Investors in Charles River Laboratories International, Urged to Investigate Potential Violations.

March 5, 2023

Trending News 🌧️

Investors of Charles River Laboratories ($NYSE:CRL) International, Inc. are being urged to investigate possible violations of federal securities laws. It has been revealed that the company is being subjected to an inquiry due to claims that it may have violated certain regulations. The inquiry, launched by a group of prominent lawyers and investors, brings to light a possible misappropriation of funds or false representation of company information. This inquiry is a cause for concern among those invested in Charles River Laboratories, as the alleged violations may have had a significant impact on the company’s past performance. If true, the accusations could lead to a loss of shareholder value and other consequences.

The results of the inquiry are yet to be revealed and as such, investors need to remain vigilant to potential risks arising from these claims. The investigation is ongoing and the ultimate result remains uncertain. Those considering investing in the company may want to take extra precautions and conduct further research into the company’s financials and other information before making any decisions.

Share Price

The uptrend is likely due to news of potential violations of the company’s ethical rules. Allegations have been made that the company may have been involved in unethical behavior, including improper financial reporting and other issues. Investors should be aware of potential risks associated with CRL’s stock.

As investors consider the company’s performance, they should take any potential violations seriously and investigate to determine if the allegations are true. If the violations are found to be substantiated, investors should reassess their position in CRL with caution. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CRL. More…

| Total Revenues | Net Income | Net Margin |

| 3.98k | 486.23 | 12.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CRL. More…

| Operations | Investing | Financing |

| 619.64 | -607.92 | -42.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CRL. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.6k | 4.58k | 58.38 |

Key Ratios Snapshot

Some of the financial key ratios for CRL are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.9% | 22.8% | 17.2% |

