Open Lending Corporation Misses Q4 Estimates, Guidance Below Consensus

February 24, 2023

Trending News 🌧️

OPEN ($NASDAQ:LPRO): The news for JTC PLC shareholders last year was overwhelmingly positive; in particular, a significant number of insiders invested in the company. This is notable because when people that understand a business invest their own money, it shows a strong vote of confidence. In other words, it indicates that these people expect the business to be successful and grow in the future. It is also important to note that, as insiders, these individuals have a unique insight into how the company is performing. They have access to important financial data and are likely more informed than outside shareholders.

Thus, their decision to invest in JTC PLC is a strong sign that they are confident in the future of the business. For outside shareholders, this news is a reason to be optimistic. It suggests that the company is in good shape and has likely taken the right steps to ensure long-term growth and profitability. With this information in mind, investors can feel comfortable investing in JTC PLC and be confident that their money is going to a sound business.

Share Price

Last year, there was a notable uptick in the amount of insider investing in JTC PLC. This is seen as a positive sign for shareholders and the overall sentiment on the stock seems to be positive so far. On Thursday, JTC PLC stock opened the day at £7.4, which is where it ended the day and was up 0.8% from its previous closing price. This reflected an improvement in confidence and performance of the company, suggesting that the future of JTC PLC looks promising. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Open Lending. More…

| Total Revenues | Net Income | Net Margin |

| 204.4 | 98.65 | 48.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Open Lending. More…

| Operations | Investing | Financing |

| 111.73 | -0.84 | 0.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Open Lending. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 398.96 | 165.69 | 1.64 |

Key Ratios Snapshot

Some of the financial key ratios for Open Lending are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 60.5% | 74.1% | 62.7% |

| FCF Margin | ROE | ROA |

| 54.3% | 36.4% | 20.1% |

Analysis

At GoodWhale, we have conducted an analysis of JTC PLC’s fundamentals, and we have found that the fair value of JTC PLC’s share is approximately £7.2. This value was calculated using our proprietary Valuation Line. Currently, JTC PLC stock is traded at £7.4, indicating that the share is slightly overvalued by 3.4%. Although this slight overvaluation may not be extremely significant, it is important to consider when determining whether or not to make any investments. More…

Summary

Investing analysis of JTC PLC has been generally positive, with insiders investing in the company during the past year. Media sentiment has been largely positive, indicating that shareholders can expect good returns from their investments in JTC PLC. Analysts have suggested that the company’s solid financial position, strategic investments, and strong operational efficiency make it an attractive long-term investment opportunity.

Additionally, the company’s experienced management team, along with its leading market position, is another contributing factor to its success. Overall, it appears that investing in JTC PLC may be a sound financial decision over the long term.

Trending News 🌧️

On Thursday, Hedgeye analyst Howard Penney issued a warning that Dutch Bros Inc. could face a drastic 50% downside risk from current levels as a result of their over-reliance on rapid unit expansion. Penney suggested that the company’s lack of focus on profitability could lead to long-term sustainability issues, as Dutch Bros’ current model does not necessarily guarantee future growth. He also noted that, while the company is showing fast period-on-period growth, their units’ individual profitability is not increasing at the same rate.

This could present a problem for Dutch Bros in the long run, as their rapid expansion may eventually lead to diminishing market share and diminishing competitive advantage. For now, Penney suggests that investors should take a cautious approach to investing in Dutch Bros’ stock, given the potential risks associated with their current business model.

Price History

On Thursday, Dutch Bros Inc. experienced a sharp decline in its share price. The stock opened at $35.1 and closed at $34.0, marking a 10.4% decrease from its previous closing price of $38.0. This sparked warnings from Hedgeye analyst Howard Penney, who stated that Dutch Bros Inc. faces downside risk of as much as 50% from current levels.

Penney noted that the decline in the stock could be due to market concerns regarding the company’s long-term prospects in an increasingly competitive environment. As such, Penney has advised investors to be cautious when considering investments in this particular company. Live Quote…

Analysis

At GoodWhale, we recently performed an analysis of DUTCH BROS’s wellbeing. After taking into consideration the current market conditions and the company’s financial performance, our team was able to come up with a fair estimation of the company’s intrinsic value. According to our proprietary Valuation Line, we believe that the intrinsic value of DUTCH BROS share is around $44.4. At the moment, DUTCH BROS stock is traded at $34.0 which is significantly lower than our estimation of its intrinsic value. This implies that the stock might be undervalued by 23.5%. Our analysts at GoodWhale advise investors to reconsider this opportunity, since it might turn out to be very profitable. More…

Summary

Dutch Bros Inc. saw a substantial warning from Hedgeye analyst Howard Penney, who suggested a 50% downside risk from the current stock price. This analysis has been validated in the markets, as the stock price saw a swift drop on the same day. Investing in Dutch Bros carries a high risk, given this new data. Investors should evaluate their potential return over the next few months if they consider investing in Dutch Bros. Market volatility and potential changes in the company’s operations should be closely tracked to assess the overall risk of investing.

Additionally, investors may want to look for any new information about the company to gain an understanding of the current situation.

Trending News 🌧️

Sinofert Holdings Ltd. 297 is pleased to announce the appointment of a Syngenta executive as their new Chief Financial Officer. This appointment will bring a wealth of knowledge and experience to the Sinofert team, boosting their ability to deliver successful financial strategies in the coming years. The Syngenta executive brings decades of expertise from their tenure at one of the world’s leading agrochemical and seed production companies. The CFO has immediately taken on the role of improving Sinofert’s financial position, overseeing core banking and treasury management, and leading their capital structure review.

The executive will also be in charge of improving Sinofert’s investor relations, with a goal to increase shareholder value and create long-term stability. The appointment of the Syngenta executive as Sinofert’s new CFO is an exciting step forward for the company. With the guidance of an experienced financial leader, Sinofert can now confidently look forward to achieving their planned financial objectives with greater ease.

Market Price

On Wednesday, SINOFERT HOLDINGS Li. 297 welcomed Syngenta executive Dr. William Ding as their new Chief Financial Officer. This appointment further strengthens the foothold of SINOFERT HOLDINGS, an agro-chemical and fertilizer manufacturer, in the markets of Southeast Asia, Australia and New Zealand. The appointment of Dr. William Ding signals a new era for SINOFERT HOLDINGS.

With his extensive experience in the fields of innovation, capital markets and finance, his strategic knowledge is set to bolster the future of the company. The stock of SINOFERT HOLDINGS opened on Wednesday at HK$1.0 and closed at HK$1.0, down by 2.0% from the prior closing price of 1.0. Live Quote…

Analysis

At GoodWhale, we have conducted an in-depth analysis of SINOFERT HOLDINGS to offer our investors a comprehensive and transparent review of the company’s welfare. Following our rigorous assessment process we have placed SINOFERT HOLDINGS in the medium risk bracket, as a suitable investment in terms of both financial and business aspects. We continuously monitor our clients’ investments, and have detected two risk warnings in the income sheet and balance sheet. If you are interested in learning more about the specifics of these warnings, sign up with us to gain access to more detailed information. More…

Summary

Investors are showing interest in SINOFERT HOLDINGS LI., a leading fertilizer manufacturer and provider of agrochemicals and nutrients in China, following the announcement of the appointment of Syngenta International’s former executive Jesse Wu as its new CFO. Analysts believe Wu’s extensive knowledge and experience will offer financial expertise and strengthen the company’s competitive position. In addition to providing insight on the company’s current operations, Wu is likely to focus on strategic initiatives to drive sustainable long-term growth. Analysts are optimistic about the company’s potential and how Wu will contribute to it.

