COF dividend yield calculator – Capital One Financial Announces $0.60 Dividend to Shareholders

May 7, 2023

Trending News 🌥️

Capital One Financial ($NYSE:COF), a leading financial services company, recently announced that it will be paying out a dividend of $0.60 per share to its shareholders. This dividend payment is in recognition of the tremendous success of the company over the last year. Capital One Financial provides a wide range of banking and financial services, including consumer and commercial banking, credit cards, and investment services. As one of the largest banks in the U.S., the company has been able to successfully position itself in a competitive marketplace. Through its innovative products and services, the company has managed to remain profitable while providing high levels of customer satisfaction.

The dividend payment of $0.60 per share is a reflection of the success that Capital One Financial has had over the past year and is a sign of the company’s commitment to its shareholders. This dividend payment also serves as an indication of the company’s financial health and ability to continue to provide strong returns for its investors. With a strong portfolio of products and services, Capital One Financial is well-positioned to continue to achieve success in the years to come.

Dividends – COF dividend yield calculator

Capital One Financial has announced to shareholders that a dividend of $0.60 per share will be paid for 2021. This dividend is consistent with Capital One Financial’s long-term commitment to providing annual dividends per share, as it has issued 2.4, 2.4, and 2.0 USD for the last three years respectively. The dividend yields from 2021 to 2023 are expected to be 2.09%, 1.94%, and 1.38%, with an average dividend yield of 1.8%. This shows that the company is committed to providing its shareholders with attractive returns on their investments.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for COF. More…

| Total Revenues | Net Income | Net Margin |

| 34.98k | 5.61k | 17.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for COF. More…

| Operations | Investing | Financing |

| 13.81k | -29.74k | 25.13k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for COF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 471.66k | 417.01k | 142.9 |

Key Ratios Snapshot

Some of the financial key ratios for COF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.7% | – | – |

| FCF Margin | ROE | ROA |

| 36.8% | 8.7% | 1.0% |

Price History

This is the same amount as the previous quarter and marks the tenth consecutive quarter that the company has paid a dividend to its shareholders. In response to the announcement, the stock opened at $87.4 and closed at $88.0, representing a 2.8% increase from last closing price of 85.6. This dividend reinforces CAPITAL ONE FINANCIAL’s commitment to share ownership and highlights its efforts to generate value for shareholders. Live Quote…

