FIRSTCASH HOLDINGS Reports Strong Second Quarter Results for FY2023

July 29, 2023

☀️Earnings Overview

FIRSTCASH HOLDINGS ($NASDAQ:FCFS) reported their financial results for the second quarter of FY2023, which ended on June 30 2023, on July 27 2023. The total revenue for the quarter was USD 750.6 million, a 15.9% increase compared to the same period of the previous year. However, net income for the quarter was USD 45.2 million, which was a 47.5% decrease year over year.

Price History

The stock opened at $100.0 and closed at $97.6, representing a 0.3% increase from the previous closing price of 97.4. This marks the sixth consecutive quarter of positive growth for the company, demonstrating a strong long-term trend. This increase in revenue and income was largely driven by the successful implementation of the company’s new business initiatives. These initiatives included further expanding its customer base through the adoption of new technologies, such as contactless payment methods.

This figure is a result of the company’s commitment to growth and expansion through the acquisition of new properties and businesses. The results were met with enthusiasm from investors, with the stock closing at a 0.3% increase from the previous day’s closing price. This is a testament to the confidence that investors have in the company’s long-term performance and prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Firstcash Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.93k | 231.95 | 9.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Firstcash Holdings. More…

| Operations | Investing | Financing |

| 459.75 | -336.44 | -139.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Firstcash Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.96k | 2.06k | 41.71 |

Key Ratios Snapshot

Some of the financial key ratios for Firstcash Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.1% | 11.2% | 13.0% |