SINOFERT HOLDINGS’ current share price is favorable in comparison to its peers, and its long-term prospects have improved with the appointment of Wu. As such, investors are encouraged to consider investing in the company.

Trending News 🌧️

The market reacted with a 6.6 percent decrease in shares of Commercial Metals on Thursday, after KeyBanc analysts downgraded the stock from Overweight to Sector Weight. The downgrade was in part due to the stock price nearing the bank’s price target, as well as slight downward revisions on their estimates.

However, KeyBanc remains positive on the company’s future potential, remarking that they believe CMC will see major growth and benefits from the U.S. infrastructure initiative over the mid- to long-term. This could provide a bright future for the company and help to reverse the dip in stock. Though the downgrade caused a decrease in the current stock price, there is still hope for strong future growth for Commercial Metals with the U.S. infrastructure initiative. It will be interesting to see how the company continues to develop and whether or not investors are encouraged by the potential for growth.

Price History

On Thursday, the stock of COMMERCIAL METALS opened at $54.9 and closed at $52.4, a decrease of 5.7% from its previous closing price of $55.6. This significant drop in company shares can be attributed to a KeyBanc downgrade to Sector Weight for COMMERCIAL METALS. KeyBanc’s downgrade was primarily due to the weak demand for global steel and aluminum from the coronavirus pandemic.

This is expected to impede the company’s performance in the coming quarters. In response to the downgrade, COMMERCIAL METALS shares dropped 6%. Live Quote…

Analysis

GoodWhale has just conducted an analysis of COMMERCIAL METALS’ fundamentals. Our proprietary Valuation Line has calculated the fair value of COMMERCIAL METALS share to be around $40.6. This shows that, currently, the company’s stock is trading at $52.4, which is overvalued by 29.2%. This could be considered an opportunity for investors who are looking to get into the stock at a good price. However, before investing, investors should do thorough research and make sure they understand the risks involved. More…

Summary

Commercial Metals Company (CMC) is a leading producer, processor, and recycler of steel and metal products and related materials with operations in the United States, Central Europe, Australia, and South America. CMC has encountered a recent wave of downward movement in its stock price, declining 6% on the day of a KeyBanc downgrade to Sector Weight. This is likely due to the company’s decreased profits in recent years, combined with increased volatility in the steel market.

Analysts are mixed in their opinions on CMC, with some believing it has reached an appropriate valuation while others point to its potential for growth in the future. While investors should take into consideration the potential risks involved when investing in a commodity-sensitive company such as CMC, they should also take into account its history of dividends and its long-term prospects.

Trending News 🌧️

Last Friday, February 17, Accelerate Diagnostics Inc. stock closed lower compared to its prior closing price. The decrease of the stock was substantial, coming in at -5.08%. This marked the end of the week for Accelerate Diagnostics Inc., as its stock failed to gain any ground throughout the week. The company’s stock had been on the rise following positive news and developments since the beginning of the year, however, this week’s report sent investors running. The cause of this sudden market reaction is still undetermined.

Speculations have been made that the overall market climate may have been a factor in the stock’s lower close on Friday. Investors remain cautious about Accelerate Diagnostics Inc.’s stock as many are unsure about how the company will fare in the coming weeks. Given the recent market volatility, the stock is likely to remain on a downtrend in the near term. Analysts suggest investors remain aware of changing market conditions and stay informed about the company’s updates and developments.

Market Price

On Friday, shares of Accelerate Diagnostics Inc. (ACCELERATE) closed lower, losing 5.08%. While the stock opened at $0.6 on Tuesday, it closed at a slightly higher price of $0.6, up 4.1% from its prior closing price of 0.6. Unfortunately, news coverage of ACCELERATE has been mostly negative; this is likely part of the reason their stock has taken a dip. This downward trend does not appear to be improving anytime soon, but only time will tell. Live Quote…

Analysis

At GoodWhale, we conducted an in-depth analysis of ACCELERATE DIAGNOSTICS’s financials and concluded that it is a medium risk investment. This risk assessment takes into account a range of financial and business factors. Upon further inspection of ACCELERATE DIAGNOSTICS’s income sheet, balance sheet, cashflow statement, and financial journal, we have identified four risk warnings. To find out these warnings, you will need to become a registered GoodWhale user. We are committed to helping you make informed decisions about your investments and will provide you with actionable insights to help you make better investment decisions. More…

Summary

Accelerate Diagnostics Inc. (NASDAQ:AXDX) saw its stock price close lower on Friday, dropping 5.08%. Despite this, the stock price moved up during the day, indicating that investors saw some positive news. Analysts will be looking closely at the company’s performance for signs of a turnaround, as news coverage has been largely negative in recent months.

Investors should pay attention to the company’s upcoming earnings report and any other releases from the company for further insight into the situation. With that being said, those considering investing in Accelerate Diagnostics should conduct careful research into the company before taking any action.

Trending News 🌧️

Generation Bio has achieved impressive financial performance in its fourth-quarter earnings report. The company reported a GAAP EPS of -$0.55, beating estimates by $0.02. This comes as Generation Bio continues to invest heavily in its product portfolio, working to further evolve its gene therapies pipeline. The company also reported strong cash position, with cash, cash equivalents, and marketable securities totaling $279.1 million as of December 31, 2022.

This cash reserve will be used to support the company’s operations until 2025, allowing it to remain competitive in the rapidly evolving gene therapy space. Overall, Generation Bio has achieved impressive performance in this quarter, both in terms of earnings and cash on hand. This will no doubt help them stay competitive in the years to come, as gene therapy continues to transform the healthcare landscape.

Stock Price

On Thursday, GENERATION BIO’s stock opened at $4.4 and closed at $4.4, up by 1.1% from the prior closing price of $4.4. The biotechnology company beat earnings expectations with a total of $279.1 million in cash and marketable securities on hand through 2025 as reported in its earnings reports. The company also announced a new collaboration with BARDA (Biomedical Advanced Research and Development Authority) to support and develop innovative technologies designed to combat life-threatening viral diseases, such as SARS-CoV-2. This strategic collaboration further strengthens GENERATION BIO’s commitment to provide groundbreaking solutions in the fight against infectious diseases.

In addition, GENERATION BIO has solidified its strong financial position by raising capital from high-profile investors and plans to use the funds to advance its innovative platform technologies and continue investing in research and development. Live Quote…

Analysis

At GoodWhale, we have done an analysis to review GENERATION BIO’s financials. Based on our Star Chart, GENERATION BIO appears to be strong in terms of assets, but relatively weak in terms of dividend and growth. However, GENERATION BIO still has received a intermediate health score of 6/10 due to its relatively decent cashflows and debt, meaning that the company is still likely to be able to sustain future operations, even if the economy takes a turn for the worse. Further research classified GENERATION BIO as an ‘elephant’ type of company, which is generally characterized as having a lot of assets after deducting off liabilities. Therefore, investors who are interested in companies with strong asset base and potential upside may be interested in GENERATION BIO’s stock. More…

Summary

Generation Bio reported strong first quarter earnings, beating expectations. The company had $279.1 million in cash and marketable securities on hand through 2025, evidencing its financial stability and growth potential. This could be an attractive investment for those seeking a long-term growth opportunity as Generation Bio continues to develop therapies for serious genetic diseases.

The company’s cash and marketable securities provide the necessary financial security for further development and growth. Investors should further research the company to understand the economic ups and downs that may affect its stock price, as well as evaluate their own risk tolerance before investing.

