2023: Is Cowell e Holdings’ Debt Levels Too High?

March 30, 2023

Trending News 🌧️

With Cowell ($SEHK:01415) e Holdings’ debt levels rising, investors are asking whether the company is taking on too much debt. While Cowell e Holdings has reported rising profits over the past few years, their debt levels have also grown significantly. This has led some to suggest that the company may be taking on too much debt, which could potentially put its long-term stability at risk. The first part of answering this question is to look at Cowell e Holdings’ current debt levels. This could indicate that the company is taking on too much debt and could be in danger of becoming overleveraged. Another important factor to consider is the company’s ability to service its debt. This suggests that the company is having trouble meeting its debt obligations and may be taking on too much debt. Finally, it’s important to consider Cowell e Holdings’ outlook for 2023 and beyond. The company is projecting a healthy 4% growth in earnings next year, which should help to reduce their debt levels.

However, it’s still unclear whether this will be enough to offset their high levels of debt. Overall, while it’s difficult to definitively say whether or not Cowell e Holdings’ debt levels are too high, it is clear that the company is taking on more debt than the industry average and may be in danger of becoming overleveraged. Investors should watch the company’s performance closely in the coming years to gauge whether their current debt levels are manageable or not.

Stock Price

On Monday, COWELL E stock opened at HK$19.6 and closed at HK$20.0, indicating a 1.9% increase from its previous closing price of 19.6. These figures suggest that investors remain optimistic over the company’s ability to manage its debt load. It is important to note that while Cowell e Holdings’ debt levels remain high, they have been gradually decreasing over the past few years.

Additionally, the company has taken proactive steps to reduce its debt levels through cost cutting measures and by strengthening its cash flow. This suggests that the company is making significant progress towards reducing its overall debt load. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cowell E. More…

| Total Revenues | Net Income | Net Margin |

| 906.21 | 58.69 | 8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cowell E. More…

| Operations | Investing | Financing |

| 167.81 | -79.94 | 139.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cowell E. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 608.21 | 288.24 | 0.37 |

Key Ratios Snapshot

Some of the financial key ratios for Cowell E are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.0% | 80.1% | 7.6% |

