Iqvia Holdings Intrinsic Stock Value – IQVIA Holdings Could See a Beat and Raise Scenario Ahead

May 24, 2023

Trending News 🌥️

IQVIA ($NYSE:IQV) Holdings, formerly known as Quintiles IMS Holdings Inc., is a global healthcare information and technology company based in Durham, North Carolina. IQVIA Holdings provides data and analytics to life science companies, healthcare providers, payers, government agencies and researchers for a variety of purposes. Through its technology platform, the company helps clients make informed decisions in the areas of pricing, reimbursement, clinical trial management, and research and development. Recently, there has been growing evidence that IQVIA Holdings could be on track to exceed expectations and boost its performance in the coming months. The company has been investing heavily in its product portfolio to bring greater innovation and efficiency to the healthcare industry.

In addition, it has made several strategic acquisitions to expand its reach both domestically and internationally. IQVIA Holdings has also implemented a rigorous cost-cutting strategy, which has enabled it to keep costs down and maximize efficiencies. All of these efforts point to the possibility of a beat and raise scenario for IQVIA Holdings. Investors should take note of these positive developments and keep an eye on IQVIA Holdings in the near future. The company’s strategic investments in technology and cost-saving measures have positioned it to be a leader in the healthcare industry. This could be a great opportunity for investors looking for a long-term play in the healthcare sector.

Price History

On Tuesday, the stock opened at $201.0 and closed at $201.8, indicating that investors are expecting good news from the company’s upcoming earnings reports. Analysts are bullish on IQVIA HOLDINGS‘ future prospects, citing their strong presence in the healthcare analytics market and the potential for further growth going forward. The company’s focus on providing data-driven insights to improve healthcare outcomes and reduce costs is expected to benefit them in the long-run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Iqvia Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 14.49k | 1.05k | 7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Iqvia Holdings. More…

| Operations | Investing | Financing |

| 2.17k | -1.61k | -386 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Iqvia Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 25.74k | 19.81k | 31.98 |

Key Ratios Snapshot

Some of the financial key ratios for Iqvia Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.1% | 29.4% | 12.4% |

