Primoris Services to Transfer Listing to NYSE in 2023, Symbol PRIM

March 30, 2023

Trending News 🌥️

Primoris Services ($NASDAQ:PRIM) is set to make a major move in 2023 by transferring its common stock listing to the New York Stock Exchange, symbolized as PRIM. Primoris is one of the leading industrial infrastructure companies in North America, and the move to the NYSE is a major milestone for the company and its shareholders. The NYSE listing will bring increased visibility and liquidity to Primoris Services common stock. The company is confident that listing on the NYSE will benefit their stockholders, as well as increase investor appeal.

Additionally, Primoris Services expects that their move to the NYSE will further elevate their reputation as a premier industrial infrastructure company. Primoris Services has enjoyed a long and successful track record of delivering reliable industrial infrastructure services. The company is committed to providing excellent service and customer satisfaction, with a focus on sustainable practices. Primoris Services is looking forward to the future and continuing their legacy of high-quality services and excellent customer relations. The company believes that this move will enhance the value of their common stock and increase investor appeal. They are confident that their commitment to service excellence and sustainable practices will continue to bring success in the future.

Price History

So far, media sentiment around the news has been mostly positive. On the day of the announcement, Primoris Services opened at $24.2 and closed at $24.1, down 0.7% from its prior closing price of 24.3. It remains to be seen whether this news will have a positive impact on stock performance in the future. Primoris Services is confident that the change will provide them with additional visibility and result in more liquidity and improved market capability. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Primoris Services. More…

| Total Revenues | Net Income | Net Margin |

| 4.42k | 133.02 | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Primoris Services. More…

| Operations | Investing | Financing |

| 83.35 | -481.94 | 452.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Primoris Services. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.54k | 2.44k | 20.87 |

Key Ratios Snapshot

Some of the financial key ratios for Primoris Services are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.5% | 7.6% | 4.5% |

