Materion Corporation Intrinsic Value Calculation – Materion Demonstrates Smart Debt Management Practices.

April 11, 2023

Trending News ☀️

Materion Corporation ($NYSE:MTRN) is an international industrial technology company that manufactures and supplies highly engineered advanced materials and products for a range of industries, including automotive, aerospace, energy, telecommunications and other industries. Recently, they have demonstrated smart debt management practices, which has enabled them to remain successful and well-positioned for growth. It appears that Materion is being judicious with its use of debt. The company has managed its debt levels conservatively so that they remain manageable. This allows them to easily meet their debt service obligations while keeping the balance sheet strong. To further strengthen their liquidity position, the company has taken steps to reduce its capital expenditures and optimize other working capital sources.

Materion has also adopted an active approach to managing its debt. The company regularly reviews its borrowing capacity, cost of borrowing, and debt profile to determine its ability to maximize the benefit from its debt and financing activities. They have also sought to reduce their long-term debt by taking advantage of current market conditions and refinancing at lower interest rates. Overall, Materion’s smart debt management practices have helped them remain financially sound and have enabled them to maintain a healthy cash balance. This provides the company with the flexibility to pursue growth opportunities, invest in their operations, and continue to deliver products and services to their customers.

Price History

Materion Corporation demonstrated smart debt management practices on Monday. The stock opened at $111.0 and closed at $113.0, an increase of 0.4% from the previous closing price of 112.5. This gain was achieved despite the volatility in the stock market due to the coronavirus pandemic. The company’s ability to maintain a steady course and make smart decisions in the face of uncertainty is a testament to its sound management principles.

By managing its debt and investing in long-term strategies, Materion Corporation has shown that it is well-positioned to survive economic downturns and remain profitable in the long run. This shows that the company is in good financial health and is capable of making sound decisions even during challenging times. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Materion Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.76k | 85.99 | 4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Materion Corporation. More…

| Operations | Investing | Financing |

| 115.96 | -79.73 | -35.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Materion Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.69k | 891.99 | 37.35 |

Key Ratios Snapshot

Some of the financial key ratios for Materion Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.0% | 13.3% | 7.1% |

