Putnam Investments LLC Reduces Stake in OneMain Holdings, in 2023.

March 20, 2023

Trending News 🌥️

ONEMAIN ($NYSE:OMF): OneMain Holdings, Inc. has seen a significant reduction in its stock holdings from Putnam Investments LLC in 2023. Putnam had previously held a large stake in the company, but has since shifted its investments elsewhere. This move could signal an underlying concern about the future performance of OneMain Holdings and the wider industry. The decline in stock holdings is likely to have financial repercussions for OneMain Holdings, Inc. as it will be deprived of a major source of capital. This could potentially have an impact on the company’s ability to pay dividends, expand operations and further invest in research and development.

It is also likely to affect investor confidence in the company and other organizations in the same industry. OneMain Holdings, Inc. must now take steps to ensure that its stock remains attractive and that its investments remain stable. There are a number of strategies it can employ, such as increasing its dividend payouts, investing in new projects or hiring experienced managers to help guide the company through this period of uncertainty. If successful, the company could still reap the rewards of its previous investments and position itself as a leader in the industry.

Share Price

On Tuesday, ONEMAIN HOLDINGS shares opened at $37.0 and finished the day at $35.9, representing an increase of 0.7% from the previous closing price of 35.7. The total number of shares sold is also unknown at this point. This news has caused some investors to take note and could potentially impact the stock price of ONEMAIN HOLDINGS going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Onemain Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 4.2k | 878 | 21.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Onemain Holdings. More…

| Operations | Investing | Financing |

| 2.39k | -2.12k | -326 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Onemain Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 22.53k | 19.5k | 24.56 |

Key Ratios Snapshot

Some of the financial key ratios for Onemain Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.3% | – | – |

