Navient Announces Plans for Diversified Investment Portfolio

April 22, 2023

Trending News 🌥️

Navient Corporation ($NASDAQ:NAVI), a financial services company that provides education loan management and asset management services, recently announced plans for a diversified investment portfolio. On Thursday, Navient submitted a registration statement to the US Securities and Exchange Commission regarding the potential sale of different types of securities on an ongoing basis. This announcement comes as Navient continues to strategically position itself as a leader in providing services to the student loan market. As part of their investment portfolio, Navient is looking to issue common stock and warrants, bank debt securities, debt securities, and other equity securities. Proceeds from these investments would be used for working capital, investments, acquisitions and other general corporate purposes. The company plans to use these funds to further develop their services, expand their reach, and capitalize on the growing demand for student loan management services.

In addition to this announcement, Navient has been actively building relationships with the government and private institutions to explore opportunities for additional business partnerships. This move reflects Navient’s commitment to meeting the needs of customers while also delivering on their promise of providing top-notch service. Through its diversified investment portfolio, Navient aims to expand its reach, increase its returns and create long-term value for its shareholders. With such an ambitious plan in place, it is likely that Navient will continue to be a leader in the student loan servicing industry in the years to come.

Stock Price

On Friday, NAVIENT CORPORATION announced plans to diversify its investment portfolio. The company’s stock opened at $16.4 and closed at $16.5, a rise of 0.6% from the previous closing price of $16.4. NAVIENT CORPORATION plans to use this increase in stock value to diversify its investments into different sectors such as technology, healthcare, and consumer goods. The announcement comes as NAVIENT CORPORATION seeks to further diversify its portfolio in order to mitigate risk and maximize returns. The company has identified a set of attractive investments and is actively seeking investment opportunities in these sectors.

NAVIENT CORPORATION believes that diversifying its investments will help it better manage its portfolio and increase its overall returns. The announcement has been met with positive sentiment from investors, who are hopeful that NAVIENT CORPORATION’s diversification plans will bring positive returns in the long-term. NAVIENT CORPORATION’s decision to diversify its portfolio is a prudent move that will ensure the company remains competitive in the ever-changing financial markets. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Navient Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.74k | 645 | 39.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Navient Corporation. More…

| Operations | Investing | Financing |

| 305 | 10.59k | -9.66k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Navient Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 70.8k | 67.82k | 21.92 |

Key Ratios Snapshot

Some of the financial key ratios for Navient Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.5% | – | – |

