ALLY FINANCIAL Dismisses Comparisons To Failed Banks

April 8, 2023

Trending News 🌧️

ALLY FINANCIAL ($NYSE:ALLY) has dismissed comparisons of its stock to failed banks, noting that it is not an appropriate comparison. ALLY FINANCIAL is a digital financial services company that provides auto financing, banking products, and digital advice. The company offers a variety of services, including retail and commercial banking, online banking, auto financing, and stock trading. It also provides business financing, insurance, and wealth management services.

Ally Financial has a strong presence in the United States, Canada, and Mexico. The company is well-positioned for growth in the global economy. With its diversified product portfolio and strong financial performance, Ally Financial has been able to successfully distance itself from the comparison to failed banks.

Market Price

On Thursday, ALLY FINANCIAL stock opened at $25.8 and closed at $26.1, up by 2.0% from prior closing price of 25.6. This increase in stock value was primarily attributed to the company’s efforts to distance itself from comparisons to failed banks. ALLY FINANCIAL is represented by a network of auto finance, online banking and other financial services, and therefore, stands in stark contrast to the traditional banking services that have been viewed as precarious in these market conditions. This announcement by the company has helped put investors at ease and has led to an uptick in the stock value. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ally Financial. More…

| Total Revenues | Net Income | Net Margin |

| 9.24k | 1.6k | 18.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ally Financial. More…

| Operations | Investing | Financing |

| 6.25k | -17.26k | 11.57k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ally Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 191.83k | 178.97k | 42.96 |

Key Ratios Snapshot

Some of the financial key ratios for Ally Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.1% | – | – |