| FCF Margin | ROE | ROA |

| -0.3% | 11.4% | 3.5% |

Analysis

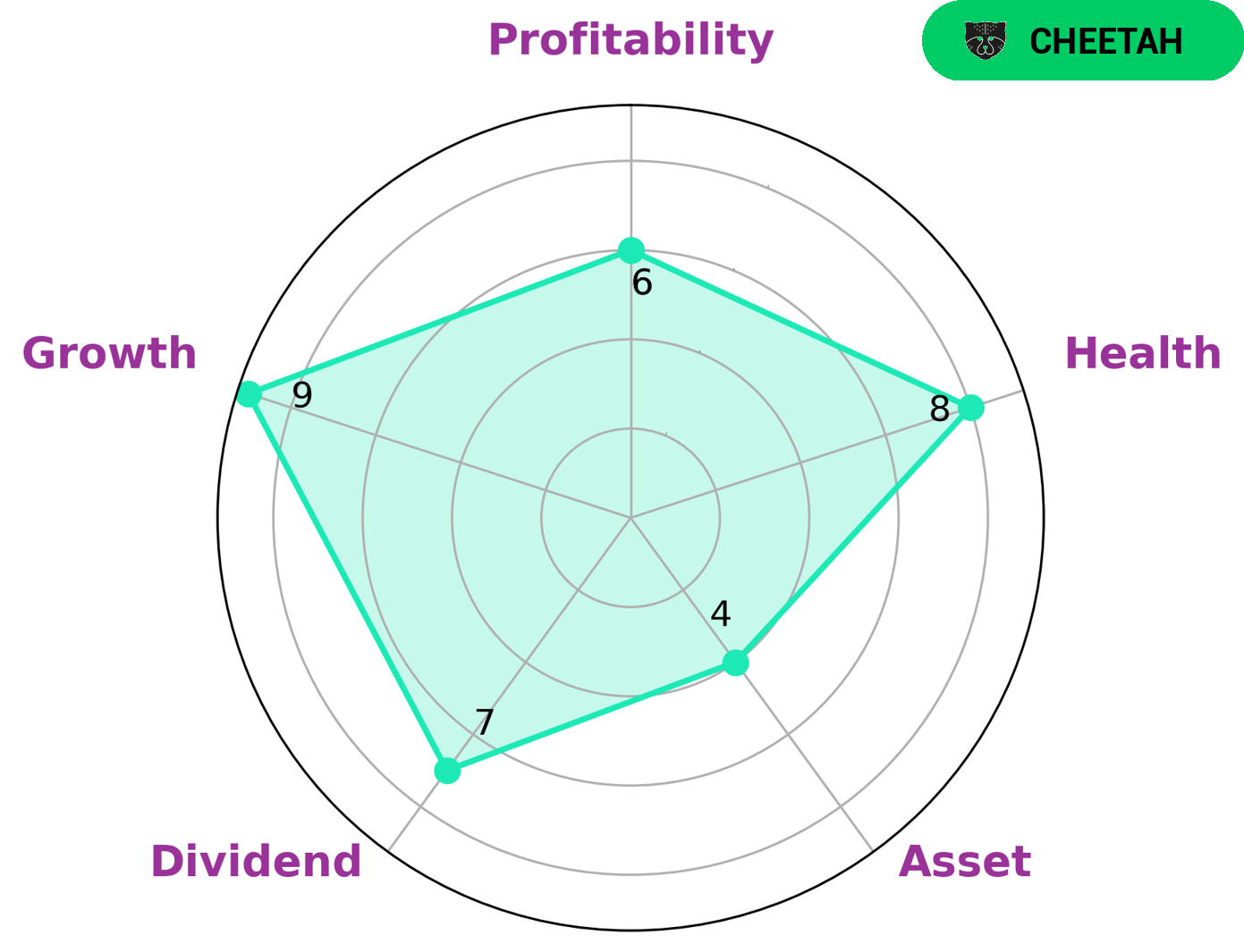

As part of our analysis of PRIMORIS SERVICES, GoodWhale used the Star Chart to assess the company’s wellbeing. The Star Chart classified PRIMORIS SERVICES as a “cheetah” company – a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. We believe this type of company would likely be attractive to investors looking for growth opportunities with higher potential returns. PRIMORIS SERVICES was strong in dividend and growth, and medium in asset and profitability. Furthermore, we gave PRIMORIS SERVICES a health score of 8/10 with regard to its cashflows and debt; this suggests that the company is capable of sustaining future operations in times of crisis. More…

Peers

Primoris Services Corp faces stiff competition from APi Group Corp, PT Meta Epsi Tbk, and MasTec Inc in the engineering and construction services industry. All of these companies are vying for the same contracts, putting pressure on Primoris Services Corp to stay ahead of the competition. The competition is fierce, and only the most innovative and resourceful companies will succeed.

– APi Group Corp ($NYSE:APG)

API Group Corp is a leading global provider of advanced materials and components for high technology industries. The company has a market cap of 5.22 billion as of 2023, reflecting its strong financial performance and growth potential. Its Return on Equity (ROE) of 4.34% is well above the industry average, indicating the company’s ability to generate returns from reinvesting profits back into the business. API Group Corp provides a variety of products, including precision engineering materials, optoelectronic components, and optical coatings, to support the development of emerging technologies. The company’s broad portfolio of products and services enables it to meet the needs of customers across a range of industries.

– PT Meta Epsi Tbk ($IDX:MTPS)

PT Meta Epsi Tbk is an Indonesian company that provides manufacturing and trading products and services in the engineering and industrial sectors. As of 2023, the company has a market cap of 173.04B and a Return on Equity (ROE) of -123.31%. This market cap size indicates the size and strength of the company, and its ROE shows that it has not been performing well financially in recent years. As a result, the company has been making efforts to improve its profitability and increase its value.

– MasTec Inc ($NYSE:MTZ)

MasTec Inc is an infrastructure construction company specializing in the engineering, building, installation, maintenance, and upgrade of energy, communications, and utility infrastructure. The company has a market capitalization of 7.76 billion dollars as of 2023, indicating the sizable size and presence that MasTec Inc has in its industry. Its return on equity of 4.94%, meanwhile, indicates that the company is able to generate a healthy profit for its shareholders on every dollar of equity invested. MasTec Inc is an industry leader in its field and continues to be an attractive investment for many investors.

Summary

Primoris Services Corporation (NYSE: PRIM) is a leading provider of specialty contracting services operating across the United States and Canada. The company is set to transfer its listing to the New York Stock Exchange (NYSE) in 2023, under the ticker symbol PRIM. Primoris Services’s business model focuses on five main sectors: infrastructure, specialty civil and underground construction, fabrication, maintenance, and engineering services. With the company’s focus on the infrastructure sector, there may be some potential for capital gains over the next few years as the company takes advantage of the current infrastructure boom.

However, investors should note that there has been some press in recent times about Primoris Services’s potential involvement in a bribery scandal in Mexico. Although the company has not been formally charged with any wrongdoing, investors should be aware of this risk when considering an investment in Primoris Services stock. Overall, Primoris Services is well-positioned for long-term growth in a sector that is seeing rapid expansion. The company’s transfer listing to the NYSE in 2023 could bring higher institutional investor interest, providing more liquidity and capital gains potential in the near future. With a low P/E ratio and consistent analyst ratings, risk-averse investors may want to consider Primoris Services as a viable option for their portfolio.

Recent Posts