Macy’s Ready to Outperform Rivals with Solid Margin of Safety

May 19, 2023

Trending News ☀️

Macy’s ($NYSE:M), one of America’s leading retailers, is set to outperform its rivals with a strong margin of safety. With a sound financial position and strong liquidity, Macy’s has the ability to capitalize on opportunities faster than its competitors. The company’s margin of safety gives it the capacity to absorb market volatility or declining sales without being overly impacted.

In addition, Macy’s has a very strong balance sheet with significant cash reserves that can be used to make strategic investments and weather economic downturns. Over the years, the company has become a leading retailer of clothing, accessories, home furnishings, and much more.

Additionally, it operates an expansive network of stores across the US, Canada, Puerto Rico, and Guam. Its stores offer a vast selection of merchandise at competitive prices, making it attractive to customers looking for value. Furthermore, Macy’s also offers e-commerce platforms and mobile apps that help customers easily shop online. Its extensive experience and expertise in the retail industry are sure to give it an edge over its rivals. As such, investors should take note of the potential upside for Macy’s stock and should consider adding it to their portfolio.

Share Price

On Thursday, MACY’S stock opened at $15.7 and closed at $15.9, up by 1.7% from its prior closing price of 15.6. The surge in prices reflects the investors’ confidence in MACY’S ability to deliver consistent returns and remain competitive in the current economic environment. Furthermore, the company’s strong financials and cost-saving initiatives are expected to provide further support to its stock performance in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Macy’s. More…

| Total Revenues | Net Income | Net Margin |

| 25.3k | 1.18k | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Macy’s. More…

| Operations | Investing | Financing |

| 1.61k | -1.17k | -1.3k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Macy’s. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.87k | 12.78k | 12.81 |

Key Ratios Snapshot

Some of the financial key ratios for Macy’s are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.0% | 13.1% | 6.6% |

