Navient Corporation Posts Impressive Earnings with Quarter Over Quarter Increase of 30%

April 27, 2023

Trending News ☀️

The company’s Non-GAAP earnings per share of $1.06 exceeded expectations by $0.24 while its revenue of $322M was higher than the expected $95.67M. This comes as great news for those who have invested in the company or its stock, as the quarterly figures show a consistent increase in the performance of the organization. Navient Corporation ($NASDAQ:NAVI) is a Delaware-based financial services company that provides asset management and business processing solutions. It helps clients manage their student loans, mortgages and other financial commitments, providing comprehensive guidance and advice to help consumers get the most out of their loans. The company’s portfolio of services includes loan servicing, loan origination, loan consolidation, loan rehabilitation and debt collection.

It has operations in the United States, Puerto Rico and the United Kingdom. With its strong market presence and ever-growing portfolio of services, the company is well-positioned to continue to thrive in the years to come. Investors can be confident that Navient Corporation is an organization with staying power, making it a valuable asset for investors looking for long-term growth potential.

Price History

This significant increase caused the company’s stock to open at $16.0 and close at $16.4, up by 2.7% from the prior closing price of $16.0. The company’s strong QoQ performance has put it in a great position for long-term success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Navient Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.74k | 645 | 39.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Navient Corporation. More…

| Operations | Investing | Financing |

| 305 | 10.59k | -9.66k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Navient Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 70.8k | 67.82k | 21.92 |

Key Ratios Snapshot

Some of the financial key ratios for Navient Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.5% | – | – |

| FCF Margin | ROE | ROA |

| 17.6% | 17.4% | 0.7% |

Analysis

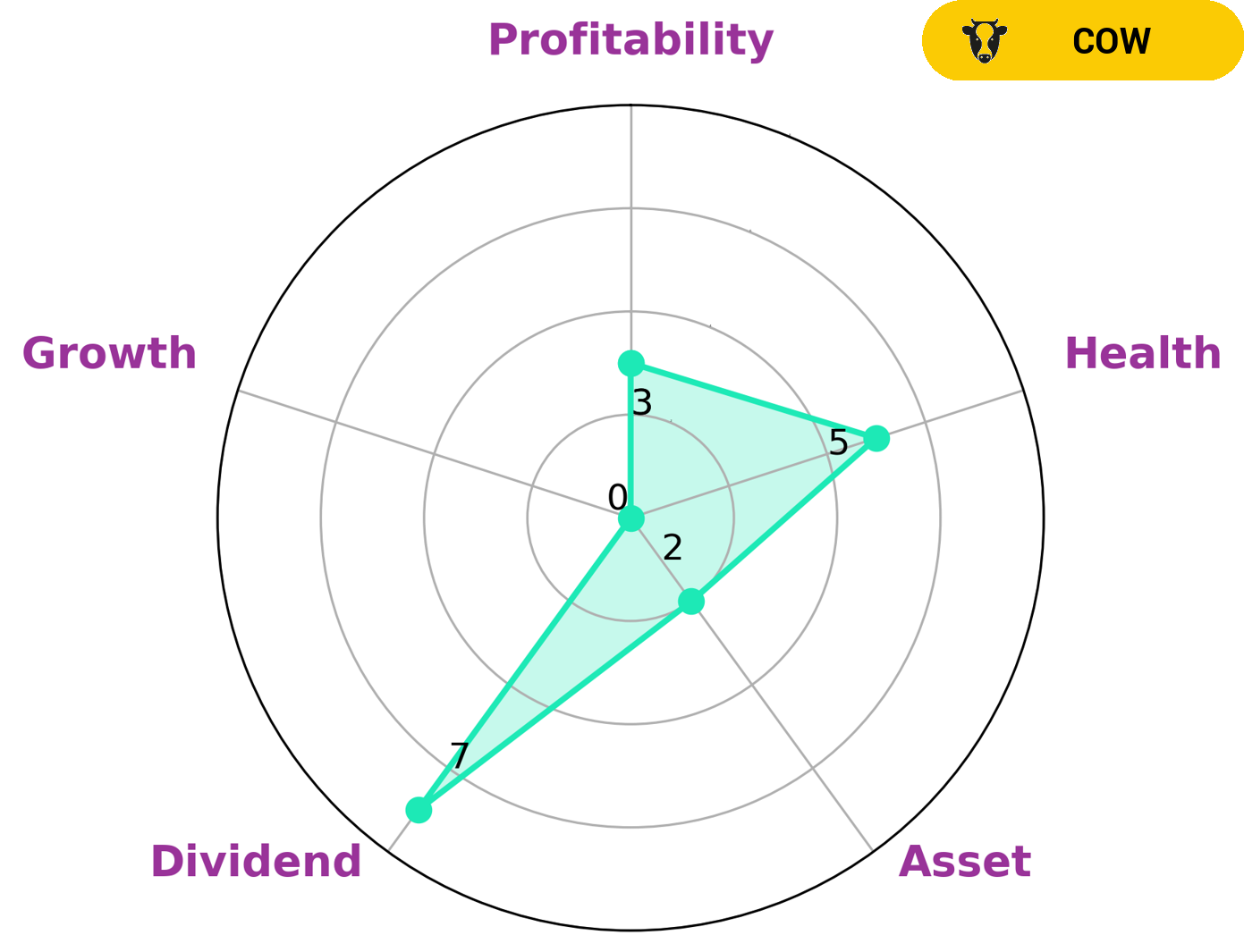

As GoodWhale’s analysis of NAVIENT CORPORATION‘s financials has revealed, the company stands out for its strength in dividend payments. However, it appears to be weak in asset and growth, as well as profitability. Therefore, we have classified NAVIENT CORPORATION as a ‘cow’, which we have concluded to be a type of company with the track record of paying out consistent and sustainable dividends. This makes NAVIENT CORPORATION an attractive option for investors who are looking for steady returns from dividend payments. Furthermore, NAVIENT CORPORATION has an intermediate health score of 5/10, suggesting that it has the potential to pay off its debt and fund future operations. More…

Peers

It is a for-profit company and one of the four largest providers of student loans in the United States. The other three companies are SLM Corp, Nelnet Inc, and Capital Trade Links Ltd.

– SLM Corp ($NASDAQ:SLM)

SLM Corp is a financial services company that specializes in student loan management and servicing. The company has a market cap of $3.88 billion as of 2022. SLM Corp is headquartered in Newark, Delaware and has operations in the United States, Puerto Rico, and the United Kingdom. The company services over $300 billion in student loans for over 10 million borrowers.

– Nelnet Inc ($NYSE:NNI)

Nelnet is a publicly traded student loan servicing company headquartered in Lincoln, Nebraska. Nelnet serviced $247 billion in student loans as of December 31, 2019. It is the second largest student loan servicer in the United States behind Navient. The company also provides Tuition Payment Plans and Guaranteed Asset Protection insurance.

– Capital Trade Links Ltd ($BSE:538476)

As of 2022, Capital Trade Links Ltd has a market cap of 833.6M and a ROE of 4.14%. The company is engaged in the business of providing trade financing and support services to clients in the international trade market. It offers a range of services including trade financing, export financing, import financing, and risk management. The company has a strong focus on providing quality services to its clients and has a reputation for being a reliable and trustworthy partner in the international trade market.

Summary

Navient Corporation is a financial services company focused on servicing and managing consumer loans. Through their strong financial performance, the company demonstrated their capability in providing quality services and meeting customer needs. This has generated confidence among investors and has led to an increase in stock prices. Navient’s strong fundamentals and outlook make it an attractive investment for those seeking long-term gains.

Recent Posts