| FCF Margin | ROE | ROA |

| 56.8% | 24.1% | 3.2% |

Analysis

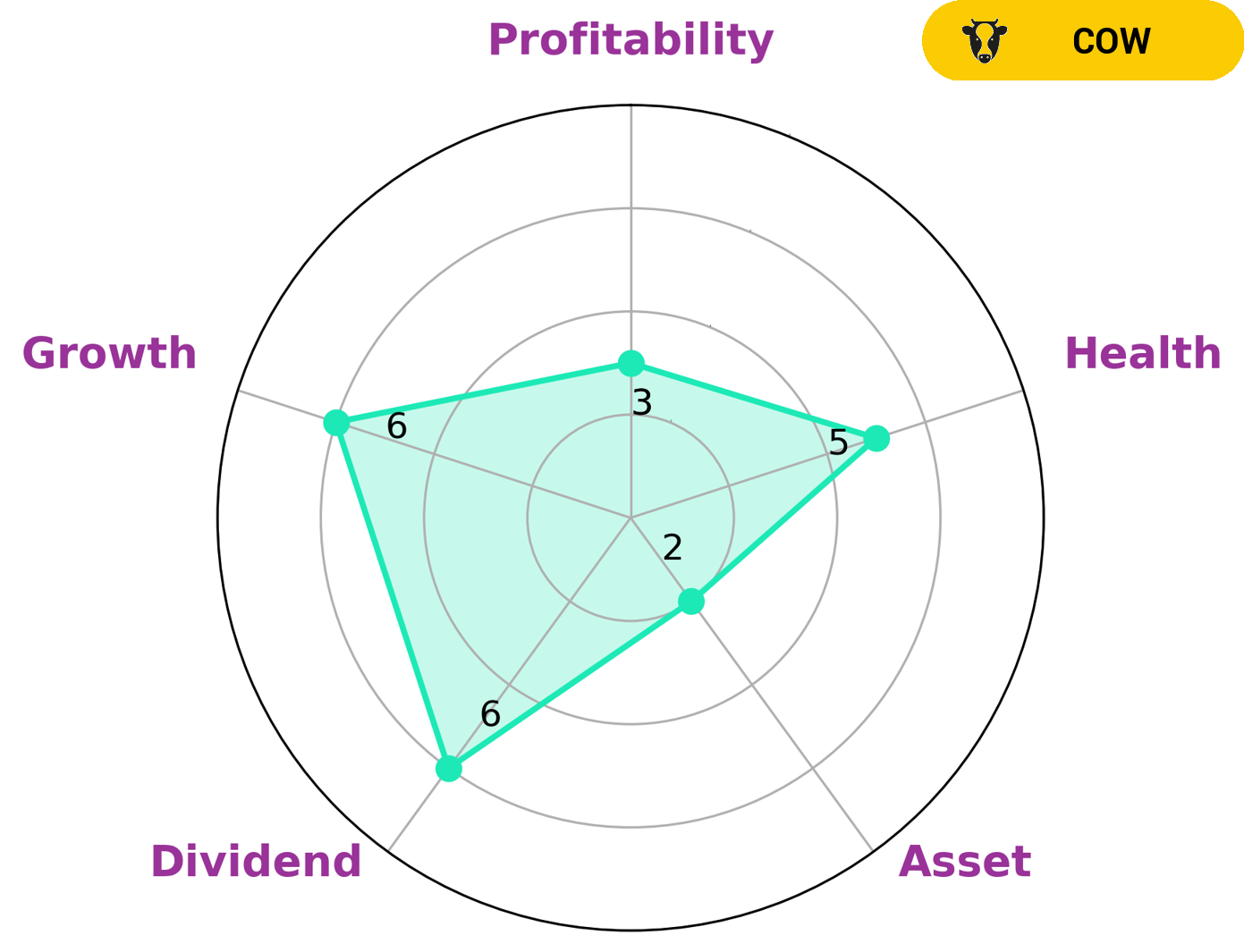

As GoodWhale, we have performed an analysis of ONEMAIN HOLDINGS‘ financials. According to Star Chart, ONEMAIN HOLDINGS is classified as ‘cow’, a type of company with the track record of paying out consistent and sustainable dividends. This makes it attractive to dividend investors who are looking for reliable and steady income. Based on our analysis, ONEMAIN HOLDINGS has an intermediate health score of 5/10 with regards to its cashflows and debt. This implies that the company is able to pay off debt and fund future operations. Furthermore, ONEMAIN HOLDINGS is strong in stable dividends, medium in dividend growth and weak in asset and profitability. This makes it an interesting investment option for those who are looking for more consistent dividend payments. More…

Peers

The company offers a wide range of products and services to meet the needs of its customers. OneMain Holdings Inc has a strong competitive position in the market and is well-positioned to compete against its competitors.

– Nicholas Financial Inc ($NASDAQ:NICK)

Nicholas Financial Inc is a specialty finance company that provides consumer and small business loans through a network of branches and independent loan brokers. The company has a market cap of 44.24M as of 2022. Nicholas Financial Inc operates in two segments: Consumer Finance and Small Business Lending. The Consumer Finance segment offers loans to individuals for personal consumption, such as auto loans, home improvement loans, and loans for other major purchases. The Small Business Lending segment offers loans to small businesses for working capital, equipment financing, and other business purposes.

– Geneva Finance Ltd ($NZSE:GFL)

Geneva Finance Ltd is a New Zealand-based company engaged in the provision of personal finance solutions. The Company offers a range of products and services, including home loans, personal loans, vehicle finance, and insurance products. It operates through a network of branches located across New Zealand.

– Zip Co Ltd ($ASX:ZIP)

Zip Co Ltd is an Australian financial technology company that offers buy now, pay later services. The company has a market capitalization of 875.04 million as of 2022 and a return on equity of -21.16%. Zip Co Ltd offers its services through a mobile app and a website. The company was founded in 2013 and is headquartered in Sydney, Australia.

Summary

Investors in OneMain Holdings, Inc. have seen a significant reduction in their holdings in 2023 as Putnam Investments LLC has sold a large portion of their stake in the company. Investment analysis of OneMain suggests that the company is well-positioned to capitalize on the opportunities in the consumer finance industry, having built a strong presence in the subprime lending sector. Financial metrics such as liquidity, profitability, and debt-to-equity ratios are improving, suggesting healthy growth potential.

However, investors must consider the potential risks of continuing to invest in OneMain, including a highly competitive landscape, uncertainty surrounding economic conditions, and increasingly stringent regulatory requirements. Overall, given the company’s strong financial foundation, analysts recommend keeping a close eye on OneMain to capitalize on future positive developments.

Recent Posts