| FCF Margin | ROE | ROA |

| 14.2% | 12.6% | 6.0% |

Analysis

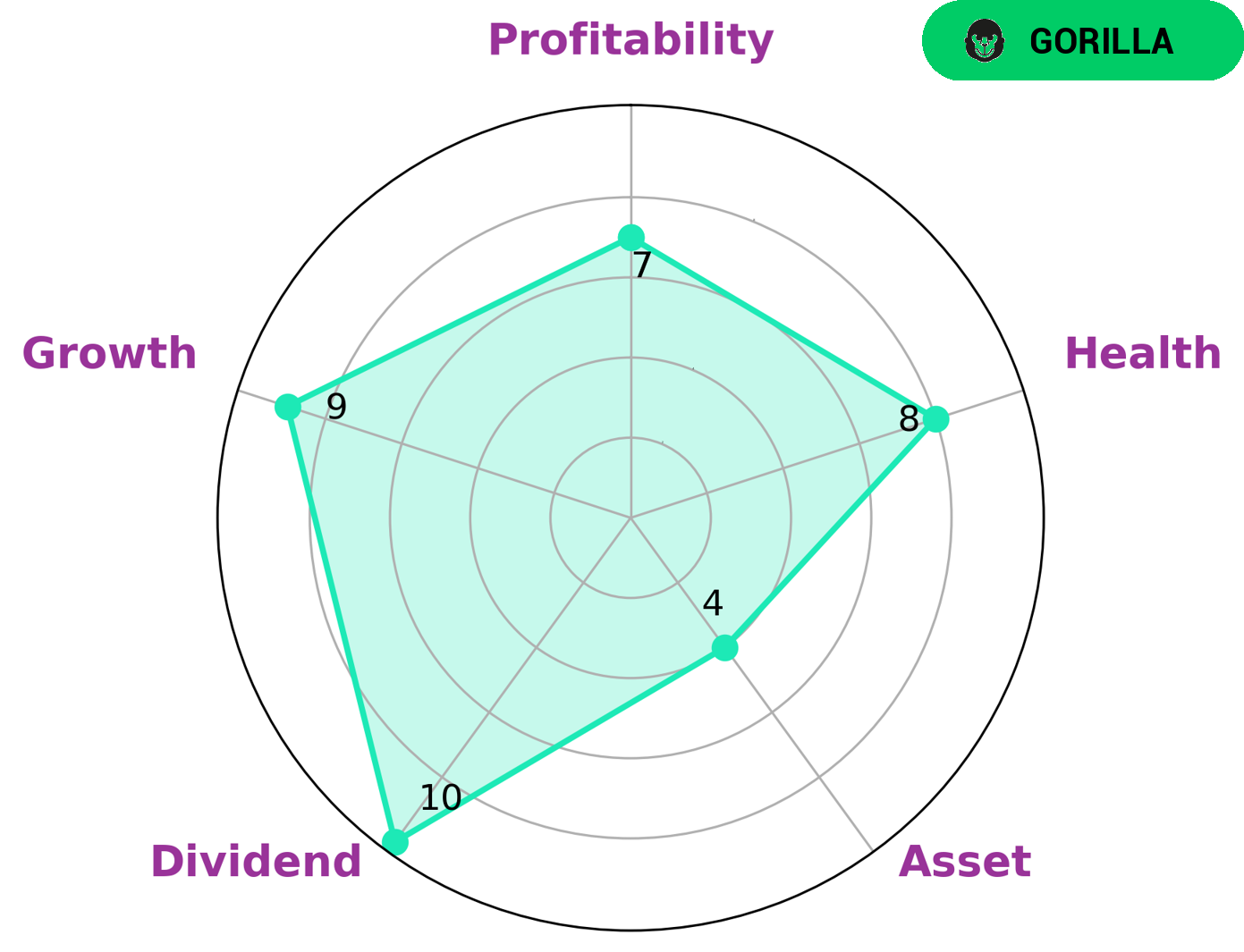

At GoodWhale, we analyzed the financials of FIRSTCASH HOLDINGS and found that it has a high health score of 9/10 with regard to its cashflows and debt, indicating that it is capable to sustain future operations in times of crisis. In addition, FIRSTCASH HOLDINGS has strong performance in dividend, growth, and profitability, along with medium performance in asset. Based on its performance, we classified FIRSTCASH HOLDINGS as a ‘gorilla’, a type of company which achieved stable and high revenue or earning growth due to its strong competitive advantage. As such a company, FIRSTCASH HOLDINGS may be of interest to investors who are looking for stable and growing returns in the long-term. Its strong financial position means that it should be able to maintain consistent dividends or capital appreciation over time. Investors who are interested in investing in companies with competitive advantages could also benefit from investing in FIRSTCASH HOLDINGS. More…

Peers

The company offers a variety of cash advance products and services to its customers. FirstCash Holdings Inc competes with a number of other companies in the cash advance industry, including Regional Management Corp, Ceejay Finance Ltd, Neil Industries Ltd.

– Regional Management Corp ($NYSE:RM)

Regional Management Corp. is a specialty finance company that provides personal loans, automobile loans, and credit solutions. The company operates in the United States and Puerto Rico. Regional Management Corp. was founded in 1987 and is headquartered in Greenville, South Carolina.

– Ceejay Finance Ltd ($BSE:530789)

Ceejay Finance Ltd is a company that provides financial services. The company has a market capitalization of $355.18 million as of 2022 and a return on equity of 9.78%. The company provides services such as loans, credit cards, and insurance. The company also provides investment services.

– Neil Industries Ltd ($BSE:539016)

Nirali Industries Ltd is an Indian company that manufactures and markets stainless steel products. The company has a market cap of 138.83M as of 2022 and a Return on Equity of -2.46%. Nirali Industries Ltd manufactures a range of stainless steel products including kitchenware, utensils, and appliances. The company has a strong presence in the Indian market and is expanding its operations into other markets such as the Middle East and Africa.

Summary

Investors may want to take a closer look at FIRSTCASH HOLDINGS after the company reported their second quarter financial results for FY2023, ending June 30 2023. Total revenue for the quarter increased 15.9% compared to the same quarter of the previous year, ending at USD 750.6 million. Net income for the quarter, however, decreased 47.5%, ending at USD 45.2 million. Investors should be cautious when considering investing in FIRSTCASH HOLDINGS as these results are not promising, and a closer analysis of the company’s financials is needed before making any decisions.

Recent Posts