| FCF Margin | ROE | ROA |

| 7.4% | 15.2% | 5.6% |

Analysis

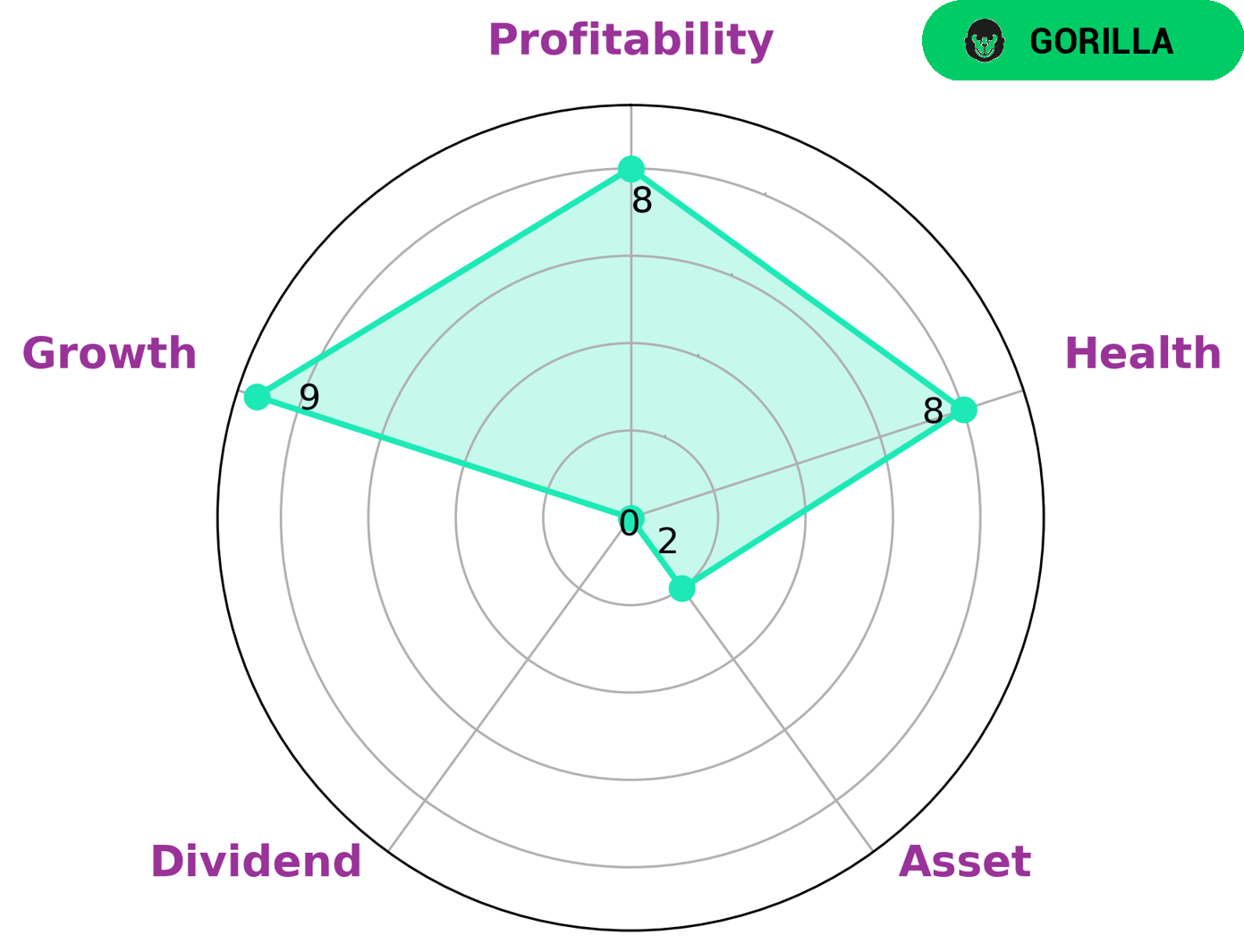

At GoodWhale, we conducted an analysis of CHARLES RIVER LABORATORIES INTERNATIONAL’s wellbeing. Our Star Chart revealed that the company has a high health score of 8/10 with regard to its cashflows and debt, indicating it is able to sustain future operations in times of crisis. When assessing other factors, it is clear that CHARLES RIVER LABORATORIES INTERNATIONAL is strong in growth and profitability, but weaker in asset and dividend. In terms of its competitiveness, CHARLES RIVER LABORATORIES INTERNATIONAL was classified as a ‘gorilla’, achieving stable and high revenue or earnings growth due to its strong competitive advantage. Given the strength of the company in terms of cashflow, coupled with its profitability and growth potential, we anticipate that value investors may be interested in such a company. On the other hand, those looking for capital gains may be more inclined to invest in CHARLES RIVER LABORATORIES INTERNATIONAL due to its stability and competitive edge. More…

Peers

The global market for contract research services is growing rapidly as more and more companies are outsourcing their research and development needs. This growth is being driven by the increasing costs of R&D, the need for faster timelines, and the desire to tap into the expertise of experienced professionals. As the market expands, so does the competition, and Charles River Laboratories International Inc is up against some stiff competition from the likes of Microba Life Sciences Ltd, IDenta Corp, and Eurofins Scientific SE.

– Microba Life Sciences Ltd ($ASX:MAP)

Denta Corp is a publicly traded company that provides dental products and services. The company has a market capitalization of 1.5 million as of 2022 and a return on equity of -10.42%. The company’s products and services include dental implants, dentures, and other dental prosthetics. Denta Corp also provides dental education and training services. The company was founded in 2006 and is headquartered in New York, New York.

– IDenta Corp ($OTCPK:IDTA)

Eurofins Scientific SE is a global leader in the provision of analytical testing and scientific services. The company has a market capitalization of 13.54 billion as of 2022 and a return on equity of 12.32%. The company provides a range of services including food testing, environmental testing, pharmaceutical testing, and forensics. Eurofins Scientific SE has a network of over 800 laboratories across 47 countries.

Summary

Investors in Charles River Laboratories International, Inc. are advised to investigate possible violations that have taken place. While no specific evidence has been presented, the company has been accused of operating and delivering goods and services to the government despite existing sanctions. It is important for potential investors to thoroughly review all data and facts before investing in Charles River Laboratories International, Inc. to ensure that they understand the risks associated with investing in the company. Furthermore, it is recommended that investors consult with an experienced financial professional before making any decisions regarding their investments in Charles River Laboratories International, Inc.

Recent Posts