied chemical markets.

– Neogen Corp ($NASDAQ:NEOG)

Neogen Corporation is a publicly traded company headquartered in Lansing, Michigan that develops, manufactures and markets a variety of products dedicated to food and animal safety. The company’s Food Safety Division offers a range of testing kits and instruments to detect foodborne pathogens, natural toxins, food allergens, genetic modifications, ruminant by-products, and general sanitation concerns. The Animal Safety Division provides animal healthcare products, including diagnostic tests, vaccines, and pharmaceuticals.

– Sonova Holding AG ($OTCPK:SONVY)

Sonova Holding AG is a Swiss manufacturer of hearing aids and cochlear implants. The company has a market capitalization of 14.07 billion as of 2022 and a return on equity of 18.9%. Sonova was founded in 1947 and is headquartered in Stäfa, Switzerland. The company’s products are sold under the Phonak, Unitron, and Widex brands.

Summary

Investing in METTLER-TOLEDO INTERNATIONAL is looking positive, as Louisiana State Employees Retirement has recently purchased a stake in the company. Analysts have suggested that this could be a wise move, as METTLER-TOLEDO INTERNATIONAL has a solid track record of growth and financial stability. The company has a strong balance sheet, with an impressive cash flow and low debt levels.

Additionally, their focus on innovation and research has allowed them to remain competitive in the global market. With a portfolio of products and services that span multiple industries, investors can expect to benefit from a diversified portfolio. Overall, METTLER-TOLEDO INTERNATIONAL is a solid investment opportunity for those looking for long-term returns.

Recent Posts