| FCF Margin | ROE | ROA |

| 17.6% | 17.4% | 0.7% |

Analysis

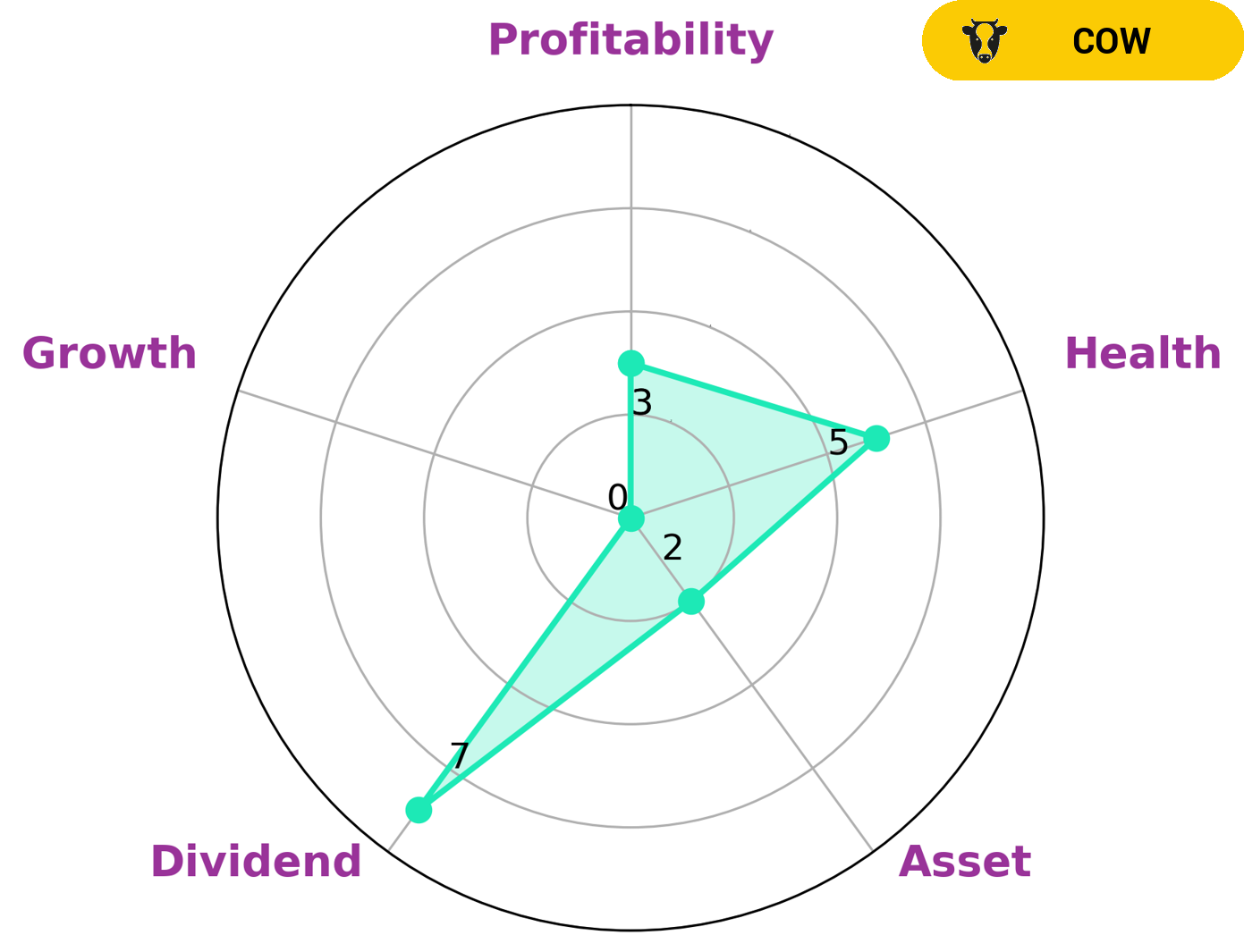

GoodWhale conducted an analysis of NAVIENT CORPORATION‘s wellbeing, with the results presented in our Star Chart. Based on our research, we classified NAVIENT CORPORATION as a ‘cow’, meaning that it has the track record of paying out consistent and sustainable dividends. Investors looking for reliable dividend income may be very interested in the company. NAVIENT CORPORATION is strong in dividend, but weak in asset, growth, and profitability. The company has an intermediate health score of 5/10 considering its cashflows and debt. This suggests NAVIENT CORPORATION might be able to pay off its debt and fund future operations. More…

Peers

It is a for-profit company and one of the four largest providers of student loans in the United States. The other three companies are SLM Corp, Nelnet Inc, and Capital Trade Links Ltd.

– SLM Corp ($NASDAQ:SLM)

SLM Corp is a financial services company that specializes in student loan management and servicing. The company has a market cap of $3.88 billion as of 2022. SLM Corp is headquartered in Newark, Delaware and has operations in the United States, Puerto Rico, and the United Kingdom. The company services over $300 billion in student loans for over 10 million borrowers.

– Nelnet Inc ($NYSE:NNI)

Nelnet is a publicly traded student loan servicing company headquartered in Lincoln, Nebraska. Nelnet serviced $247 billion in student loans as of December 31, 2019. It is the second largest student loan servicer in the United States behind Navient. The company also provides Tuition Payment Plans and Guaranteed Asset Protection insurance.

– Capital Trade Links Ltd ($BSE:538476)

As of 2022, Capital Trade Links Ltd has a market cap of 833.6M and a ROE of 4.14%. The company is engaged in the business of providing trade financing and support services to clients in the international trade market. It offers a range of services including trade financing, export financing, import financing, and risk management. The company has a strong focus on providing quality services to its clients and has a reputation for being a reliable and trustworthy partner in the international trade market.

Summary

Navient Corporation is a publicly traded company that provides loan management, servicing, and asset recovery services to the education, healthcare, and government industries. Investors interested in NAVIENT’s stock should conduct a thorough analysis of the company’s financials, competitive landscape, and management team, among other factors. NAVIENT has a high debt-to-equity ratio and the company’s financial performance has been mixed over the last few years. NAVIENT faces strong competition from several large companies, and its stock price has been volatile.

Investors should consider NAVIENT’s dividend yield and dividend track record when evaluating its stock as a potential investment. NAVIENT has a long history of dividend payments, though it has suspended payments over the last couple of years. By evaluating NAVIENT’s financials, competitive advantage, and dividend history, investors can make an informed decision when considering investing in NAVIENT’s stock.

Recent Posts