| FCF Margin | ROE | ROA |

| 2.2% | 10.0% | 4.6% |

Analysis – Materion Corporation Intrinsic Value Calculation

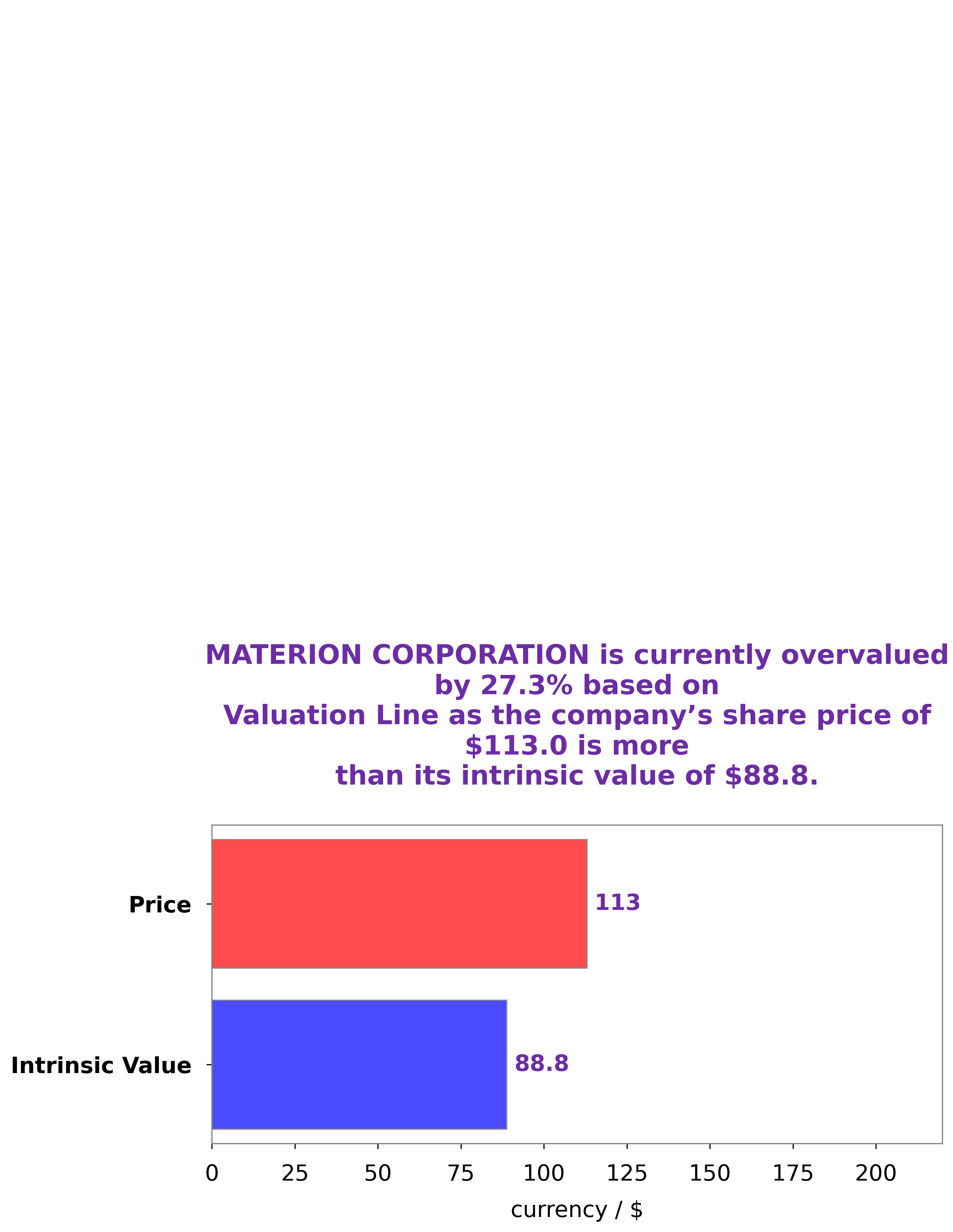

As GoodWhale, we have analyzed MATERION CORPORATION‘s financials. After our thorough review of their books, we have determined that the intrinsic value of MATERION CORPORATION’s share is around $88.8, calculated using our proprietary Valuation Line. Currently, MATERION CORPORATION’s stock is being traded at $113.0. This means the stock is overvalued by 27.2%. More…

Peers

Materion Corp, Advanced Technology & Materials Co Ltd, Toho Titanium Co Ltd, and Anhui Xinke New Materials Co Ltd are all in competition with each other to be the leading supplier of titanium and other materials. All four companies are striving to develop new and innovative ways to produce titanium and other materials faster, cheaper, and with fewer emissions.

– Advanced Technology & Materials Co Ltd ($SZSE:000969)

Advanced Technology & Materials Co Ltd has a market cap of 8.11B as of 2022, a Return on Equity of 4.03%. The company manufactures and sells a variety of products, including electronic components, semiconductors, and optoelectronic devices. It also provides services such as research and development, design, and packaging.

– Toho Titanium Co Ltd ($TSE:5727)

Toho Titanium Co. Ltd. engages in the production and sale of titanium products. It operates through the Titanium and Other Products segments. The Titanium segment offers titanium sponge, titanium ingots, titanium mill products, and titanium products for industrial applications. The Other Products segment includes zircon products, hafnium products, and rare metals. The company was founded by Kichinosuke Taguchi on August 1, 1950 and is headquartered in Tokyo, Japan.

– Anhui Xinke New Materials Co Ltd ($SHSE:600255)

Anhui Xinke New Materials Co., Ltd. is engaged in the research, development, production and sales of rare earth, new inorganic functional materials and new energy products. The Company operates its business through three segments. The Rare Earth and New Inorganic Functional Materials segment is engaged in the research and development, production and sales of rare earth smelting and separation, new inorganic functional materials and new energy products. The Chemical Products Segment is engaged in the research and development, production and sales of chemical products. The Others segment is engaged in the provision of technical services. The Company’s products include rare earth oxides, rare earth metals, rare earth alloys, new inorganic functional materials and new energy products, among others.

Summary

Materion Corporation is a strategic investor, focusing on the long-term growth of its portfolio. The company has a healthy balance sheet, with a low debt-to-equity ratio and an ample amount of liquidity. Materion has a diversified portfolio, investing in a variety of industries and asset classes, including equities, fixed income, real estate, commodities, and currencies. The company also has a strong record of prudent risk management, with a disciplined approach to evaluating and managing risk.

In addition, Materion’s experienced management team has developed a strong knowledge of the markets they invest in, allowing them to make successful investments in the most attractive opportunities. By carefully considering its investment options and maintaining a flexible approach to investing, Materion aims to achieve its long-term financial goals.

Recent Posts