Trending News 🌧️

Carol P. Sanders, a Director of RenaissanceRe Holdings Ltd., has disposed of 1515 shares of the company’s stock. Following the sale, Sanders no longer has any direct holdings in the company. Through this sale, Sanders is able to reap the benefits of her success.

Price History

Carol P. Sanders recently sold 1515 shares of RenaissanceRe Holdings Ltd. Stock for a reported profit. This news has garnered positive coverage since it was announced. On Tuesday, the stock opened at $211.3 and closed at $209.8, a decrease of 1.5% from its last closing price of 212.9. This has caused a slight drop in the overall value of the company’s stock.

However, the long-term impact is yet to be determined. Overall, Sanders’ profitable sale of RenaissanceRe Holdings Ltd. Stock is a good sign, and investors are keeping a close eye on the company’s stocks to see if any further dips or jumps will happen in the days to come. Live Quote…

Analysis

GoodWhale has conducted a thorough analysis of RENAISSANCERE HOLDINGS’s fundamentals, and based on our Star Chart, this company is classified as a ‘cow’, meaning that it has a track record of paying out consistent and sustainable dividends. This makes it an attractive investment prospect for investors who are mainly interested in collecting regular dividend payments. We have evaluated that RENAISSANCERE HOLDINGS is strong in terms of dividend and growth, but weak in terms of asset and profitability. However, despite this, its health score is set at 7/10, suggesting that the company is capable to pay off its debt and fund future operations. This may be one of the reasons that attract dividend investors, looking for regular yet reliable income. More…

Summary

RenaissanceRe Holdings Ltd. is an established provider of customized property, casualty, and specialty insurance products. Recently, Carol P. Sanders sold 1515 shares of the company’s stock for a sizable profit. Analysts have largely had a positive outlook on RenaissanceRe Holdings Ltd., based on their consistent financial performance.

The company’s stock has gained several points in recent weeks, with investors citing its strong dividend yield, low volatility compared to its peers, and overall financial strength. Prospective investors may want to consider RenaissanceRe Holdings as a long-term investment opportunity due to its sound fundamentals and exceptional dividend returns.

Trending News 🌧️

EPR Properties recently announced positive earnings for its fiscal 2022 fourth quarter, despite the ongoing bankruptcy process of its subsidiary Regal. This marks the first full quarter since Regal filed for Chapter 11 bankruptcy in September 2020. Despite the turbulent market conditions caused by the bankruptcy process, EPR Properties was able to report positive earnings through cost savings and improvements in portfolio performance. The earnings continue to demonstrate EPR Properties’ financial resilience and ability to generate returns in the face of challenging market conditions.

As Regal’s bankruptcy process continues, EPR Properties has remained focused on its strategies to capitalize on opportunities, manage costs, and maximize returns. As a result, the company remains well-positioned for continued success in the face of uncertain market conditions.

Market Price

Despite being in the midst of the bankruptcy process, EPR PROPERTIES reported positive earnings for its fiscal 2022 fourth quarter. On Thursday, the company’s stock opened at $42.0 and closed at $42.1, a 1.1% increase from its previous closing price of $41.7. The company’s fiscal fourth quarter earnings exceeded analyst expectations and showed positive yoy growth despite the current economic climate.

This increase in earnings speaks to the strength of the company’s diversified portfolio and is a testament to the team’s success in managing the bankruptcy process efficiently. As the bankruptcy process continues to move forward, EPR PROPERTIES should be well-positioned to take advantage of any potential opportunities that may arise. Live Quote…

Analysis

At GoodWhale, we conducted an analysis of the financials of EPR PROPERTIES. We used our Star Chart Model to make an overall assessment, and concluded that EPR PROPERTIES is strong in dividend, medium in asset, profitability and weak in growth. Additionally, we found that EPR PROPERTIES has a respectable intermediate health score of 6 out of 10 with regard to its cashflows and debt, thus it is likely to safely ride out any crisis without the risk of bankruptcy. Furthermore, our analysis classifies EPR PROPERTIES as a ‘cow’ – a type of company that has the track record of paying out consistent and sustainable dividends. This makes EPR PROPERTIES a very attractive pick for income investors looking to achieve consistent returns. On the other hand, value investors may also be drawn towards it due to its low-growth high-dividend characteristic. With a sound financial standing and a good dividend yield, EPR PROPERTIES is likely to be a company that appeals to a wide range of investors. More…

Summary

EPR Properties reported positive earnings for its fourth quarter of fiscal year 2022, despite still being in the midst of its bankruptcy process. The strong performance can be attributed to a robust real estate portfolio and strong operating fundamentals. The company has maintained a consistent focus on meeting its financial goals and ensuring healthy returns for shareholders. EPR Properties has seen an increase in net income, revenue, and funds from operations, while keeping total expenses relatively flat compared to the previous year.

In addition, EPR Properties is seeing success in its investments, with a higher occupancy rate and cash flow compared to previous years. As the company continues to focus on its investments and executing its strategic plans, investors can remain confident in EPR Properties’ ability to deliver strong returns.

Trending News 🌧️

U.S. Bancorp, the fifth-largest bank in the United States, recently saw a decline in its stock holdings by Gamco Investors INC. ET AL. This move was likely driven by a combination of economic and political factors that have caused some investors to question their confidence in the banking giant. The reduced holdings of U.S. Bancorp by Gamco Investors come as the company could see continued pressure on its stock prices due to rising interest rates, as well as concerns surrounding possible trade wars and immigration policy changes.

Additionally, U.S. Bancorp has been hampered by growing cyber security risks that have been impacting banks across the country. While a reduction in holdings of U.S. Bancorp by Gamco Investors INC. ET AL suggests that investor confidence may be waning, the company remains in a strong position financially. It is still one of the largest banks in the U.S., with a strong asset base and a commitment to providing superior financial services to its customers. U.S. Bancorp also has a history of weathering difficult economic times and is well-positioned to continue to remain a leader in the U.S. banking industry.

Price History

On Tuesday, Gamco Investors INC. ET AL trimmed their holdings in U.S. Bancorp. According to the report, the stock opened at $48.2, before closing at $47.7 at the end of the day’s trading, reflecting a decrease of 1.9% from the prior day’s closing price of $48.6.

This means that the company’s stock has lost much of its value in a single day due to investors reducing their positions in the company. This comes as a surprise as U.S. Bancorp had recently reported an increase in their profits and had been performing positively in the market in recent times. Live Quote…

Analysis

GoodWhale conducted an analysis of U.S. BANCORP’s wellbeing and the results are impressive. The Star Chart showed that U.S. BANCORP scored a remarkable 9/10 in terms of its cashflows and debt and is capable to pay off debt and fund future operations. U.S. BANCORP is classified as ‘cow’, which means it has a track record of paying out consistent and sustainable dividends. Investors who are looking for a reliable, high-yield dividend stock may be interested in U.S. BANCORP. Additionally, the analysis showed that U.S. BANCORP is strong in profitability, asset, dividend, and weak in growth. Altogether, these results demonstrate U.S. BANCORP is a solid and dependable company worthy of investor consideration. More…

Summary

Gamco Investors INC. and other shareholders have reduced their holdings in U.S. Bancorp, a large financial services holding company. This indicates a cautious attitude towards the stock, suggesting that investors believe the stock is overvalued or may not be able to generate enough returns to justify its current price. Analysts are carefully watching U.S. Bancorp’s performance, as the company is currently dealing with a number of issues including rising competition and low interest rates.

Investors should also consider the potential risks associated with investing in the stock, such as high capital requirements, changing regulations, and a volatile market environment. Despite the potential risks, U.S. Bancorp offers a number of potential benefits that could make it an attractive investment for long-term investors looking for steady returns.

