Commerce Bank Cuts 24.1% of Liberty Broadband Holdings in Q4

May 30, 2023

☀️Trending News

Liberty Financial ($ASX:LFG) is a publicly-traded company specializing in investments, with a primary focus on telecom, cable, and media. In the fourth quarter of the year, Missouri-based financial institution Commerce Bank revealed that it had decreased its ownership of Liberty Broadband shares by 24.1%. This represents a significant drop in the bank’s investment in the company. While the exact reasons for this decline are unknown, it is likely due to the current economic climate. With companies facing uncertain times due to the pandemic, it’s possible that Commerce Bank felt it necessary to reduce its exposure to Liberty Financial and its stocks. This news is sure to be worrying for investors, as it indicates a lack of confidence in Liberty Financial from one of its primary supporters.

However, it’s important to remember that this decrease does not necessarily reflect a lack of faith in the company’s future prospects. It may simply be an attempt to minimize risk during turbulent times. As such, it is recommended that those interested in Liberty Financial keep an eye on its performance and make decisions based on their own personal investment goals.

Analysis

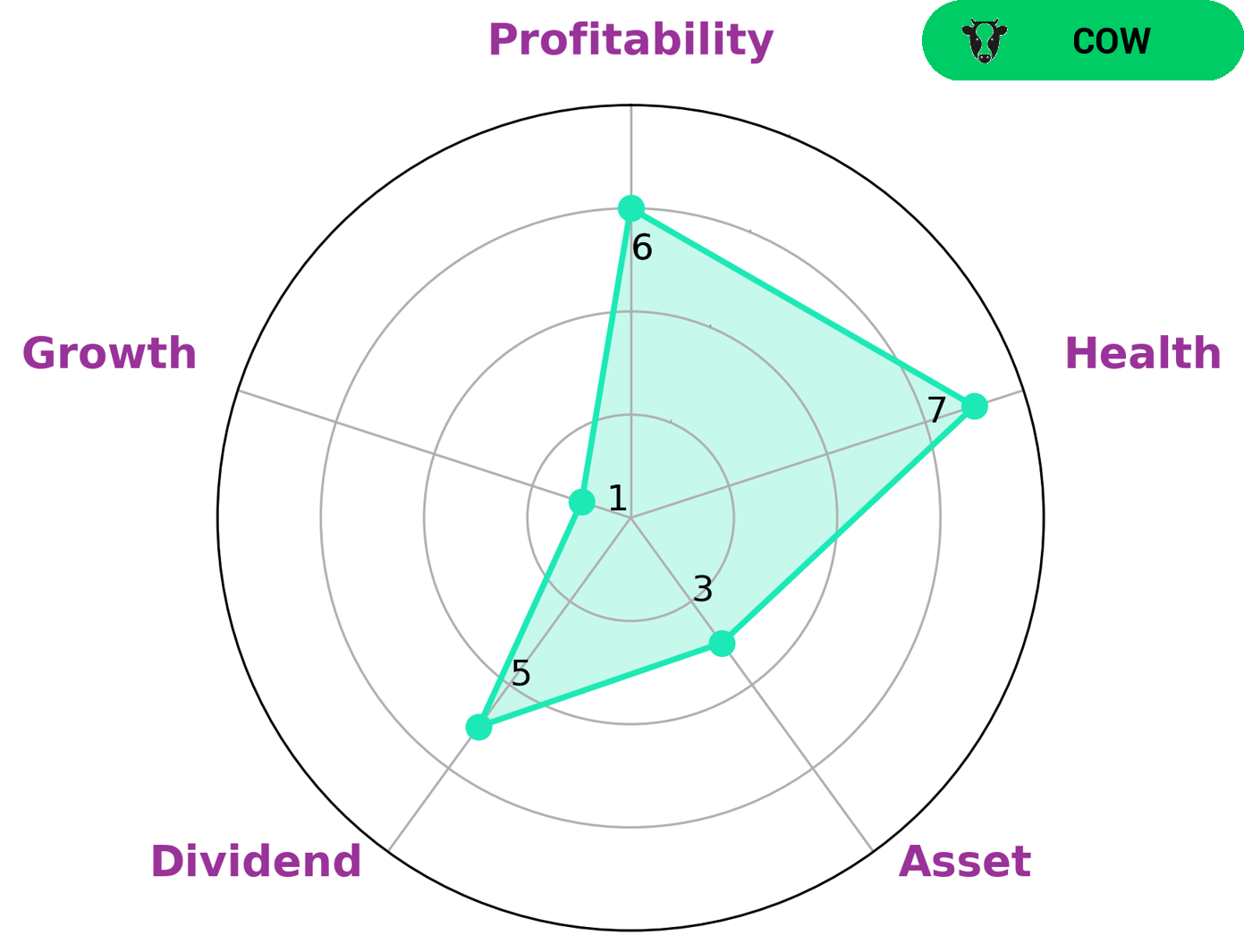

At GoodWhale, we have conducted a fundamental analysis of LIBERTY FINANCIAL. Our Star Chart classification has categorized this company as a ‘cow’, which implies that it has a track record of providing consistent and sustainable dividends. This type of company is likely to be of interest to investors seeking a reliable source of income throughout the investment life cycle. When assessing LIBERTY FINANCIAL, we have determined that it is strong in terms of dividend, profitability, and weak in terms of assets and growth. Despite these weaknesses, the company has a high health score of 7/10, indicating that it is capable of paying off its debt and funding future operations through its cashflows. This makes LIBERTY FINANCIAL an attractive choice for income-seeking investors who are looking for a secure and reliable investment vehicle. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Liberty Financial. More…

| Total Revenues | Net Income | Net Margin |

| 855.58 | 206.97 | 25.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Liberty Financial. More…

| Operations | Investing | Financing |

| -36.87 | -34.51 | -103.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Liberty Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.47k | 13.31k | 3.83 |

