23andme Holding Intrinsic Value Calculation – 23ANDME HOLDING Reports Q4 Earnings Results for FY2023 on May 25th

June 1, 2023

🌥️Earnings Overview

On May 25, 2023, 23ANDME HOLDING ($NASDAQ:ME) reported its financial results for Q4 of the fiscal year 2023, which ended on March 31, 2023. Total revenue for the quarter amounted to USD 92.4 million, representing an 8.1% decrease compared to the same period the prior year. Net income for Q4 was USD -64.1 million, a positive change from the deficit of -69.5 million reported in Q4 of FY2022.

Market Price

Stock opened at $2.1 and closed down at $2.0, a 2.4% decrease from the previous closing price of $2.1. During the quarter, 23ANDME HOLDING saw total revenue increase by 8%, with the majority of their revenue coming from Genetic Testing Service, a subscription package with a variety of services.

Additionally, the company saw an increase in sales of their pathology services and research services. This is largely attributed to their increased revenue as well as their successful cost-cutting measures throughout the year. Furthermore, 23ANDME HOLDING had strong cash flow and healthy balance sheet, allowing them to further invest in research and development and other growth opportunities. Overall, 23ANDME HOLDING had a successful quarter and their strong earnings results indicate that the company is on track to continue their positive momentum into the upcoming quarters. Investors should keep an eye on 23ANDME HOLDING as they continue to expand their services and report more positive earnings results in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 23andme Holding. More…

| Total Revenues | Net Income | Net Margin |

| 299.49 | -311.66 | -104.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 23andme Holding. More…

| Operations | Investing | Financing |

| -165.39 | -11.3 | 9.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 23andme Holding. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 942.6 | 228.66 | 1.55 |

Key Ratios Snapshot

Some of the financial key ratios for 23andme Holding are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.7% | – | -108.2% |