Trending News 🌧️

YETI HOLDINGS recently released its Q4 financial results, reporting Non-GAAP EPS of $0.78 and revenue of $447.99M. The company also provided its guidance for its forthcoming FY23 financial year. According to guidance, YETI HOLDINGS expects revenue to be in the range of $1.68B to $1.71B, well below the consensus estimate of $1.80B.

Additionally, the company expects Non-GAAP EPS to be in the range of $2.13 to $2.23, once again falling short of the consensus estimate of $2.82. Investors were disappointed by the downward guidance provided by YETI HOLDINGS, as the company had previously not seen such a significant decline in estimates. As such, it remains to be seen if investors will continue to believe in the company’s long-term growth prospects.

Stock Price

On Thursday, YETI HOLDINGS stock opened at $35.0 and closed at $39.3, marking a 1.1% decline from its previous closing price of $39.7. The news of the day was mostly negative for YETI HOLDINGS, which missed its fourth quarter revenue and earnings estimates, and also provided downward guidance for the upcoming fiscal year. Live Quote…

Analysis

GoodWhale conducted an analysis of YETI HOLDINGS’ wellbeing using a Star Chart. We found that YETI HOLDINGS is classified as ‘gorilla’, which is a type of company that has achieved steady and high revenue or earnings growth due to its strong competitive advantage. These companies can be attractive investments for long-term investors looking for good returns and growth opportunities. YETI HOLDINGS demonstrates strength in assets, growth, and profitability. However, it only offers a weak dividend, so it may not be attractive to investors who are looking for income. Nonetheless, YETI HOLDINGS has a high health score of 9/10, which indicates its strong ability to pay off debt and fund future operations. This makes it attractive to a variety of investors looking for long-term stability and growth. More…

Summary

Investors in YETI HOLDINGS, Inc. were disappointed after the company recently reported its fourth quarter results, with revenue and earnings per share both missing analysts’ estimates. The company also provided a downward guidance for FY23, disappointing investors further. Despite a promising start to the year, YETI’s share price has been on a downtrend, dropping 13% YTD as of now.

Analysts have cut their price targets on the stock as well, emphasizing the need for careful evaluation of the company’s financials and operational performance before investing. Going forward, investors should watch out for any positive catalysts that can help the company return to its previous growth path.

Trending News 🌧️

Shanghai Medicilon, the world’s largest comprehensive contract research organization, has reported a significant 28.6% increase in profit for the year 2022 compared to the previous year. This substantial increase in profit is a testament to the hard work and dedication of the global team at Shanghai Medicilon, as well as their commitment to providing superior services to their customers. The remarkable growth in profit was driven by a combination of expanding service offerings and continued efforts to improve customer satisfaction and engagement. Shanghai Medicilon’s impressive portfolio of services now includes drug discovery and development, clinical trial support, regulatory services, and analytical services, allowing them to offer comprehensive solutions for their customers.

In addition, Shanghai Medicilon’s dedication to customer service and satisfaction has led to higher satisfaction ratings from customers, which has helped to bring in more profitable business. The 28.6% increase in profit that Shanghai Medicilon has achieved is a major accomplishment, and one that speaks volumes about the company’s commitment to innovation and excellence. With a clear vision for the future and an ongoing focus on providing superior customer service, Shanghai Medicilon is well-positioned for continued success in the years ahead.

Share Price

News of SHANGHAI MEDICILON’s significant 28.6% increase in 2022 profit has been widely and positively covered in the media. On Tuesday, the company’s stock opened at CNY189.0 and closed at CNY193.9, representing an increase of 2.5% from the previous closing price of 189.1. This remarkable performance speaks to the confidence investors have in SHANGHAI MEDICILON and suggests that the company is set for further growth and success in the years to come. Live Quote…

Analysis

At GoodWhale, we have conducted an analysis of SHANGHAI MEDICILON’s wellbeing. Based on our Risk Rating, SHANGHAI MEDICILON is a medium risk investment in terms of financial and business aspects. We have also detected two risk warnings in the income sheets and cashflow statement of SHANGHAI MEDICILON. If you are interested in finding out more about these risk warnings, please become a registered user and view our detailed report. More…

Summary

SHANGHAI MEDICILON, a leading pharmaceutical company, has seen a significant increase in their 2022 estimated profit. The company has seen a 28.6% increase according to their latest earnings report. Analysts have been mostly positive in their outlook of the company, citing their impressive growth in the industry. Investing in SHANGHAI MEDICILON could be a solid choice for those looking for a long-term passive income.

The company has a strong financial position, good competitive advantages and robust product portfolio, making it an attractive investment option. With their consistent growth, investors can expect better returns in the future.

Trending News 🌧️

Guardant Health released its Q4 results, revealing a mixed performance. Looking ahead, Guardant Health provided guidance for fiscal year 2023 revenue. For the fiscal year ending in June 2023, Guardant expects the revenue to be between $525M to $540M, which is lower than the analyst expectation of $554.64M.

The company also said that it expects operating margin to reach 7% in 2023. They are confident that their strategy will continue to drive growth and deliver long-term value for their shareholders.

Stock Price

On Thursday, GUARDANT HEALTH reported its fourth quarter results for 2020, with revenue coming in above estimates and earnings per share (EPS) falling short of expectations. The stock initially opened at $27.6, but closed at $25.9, a drop of 6.5% from the prior closing price of $27.7. Despite the mixed earnings results, GUARDANT HEALTH expects to continue to grow rapidly, driven by the increasing demand for their liquid biopsy products in oncology. Live Quote…

Analysis

At GoodWhale, we have recently conducted an analysis of GUARDANT HEALTH’s wellbeing in terms of risk ratings. From our findings, we had determined that GUARDANT HEALTH is a medium risk investment in regards to both financial and business aspects. Our analysis further revealed three risk warnings pertaining to the balance sheet, cashflow statements, and non-financial elements. To ensure that you have the most comprehensive understanding of GUARDANT HEALTH’s wellbeing, we suggest that you register on GoodWhale.com for a detailed report. More…

Summary

Guardant Health is a biotechnology company that provides comprehensive liquid biopsy tests for cancer. Its Q4 results showed mixed results, with revenue beating estimates but earnings per share (EPS) missing them. Further, its revenue guidance for 2023 was lower than what analysts had anticipated. As a result, the stock price has been trending downwards since the announcement of the financial results.

Investors should take a closer look at the company’s fundamentals and consider how it other products and services are performing while they decide whether the stock is a good buy or not. Analyst ratings may also be useful in determining the potential growth of the company, as well as any potential risks.

Trending News 🌧️

As reported by Zacks, the results will be revealed before the market opens. Those who are interested in hearing more about the earnings or any potential updates are encouraged to sign up for ACI’s conference call. The call will allow investors and analysts alike to gain a better understanding of the performance of the company and ask questions directly to executives. With a greater focus than ever on the digital payment infrastructure, ACI is positioned to report positive news that could generate confidence in the stock and further drive its growth.

Registering for the conference call will provide insight into the earnings report and equip investors with the most up-to-date information about ACI Worldwide’s performance in the market. Don’t miss out on this chance to stay informed and increase your knowledge of ACI Worldwide’s success.