| FCF Margin | ROE | ROA |

| 10.7% | 13.8% | 7.1% |

Analysis

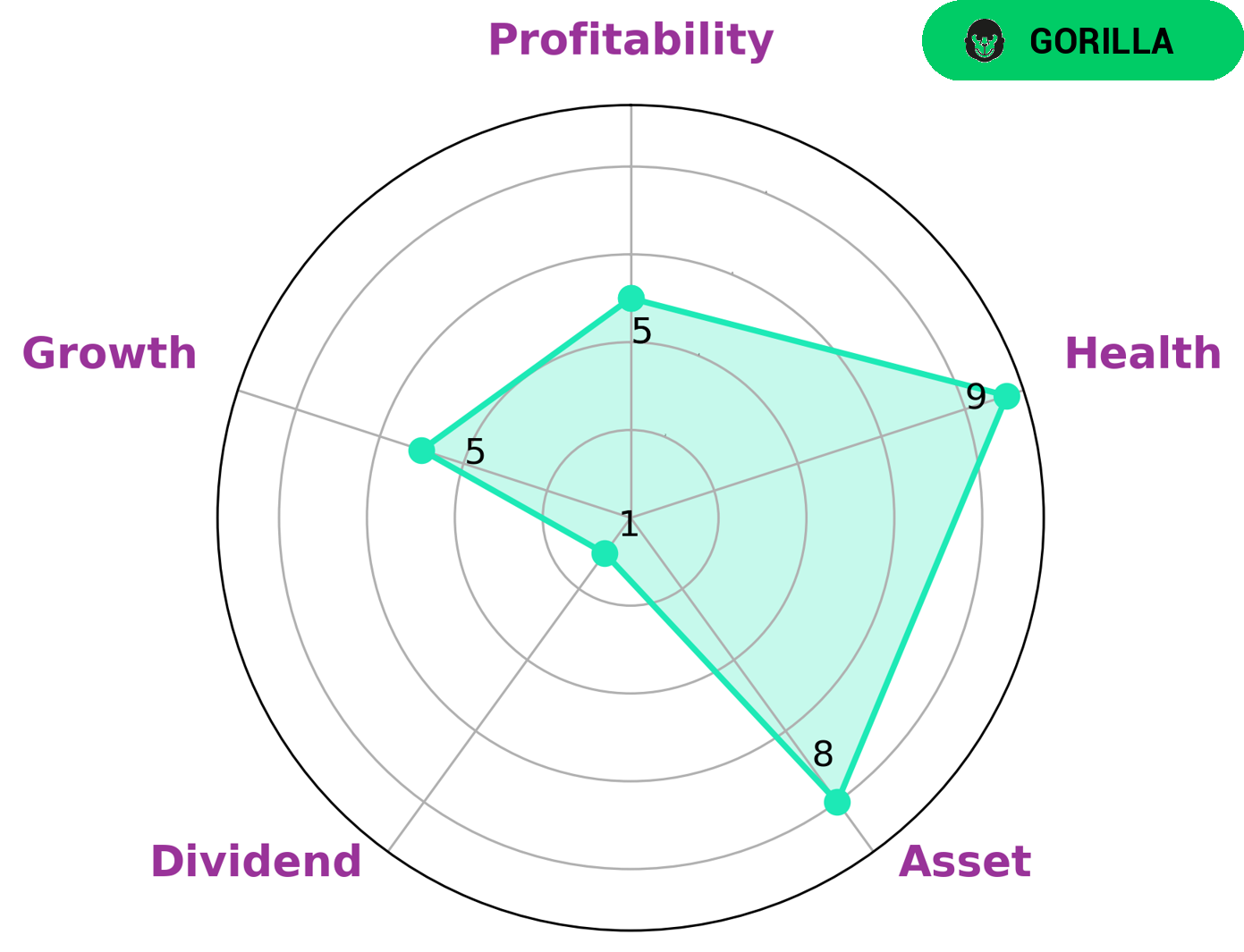

GoodWhale has analyzed COWELL E’s wellbeing and determined that they are a “gorilla” type of company, meaning that they have achieved stable and high revenue or earning growth due to their strong competitive advantage. Investors who are interested in such companies would be looking for a solid return on their investment. COWELL E has a high health score of 9/10, indicating that they are capable of paying off debt and funding future operations. GoodWhale also notes that COWELL E is strong in terms of assets, medium in terms of growth, profitability and weak in dividend. With this information, investors have an idea of where the company stands in terms of its financial health. Investing in COWELL E could be a lucrative endeavor for those who are looking for a long-term return on their investment. More…

Peers

It is a major competitor in the electronics industry, competing against other well-established companies such as Shenzhen Microgate Technology Co Ltd, Wieson Technologies Co Ltd, and Mildex Optical Inc. All of these companies strive to provide high-quality products, services, and solutions in order to remain competitive in the ever-growing electronics market.

– Shenzhen Microgate Technology Co Ltd ($SZSE:300319)

Shenzhen Microgate Technology Co Ltd is a leading technology company based in Shenzhen, China. The company provides a wide range of products and services including artificial intelligence, cloud computing, IoT, and more. As of 2023, the company has a market capitalization of 6.69B and a Return on Equity (ROE) of 4.57%. This indicates a strong financial performance, which is likely to continue as the company expands its operations in the future. Additionally, the company’s strong position in the technological arena helps provide a foundation for future growth.

– Wieson Technologies Co Ltd ($TPEX:6272)

Wieson Technologies Co Ltd is a technology company that specializes in the design, manufacture, and sales of electronic products and components. With a market cap of 799.97M as of 2023, the company is one of the leading players in the industry. Its Return on Equity (ROE) has also been impressive, currently standing at 17.34%. This shows that the company is efficiently managing its resources and generating a healthy return on its investments.

– Mildex Optical Inc ($TPEX:4729)

Mildex Optical Inc is a company that designs and manufactures optical components and systems. It has a market cap of 1.16B as of 2023 and a Return on Equity of -1.68%. The market cap is an indicator of the company’s size and its total value in the market. A negative return on equity indicates that the company is not generating enough profits to cover its equity investments. Mildex Optical Inc is faced with the challenge of increasing its profitability and improving its returns to shareholders.

Summary

Cowell e Holdings is a company with a high debt level relative to its size.

However, current media coverage of the company’s financial situation is largely positive. Analysts suggest that the company has sufficient cash flow to pay off its debt, and its balance sheet is strong enough to sustain future growth. Furthermore, the company has taken steps to reduce its debt-to-equity ratio and appears to be in a financially sound position.

In addition, the company has a solid track record of creating shareholder value by delivering consistent profits. As such, investors should remain confident in their investment in Cowell e Holdings, despite its high debt level.

Recent Posts