| FCF Margin | ROE | ROA |

| 1.3% | 30.2% | 6.2% |

Analysis

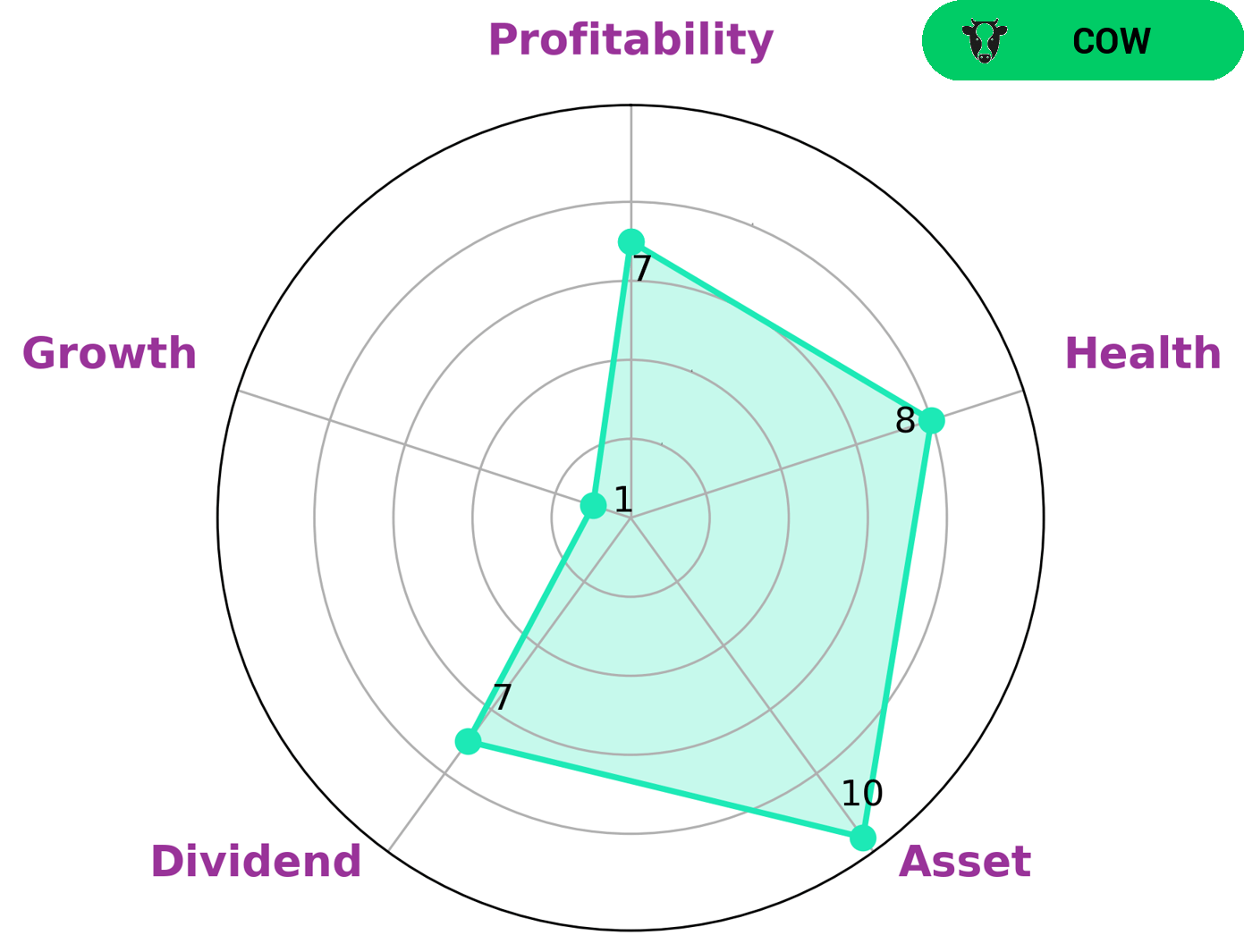

Analyzing Macy’s financials with GoodWhale, we can see that according to the Star Chart, Macy’s is strong in asset management, dividend yield, and profitability, but weak in growth. The company has a high health score of 8/10, which indicates that it is capable of safely riding out any crisis without the risk of bankruptcy. From our analysis, Macy’s is classified as a ‘cow’, a company with a track record of paying out consistent and sustainable dividends. This makes Macy’s an attractive option for income-seeking investors who are looking for a steady and reliable source of income. More…

Peers

Macy’s Inc, World Co Ltd, Kohl’s Corp, and PT Ramayana Lestari Sentosa Tbk are all retail companies.

– World Co Ltd ($TSE:3612)

As of 2022, World Co Ltd has a market cap of 46.04B and a Return on Equity of 4.14%. The company is engaged in the business of providing online services. It offers a range of services, including online search, advertising, maps, software applications, and cloud computing.

– Kohl’s Corp ($NYSE:KSS)

Kohl’s Corp is an American department store retail chain. The company has a market capitalization of $3.56 billion as of 2022 and a return on equity of 16.46%. Kohl’s operates 1,158 stores in 49 states. The company offers a wide variety of merchandise, including apparel, shoes, cosmetics, and home goods. Kohl’s is known for its discount pricing and extensive promotions.

– PT Ramayana Lestari Sentosa Tbk ($IDX:RALS)

Ramayana Lestari Sentosa Tbk is an Indonesian conglomerate with interests in retail, malls, and real estate. The company has a market cap of 3.67 trillion as of 2022 and a return on equity of 6.89%. The company was founded in 1973 and is headquartered in Jakarta, Indonesia.

Summary

Macy’s is an American department store chain that has grown significantly in recent years. Investing analysis suggest that Macy’s is well-positioned to outperform its peers with a compelling margin of safety. Financial metrics demonstrate that Macy’s is a financially healthy company, with high liquidity, strong cash flow and a strong balance sheet. Analysts also point to Macy’s successful cost cutting initiatives and its ability to successfully leverage digital technology to drive customer engagement and sales growth.

Recent Posts