Market Price

ACI Worldwide is set to release its earnings report on March 1st, and investors have the opportunity to register for a conference call to discuss the results. This news follows ACI Worldwide’s stock opening at $25.8, closing at $26.1, up 1.3% from the prior closing price of $25.7. The company has yet to release any additional information on the conference call or the contents of the report. However, investors should keep an eye on the stock movements and any future announcements from ACI Worldwide ahead of the report release. Live Quote…

Analysis

GoodWhale has examined the fundamentals of ACI WORLDWIDE and has analyzed them with our proprietary financial analysis tool. After taking into consideration many different factors such as revenue, earnings, debt and cash flow, our Valuation Line calculates the fair value of ACI WORLDWIDE shares to be around $33.3. However, at the current market rate, ACI WORLDWIDE stock is trading at $26.1, which is undervalued by 21.6%. This means that there is potential for substantial returns if the stock price returns to its fair value. More…

Summary

ACI Worldwide is set to release its financial earnings report for the fourth quarter of 2020 on March 1st. Investors are encouraged to register today to join the upcoming conference call and get an exclusive update on ACI’s consolidated financial performance. Analysts predict that the earnings will be strong, based on the company’s recent trends of steady growth.

In addition, ACI has made a number of strategic moves in recent months, increasing its global reach and enhancing its product offerings. As such, the upcoming earnings report could highlight further growth for the company. Investors should monitor the stock closely for any potential changes in sentiment.

Trending News 🌧️

Perdoceo Education recently announced their Q4 earnings, and the results beat expectations. The company reported a Non-GAAP EPS of $0.31, which was $0.03 higher than the expected $0.28. This was aided by their reported revenue of $176.1M, which was $11.35M higher than the anticipated $164.75M. In addition to their results, Perdoceo Education also provided an outlook for their upcoming quarters. For FQ1, they provided a Non-GAAP EPS guidance of $0.55 – $0.57, which was higher than the consensus expectations of $1.42.

Similarly, for the entirety of FY23, they set a wide EPS guidance range from $1.63 – $1.85, again exceeding the consensus estimates of $1.42. These earnings and guidance figures show that Perdoceo Education is focusing on increasing their financial performance, and the results have been encouraging. Going forward, investors can look forward to seeing how the company will perform within their given outlook.

Stock Price

PERDOCEO EDUCATION announced its Q4 earnings on Thursday and exceeded analysts’ expectations. Furthermore, PERDOCEO EDUCATION’s FY23 guidance was also much higher than expectations, further signifying a positive performance in the coming quarters. The stock opened at $14.0 and closed at $13.7, resulting in a 1.2% dip from the previous closing price of $13.9. Despite this, PERDOCEO EDUCATION still remains a strong stock in the market, and investors will be monitoring their performance closely in the coming quarters. Live Quote…

Analysis

At GoodWhale, we recently completed an analysis of PERDOCEO EDUCATION’s wellbeing. Our Risk Rating tool has scored the business and financial aspects of the company as a medium risk investment. This means that investors should take caution before investing in this company due to potential risks. We have also detected one risk warning in the income sheet of the company. If you are interested in getting more detailed information about this warning, don’t hesitate to register with us to check it out. More…

Summary

PERDOCEO EDUCATION has reported its fourth quarter earnings and financial guidance, showing strong performance in both. Earnings have beat estimates, while the FY23 guidance is higher than the consensus. Investors should note that the company boasts a strong balance sheet, healthy cash flow, and low current liabilities among its key financial metrics, and could be a profitable investment opportunity in the coming months. PERDOCEO EDUCATION’s recent success and solidity makes it an attractive buy for investors looking for both short-term gains and long-term growth.

Trending News 🌧️

TACTILE SYSTEMS TECHNOLOGY Inc. is set to report a record quarterly earning of 14 cents per share on February 21. This impressive report is part of an even more impressive rise in the company’s quarterly revenue, further solidifying the company’s strong business model. The earnings come at a time when the market is anticipating a strong quarter for health technology companies. TACTILE SYSTEMS TECHNOLOGY Inc. has been a mainstay in the market for many years now so the expectations are high that the company’s results will be just as impressive as its peers.

Moreover, the company has consistently out-performed its own earnings estimates in the past, making it one of the most reliable stocks in its sector. It remains to be seen whether TACTILE SYSTEMS TECHNOLOGY Inc. will live up to the market’s expectations and post record quarterly earnings on February 21. Analysts are confident that the company’s business model has enabled it to remain a top player in the health technology sector and that it will continue to be a reliable source for investors for many years to come.

Share Price

The news surrounding TACTILE SYSTEMS TECHNOLOGY Inc.’s upcoming earnings report on February 21st is largely positive. On Tuesday, the company’s stock opened at $14.9 and closed at $13.0, a 7.6% drop from the previous closing price of $14.0. These fluctuations indicate a volatile market for TACTILE SYSTEMS TECHNOLOGY, but investors are hopeful that the company’s quarterly earnings report will show a much more favorable outlook. Many anticipate that this report will be a record-breaking quarter for the company and will create a more stable stock outlook for TACTILE SYSTEMS TECHNOLOGY going forward. Live Quote…

Analysis

At GoodWhale, we have been analyzing the financials of TACTILE SYSTEMS TECHNOLOGY to assess the risk associated with the investment. After our thorough research and analysis, we have determined that TACTILE SYSTEMS TECHNOLOGY is a high risk investment in terms of financial and business aspects. Our research has identified four risk warnings in TACTILE SYSTEMS TECHNOLOGY’s balance sheet, cash flow statement, non-financial and financial journals. We invite you to register with us to take a deeper look into these risk warnings to determine how they may affect your potential investments. More…

Summary

Tactile Systems Technology Inc. is expecting to post record quarterly earnings on February 21st, which has generated mostly positive news sentiment. Despite the good news, the stock price of the company has moved down on the same day. This may be due to investors being uncertain on how the company will perform in the long-term, or it may be due to a lack of confidence in the short-term outlook of the company. It is important for investors to consider a range of factors when analyzing their investment in Tactile Systems Technology Inc., such as their past performance, current financials, and industry trends.

They should also assess the risks associated with investing in the company, such as potential changes in market conditions, government regulations, and competition. By considering all of these factors, investors can make an informed decision regarding investing in Tactile Systems Technology Inc. and hopefully achieve a successful return on their investment.

Trending News 🌧️

Spirit Realty Capital has announced a quarterly dividend of $0.663 per share, a 6.17% raise from their previous period. This dividend will be paid on April 14 to shareholders of record on March 31, and the ex-dividend date is March 30th. Seeking Alpha has outlined a comprehensive Dividend Scorecard, Yield Chart, and Dividend Growth in order to paint a clear picture of the company’s dividend policies. This dividend has become a reliable source of income for long-term investors in Spirit Realty Capital, as it has consistently grown over the last few years.

Analysts are predicting that this trend is likely to continue, providing investors with a steady and reliable source of income for the foreseeable future. For those looking to take advantage of the current dividend, now is the perfect time to invest in Spirit Realty Capital as the company continues to move forward in its industry.

Dividends

Spirit Realty Capital has just announced that it will be issuing a 6.17% quarterly dividend of $0.663/share. This remarkable dividend rate upholds the company’s notable history of paying regular dividends. Over the last three years, Spirit Realty Capital has issued an annual dividend per share worth 2.58 USD, 2.53 USD and 2.5 USD.

The dividend yields from 2020 to 2022 are estimated to be 5.81%, 5.45% and 6.75%, with an average dividend yield of 6%. With its impressive total return potential and attractive yield, Spirit Realty Capital is definitely worth considering for those seeking attractive dividend stocks.

