Huntington National Bank Reduces Stake in Danaher Corporation

November 25, 2023

🌥️Trending News

Huntington National Bank has recently announced a reduction in their stock holdings in Danaher Corporation ($NYSE:DHR). Danaher Corporation is a multinational conglomerate headquartered in the Washington, D.C. area. It manufactures and sells products across a wide array of industries, including life sciences, diagnostics, dental, environmental and industrial technologies. Furthermore, the company has reported consistent growth for its quarterly earnings over the past several years.

Despite Huntington National Bank’s reduction of its stake in Danaher Corporation, the company remains one of the most attractive investments in the market. Its diverse portfolio of businesses provides investors with stability in a volatile market, and its solid financial performance makes it a reliable choice for investors. As such, Danaher Corporation is likely to remain an attractive option for many investors going forward.

Stock Price

The stock opened at $221.0 and closed at $221.4. This slight increase indicates that investors are optimistic about Danaher Corporation‘s future prospects despite the reduction in stake by Huntington National Bank. Investors are paying close attention to the company’s strategy in the current market and the impact of their decisions on the stock price. As news of this stake reduction spreads, investors will continue to monitor Danaher Corporation’s stock and decide whether or not to continue investing in this company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Danaher Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 29.57k | 5.87k | 20.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Danaher Corporation. More…

| Operations | Investing | Financing |

| 8.09k | -1.88k | 1.07k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Danaher Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 87.73k | 35.32k | 70.93 |

Key Ratios Snapshot

Some of the financial key ratios for Danaher Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.2% | 24.7% | 23.9% |