| FCF Margin | ROE | ROA |

| 29.4% | 11.6% | 0.8% |

Analysis

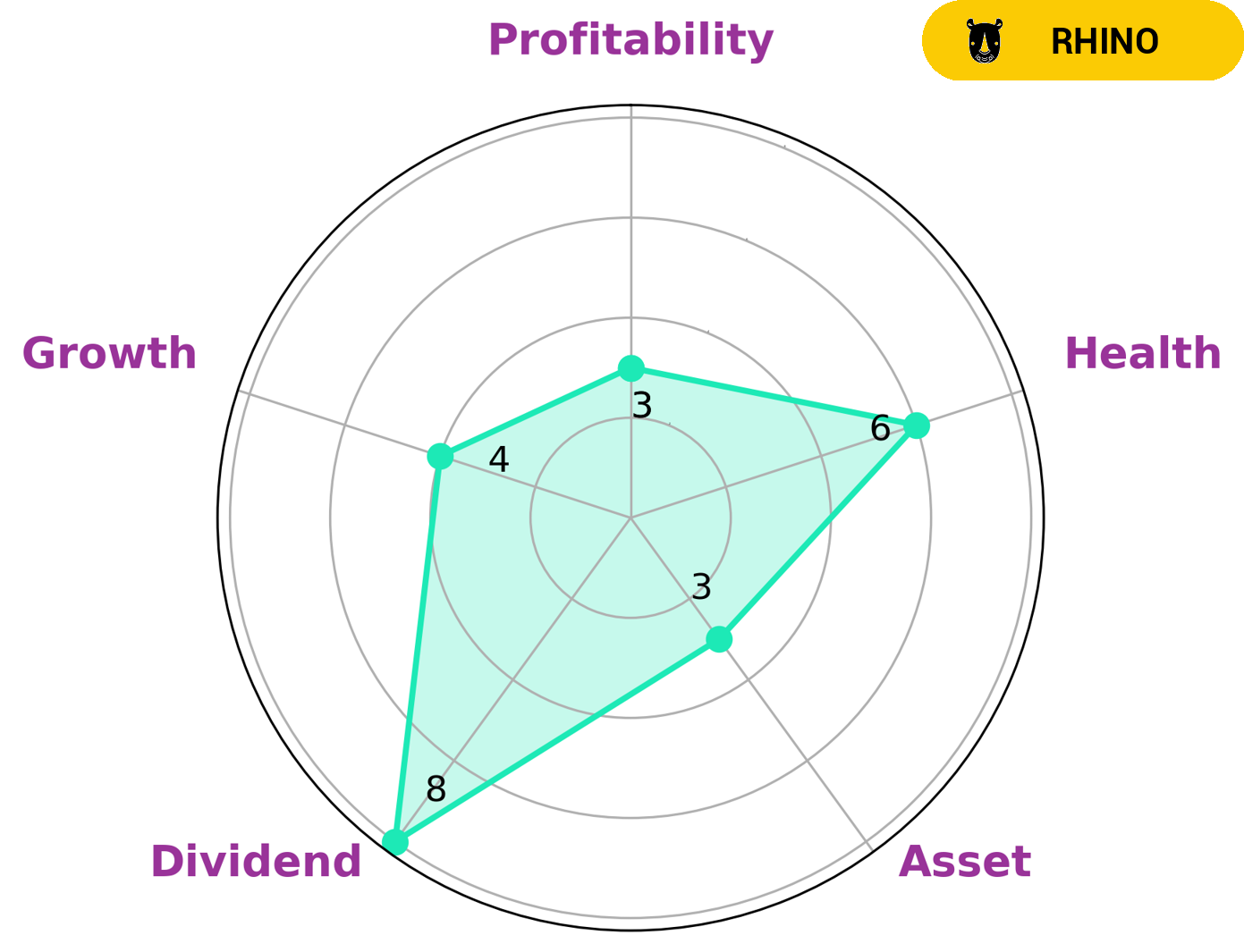

GoodWhale conducted an analysis of ALLY FINANCIAL‘s financials and classified it according to Star Chart as a ‘rhino’ company. We believe this means that the company has achieved moderate revenue or earnings growth. From our perspective, this makes ALLY FINANCIAL an interesting proposition for investors who have a medium to long-term investment timeframe and are looking for reliable dividend income and moderate earnings growth. On the asset and profitability front, ALLY FINANCIAL isn’t particularly strong; however, in terms of cashflows and debt, it scores relatively well with an intermediate health score of 6/10. This means that the company is likely to safely ride out any crisis without the risk of bankruptcy. Overall, ALLY FINANCIAL is a decent choice for medium-term investors looking for reliable dividend income and moderate earnings growth. More…

Peers

The company competes with other online banking providers, such as Jumbo Finance Ltd, Avasara Finance Ltd, and Dharani Finance Ltd. Ally Financial Inc has a strong focus on providing a great customer experience, offering competitive rates and products, and providing excellent customer service.

– Jumbo Finance Ltd ($BSE:511730)

Avasara Finance Ltd is an Indian finance company that provides a range of financial products and services to individuals and businesses. The company has a market cap of 65.11M as of 2022 and a Return on Equity of -11.47%. The company offers products and services such as personal loans, home loans, business loans, credit cards, and investment products. Avasara Finance Ltd is headquartered in Mumbai, India.

– Avasara Finance Ltd ($BSE:511451)

Dharani Finance Ltd, a Non-Banking Financial Company, has a market cap of 35.31M as of 2022. The company’s Return on Equity is 0.1%. Dharani Finance Ltd is engaged in the business of providing financial services to the rural and semi-urban areas of Tamil Nadu. The company offers various products and services such asterm loans, working capital loans, vehicle loans, housing loans, and microfinance.

Summary

ALLY FINANCIAL is a leading digital financial services company that provides a wide range of personal finance and commercial banking products and services. Recently, the company has warned investors that comparisons to other recently failed banks, such as Bank of America and Citigroup, are inappropriate. Because of its advanced digital operations, ALLY’s investments have been performing well, delivering higher returns for investors. The company has also been expanding its portfolio offerings to include new products such as online trading, mobile banking, and mutual fund investments, which have all been successful.

In addition, the company has implemented a strong risk management system that helps protect its customers and investors. With its solid track record and reliable products and services, ALLY FINANCIAL is well positioned to remain a leader in the digital finance industry.

Recent Posts