Price History

On Thursday, SPIRIT REALTY CAPITAL declared a quarterly dividend of $0.663 per share, translating to an impressive 6.17% yield for shareholders. The news was well received by investors, as seen in the mostly positive media sentiment surrounding it. The stock opened that day at $43.3 and closed at $43.0, which was slightly lower than the prior closing price of $43.1. This decline, however, was minor and could be attributed to normal market volatility. Live Quote…

Analysis

At GoodWhale, we analyze SPIRIT REALTY CAPITAL’s financials to provide insights into their financial health. Our Risk Rating feature indicates that this is a relatively low-risk investment, given their financial and business aspects. We detected one risk warning in the company’s balance sheet; if you’re interested in learning more, register on goodwhale.com and take a look for yourself. GoodWhale can help provide an informed decision when it comes to investing in SPIRIT REALTY CAPITAL. More…

Summary

Spirit Realty Capital is a real estate investment trust that focuses primarily on the leasing and owning of single-tenant commercial real estate. The company recently announced a quarterly dividend payment of $0.663 per share, representing a 6.17% yield. Analyzing this company for potential investment is a complex process that needs to consider a variety of factors. These include the industry and market environment, Spirit Realty’s operating performance, the size and composition of the portfolio, its financial position, the dividend policy, and other relevant factors. It is important to understand that investing in this company involves considerable risk, as a downturn in the real estate market can have a dramatic impact on the value of the company’s portfolio.

Additionally, since most of its portfolio is comprised of single-tenant properties; changes in the tenant base could have a significant impact on the company’s future performance. Nevertheless, judging from the positive media sentiment and attractive dividend yield, Spirit Realty Capital may be an investment worth considering.

Trending News 🌧️

Quadrant Capital Group LLC has invested a total of $110,000 in Teledyne Technologies Incorporated. Teledyne Technologies Incorporated specializes in providing advanced and engineered systems that combine the power of a number of technology companies including defense, aerospace, industrial, medical, and energy markets. Their goal is to make sure their products are of the highest quality and they are constantly researching new technologies to provide their customers with innovative solutions. Teledyne Technologies Incorporated designs and manufactures systems for highly specialized applications such as communications, medical imaging, aerospace, and electronics systems. The $110,000 investment from Quadrant Capital Group LLC will help Teledyne Technologies Incorporated build on their existing technology and expand their research and development capabilities. It will also help them to create more innovative products that can be of use to a wider range of customers.

The investment will also provide them with the resources needed to stay competitive in the global markets and stay ahead of their competitors. It will also help them to increase their market share and further its business globally. This investment is a great opportunity for both Quadrant Capital Group LLC and Teledyne Technologies Incorporated. It marks an important step forward for both parties and will provide them with the resources needed to move forward in their respective industries. This is sure to help both companies remain competitive and continue to be leaders in the industry.

Price History

On Tuesday, Quadrant Capital Group LLC announced investment of $110,000 in Teledyne Technologies Incorporated (TELEDYNE TECHNOLOGIES). This was reflected in the stock market where TELEDYNE TECHNOLOGIES opened at $436.7 and closed at $428.9, down by 2.3% from prior closing price of 439.0. This investment is a part of an ongoing trend of the company’s expanding portfolio, which includes long-term investments, equities, and other securities. Although the market reacted negatively, investors are hoping for a positive return in the future with this fresh capital injection. Live Quote…

Analysis

At GoodWhale, we have conducted a thorough analysis of TELEDYNE TECHNOLOGIES’s fundamentals to get an estimate of its intrinsic value. After carefully calculating its financials, our proprietary Valuation Line indicates that the intrinsic value of TELEDYNE TECHNOLOGIES’s share is approximately $468.4. Currently, the stock is trading at $428.9, thus making it an attractive investment option given the 8.4% discount that investors are getting. More…

Summary

Quadrant Capital Group LLC recently invested $110,000 in Teledyne Technologies Incorporated. Teledyne Technologies is a diversified industrial company that provides sophisticated instrumentation, digital imaging, aerospace and defense electronics, and engineered systems. The investment from Quadrant Capital indicates a positive sentiment on Teledyne’s performance. Analysts are optimistic about Teledyne’s future with strong sales across its key products and services. The company has a wide portfolio of market-leading products and services that can support sustained growth. In recent years, the company has implemented strategic acquisitions, which have helped drive additional revenues. Teledyne is well-positioned to capitalize on the long-term trend of rising demand in its target end markets.

Additionally, the company has streamlined its operations to be nimble and responsive to customer needs. With all indicators pointing to a positive future, Quadrant Capital’s investment is a solid move.

Trending News 🌧️

Iron Mountain has recently declared a quarterly dividend of $0.6185 per share. This dividend is in line with previous dividend payments and will be paid out to shareholders of record as of March 15th, with an ex-dividend date of March 14th. Therefore, investors will have the opportunity to purchase Iron Mountain shares prior to the dividend payment date in order to receive the dividend. The dividend that Iron Mountain is offering has a current yield of 4.89%, making it one of the more attractive investments for those looking for a reliable dividend-paying stock. Investors can also find further details regarding Iron Mountain’s dividend scorecard, yield chart, and dividend growth on the Seeking Alpha website.

This provides potential investors with a better understanding of the stock and its dividends. Overall, Iron Mountain’s quarterly dividend of $0.6185 per share and its yield of 4.89% make it an attractive investment for those looking for a reliable dividend-paying stock. Therefore, investors should consider taking advantage of this opportunity before the ex-dividend date of March 14th.

Dividends

Iron Mountain, a provider of storage and information and management services, has announced a quarterly dividend of $0.6185/Share, yielding 4.89%. Over the last three years, IRON MOUNTAIN has issued an annual dividend per share of 2.47 USD, and its dividend yields from 2020 to 2022 are 5.04%, 5.94%, 8.64%, respectively, with an average dividend yield of 6.54%. This makes it attractive to investors looking for dividend stocks that offer consistent returns. The company’s consistent dividends combined with its extensive suite of services make IRON MOUNTAIN an intriguing option for investors seeking steady dividend returns with potential for capital appreciation.

Stock Price

Iron Mountain Incorporated recently declared a regular quarterly dividend of $0.6185 per share, resulting in a yield of 4.89%. The news has mostly been met with mixed reactions so far. On Thursday, IRON MOUNTAIN’s stock opened at $52.1 per share and closed at $52.8, up by 4.2% from its previous closing price of $50.6.

This results in a total return of over 10.4% for the year. Investors appear to be responding positively to the news and are expecting to see further gains in the near future. Live Quote…

Analysis

At GoodWhale, we recently completed an analysis of IRON MOUNTAIN’s wellbeing. Based on our Risk Rating, IRON MOUNTAIN is a low risk investment in terms of financial and business aspects. Our analysis included an assessment of the company’s overall financials and operations, and a review of the management’s strategy and execution. We are confident that currently IRON MOUNTAIN presents a relatively low risk investment opportunity for investors. However, it is important to do your own due diligence and regularly review potential risks of any investments you decide to make. To make this easier for you, GoodWhale is thrilled to provide services that can help with this process. If you are interested in conducting an in-depth analysis of IRON MOUNTAIN’s business and financial areas with potential risks, why not register with us today at goodwhale.com? We look forward to helping you get the most out of your investments. More…

Summary

Iron Mountain Incorporated recently declared a quarterly dividend of $0.6185 per share, with a yield of 4.89%. The investor response to this news has been mixed so far. However, the stock price has increased on the same day that the dividend was announced, indicating a potentially positive outlook for investment in Iron Mountain. Investors should closely monitor market news surrounding this company for the latest updates on dividend rate and yield, as well as any other information that can influence their investment decisions.

