Ryohin Keikaku Stock Fair Value Calculator – RYOHIN KEIKAKU Reports Q2 Earnings Results for FY2023, as of February 28 2023.

April 20, 2023

Earnings Overview

On April 14 2023, RYOHIN KEIKAKU ($TSE:7453) reported its earnings results for the second quarter of the fiscal year 2023, which ended on February 28 2023. Total revenue for the quarter was JPY 3.5 billion, a decrease of 50.1% from the same period in the prior year. However, net income increased 20.4%, to JPY 146.4 billion.

Market Price

The stock opened at JP¥1470.0, at the start of the day and closed at JP¥1484.0, a slight increase of 0.1% from its prior closing price of 1483.0. The company’s strong balance sheet and increased cash flow is expected to be a major driver for future growth. Overall, investors seemed pleased with RYOHIN KEIKAKU‘s financial performance in the second quarter of FY2023 and the stock ended the day in positive territory. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ryohin Keikaku. More…

| Total Revenues | Net Income | Net Margin |

| 535k | 17.14k | 3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ryohin Keikaku. More…

| Operations | Investing | Financing |

| 19.21k | -20.07k | -50.6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ryohin Keikaku. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 396.76k | 155.1k | 905.39 |

Key Ratios Snapshot

Some of the financial key ratios for Ryohin Keikaku are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.1% | -16.8% | 5.0% |

