Semtech Corporation Leveraging Debt to Reach New Heights

July 13, 2023

🌧️Trending News

Semtech Corporation ($NASDAQ:SMTC) is a leading supplier of analog and mixed-signal semiconductor products. The company’s products are used in a wide range of applications and industries, including automotive, communications, computing, consumer, industrial, medical, and mobile. By leveraging debt to reach new heights, Semtech Corporation has become one of the most successful companies in the semiconductor industry. Through these strategic measures, Semtech is able to finance its operations and pursue organic and inorganic growth opportunities to further strengthen its position in the semiconductor industry.

Stock Price

On Wednesday, the company’s stock opened at $27.8 and closed at $27.9, a 2.2% increase from the previous closing price of $27.3. This is a sign of the company’s financial success and commitment to using debt strategically to reach new heights. The surge in stock price gives investors confidence in Semtech Corporation’s ability to continue to successfully use leverage to propel the company into the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Semtech Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 790.92 | -6.08 | -1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Semtech Corporation. More…

| Operations | Investing | Financing |

| -13.33 | -1.25k | 1.15k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Semtech Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.5k | 1.77k | 11.46 |

Key Ratios Snapshot

Some of the financial key ratios for Semtech Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.0% | -34.5% | 4.4% |

| FCF Margin | ROE | ROA |

| -6.0% | 2.9% | 0.9% |

Analysis

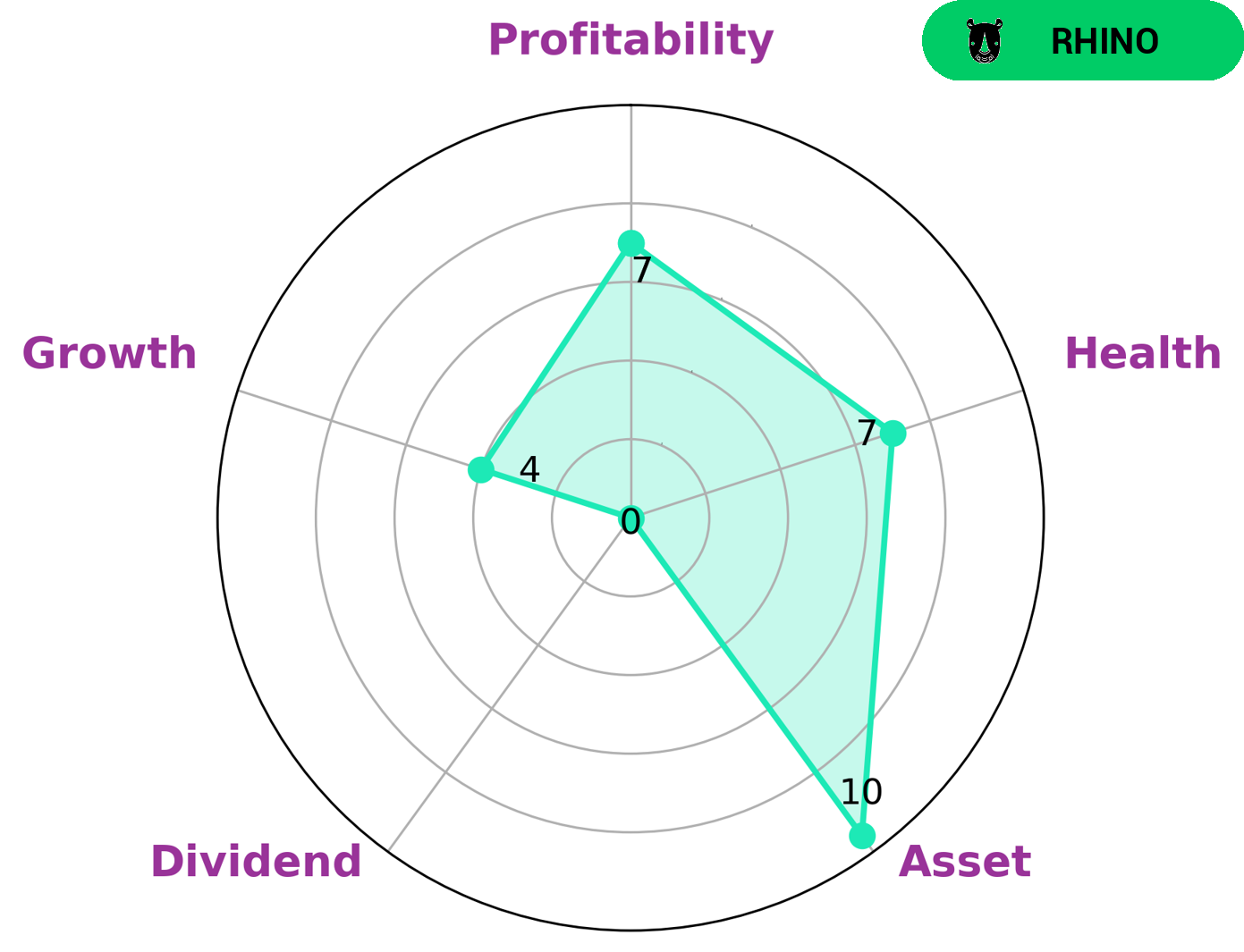

At GoodWhale, we performed an analysis of SEMTECH CORPORATION‘s wellbeing. Our Star Chart shows that they have a high health score of 8/10, which takes into account both their cashflows and debt. We conclude that SEMTECH CORPORATION is capable of paying off their debt and funding future operations. We also observe that they are strong in asset and profitability, and weak in dividend and growth. Given their performance, we classify them as ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. With their strong health score, SEMTECH CORPORATION could be an interesting investment for those looking for a reliable, low-risk option. They have steady cash flows and low debt, making them a good choice for long-term investors. Additionally, their strength in asset and profitability make them an attractive option for those looking for short-term gains. More…

Peers

Its products are found in a wide range of applications including communications, computing, consumer, industrial, automotive, and Internet of Things. Semtech’s competitors include Diodes Inc, Renesas Electronics Corp, and Vanguard International Semiconductor Corp.

– Diodes Inc ($NASDAQ:DIOD)

Diodes Incorporated is a leading global manufacturer and supplier of high-quality application specific standard products within the broad discrete, logic and analog semiconductor markets. Diodes serves the consumer electronics, computing, communications, industrial, automotive and medical market segments.

– Renesas Electronics Corp ($TSE:6723)

Renesas Electronics Corp is a Japanese semiconductor company. As of 2022, its market cap is 2.24T and its ROE is 14.83%. The company produces a wide range of semiconductor products, including microcontrollers, SoCs, and ASSPs. It also offers a variety of services, such as design, development, and manufacturing.

– Vanguard International Semiconductor Corp ($TPEX:5347)

Vanguard International Semiconductor Corp is a Taiwanese company that manufactures and sells semiconductors. It has a market cap of 106.7B as of 2022 and a Return on Equity of 32.12%. The company’s products include DRAMs, SRAMs, flash memory, and CMOS image sensors.

Summary

SEMTECH Corporation is a technology company that designs, manufactures, and markets analog and mixed-signal semiconductor products. Investing in SEMTECH Corporation requires careful analysis of its financials. Investors should consider all of these factors when considering investing in SEMTECH Corporation.

Recent Posts