| FCF Margin | ROE | ROA |

| 10.4% | 19.2% | 4.4% |

Analysis – Iqvia Holdings Intrinsic Stock Value

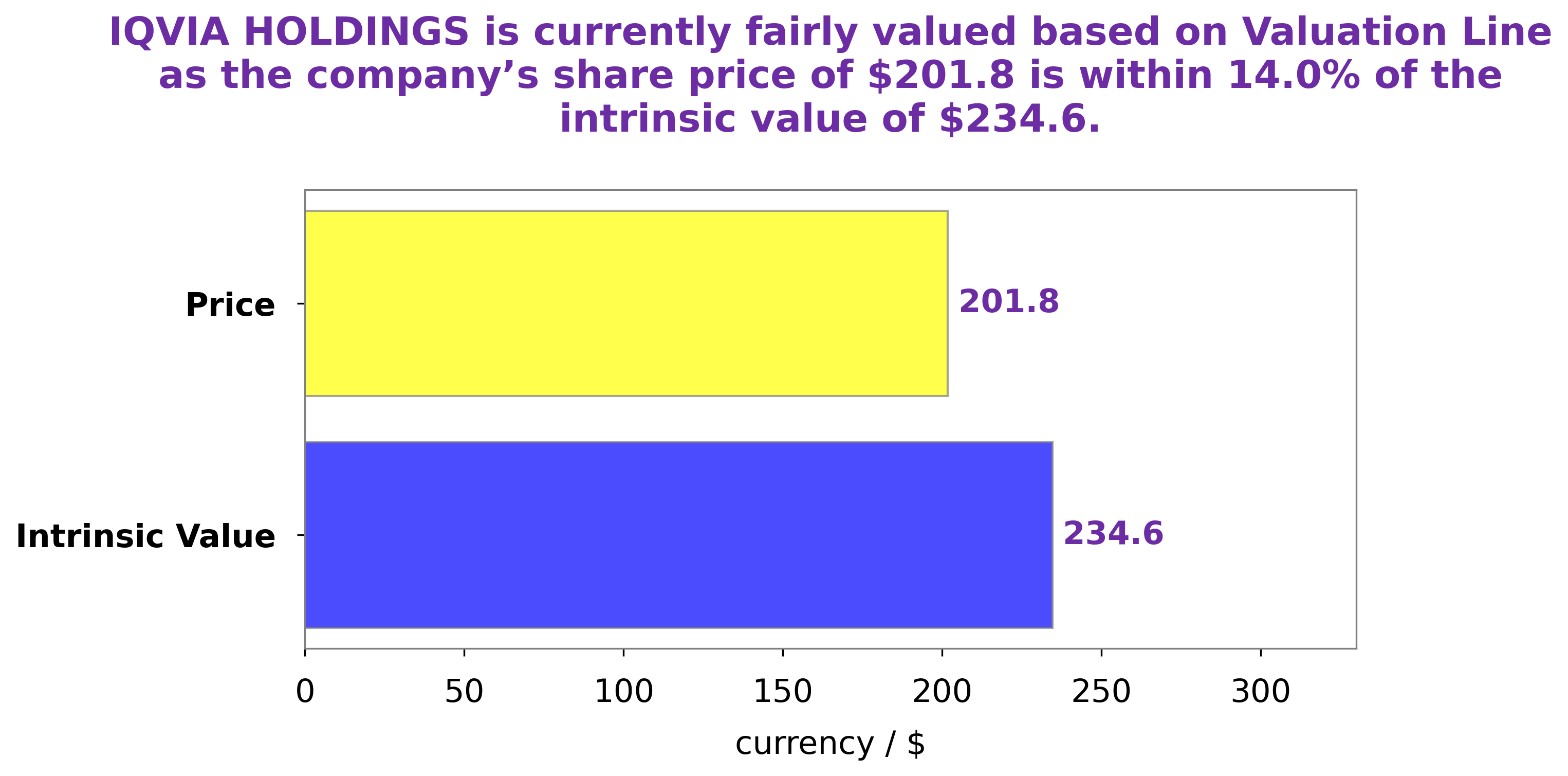

At GoodWhale, we have undertaken an analysis of the fundamentals for IQVIA HOLDINGS. Our proprietary Valuation Line has calculated an intrinsic value of around $234.6 for the IQVIA HOLDINGS share. Meanwhile, the current price of the IQVIA HOLDINGS stock is traded at $201.8. This signifies that the stock is undervalued by 14.0%. Therefore, we believe that it is a good time to invest in IQVIA HOLDINGS for investors looking for long-term gains. More…

Peers

IQVIA Holdings Inc is a provider of data, technology, and analytical solutions to the healthcare industry. The company’s competitors include Diaceutics PLC, Centogene NV, and CMIC HOLDINGS Co Ltd.

– Diaceutics PLC ($LSE:DXRX)

Diaceutics is a diagnostic company that develops and commercializes diagnostic tests for personalized medicine. The company has a market cap of 69.27M as of 2022 and a return on equity of 0.03%. The company’s products are used by pharmaceutical companies to guide the development and use of personalized medicines.

– Centogene NV ($NASDAQ:CNTG)

As of 2022, Centogene NV has a market cap of 28.44M and a return on equity of -141.43%. The company is a genetic testing and precision medicine company that uses its proprietary technology platform to provide insights into the cause and progression of rare and complex diseases. The company’s products and services are used by pharmaceutical and biotech companies, academic research institutes, and patients and their families to improve the understanding of disease and enable the development of personalized treatments.

– CMIC HOLDINGS Co Ltd ($TSE:2309)

CMIC Holdings Co Ltd is a Japanese conglomerate with a market capitalization of 29.85 billion as of 2022. The company has a return on equity of 22.28%. CMIC Holdings Co Ltd is involved in a wide range of businesses, including chemicals, pharmaceuticals, food, and beverages.

Summary

IQVIA Holdings is an analytics and technology firm that provides data, insights and solutions for the healthcare industry. Recent analysis on the company suggests that it could potentially deliver a beat and raise quarterly report, driven by an increase in sales of its core products. This includes strong growth in its healthcare consulting and technology offerings, as well as pharmaceutical services and clinical research services.

Investors should pay attention to IQVIA’s performance in the coming quarters as the company has already delivered steady growth despite current market conditions. Furthermore, due to its impressive scale and a recently announced acquisition strategy, it is likely that IQVIA will be able to continue its strong performance in the future.

Recent Posts