| FCF Margin | ROE | ROA |

| 22.9% | 8.5% | 5.0% |

Analysis

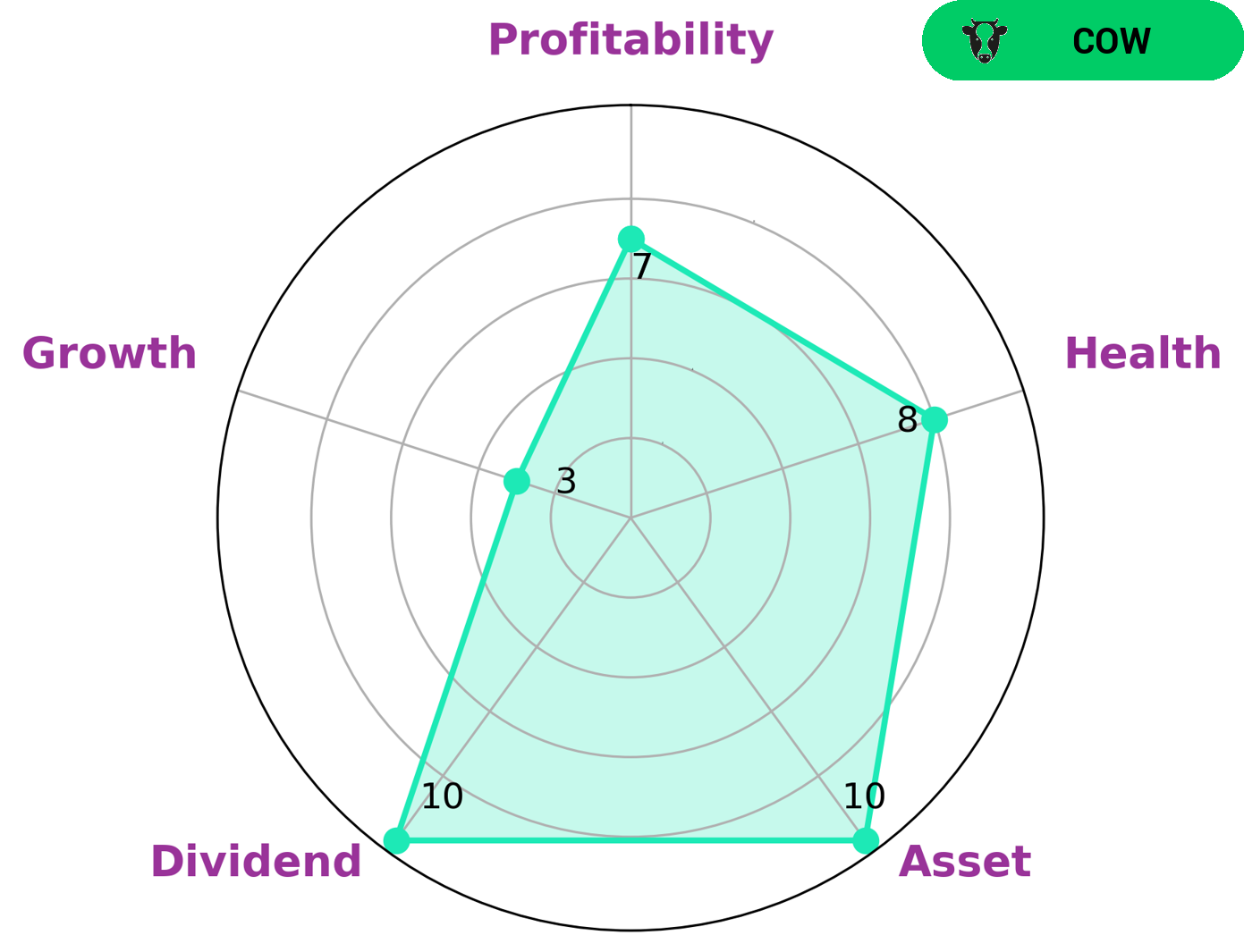

At GoodWhale, we have analyzed the financials of DANAHER CORPORATION and found that it is strong in asset, dividend, and profitability. Our Star Chart also shows that the company has medium growth. We rate DANAHER CORPORATION an 8 out of 10 in terms of health score, which is a sign that it is capable to safely ride out any crisis without the risk of bankruptcy. We classify DANAHER CORPORATION as “rhino” type of company, suggesting it has achieved moderate revenue or earnings growth. For investors interested in such a company, DANAHER CORPORATION is a safe bet. It offers the stability of high profits and dividends, combined with more moderate growth prospects. It also has a high health score, meaning it can stay afloat in any economic downturn. If you are an investor looking for stability and moderate growth, then DANAHER CORPORATION might be the right choice for you. More…

Peers

Danaher Corp is a large company that operates in many different industries. Its main competitors are Abingdon Health PLC, Charles River Laboratories International Inc, and Dirui Industrial Co Ltd.

– Abingdon Health PLC ($LSE:ABDX)

Abingdon Health is a medical technology company that develops, manufactures, and markets diagnostic products and services for the early detection and monitoring of disease. The company has a market capitalization of 8.22 million as of 2022 and a return on equity of -39.58%. Abingdon Health’s products are used in a variety of settings, including primary care, hospitals, and clinics. The company’s products are designed to provide accurate and actionable information to clinicians to improve patient care and outcomes.

– Charles River Laboratories International Inc ($NYSE:CRL)

River Laboratories is a global provider of drug discovery, development and manufacturing services. The company has a market cap of $10.15 billion and a return on equity of 13.86%. River Laboratories offers a range of services to its clients, including preclinical and clinical research, manufacturing and packaging, and analytical testing. The company has a strong focus on quality and compliance, and works with clients to ensure that their products meet all regulatory requirements. River Laboratories is headquartered in Wilmington, Massachusetts.

– Dirui Industrial Co Ltd ($SZSE:300396)

Drui Industrial Co Ltd is a company that manufactures and sells medical devices. The company has a market cap of 6.61B as of 2022 and a ROE of 8.7%. The company’s products include medical equipment, such as X-ray machines, ultrasound machines, and CT scanners. The company also manufactures and sells medical supplies, such as gloves, gowns, and masks.

Summary

Danaher Corporation is a leading manufacturer of medical, industrial and consumer products. Recently, Huntington National Bank has reduced its stock position in the company. This could indicate that Huntington National Bank is no longer bullish on the prospects of Danaher Corporation. Investors should evaluate the company’s current financial health and outlook before making any investment decisions. Profitability, cash flow, and debt-to-equity ratios are key metrics to consider when investing in Danaher Corporation.

Additionally, investors should consider the company’s competitive position within its industry, including market share, product offerings, and pricing strategy. Overall, investors should use due diligence and research before investing in Danaher Corporation in order to make the best decision for their own financial goals.

Recent Posts