Trending News 🌧️

Nellore Capital Management LLC recently made the news when it announced a reduction in its stock holdings in Coupang, Inc. This marks a significant move for the company as it seeks to adjust its investment portfolio and reduce its risk profile. Coupang is a leading South Korean e-commerce company and the stakes were significantly reduced after Nellore Capital Management LLC evaluated the overall market conditions. The company is known for its ambitious plans to expand rapidly in the global market and has seen tremendous success so far. The decision to reduce the stake comes at a crucial time as the company is seeking to focus on long-term growth while also protecting its short-term gains. Nellore Capital Management LLC has long been a strong supporter of Coupang and will remain committed to its success.

The company is confident that the changes it has made will benefit Coupang in the long run. Coupang’s stock prices have remained relatively stable despite the reduction in holdings. Analysts believe that this signals a positive outlook for the company and that its future prospects are strong. Nellore Capital Management LLC is confident that its decision will help Coupang continue to grow and achieve success.

Stock Price

On Tuesday, Nellore Capital Management LLC announced they had reduced their stake in Coupang, Inc. This news has been met with mostly negative sentiment. On the same day, Coupang, Inc.’s stock opened at $15.5 and closed at $14.9, resulting in a 5.6% drop from the previous closing price of 15.8. This marked the lowest close in the past three weeks. Analysts are now questioning whether there is further downside for Coupang, Inc.’s stock price. Live Quote…

Analysis

At GoodWhale, we recently conducted an analysis of COUPANG’s wellbeing. After an in-depth examination of the financial and business aspects of the company, our Risk Rating gave COUPANG a “medium risk” score. In terms of cash flow, we detected one risk warning, which is available to registered GoodWhale users. If you haven’t already done so, we recommend becoming a registered user of GoodWhale to understand COUPANG’s potential better. Our analysis is designed to provide you with the most accurate assessment of COUPANG’s financial security and help you make an informed decision before investing. More…

Summary

Investors of Coupang, Inc. should be aware that Nellore Capital Management LLC recently reduced their stake in the company. Following this news, the stock price dropped, indicating a negative market sentiment towards the company. It is important that investors analyze the company’s financial metrics and other information before making any decisions.

Analyzing the financial conditions, management quality, competitive advantages, and other key metrics can give investors a better idea of whether they should invest in the company or not. Furthermore, investors should also be mindful of current market conditions to gain an understanding of the outlook for this company and the industry as a whole.

Trending News 🌧️

TransUnion recently declared a quarterly dividend of $0.105 per share, offering a dividend yield of 0.63%. This dividend payment is in keeping with prior quarterly payments and will be paid out on March 24 to shareholders of record on March 9. The ex-dividend date for this payment is March 8. TransUnion’s dividend scorecard, yield chart, and dividend growth information can be obtained through the Seeking Alpha website. This provides investors with a valuable resource to ascertain the relative performance of the company and its potential as an investment.

Furthermore, TransUnion’s dividend payment affords investors with a source of steady income from their investment in the company. The payment of dividends demonstrates TransUnion’s commitment to returning value to shareholders, and the quarterly dividend payment is a tangible demonstration of that commitment. Investors interested in learning more about TransUnion’s dividend decision-making process and performance can find more information through the Seeking Alpha website.

Dividends

TransUnion, a leading global Credit Bureau, recently declared a quarterly dividend of $0.105 per share, equating to an annual dividend yield of 0.63%. This marks an increase on the prior three year’s dividends which stood at $0.4 per share every year. The dividend yields from 2020 to 2022 have been consistent at 0.52%, producing an overall average dividend yield of 0.52%. This declaration serves as a demonstration of the financial strength of the company, and further affirms TransUnion’s commitment to developing long-term relationships with shareholders.

Share Price

On Thursday, TRANSUNION declared a quarterly dividend of $0.105 per share, resulting in an annualized yield of 0.63%. This dividend will be payable on February 28th to shareholders of record at the close of business on February 14th. Following the news, TRANSUNION stock opened at $67.2 and closed at $66.4, a drop of 0.5% from its last closing price of $66.7. Live Quote…

Analysis

As GoodWhale conducted a wellbeing analysis for TRANSUNION, we can see from the Star Chart that TRANSUNION is classified as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. This may be of interest to investors looking for strong long-term performance. Upon further investigation into the company’s financial health, we found TRANSUNION to have a high health score of 8/10 with regard to its cashflows and debt, indicating that the company is capable of sustaining operations in times of crisis. Specifically, TRANSUNION is strong in dividend, growth, and profitability, though it is weak in terms of asset. Therefore, considering its overall financial health, TRANSUNION may be of particular interest to investors who value financial stability and dependability. More…

Summary

TransUnion, a leading financial technology and risk information solutions provider, recently announced a quarterly dividend of $0.105 per share. This dividend will produce a yield of 0.63%. Investors should consider TransUnion, as it could be an attractive addition to any long-term, dividend-growth portfolio. The company’s strong financial performance, with consistent revenue growth and increased profits, is a positive indicator of its ability to pay out dividends.

TransUnion has also focused on cost and operational efficiency, which has allowed them to increase their cash position that also supports their dividend payments. Overall, TransUnion is a great opportunity for investors who are looking for a steady income stream from their investments.

Trending News 🌧️

Mary Sue Robinson, a long-time employee at Scholastic Corporation, has recently been promoted to a higher position within the company. This move strengthens her involvement with the corporation and allows her to contribute towards its success. As the newly appointed Investment Director, Ms. Robinson is responsible for overseeing all of the company’s investments and ensuring that the decisions are made in the best interest of the organization and its shareholders. She will also be in charge of developing new strategies to optimize returns on investments. In her new capacity, she will now be responsible for ensuring that the company’s investment portfolio grows and performs optimally, allowing it to remain competitive in the ever-changing market.

The move to promote Mary Sue Robinson to a higher position is a testament to her expertise and commitment to Scholastic Corporation. She has been an invaluable asset to the organization and will continue to be a strong leader in her new role. With her vast knowledge and experience within the company, she is well-equipped to strengthen investment in Scholastic Corporation and help it reach its goals.

Market Price

On Friday, Mary Sue Robinson made a strong investment in Scholastic Corporation. Her decision was marked by the opening of SCHOLASTIC CORPORATION stock at $45.6 and closing at $45.8, representing a 1.0% increase from its last closing price of $45.4. This move is indicative of Robinson’s confidence in the company’s ability to continue to deliver successful and profitable results for investors. It appears clear that Scholastic Corporation will continue to benefit from Robinson’s support as she seeks to further strengthen her commitment to the corporation. Live Quote…

Analysis

At GoodWhale, we strive to provide the most accurate analysis of SCHOLASTIC CORPORATION to our clients. After analyzing the fundamentals of SCHOLASTIC CORPORATION, we have calculated its intrinsic value to be around $39.2 through our proprietary Valuation Line. This means that currently, the stock is being traded in the market at a price of $45.8, which is a fair price but is still overvalued by 16.9%. More…

Summary

Mary Sue Robinson has recently made a notable investment in Scholastic Corporation. The company has managed to sustain net income growth of 6.5% over the last five years, and is expected to continue to show further growth in the near future. With a commitment to quality and customer service, Scholastic Corporation is an attractive stock choice for investors.

Trending News 🌧️

Open Lending Corporation recently reported their fourth quarter results, to the disappointment of investors. The company reported a GAAP EPS of -$0.03, missing the consensus by $0.13. To make matters worse, their FQ1 revenue guidance of $30 – $34 million is well below the consensus of $37.96M. This news has caused Open Lending Corporation’s stock to drop significantly in value and sent shockwaves throughout the financial sector.