| FCF Margin | ROE | ROA |

| -59.0% | -27.6% | -21.5% |

Analysis – 23andme Holding Intrinsic Value Calculation

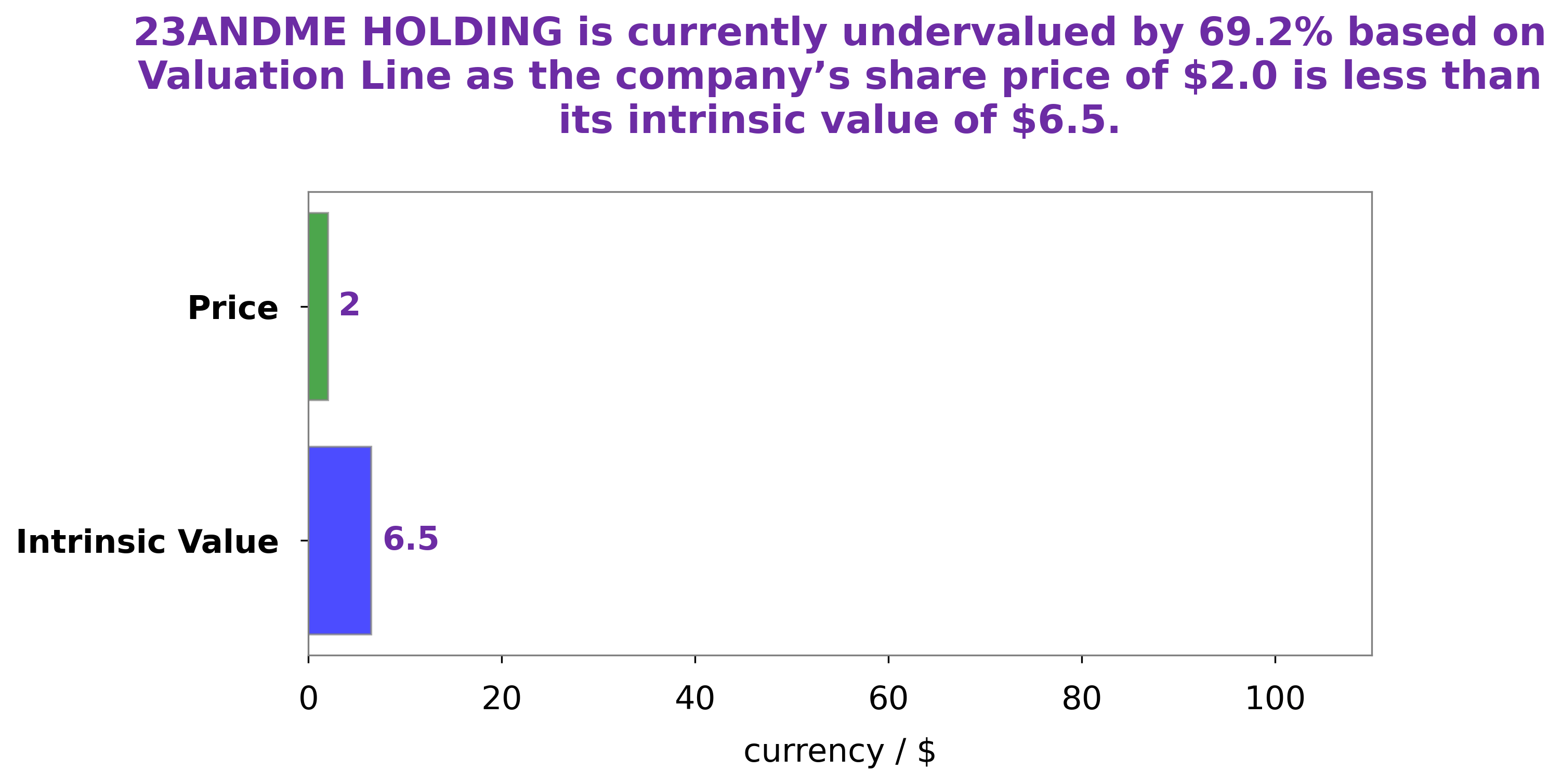

At GoodWhale, we have conducted an analysis of 23ANDME HOLDING‘s wellbeing. After careful consideration of the company’s financials, our proprietary Valuation Line has estimated the intrinsic value of a 23ANDME HOLDING share at around $6.5. At the time of writing, the stock is trading at just $2.0; this represents a discount of 69.0%, meaning the stock is currently undervalued. This represents a great opportunity for investors who are looking to capitalize on a potentially underestimated asset. More…

Peers

The company offers a range of tests, including those for ancestry, health, and wellness. Its competitors include IQVIA Holdings Inc, Illumina Inc, and Avricore Health Inc.

– IQVIA Holdings Inc ($NYSE:IQV)

In 2022, IQVIA Holdings Inc had a market capitalization of $40.44 billion and a return on equity of 21.52%. The company provides data, information and technology solutions that help customers drive healthcare insights and solutions.

– Illumina Inc ($NASDAQ:ILMN)

Illumina Inc has a market cap of 34.93B as of 2022, a Return on Equity of -29.49%. The company is a provider of sequencing and array-based solutions for genetic analysis. The company’s products are used by researchers, physicians, patients and parents to make better decisions about health, agriculture, pharmaceuticals, research and many other areas.

– Avricore Health Inc ($TSXV:AVCR)

Avricore Health Inc is a Canadian biotechnology company that develops and commercializes products for the early detection and prevention of chronic disease. The company has a market cap of 25.4 million as of 2022 and a return on equity of -46.21%. Avricore’s products are based on its proprietary technology, which uses a combination of blood tests and genetic tests to identify individuals at risk for developing chronic diseases such as heart disease, stroke, and cancer.

Summary

23ANDME HOLDING reported total revenues of USD 92.4 million for FY2023 Q4, a 8.1% decrease year-over-year. Net income for the quarter was USD -64.1 million, an improvement from the previous year’s deficit of -69.5 million. Investing analysis indicates that 23ANDME HOLDING is still in a period of financial hardship, as indicated by the decrease in revenues despite an improved net income.

Investors may be cautious as the company continues to face potential losses in the future. It will be important for the company to increase its revenues and to develop strategies to offset any potential losses.

Recent Posts