Key Ratios Snapshot

Some of the financial key ratios for Liberty Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 83.4% |

| FCF Margin | ROE | ROA |

| -4.8% | 45.9% | 3.6% |

Peers

The company has a strong presence in the United States, Europe, and Asia. The company’s competitors include Capital India Finance Ltd, Cholamandalam Investment and Finance Co Ltd, and S R G Securities Finance Ltd.

– Capital India Finance Ltd ($BSE:530879)

Capital India Finance Ltd is an India-based company engaged in the business of lending and borrowing. The Company’s segments include Lending and Borrowing. It offers a range of loan products, including home loans, personal loans, business loans, and loans against property. The Company also provides some value-added services, such as loan against shares, gold loans, and construction finance. Capital India Finance Ltd is headquartered in New Delhi, India.

– Cholamandalam Investment and Finance Co Ltd ($BSE:511243)

Cholamandalam Investment and Finance Company Limited is an Indian diversified financial services conglomerate. The company offers a range of financial services including asset management, venture capital, investment banking, private equity, and insurance. As of March 31, 2021, the company had a market capitalization of 585.36 billion.

The company was founded in 1978 and is headquartered in Chennai, India. Cholamandalam Investment and Finance Company Limited is a subsidiary of Murugappa Group, one of the largest business conglomerates in India.

– S R G Securities Finance Ltd ($BSE:536710)

R G Securities Finance Ltd is a market leader in providing securities finance and related services. The company has a market capitalization of $90.58 million as of March 31, 2022. R G Securities Finance Ltd offers a broad range of services including securities lending, borrowing, and trading; collateral management; and prime brokerage. The company’s clients include institutional investors, broker-dealers, and hedge funds.

Summary

Liberty Financial is a financial services company that focuses on providing investment products to individuals and institutional investors. Their portfolio consists of stocks, bonds, mutual funds, and ETFs. With this reduction in Liberty Broadband holdings, Commerce Bank may be signaling a potential shift in its investment strategy. Investors should pay attention to any further changes in Liberty Financial’s share price or dividend payments.

Recent Posts