Analysis

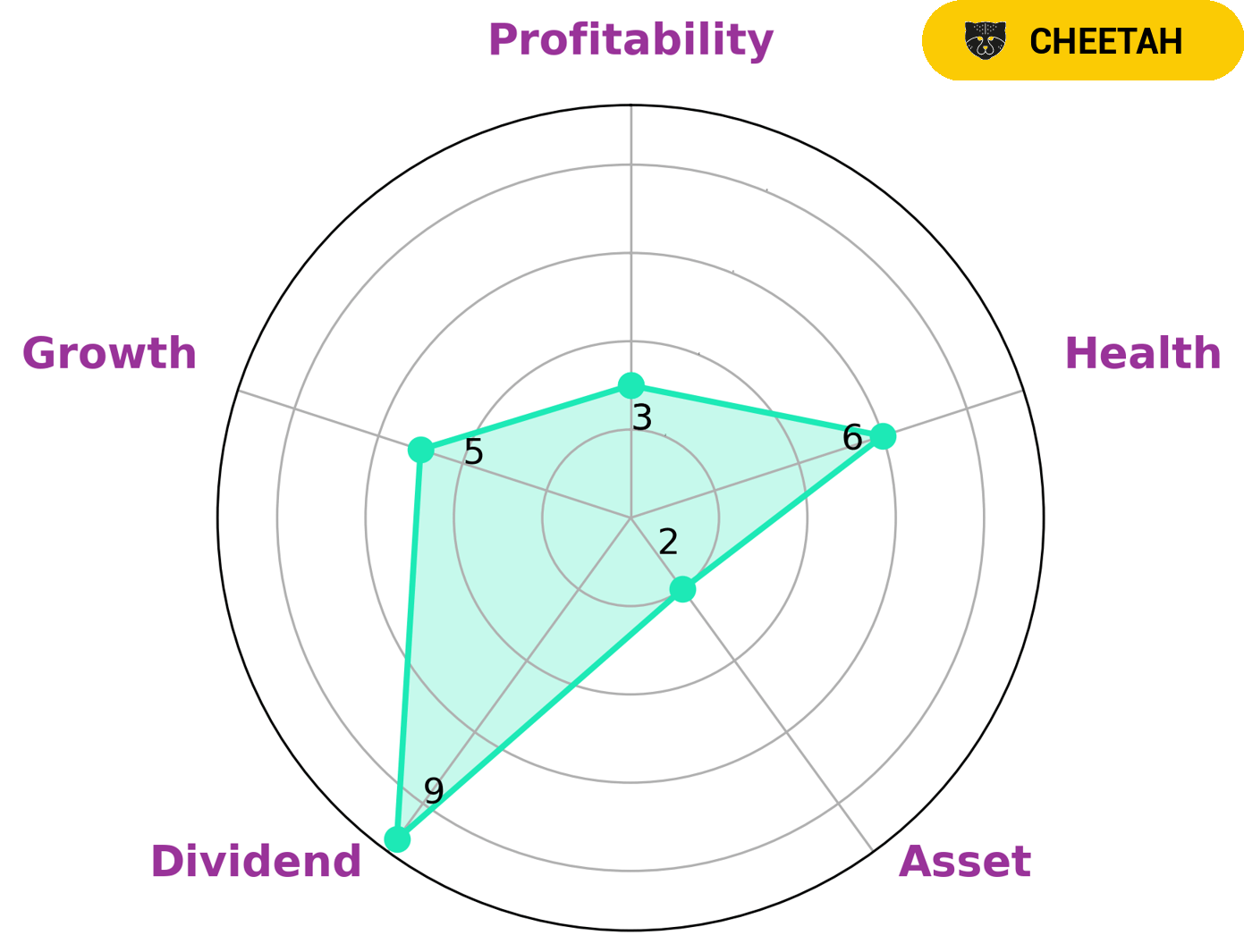

GoodWhale has conducted an analysis of CAPITAL ONE FINANCIAL’s financials. According to our Star Chart, CAPITAL ONE FINANCIAL is classified as a ‘cheetah’ type of company, meaning it has achieved great success in terms of revenue or earnings growth but its stability may be questionable due to lower profitability. This may make CAPITAL ONE FINANCIAL an interesting investment opportunity for investors looking to leverage its potential growth while taking the associated risk. When looking at the company’s performance across various indicators, we can see that CAPITAL ONE FINANCIAL is strong in dividend, medium in growth, and weak in asset and profitability. However, its intermediate health score of 6/10, considering its cashflows and debt, indicates that it is likely to sustain future operations even in times of crisis. More…

Peers

In the financial world, competition is fierce. Capital One Financial Corp is up against some tough competition from Hanhua Financial Holding Co Ltd, Oportun Financial Corp, and Jianpu Technology Inc. All of these companies are fighting for a piece of the pie, and they are all hoping to come out on top. Capital One has been a top player in the financial game for a while now, but its competitors are quickly catching up. It will be interesting to see how this competition plays out in the coming years.

– Hanhua Financial Holding Co Ltd ($SEHK:03903)

Hanhua Financial Holding Co Ltd has a market cap of 1.29B as of 2022, a Return on Equity of 0.78%. The company operates in the financial services industry in China, providing banking and other financial services to corporate and individual customers.

– Oportun Financial Corp ($NASDAQ:OPRT)

Oportun Financial is a publicly traded company with a market capitalization of 164.64 million as of 2022. The company has a return on equity of 9.05%. Oportun Financial is a provider of financial services to underserved consumers and small businesses in the United States. The company offers unsecured personal loans, small business loans, and related products and services.

– Jianpu Technology Inc ($NYSE:JT)

Jianpu Technology Inc is a Chinese internet company that provides an online platform for users to find and compare credit products. As of 2022, the company had a market cap of 33.89 million and a return on equity of -35.21%. The company’s platform offers users access to credit products from a variety of financial institutions, including banks, credit card companies, and online lenders.

Summary

Recently, the company declared a dividend of $0.60 per share, which marks the fourth consecutive quarterly dividend. Capital One Financial’s performance has been steady over the years, with a solid return on equity, steady revenue growth, and relatively low debt levels. The company has also consistently increased its dividend payments, which is a positive sign for long-term investors. This combined with its strong financials and generous dividend makes Capital One Financial a compelling investment opportunity.

Recent Posts