Many are concerned about what this could mean for the company’s future prospects and profitability going forward. Investors remain cautiously optimistic as they wait for further details from the company in the coming months.

Market Price

News coverage of Open Lending Corporation has been mostly negative after the company released disappointing earnings results in the fourth quarter and a guidance that fell below consensus estimates. On Thursday, OPEN LENDING’s stock opened at $8.5 and closed at $8.6, up by 2.6% from its prior closing price of 8.4 despite the bleak news. However, there remains the possibility that further negative news may cause the stock to tumble in the near future. Live Quote…

Analysis

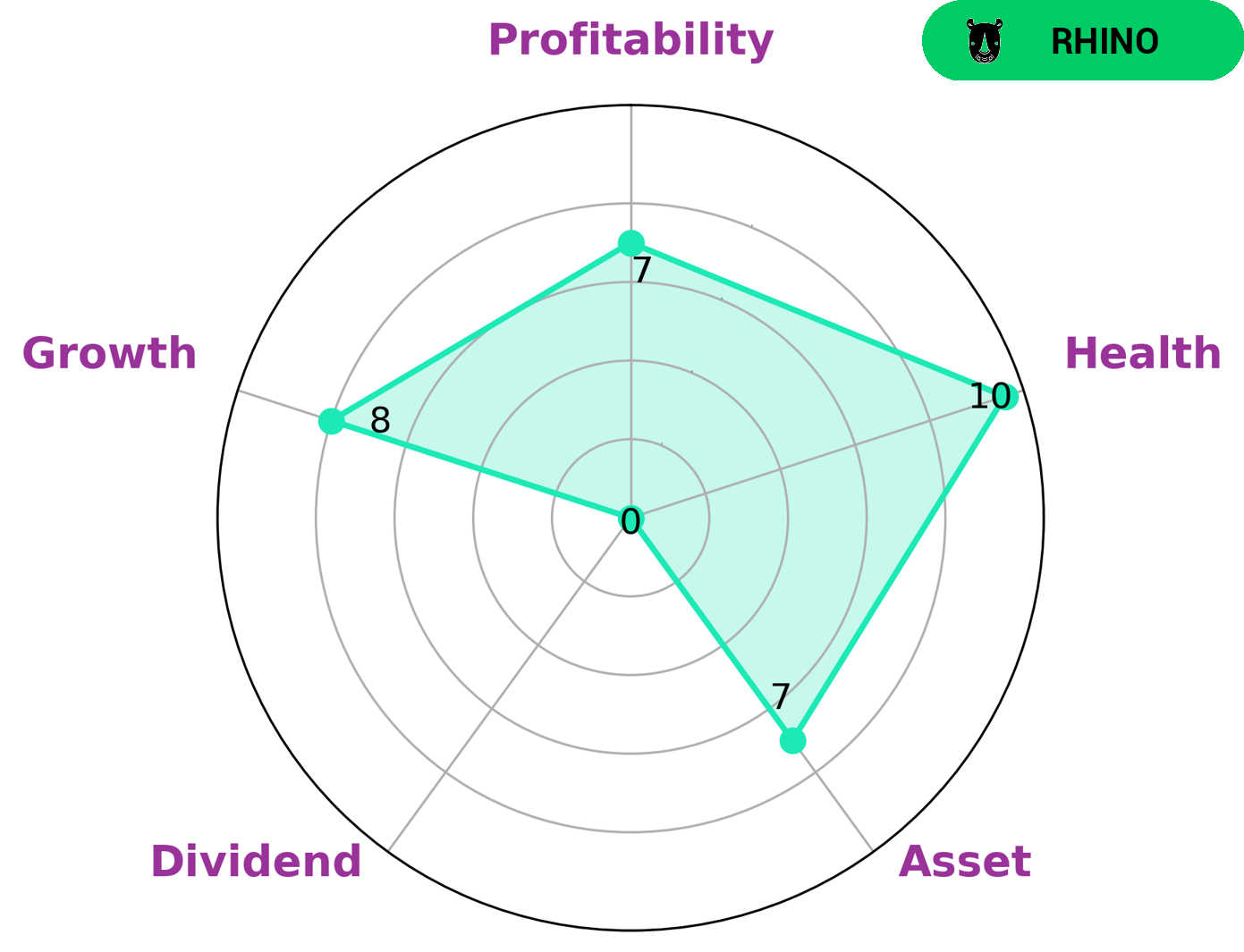

At GoodWhale, we have conducted a thorough analysis of OPEN LENDING‘s wellbeing. Our Star Chart showed that OPEN LENDING is strong in asset, growth, and profitability, but relatively weak in dividend. In addition, OPEN LENDING has a high health score of 10/10 when it comes to cash flows and debt, indicating that it is capable to pay off the debt and fund future operations. From our analysis, we have classified OPEN LENDING as ‘rhino’, meaning it has achieved moderate revenue or earnings growth. Investors who may be interested in such a company could include those who value capital appreciation, as well as those who are looking for low-risk high-return investments. They should consider OPEN LENDING’s strong asset, growth, and profitability, as well as its ability to provide stable returns and cover its debts. Furthermore, since the company has achieved moderate revenue or earnings growth, the investor should look at its potential for further growth in the future. More…

Peers

It is a leading force in the industry alongside competitors such as Oportun Financial Corp, Medallion Financial Corp, and CreditAccess Grameen Ltd. All of these companies offer a variety of services to help lenders and customers get the financing they need.

– Oportun Financial Corp ($NASDAQ:OPRT)

Oportun Financial Corp is a consumer financial services company that specializes in providing responsible credit to individuals and their families who lack access to traditional banking or other forms of credit. As of 2022, the company has a market capitalization of 160.98M, indicating that it is a moderately sized company. The return on equity (ROE) of -4.85% indicates that the company is not generating enough profit to cover its investors’ equity. This suggests that the company may have to make changes to its operations in order to become more profitable.

– Medallion Financial Corp ($NASDAQ:MFIN)

Medallion Financial Corp is a specialty finance company that specializes in consumer and commercial loans. The company’s market capitalization is 156.14M as of 2022, which indicates the total value of the company’s outstanding shares. Additionally, Medallion Financial Corp has a Return on Equity of 16.26%, which is an indicator of the company’s profitability. Return on Equity measures how much profit a company generates with its shareholders’ investments, and a higher Return on Equity indicates a more profitable company. Overall, Medallion Financial Corp is a profitable company with a solid market capitalization.

– CreditAccess Grameen Ltd ($BSE:541770)

Access Grameen Ltd is a leading microfinance institution based in India. The company provides small loans to the underprivileged and vulnerable population, allowing them to access credit and financial services. As of 2022, Access Grameen Ltd has a market capitalization of 141.42B and a Return on Equity of 11.71%. Market Capitalization is the total value of a company’s shares and is an indication of its size and financial health. Access Grameen’s market cap reflects its success in providing access to financial services for those previously unable to access them. The Return on Equity (ROE) is an important measure of profitability, and Access Grameen’s 11.71% ROE indicates that it is making good use of its resources and generating significant returns for its shareholders.

Summary

Open Lending, a provider of data-driven solutions for consumer lending, recently released its fourth quarter earnings results that fell below market expectations. The lower-than-expected results has led to a decline in the stock price of Open Lending and investors remain largely negative on the stock, as indicated by the coverage from multiple media outlets. Despite the weakened outlook for the company, analysts remain optimistic about Open Lending’s prospects as its products have potential to become a market leader within consumer lending. Going forward, investors should keep a close eye on the company’s ability to execute on their plans and meet their revised guidance expectations.

Recent Posts