| FCF Margin | ROE | ROA |

| -0.4% | 7.0% | 4.2% |

Analysis – Ryohin Keikaku Stock Fair Value Calculator

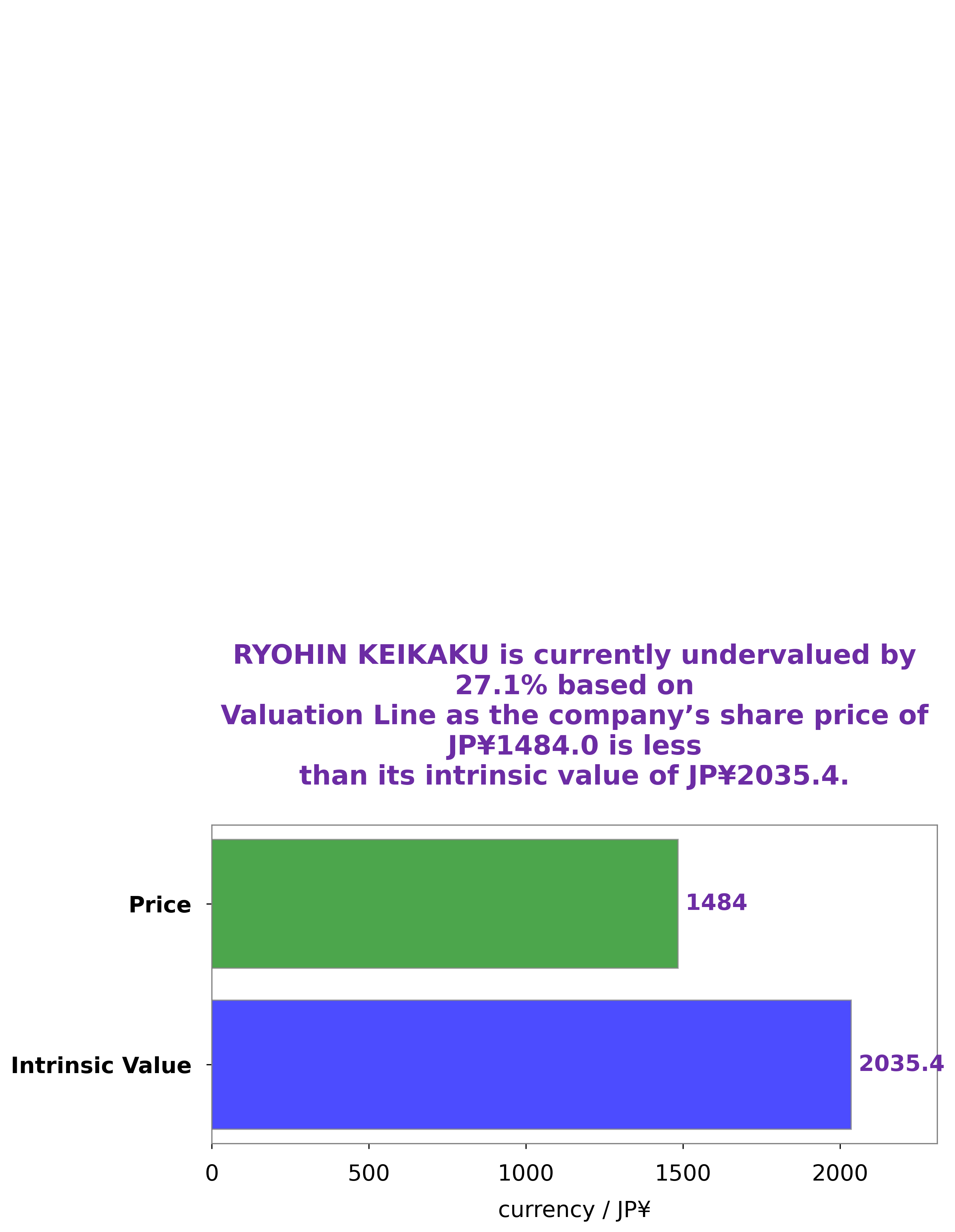

At GoodWhale, we conducted an analysis of RYOHIN KEIKAKU‘s fundamentals. We determined that the intrinsic value of their shares is around JP¥2035.4, which we calculated using our proprietary Valuation Line. Currently, the RYOHIN KEIKAKU stock is trading at JP¥1484.0, meaning it is undervalued by 27.1%. Our analysis suggests there is potential opportunity for investors to benefit from this discrepancy. More…

Peers

It faces competition from a variety of companies around the world, such as V-Mart Retail Ltd, Marks & Spencer Group PLC, and Shoppers Stop Ltd. Despite the competition, Ryohin Keikaku Co Ltd is committed to providing an exceptional experience for its customers, focusing on personal service and unique products.

– V-Mart Retail Ltd ($BSE:534976)

V-Mart Retail Ltd is a leading Indian retail chain of value stores. Founded in 2002, the brand has grown to become one of the most well-known names in Indian retail with over 350 stores today. As of 2023, the company has a market cap of 43.05B, making it one of the most valuable companies in the industry. Additionally, V-Mart Retail Ltd has an impressive Return on Equity of 9.96%, which is a testament to its strong fundamentals. The company is well-positioned to continue its growth trajectory in the coming years.

– Marks & Spencer Group PLC ($LSE:MKS)

Marks & Spencer Group PLC is a major British multinational retailer headquartered in London. It was founded in 1884 and is one of the UK’s leading retailers, providing customers with clothing, home products, and food. With a market cap of 3.24B and a Return on Equity (ROE) of 12.98%, Marks & Spencer Group PLC is a formidable presence in the retail market. The company has seen steady growth in recent years and its performance metrics suggest its continued success. Its high ROE shows that it is adept at generating profits from its investments and is also a sign of financial stability. Marks & Spencer Group PLC is well positioned to take advantage of the growing trend of online shopping within the sector and its diverse product range gives it an edge over many competitors.

– Shoppers Stop Ltd ($BSE:532638)

Shoppers Stop Ltd is a leading retail chain in India. Founded in 1991, the company has more than 80 stores across the country and has established itself as one of the premier shopping destinations in the country. As of 2023, Shoppers Stop Ltd has a market cap of 64.99B, making it one of the largest companies in the Indian retail sector. Additionally, Shoppers Stop Ltd boasts an impressive Return on Equity (ROE) of 155.38%. This figure indicates that the company is able to generate healthy returns on its investments which is an impressive feat for a retail company. Shoppers Stop Ltd’s high market cap and strong ROE is indicative of thecompany’s strong performance and the trust it has built up with its customers.

Summary

RYOHIN KEIKAKU reported total revenue of JPY 3.5 billion for their second quarter of FY2023, a decrease of 50.1% from the same period the previous year. Net income was reported at JPY 146.4 billion, an increase of 20.4% from the same period the previous year. For investors, the results indicate that despite a decrease in total revenue, the company has managed to grow its earnings significantly.

This could be attributed to cost-cutting efforts, efficient management practices and a focus on profitability. Investors should continue to monitor RYOHIN KEIKAKU’s performance to determine whether their strategies will continue to deliver increases in earnings in the future.

Recent Posts